Chapter 4- IRS Penalties and Penalty Relief Solutions

Chapter 4

IRS Penalties and Penalty Relief

INTRODUCTION

Key Highlights:

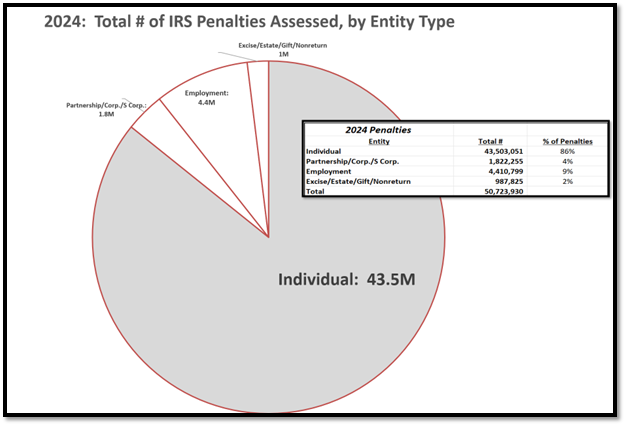

- Penalties are the most common IRS post-filing issue: there were almost 50.7 million penalties assessed to taxpayers in 2024. [IRS Data Book, 2024, Table 28]

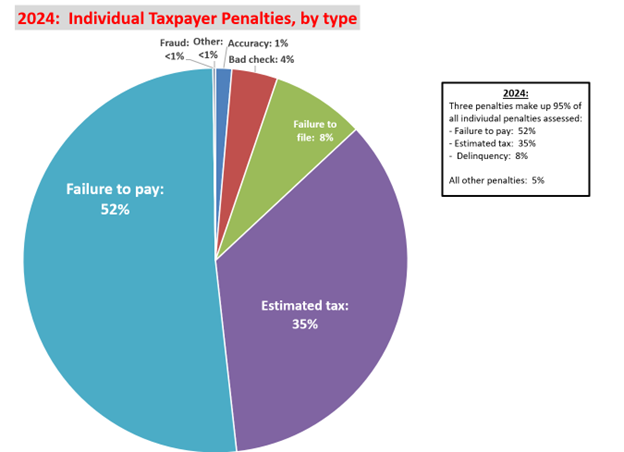

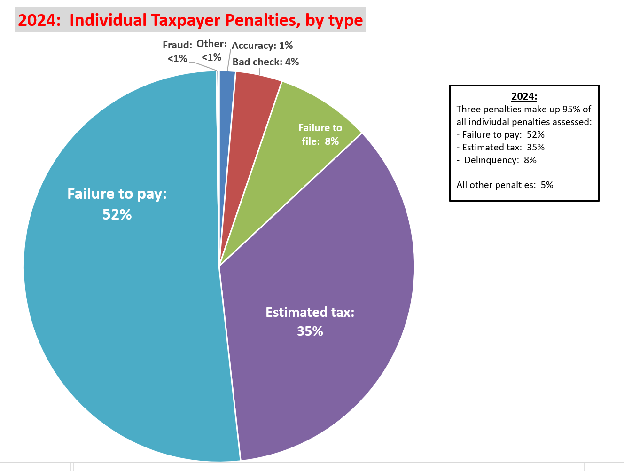

- Many types of penalties, but three penalties make up 95% of all penalties assessed to individual taxpayers: the following three penalties make up 95% of all penalties: failure to pay (FTP), failure to file (FTF), and the estimated tax (ES) penalty. [IRS Data Book, 2024, Table 28]

- ES penalties are addressed at filing: use Form 2210 (individuals) when filing to apply for exceptions to the ES penalty.

- Most common penalty relief: most taxpayers request abatement for the FTP and FTF penalties for first-time abatement or reasonable cause.

- First-time abatement for FTF and FTP penalties: taxpayers with a clean compliance history can request abatement for any amount of penalty by phone. [IRM 20.1.1.3.3.2.1 (3-29-2023)]

- Reasonable cause abatement: taxpayers can request abatement, in writing, for cause. Many reasonable cause abatements are denied, which requires the taxpayer to appeal the denial and to obtain abatement. [[IRM 20.1.1.3.2 (11-21-2017)]]

- Accuracy penalties in an audit or CP2000 notice: taxpayers should address proposed accuracy penalties during the audit/CP2000 notice by showing that they made a reasonable attempt to file an accurate return. Post-assessment abatement of accuracy penalties usually requires that the taxpayer request audit or CP2000 reconsideration.

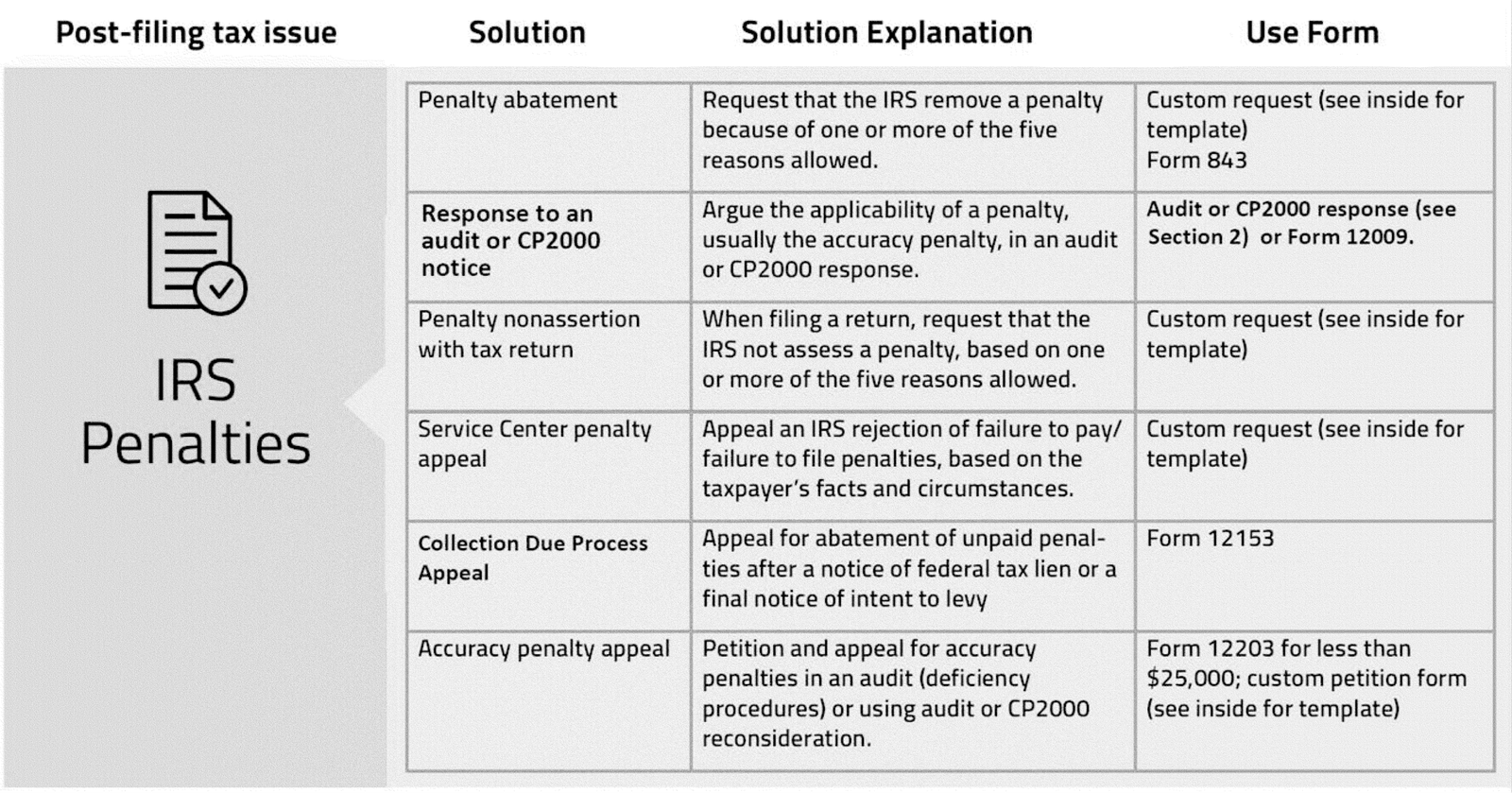

Penalty Problem/Solution Grid

What’s New for 2025?

- Late payment relief for 2020 and 2021 returns ends in 2024: on December 18, 2023, the IRS provided automatic failure to pay penalty relief for 2020 and 2021 returns for Forms 1040, 1120, 1041, and 990-T filers (IRS FS-2023-28, Dec. 2023). The failure to pay penalty relief period begins on the date the IRS issued an initial balance due notice to the eligible taxpayer, or February 5, 2022, whichever is later. The penalty relief was provided through March 31, 2024. After that date, the IRS will continue to charge the failure to pay penalty on any outstanding balance owed.

- Penalty appeals hearings: owing to IRS operational backlogs and systemic issues in recording penalty abatement appeals requests, penalty appeals hearings have taken up to two years to schedule a telephone or video conference with an IRS Appeals Officer. IRS officials are working to reduce the backlogs, but waiting time and tracking of penalty appeals cases is still an issue with the IRS.

What’s Covered in This Section?

- Step-by-step approach to resolving a penalty issue.

- How to identify if a taxpayer has a penalty on their account.

- How to request penalty abatement for the most common IRS penalties: failure to file and failure to pay.

- How to request relief from the accuracy penalties in an audit or CP2000 notice.

- How to request reconsideration of an accuracy penalty already assessed in a CP2000 notice or audit.

- How to appeal a denied penalty abatement determination.

What’s Not Covered — and Why?

- The rare penalties: as mentioned above, most taxpayers request penalty relief for three penalties — failure to file, failure to pay, and the accuracy penalty for negligence/disregard of rules and regulations or substantial understatement. The other 150+ penalties are rarely assessed but many of the principles and format covered in this section can help with these rare penalty assessments.

Most Common Taxpayer and Tax Professional Actions Performed When Addressing Penalty Issues

- Identifying penalties assessed to a taxpayer.

- Evaluating penalty abatement exceptions and options to abate.

- Requesting abatement of failure to file and failure to pay penalties using reasonable cause and first-time abatement.

- Contesting accuracy penalties in an audit or CP2000 notice.

- Requesting CP2000 or audit reconsideration for assessed accuracy penalties.

- Appealing penalty abatement denials to the IRS Independent Office of Appeals.

When to Get an Expert Involved

- IRS penalty appeals: dealing with the IRS Independent Office of Appeals on a denied penalty abatement of a significant amount.

- International penalties: evaluating options and dealing with the IRS on international issues, a focus area of IRS compliance enforcement.

- Fraud penalties: when there are indications of fraud, taxpayers should always consult a qualified attorney.

- Large dollar penalties: where more formal requests need to be made and procedures followed to request penalty relief.

- Office and field audits: where IRS auditors can assess accuracy and fraud penalties.

- Claim for refund procedures: when the IRS issues a formal Notice of Claim Disallowance and the taxpayer must file suit to recover past paid penalties.

Professional Assistance Fees

- Hourly: Range from $80-$500 an hour for an EA, CPA, or tax attorney to represent. Some tax pros accept contingency fees on abatement of assessed penalties as allowed in Treasury Circular 230.

- Flat fee: National firms can charge flat fees from $500+ depending on the amount of penalty and complexity of the issues involved.

- No fee: Low-income taxpayer clinics can assist taxpayers free of charge.

Closely Related Issues

- Unfiled returns: late filed, balance due returns will have a failure to file/failure to pay penalty assessment in which the taxpayer should consider requesting non-assertion/abatement, depending on their circumstances.

- IRS Collection: balance due taxpayers who accrue the failure to pay penalty often cannot pay the penalty and need to consider collection alternatives to full payment.

- Audits and CP2000 notices: where accuracy penalties are proposed and contested.

Time to Complete Estimates for Common Penalty Relief Solutions/Actions

| Penalty Relief Action | Estimated Hours to Complete | Average Duration Estimate |

| Obtaining tax history and transcripts from the IRS to evaluate penalties assessed and penalty history (for first-time abatement and penalty request background information) | <1 hour (best to call IRS by phone) | 1 day-3 weeks (if transcripts come by mail) |

| Request first-time abatement for failure to file/failure to pay penalties | <1 hour (by phone or online) | 3 weeks for the abatement to be recorded on the taxpayer’s IRS account |

| Reasonable cause abatement request for failure to file/failure to pay penalties | 3-5 hours (request in writing) | 16-20 weeks for IRS determination letter |

| Appealing a denied penalty abatement request for failure to file/pay with IRS Independent Office of Appeals | 3-10 hours | 12-24 months |

| Responding to an accuracy penalty proposal in an audit | 3-10 hours (depending on complexity) | Up to 30 days (audit/manager to make decision) |

| Responding to an accuracy penalty proposal in a CP2000 notice | 1-3 hours | 3-5 months |

| Appealing a denied penalty abatement request for the accuracy penalty with IRS Independent Office of Appeals (CP2000 or audit) | 3-10 hours (depending on complexity) | 4-12 months |

| Audit or CP2000 reconsideration request for penalty abatement (post-assessment) | 2-20 hours | Can take up to a year or more, depending on the complexity of the original audit/CP2000. |

UPDATES TO THIS CHAPTER

10/6/2025: IRS updated the IRS Appeals Customer Service phone number to 855-865-3401.

7/20/2025: updated with latest IRM citations

OVERVIEW OF INDIVIDUAL IRS PENALTIES AND PENALTY RELIEF

This section covers how the IRS administers penalties, common IRS penalties, and relief options.

| Topic | Covers |

|---|---|

| Introduction to IRS Penalties and Penalty Administration | The types of IRS penalties, how many penalties are assessed annually, and how many penalties are abated annually. |

| Relevant IRM Sections for Penalties and Penalty Relief | IRS guidance given to IRS personnel on how to administer and grant relief for penalties. |

| IRS Forms/Publications Related to Penalties and Penalty Relief | IRS forms and publications used in assessing and granting relief from penalties. |

| Frequently Used IRS Penalty Phone Numbers | Common IRS phone numbers used to understand penalties assessed and to request penalty relief. |

| Common IRS Notices and Taxpayer Notifications Related to Penalties | Common IRS notices used by the IRS in penalty determinations. |

| Useful IRS Website Resources and IRS Online Tools to Help with Penalty Relief | IRS web pages and online tools that are helpful in understanding penalties assessed and requesting relief from penalties. |

| Key Terms and Definitions | Important terms to understand when requesting penalty relief. |

| Identifying IRS Penalties | How to identify penalties from IRS personnel and transcripts. |

| Five Reasons for IRS Penalty Relief | The five primary reasons the IRS does not assert or will abate penalties, including the two most common reasons: reasonable cause and first-time abatement. |

| Abatement of Interest | The rare reasons when the IRS abates interest and how to request interest abatement. |

| Statute of Limitations to Request Penalty Abatement | The time limit to request penalty abatement. |

Other helpful sections:

| Topic | Covers |

|---|---|

| IRS Transcripts | How to request and read IRS transcripts, including how to identify IRS penalties from an account transcript. |

| Overview of IRS Practice and Working with the IRS after Filing | How to obtain information from the IRS, including penalties and the status of penalty abatement requests. |

Key Highlights:

- Penalties are the most common IRS tax problem. The IRS issued 50.7 million penalties in 2024. Most penalties resulted from late filing, late payment or filing an inaccurate tax return.

- Penalty relief is usually a request for non-assertion of a penalty or removal of a penalty (called penalty abatement). The type of penalty dictates the available options for relief.

- There are three penalties most commonly assessed by the IRS: failure to pay, failure to file, and the estimated tax penalty. Accuracy penalties for failing to file an accurate tax return are not common, but an accuracy penalty may be costly in an audit or CP2000 notice.

- The two most common penalty abatement reasons for the failure to file and failure to pay penalties: First-time abatement (FTA) and reasonable cause.

Introduction to IRS Penalties and Penalty Administration

In 1955, there were approximately 14 penalty provisions in the Internal Revenue Code. There are now more than ten times that number. [[IRM 20.1.1.1.1 (11-25-2011)]] In 2024, the IRS issued almost 50.7 million civil penalties to taxpayers. [IRS Data Book, 2024, Table 26] Eighty-four percent of IRS penalties are assessed against individual taxpayers for late filing, late payment, or filing an inaccurate return. [IRS Data Book, 2024, Table 28]

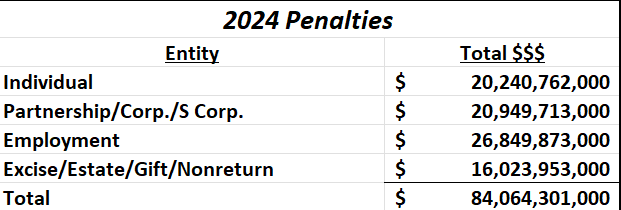

Purpose of Penalties

The purpose of IRS penalties is to enhance voluntary compliance and to promote sound tax administration by deterring noncompliant conduct. [IRS Policy Statement 20-1 at IRM 1.2.1.12.1 (6-29-2004)] Penalties should not be used by the IRS to generate revenue. However, in 2024, the IRS issued over $84 billion in penalties to all taxpayers. [IRS Data Book, 2024, Table 28]

IRS and Penalty Administration

The IRS is required to administer penalties consistently, uniformly, and accurately. It must make penalty determinations impartially and give the taxpayer the opportunity to contest the penalty. [IRS Policy Statement 20-1 at IRM 1.2.1.12.1 at (9) (6-29-2004)] The IRS stresses that penalties are not a “bargaining point” in resolving taxpayer tax return adjustments, especially when negotiating a settlement of an IRS audit with an IRS auditor or the IRS Independent Office of Appeals. [IRM 1.2.1.12.1 at (9) (6-29-2004)] Taxpayers may request relief from penalties based on their facts and circumstances and the applicable law.

Practice Tip: IRS rules do not allow auditors or their managers to settle cases by arbitrarily removing penalties. However, because most penalty determinations are subject to the interpretation of how the law applies to the taxpayer’s facts and circumstances, many IRS managers will consider waiving some or all penalties in an audit to secure an agreement on a case if the taxpayer has a credible argument for penalty relief.

The IRS provides procedural guidance for penalty relief through part 20 of its Internal Revenue Manual and through various internal resources. One resource used by the IRS to make individual penalty abatement determinations for the failure to file and failure to pay penalties is the IRS’s “Reasonable Cause Assistant” (RCA). [[IRM 20.1.1.3.6 (10-19-2020)]]The RCA is an automated tool used by IRS employees to assist in a penalty abatement determination based on reasonable cause or the first-time abatement criteria. [[IRM 20.1.1.3.6.1 (3-29-2023)]]

Most Common Penalties and How They Are Assessed

IRS penalties fall into three categories of noncompliance: underpayment, non-filing, and underreporting. The costliest IRS penalties are for non-filing (failure to file penalty) and underreporting (accuracy and fraud). The IRS uses its computer systems to automatically assess taxpayers late filing and late payment penalties when taxpayers file and pay late. For underreporting penalties (accuracy and fraud), the assessment process is more involved. If the accuracy penalty originates from a matching notice (i.e., a CP2000 Underreporter Notice), the accuracy penalty for negligence or substantial understatement is automatically applied if IRS procedural business rules are met. [[IRM 20.1.1.2.3.2 (10-19-2020)]] For example, if the taxpayer has a prior CP2000 notice, the new CP2000 notice will automatically assess an accuracy penalty for negligence. If the taxpayer meets the substantial understatement criteria, the accuracy penalty for substantial understatement will automatically be assessed on the CP2000. [See Automated Underreporter (CP2000) Notices Section for more information on accuracy penalty assessments for CP2000 notices]

For audits, accuracy penalties must be assessed by the auditor (revenue agent, tax examiner, tax compliance officer) and concurred by their manager. [[IRC §6751(b)(1)]]

The primary and most common penalties for each category of noncompliance is as follows:

| Category of Noncompliance | |||

| Underpayment | Non-filing | Underreporting | |

| Definition | Failure to pay taxes owed. | Failing to file a required return. | Failing to file an accurate return. |

| Primary penalties |

|

|

|

| Maximum penalty amount | FTP: 25% (0.5% per month)ES: varies, closely approximates interest rate. | FTF: 25% (5% per month) | Accuracy: 20%

Fraud: 75% |

| How assessed? | FTP: automatically through electronic means.

ES: normally self-assessed with a filed tax return. |

FTF: automatically through electronic means. | Accuracy or fraud in an audit: by an IRS person assigned to the audit (with concurrence by an IRS manager)

Accuracy in a CP2000 notice: by electronic means if meets IRS procedural thresholds. |

| Average penalty amount (2024- individuals only) | FTP: $348

ES: $315 |

FTF: $1,583 | Accuracy: $2,598

Fraud: $87,451 |

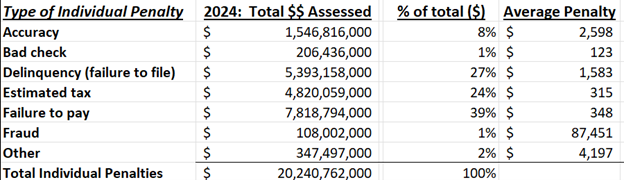

In terms of volume of penalties assessed for individuals, taxpayers are most frequently addressing a late filing and/or late payment penalty. For individuals, three penalties (failure to pay, estimated tax, and delinquency or late filing) make up 95% of all assessed penalties. [IRS Data Book, 2024, Table 28]

In terms of amount assessed, four penalties (failure to pay, delinquency/late filing, estimated tax, and accuracy) make up 99% of all penalty amounts assessed to individual taxpayers. [IRS Data Book, 2024, Table 28]

Taxpayers will need to address the accuracy penalty during the audit or CP2000 assessment process. The estimated tax penalty is generally addressed in the filing process (providing an exception on Form 2210). The failure to file and failure to pay penalties can be addressed at the time of filing (non-assertion request) or after assessment (request for abatement). Taxpayers may also appeal an adverse penalty abatement determination through various avenues afforded to them.

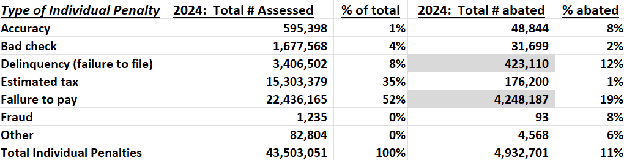

Penalty Abatement Data

For all taxpayers for 2024, only 6.5 million of the 50.7 million (13%) of all penalties assessed were abated. The number of abatements in 2024 were higher than normal years due to IRS automatic failure to pay penalty relief for 2020 and 2021 returns.

Taxpayers appear to focus on requesting abatement for the more costly penalty amounts. In 2024, 13% of penalties were abated. However, $75.2 billion of the over $84.1billion of all penalty amounts were abated. The IRS abatement amount data can be misleading as the IRS does not provide information on whether the IRS initiated relief, or the taxpayer requested abatement. In 2024, the IRS provided most of the relief automatically by summarily abating failure to pay penalties on many 2020 and 2021 returns as well as allowing significant tax and penalty abatements for employment taxes due to allowance processing of the Employee Retention Credit.

In practice, taxpayers can request abatement directly from the IRS, or the IRS may automatically abate penalties under certain circumstances. Likely, the amount of IRS penalties abated, in terms of dollars abated, are higher than the number abated due to taxpayers focusing on requesting abatement of higher penalty amounts. However, the IRS can abate penalties by itself and often does so when taxpayers request reconsideration of certain IRS assessments, such as a premature assessment for an audit, CP2000 underreporter notice, or a substitute for return filing.

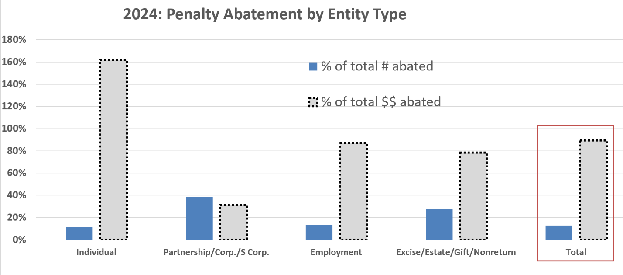

By entity type, the percentages of the total number and dollar amounts of penalties abated for 2024 appear below:

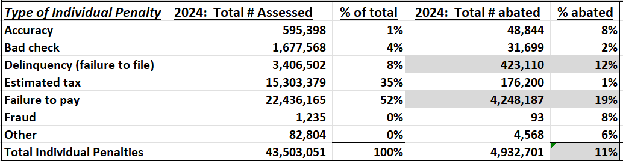

For individuals, penalty abatement varies by the type of penalty assessed. Overall, 11% of all individual penalties were abated in 2024. Abatement for each of the major individual penalty types are as follows:

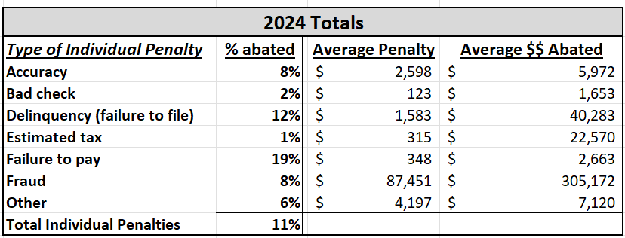

The amount of abatement data shows that taxpayers and the IRS generally address the more costly penalties. The average abatement by type of penalty are as follows:

Almost all delinquency penalties (for failure to file) were abated as part of the automatic penalty relief for failure to pay granted by the IRS on 2020 and 2021 returns. These penalties were automatically abated in August and September of 2022 and through 2024.

It is also likely that the IRS, not the taxpayer, automatically abated some of the larger amounts once the taxpayer corrected their noncompliance. For example, many delinquency (late-filing) penalties are asserted during the IRS non-filer enforcement procedures when a substitute for return (SFR) is filed by the IRS. Once the taxpayer files an original return and likely reduces the tax owed, the amount of the penalty is “abated” by the IRS automatically in the SFR reconsideration process.

Relevant IRM Sections for Penalties and Penalty Relief

Part 20 of the IRM provides the procedural rules for assessment and relief from all IRS penalties.

In practice, most individual taxpayers will likely need to address abatement of three penalties: failure to pay, failure to file, and the accuracy penalty.

When requesting abatement or non-assertion of IRS penalties, most individual taxpayers and their tax professionals will refer to the following IRM sections.

| IRM Section | Topic | What It Covers |

| 20.1.1 | Introduction and Penalty Relief | Reasons the IRS abates penalties; procedures for penalty abatement. |

| 20.1.2 | Failure to file/failure to pay penalties | Procedures for assessment and abatement of the two of the most common penalties. |

| 20.1.5 | Return related penalties | Procedures for assessment of accuracy penalties for errors made on a tax return. |

| 4.10.6 | Examination of Returns: Penalty Considerations | Factors and IRS procedures for asserting penalties in an IRS audit (mostly accuracy penalties). |

IRS Forms/Publications Related to Penalties and Penalty Relief

The forms listed below are commonly used to request penalty relief.

| Form | Description |

| Form 843 (and instructions) | Claim for Refund and Request for Abatement (Penalty abatement request) |

| Form 12009 | Request for Informal Conference and Appeals Review (Penalty review with IRS manager) |

| Form 12153 | Request for a Collection Due Process or Equivalent Hearing (Collection) |

| Form 12203 | Request for Appeals Review (Audit) |

These publications help the taxpayer to understand IRS penalties assessed and penalty relief options, including appealing adverse penalty abatement determinations.

| Publication | Description |

| Notice 746 | Information About Your Notice, Penalty and Interest |

| Notice 1155 | Disaster Relief from the IRS |

| Notice 1215 | What to do If You Disagree with the Penalty |

| Publication 4576 | Penalty Appeals: Orientation to the Penalty Appeals Process |

Frequently Used IRS Penalty Phone Numbers

Taxpayers and tax professionals can use the following IRS contacts to get information about penalties assessed on taxpayers and to request relief:

| IRS Hotline | Phone Number | Hours/Availability |

| Individual accounts (taxpayer hotline) | (800) 829-1040 | M-F, 7AM-7PM, local time |

| Business and Specialty accounts (taxpayer hotline) | (800) 829-4933 | M-F, 7AM-7PM, local time |

| Taxpayer Advocate National Hotline (central intake) | (877) 777-4778 | M-F, 7AM-7PM, local time

Local offices: 8AM-4:30PM |

| Practitioner Priority Service (tax professionals only) | (866) 860-4259

Option #2: Individual accounts Option #3: Business accounts |

M-F, 7AM-7PM, local time. |

| IRS Penalty Hotline | 855-223-4017 Ext. 225 | M-F, 7AM-7PM, local time. |

| Automated Collection: Individuals (when a taxpayer has a balance owed and is in IRS Automated Collection) | (800) 829-7650 (W&I) | M-F, 8AM-8PM, local time. |

| Automated Collection: Self-employed and businesses (when a taxpayer has a balance owed and is in IRS Automated Collection) | (800) 829-3903 (SB/SE) | M-F, 8AM-8PM, local time. |

| IRS Appeals Assistance Hotline (status of appeals request, including penalty appeals cases) | 855-865-3401 | Leave message and will get response back in 24-48 hours with appeals assignment and contact info (call back will be between 7AM-3PM PT) |

| IRS Disaster Assistance Hotline | 866-562-5227 | M-F, 7AM-7PM, local time. |

Common IRS Notices and Taxpayer Notifications Related to Penalties

The following are the most common IRS notices when requesting and receiving a determination on penalty abatement for the failure to file and failure to pay penalties.

| IRS Notice (primarily for electronically assessed penalties, i.e., FTP, FTF) | Description |

| Letter 168C/3502C/3503C | Service Center letter: Penalty abatement allowed, or additional information requested. |

| Letter 4722/4723/4724 | IRS Collection letter: Penalty abatement allowed, or additional information requested. |

| Letter 852C/853C/854C | Service Center letter: Penalty Waiver or Abatement Disallowed/Appeals Procedure Explained. |

| Letter 2413/2414 | IRS Collection letter: Penalty Waiver or Abatement Disallowed/Appeals Procedure Explained. |

| CP21B | Account adjustment: denotes the changes to the tax period/form as a result of penalty abatement. |

Accuracy Penalty Notices

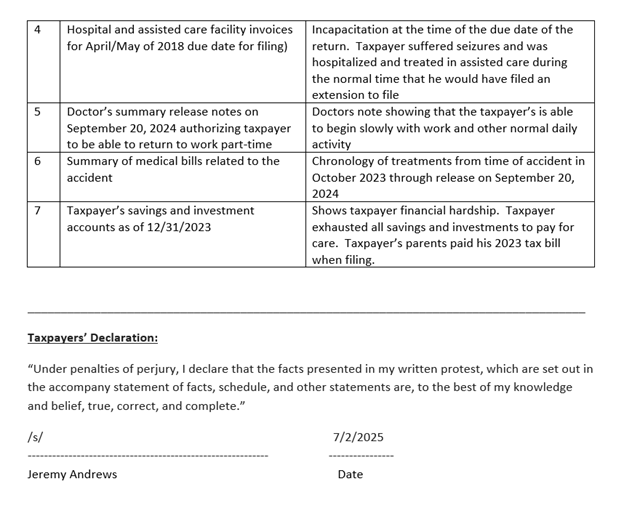

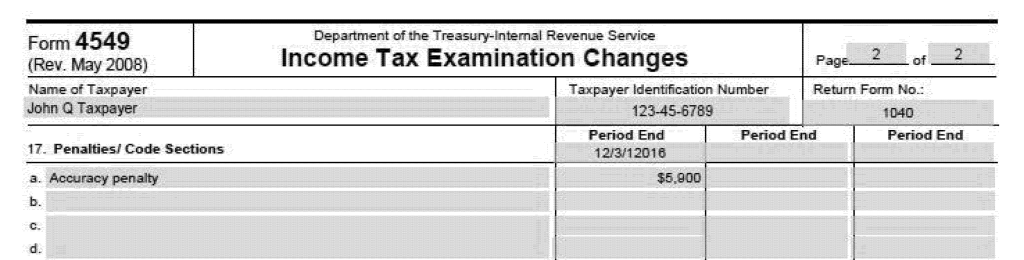

Accuracy penalties are proposed mainly during IRS audits and CP2000 notices. In an IRS audit, taxpayers would receive an examination report (Form 4549, Income Tax Examination Changes) outlining the accuracy penalty along with an explanation of why the accuracy penalty applies (Form 886-A, Explanation of Items). In a CP2000 underreporter inquiry, the IRS will propose the accuracy penalty on the CP2000 notice. If the audit or CP2000 is not resolved during the audit/CP2000 process or in IRS appeals, the taxpayer will receive a Statutory Notice of Deficiency (90-day letter, for example, an IRS Letter 531 or CP3219) that provides the calculation, amount, and explanation of the accuracy penalty proposed.

Useful IRS Website Resources and IRS Online Tools to Help with Penalty Relief

There are several IRS webpages and online tools that can provide assistance on penalty relief.

| Website | URL | Description |

| IRS Penalty Relief website | https://www.irs.gov/payments/penalty-relief | Reasons for penalty relief. |

| IRS Adminstrative Penalty Waiver website information | https://www.irs.gov/payments/administrative-penalty-relief | First time penalty abatement criteria assistance. |

| IRS Online Penalty Appeal Tool | https://www.irs.gov/appeals/penalty-appeal | Online interview to assist in making decision on whether to appeal an adverse penalty abatement determination. |

| IRS Tax relief in Disaster Situations | https://www.irs.gov/newsroom/tax-relief-in-disaster-situations | Help and penalty relief for recent disasters. |

| IRS Disaster Relief, by State | https://www.irs.gov/newsroom/around-the-nation | List of disaster relief by state. |

| IRS Transaction Code Book (IRS Document 6209), Section 10 | https://www.irs.gov/pub/irs-6209/section_10_2023.pdf | IRS transaction codes for all penalties listed on account transcripts. |

| FEMA disaster website | https://www.fema.gov/disaster | Lists of all declared disasters and the FEMA disaster number required for IRS penalty relief. |

| IRS “Your online account” tool | https://www.irs.gov/payments/your-online-account | Taxpayer IRS online account that provides transcripts and account information. |

| IRS Delinquent International Return Submission Procedures | https://www.irs.gov/individuals/international-taxpayers/delinquent-international-information-return-submission-procedures | How to address late-filed international information return penalties for reasonable cause. |

Key Terms and Definitions

| Term | Definition |

| Abatement | Penalty relief after the penalty has been assessed. Generally applicable to most IRS penalties that are automatically assessed by electronic means (i.e., failure to file and failure to pay penalties). |

| Account transcript (AT) | An IRS record of transactions on a taxpayer’s filed return or assessment for each form/tax period. Included in the AT are return filing dates, payments, assessments, and certain IRS enforcement activity, including some notices sent to the taxpayer. Also included are penalty assessments. |

| Accrued penalties | Usually refers to the failure to pay penalties that accrue on the unpaid balances owed until paid. |

| Accuracy penalty | A penalty for failing to file an accurate tax return. The most common accuracy penalties are for negligence and substantial understatement. Generally, the penalty is 20% of the underpayment. |

| Assessed penalties | Usually refers to the amount of penalties for failure to file and/or pay that is assessed at the time of filing. |

| Disaster relief | Federally declared relief for a large group of taxpayers located in an area affected by a disaster. Disaster area relief provides taxpayer an extended deadline to file and pay with no penalty. |

| Estimated tax penalty (ES) penalty | The penalty for not properly paying taxes owed throughout the tax period. It represents lost interest on the withholding/estimated tax payment amounts that should have been paid to the IRS as income was earned through the year. |

| Failure to file (FTF) penalty | A penalty for filing a tax return after the due date. The penalty is 5% per month, up to 25%. For returns due on or after 12/1/2023, if the return is over 60 days late, the minimum penalty is $485 (or, if it is lesser, 100% of the tax required to be shown on the return). This penalty is reduced by the failure to pay penalty for any month where both penalties apply. |

| Failure to pay (FTP) penalty | A penalty for not paying taxes on time. The rate is 0.5% per month of tax not paid by due date, April 15; 0.25% during approved installment agreement (if return was filed on time, and taxpayer is an individual); 1% if tax is not paid within ten days of a notice of intent to levy. The maximum penalty is 25%. This penalty along with the FTF penalty, cannot exceed 47.5%. |

| First-time penalty abatement (FTA) | A one-time IRS administrative penalty relief waiver for the failure to file/pay/deposit penalties for taxpayers with a clean compliance history. |

| Non-assertion | Penalty relief before the penalty has been assessed. |

| Reasonable cause (RC) | Any reason which establishes that that a taxpayer used ordinary business care and prudence to meet their federal tax obligations but were nevertheless unable to do so. |

| Reasonable Cause Assistant (RCA) | IRS automated tool used to determine whether the taxpayer qualifies for penalty abatement. |

| Statute of limitations | For penalty relief, the taxpayer generally has three years from the due date of the return or two years after the penalty has been paid to request abatement and a refund of the penalty paid. |

| Willful neglect | Conscious, intentional failure to comply with the provisions of the law, or reckless indifference to such provisions. |

Identifying IRS Penalties

There are three ways to identify the amount of IRS penalties assessed on a taxpayer.

- Contact the IRS: the IRS accounts management and PPS (tax practitioners) hotlines provide the total amounts of penalties, by type of penalty, for each year.

- IRS notices: many IRS notices contain the amount of penalties assessed. However, for ongoing penalties, like the failure to pay penalty, an IRS notice should not be relied upon to quantify the total amount of penalties assessed.

- IRS account transcripts: IRS account transcripts provide the amount of assessed penalties and are especially helpful for determining the total amount of failure to file, estimated tax, and accuracy penalties. IRS account transcripts may not provide a complete picture of total failure to pay penalties until the taxpayer has paid the entire balance owed for the account transcript year/form.

IRS Account Transcripts

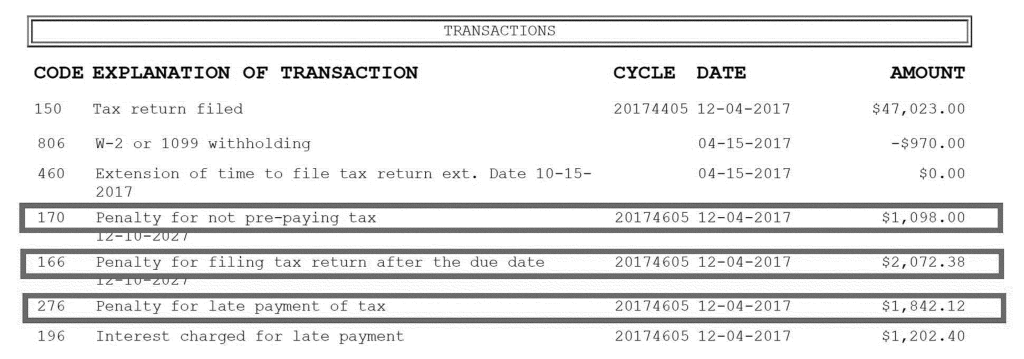

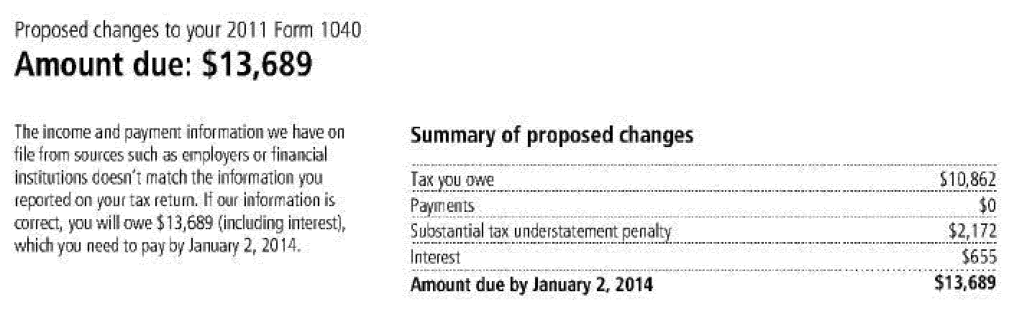

IRS account transcripts may be used to identify many commonly assessed penalties. Account transcripts are available by year, by form. For example, a taxpayer’s 2017 Form 1040 will have its own account transcript with transactions on that tax year/form. Common transaction codes for return related late filing, late payment, and accuracy penalties will appear in the transaction section of the account transcript with the following transaction codes.

| Transaction code (TC) | Penalty description |

| 160, 166 | Failure to file |

| 270, 276 | Failure to pay |

| 240 | Accuracy |

| 170, 176 | Estimated tax |

| 320 | Fraud |

An example of an assessed estimated tax, late filing, and late payment penalty appears below:

Taxpayers with an outstanding balance on a tax year should not rely on the account transcript to determine the total amount of the failure to pay (FTP) penalty. The account transcript may not have the entirety of the accrued (FTP) penalties if the taxpayer has an outstanding balance. This occurs because IRS computer systems cannot update IRS account transcripts to show accrued FTP penalties until the taxpayer pays off the initial assessed balance. IRS systems keep track of how much FTP penalty the taxpayer owes, but most of the penalty is never officially assessed to the taxpayer’s account until there are funds in the account to pay all or part of the accrued penalty. [[TIGTA Report 2012-40-113, Penalty Abatement Procedures Should Be Applied Consistently to All Taxpayers and Should Encourage Voluntary Compliance, (Sept. 19, 2012)]]

Practice Tip: Taxpayers and tax professionals should always call the IRS and get a “payoff amount” which will include the accrued FTP penalty. In addition, the taxpayer can access his or her online “View Your Tax Account” to see the accrued penalties.

IRS Civil Penalty Transcripts

Some miscellaneous penalties have special assessment procedures and do not appear on the taxpayer’s primary filed return (i.e., their Form 1040 tax module). These penalties create a separate transcript called a “civil penalty” transcript (called a “CIVPEN” tax module transcript).

Practice Tip: The IRS creates a separate “tax module” for each tax period and form for a taxpayer. In the case of a CIVPEN module, the IRS “form” is a “civil penalty” or “CIVPEN.” Tax professionals wishing to obtain information on the CIVPEN modules must be authorized for each “CIVPEN” module for each tax period on the Form 2848, Power of Attorney and Declaration of Representative.

Foreign information reporting forms are common examples where there may be penalties for the late filing of Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner, Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, and Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships.

Practice Tip: Individuals who are assessed the trust fund recovery penalty because they are a responsible person for unpaid payroll taxes are assessed a separate penalty which will be posted on a CIVPEN tax module.

The IRS also does not put the individual shared responsibility payment (the “ISRP” or 5000A penalty) on the Form 1040 account transcript. The IRS creates a separate tax module for the ISRP.

Practice Tip: A Power-of-Attorney/Appointee will not need to indicate the ISRP as a tax type on Form 2848 or 8821. The IRS allows a POA or third-party appointee with Form 1040 authorization to also obtain information and advocate for the ISRP 5000A penalty. [[IRM 21.3.7.8.3 (8-22-2023)]]

Five Reasons for IRS Penalty Relief

There are five primary reasons the IRS provides relief (non-assertion or abatement) from penalties. [[IRM 20.1.1.3 at (1) and (2) (10-19-2020)]]

| Relief reason | Explanation | Example |

| IRS error | Rely on advice of IRS. | Relief from the accuracy penalty based on oral or written advice by the IRS on a tax return position. |

| Statutory exception | Specific exclusion defined in law. | Relief from late filing and payment penalties based on disaster area relief or combat zone. |

| Appeals – hazards of litigation | IRS settlement based on likelihood of winning in court. | Relief from accuracy penalties based on an audit appeals settlement that considers the hazards of litigation. |

| Administrative waiver | IRS nonassertion or abatement to facilitate tax administration. | Mostly, failure to file and pay penalty relief under the IRS’s first-time abatement policy, and failure to deposit penalty relief also for payroll taxpayers. IRS can announce an administrative waivers based on circumstances (e.g. COVID-19 failure to file and pay penalty relief) |

| Reasonable cause | Facts and circumstances test.

FTF/FTP: circumstances outside the taxpayer’s control and not due to willful neglect that did not allow the taxpayer to comply Accuracy: a reasonable, good faith attempt to file an accurate tax return, or an honest misunderstanding of a material fact or law that is reasonable in light of all of the facts and circumstances. |

Failure to file: long-term illness/incapacitation, ignorance of law/honest mistake.

Failure to pay: financial hardship. Accuracy: reliance on third-party records, reasonable reliance on advice. |

Penalty relief due to IRS errors is rare. Also, penalty relief due to hazards of litigation is generally reserved for audit determinations and accuracy penalties that are contested in the IRS Independent Office of Appeals. Taxpayers may also receive appeals settlements for the failure to file and failure to pay penalties when appealing adverse penalty abatement determinations.

Practice Tip: Taxpayers can request penalty relief by asking for non-assertion (before the penalty is assessed) or for abatement (after the penalty is assessed). The standard and most effective procedure for accuracy and estimated tax penalty relief is to request non-assertion when filing a tax return. In an audit or CP2000 notice, accuracy penalties are contested during the audit/CP2000 investigation before they are assessed. It is possible that the taxpayer can request abatement, but to do so they must request “reconsideration” of the audit or CP2000 findings. Estimated tax penalty relief is requested when filing a tax return using Form 2210. Taxpayers can amend the Form 2210 after the ES penalty is assessed to request abatement. However, very few ES penalties are abated because the standard procedure is for taxpayers to request relief on Form 2210 when filing the return.

Claiming Disaster Area Penalty Relief

The IRS is authorized to provide federal tax relief to taxpayers affected by a federally declared disaster. When a significant disaster occurs affecting a wide area of taxpayers that warrants a federally declared disaster, the IRS often issues special instructions to facilitate evaluating the request for penalty relief. [[IRM 20.1.1.3.3.6 (11-25-2011)]] Generally, most disaster relief provides taxpayers an extension to file and pay. Taxpayers need to comply with the extended deadlines to warrant relief from penalties. Taxpayers who miss the deadlines due to extenuating circumstances may get further relief by showing reasonable cause.

In disaster situations, IRS disaster area penalty relief is generally automatically applied to a taxpayer based on their physical location (identified disaster area zip codes). Once a disaster area is declared, the IRS puts a disaster freeze code on the taxpayer’s account that automatically provides the appropriate penalty relief. [[IRM 25.16.1.7 at (2) (6-25-2012)]](https://www.irs.gov/irm/part20/irm_20-001-001r#idm140719832893232) If a taxpayer is not afforded the automatic relief, they should request relief by following the disaster relief instructions provided in the IRS penalty notice.

When taxpayers contact the IRS to self-identify that they are impacted by a disaster, they must provide the reason why they meet the criteria to qualify for the disaster relief (i.e., located in the identified disaster area). No other proof of a taxpayer’s qualification is required. [[IRM 25.16.1.7.1 (10-8-2021]]

Although the relief provided may be short, the IRS, under Internal Revenue Code sections 6081 and 6161, may abate failure to file or failure to pay penalties for up to six months based on reasonable cause criteria. To receive the penalty abatement, a taxpayer must call the IRS at the toll-free number listed on the penalty notice and explain the situation to the assistor. The taxpayer may have to file Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship. [[IRM 20.1.2.2.3.2 (2-27-2024)]]

Disaster relief also applies in situations where the taxpayer’s tax preparer is unable to file returns or make payments on behalf of the client because of the disaster. Taxpayers outside of the disaster area may qualify for relief if their preparer is in the disaster area, and the preparer is unable to file or pay on their behalf.

To obtain the postponement for filing or payment, the taxpayer must:

- Call the Disaster Assistance Hotline at 1-866-562-5227,

- Explain that the necessary records are located in a covered disaster area, and

- Provide the FEMA disaster number of the county where the tax preparer is located. [https://www.fema.gov/disaster/declarations]

Two Most Common Penalty Relief Requests: First-Time Abatement and Reasonable Cause

Out of the five reasons the IRS abates penalties, taxpayers most often need to utilize one or both of the following two options:

- First-time penalty abatement (FTA): an administrative waiver that abates the failure to file and pay penalties for one tax period for taxpayers with a clean compliance history (filed all required returns, no penalties in past three years other than estimated tax penalty, and in good standing with the IRS on outstanding balances owed).

Practice Tip: FTA does not apply to the accuracy penalty and the estimated tax penalty.

- Reasonable cause (RC): a facts and circumstances test that provides a reasonable basis for noncompliance and penalty relief.

The IRS reports that over 1.7 million individual taxpayers qualify for FTA each year. Many taxpayers also have reasonable cause circumstances that warrant relief from penalties. Most IRS request for penalty relief are made requesting FTA or RC. IRS procedures call for all penalty abatements that qualify for FTA be classified as FTA even if RC applies. For example, if a taxpayer qualifies for both FTA and RC abatement in a year, the IRS will provide abatement based on FTA. [IRM 20.1.1.3.3.2.1 at (12) (3-29-2023)] This will disqualify the taxpayer from receiving FTA for the next three years. [Taxpayers can address multiple years of penalties by qualifying for FTA in year one and RC in a subsequent year.]

However, the IRS publishes that if a penalty is removed in the prior 3-year lookback for an “acceptable reason” other than FTA, the taxpayer is considered to have a clean compliance history for purposes of applying FTA. [https://www.irs.gov/payments/administrative-penalty-relief] In short, the IRS has been inconsistent in how they interpret the lookback period for FTA. Often, the IRS “codes” the penalty relief as FTA when reasonable cause applies, removing the ability for the taxpayer to use FTA for the next three tax years.

In 2019, the IRS allowed FTA on 264,715 taxpayers. In comparison, in 2019, only 18,926 taxpayers were granted reasonable cause abatement. [Taxpayer Advocacy Panel, 2020]

First-Time Abatement Application

FTA applies to many different individual, business, and specialty tax returns and may be used to abate the failure to file and the failure to pay penalty. For employment tax returns, FTA could also be used to abate the first period failure to deposit penalty.

| FTA Qualifying Returns |

|---|

Income tax returns:

|

| Employment tax returns: |

| Excise tax returns: |

FTA does not apply to the following returns: [IRM 20.1.1.3.3.2.1 at (7) and (8) (3-29-2023)]

- Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return

- Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return

- Form 990 Series, Return of Organization Exempt from Income Tax

- Form 1096/1099, Annual Summary and Transmittal of U.S. Information Returns (regarding failure to file information statements, such as Forms 1099, W-2G and 1098)

- Form W-3/W-2, Transmittal of Wage and Tax Statements (regarding failure to file Forms W-2)

- Form 5500 Series, Annual Return/Report of Employee Benefit Plan

- Form 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations, and

- Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

Reasonable Cause Penalty Relief Application

Most penalties can be abated if the taxpayer has reasonable cause. For the most common penalties (FTF, FTP), reasonable cause relief applies. In addition, the accuracy penalty (proposed in audits and CP2000 notices) also has a reasonable cause exception. For the ES penalty, a reasonable cause exception does not apply. Taxpayers request relief from ES penalties by providing an exception on Form 2210.

The following table details IRS penalties that qualify for reasonable cause relief.

| Penalty Section | Type of Penalty | Reasonable Cause Relief | Other Relief |

| IRC §6039E | Failure to Provide Information Concerning Resident Status | Yes | Yes |

| IRC §6651(a)(1) | Failure to File Tax Return | Yes | Yes |

| IRC §6651(a)(2) | Failure to Pay Tax When Due | Yes | Yes |

| IRC §6651(a)(3) | Failure to Pay within ten Days of Notice of Additional Tax Due (notices issued prior to 1/1/1997) | Yes | Yes |

| IRC §6651(a)(3) | Failure to Pay within 21 Days of Notice of Additional Tax Due (ten business days if amount is $100,000 or more) (notices issued after 12/31/1996) | Yes | Yes |

| IRC §6651(f) | Fraudulent Failure to File | No | No |

| IRC §6652(a)(1) | Failure to File Certain Information Returns | Yes | Yes |

| IRC §6652(c)(1) | Failure to File Annual Return by Exempt Organization | Yes | Yes |

| IRC §6652(c)(2) | Failure to File Returns Under IRC §6034 or IRC §6043(b) | Yes | Yes |

| IRC §6652(d)(2) | Notification of Change in Status of a Plan | Yes | Yes |

| IRC §6652(e) | Information Required in Connection with Certain Plans of Deferred Compensation—Form 5500, Annual Return/Report of Employee Benefit Plan | Yes | Yes |

| IRC §6652(h) | Failure to Give Notice to Recipients of Certain Pension, Distributions, etc. | Yes | Yes |

| IRC §6652(i) | Failure to Give Written Explanation to Recipients of Certain Qualifying Rollover Distributions | Yes | Yes |

| IRC §6652(j) | Failure to File Certification with Respect to Certain Residential Rental Projects | Yes | Yes |

| IRC §6654 | Estimated Tax Penalty on Individuals | No | Yes |

| IRC §6655 | Estimated Tax Penalty on Corporations | No | No |

| IRC §6656(a) | Failure to Deposit | Yes | Yes |

| IRC §6657 | Bad Checks | Yes | Yes |

| IRC §6662 | Accuracy-Related Penalty on Underpayments | Yes | Yes |

| IRC §6662A | Accuracy-Related Penalty on Understatements with Respect to Reportable Transactions | Yes | Yes |

| IRC §6663 | Fraud | No | No |

| IRC §6676 | Erroneous Claim for Refund or Credit | Yes | No |

| IRC §6692 | Failure to File Actuarial Report | Yes | Yes |

| IRC §6698 | Failure to File Partnership Return | Yes | Yes |

| IRC §6699 | Failure to File S Corporation Return | Yes | Yes |

| IRC §6721 | Failure to File Correct Information Reporting Returns | Yes | Yes |

| IRC §6722 | Failure to Furnish Correct Payee Statements | Yes | Yes |

| IRC §6723 | Failure to Comply With other Information Reporting Requirements | Yes | Yes |

Reasonable cause relief is a facts and circumstances test. Taxpayers must exercise ordinary business care and prudence when complying. Ordinary business care and prudence includes making provisions for business obligations to be met when reasonably foreseeable events occur.

Reasonable cause is generally established when the taxpayer exercises ordinary business care and prudence, but, due to circumstances beyond the taxpayer’s control, the taxpayer was unable to timely meet the tax obligation.

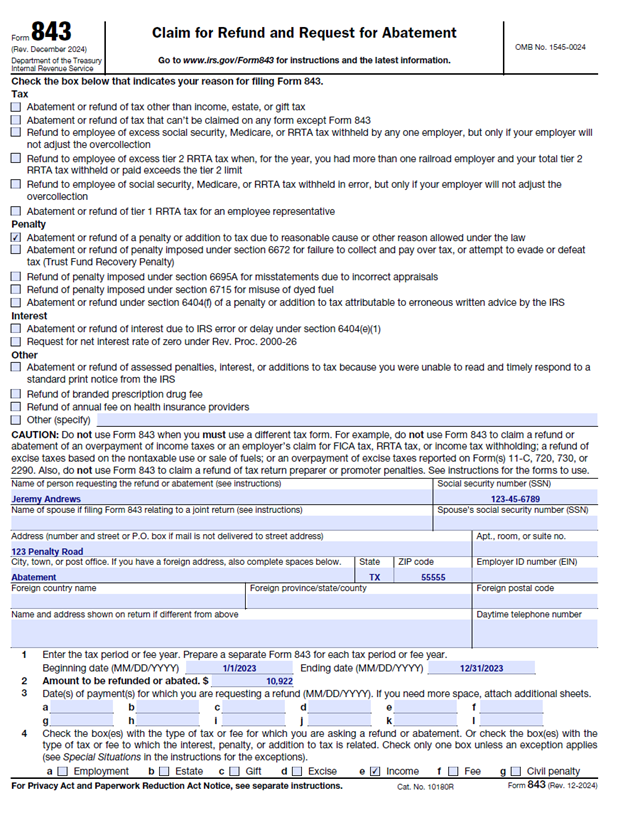

Abatement of Interest

In rare circumstances, taxpayers may have interest charges abated. If the IRS calculated interest incorrectly or the taxpayer has cause for interest abatement, the taxpayer should request interest abatement via Form 843, Claim for Refund and Request for Abatement. [[IRM 20.2.7.14 (12-20-2023)]]

Most circumstances in which the IRS will abate interest involve an undue delay by an IRS employee. This occurs when an IRS employee caused an unreasonable error or delay and the taxpayer did not significantly contribute to the error or delay. Taxpayers should review IRM 20.2.7.5.1 (12-20-2023) for specific circumstances that are deemed unreasonable errors or delays that warrant interest abatement.

The IRS is also authorized to abate assessed interest due to a “mathematical error” on a return prepared by an IRS employee while preparing income tax returns in his or her official capacity or as a voluntary income tax assistance (VITA) volunteer. [[IRM 20.2.7.4.1 at (1) (12-20-2023)]]

Statute of Limitations to Request Penalty Abatement

Taxpayers requesting abatement of penalties must do so before the refund statute of limitations (RSED) expires — that is, within three years after the penalty is assessed or two years after the penalty has been paid. Tax periods with unpaid penalty assessments are open for abatement. [IRM 25.6.1.10.1 at (3) (10-2-2023)]

If the RSED is still open, taxpayers should request FTA as far back as 2001. Taxpayers can also request penalty abatement multiple times for the same year. For example, a taxpayer can request FTA for the FTP for a year with an open balance owed and request the abatement again after additional FTP has accrued. In practice, many taxpayers and tax professionals try to request FTA once by waiting until the balance is almost paid and the FTP penalty has stopped accruing.

IRS PENALTY ABATEMENT: LATE FILING AND LATE PAYMENT

This section covers how to request penalty relief for two common IRS penalties.

| Topic | Covers |

| Common IRS Penalties | The three most common penalties: failure to pay, failure to file, and estimated tax; how taxpayers obtain relief from the estimated tax penalty. |

| Failure to Pay Penalty Basics | How the failure to pay penalty is computed and assessed, and what penalty relief options are available. |

| Failure to File Penalty Basics | How the failure to file penalty is computed and assessed, and what penalty relief options are available. |

| First Option for Abatement of FTF/FTP Penalties: First-Time Penalty Abatement | How to qualify and request first-time penalty abatement. |

| Reasonable Cause Abatement | What returns and conditions qualify for FTA and how to request FTA from the IRS. |

| Requesting Reasonable Cause Penalty Abatement | How to request reasonable cause penalty abatement. |

| Steps to Request FTF and FTP Penalty Abatement | The steps to follow to evaluate and request penalty abatement. |

| Appealing Adverse Penalty Abatement Determinations | Available options and how to appeal an adverse penalty abatement determination. |

| Late Filing Penalty Abatement for Related International Information Returns | Penalty relief options for individual penalty assessments for late filing of international information returns. |

| Example: FTF and FTP Reasonable Cause Abatement Request | A comprehensive example of an FTF and FTP penalty abatement request for reasonable cause. |

| Template Penalty Abatement Request Letter/Attachment to Form 843 | A template to use when requesting penalty abatement. |

Other helpful sections:

| Topic | Covers |

|---|---|

| Overview of Unfiled Past-Due Tax Returns | How to resolve past due returns, including requesting relief from the failure to file penalty. |

| Additions to Unpaid Taxes: Failure to Pay Penalty and Accrued Interest | How to reduce the failure to pay penalty by entering into an installment agreement with the IRS. |

| IRS Transcripts | How to identify the amount of penalties assessed. |

Key Highlights:

- FTP and FTF penalties make up almost two-thirds of all penalties assessed on individuals. The IRS assesses these penalties automatically when the taxpayer files late and/or does not pay on time.

- Most taxpayers must request relief from the FTP and FTF penalty by requesting abatement — that is, relief after the penalty has been assessed.

- First-time penalty abatement and reasonable cause abatement are the two most common reasons to request abatement for the FTP and FTF penalties. FTA is the most common reason to request and receive abatement. The IRS has also released limited administrative penalty waivers for the FTF and FTP penalties as a result of taxpayer hardships during the pandemic.

- Taxpayers can, and often need to, request an appeal if the IRS denies penalty abatement. There are several appeals options available to taxpayers with denied penalty abatement requests or with outstanding balances that include penalties.

Common IRS Penalties

Three penalties make up 95% of all penalties assessed on individual taxpayers:

- The failure to pay (FTP) penalty: 52%

- The estimated tax (ES) penalty: 35%

- The failure to file (FTF) penalty: 8%

The FTP and FTF penalties are abated at much higher rates than the ES penalty. In 2022, the IRS automatically abated 2019 and 2020 FTF penalties for taxpayers who met certain conditions. In 2023 and 2024, the IRS abated FTP penalties for taxpayers who met certain conditions on 2020 and 2021 returns. As a result, the number of abatements for 2022-2024 were more than the total number assessed. [ Penalty Relief for Certain Taxpayers Filing Returns for Taxable Years 2019 and 2020 andIRS helps taxpayers by providing penalty relief on nearly 5 million 2020 and 2021 tax returns; restart of collection notices in 2024 marks end of pandemic-related pause .]

[IRS Data Book, 2024, Table 28]

FTP and FTF penalty relief may be requested prior to or after assessment. However, ES penalties are best addressed by applying for a waiver using Form 2210 when filing a return.

Estimated Tax Penalty Relief

The estimated tax (ES) penalty makes up 35% of all individual penalties. The ES penalty is a penalty for failure to prepay tax as required via withholding or estimated tax payments. However, taxpayers rarely request abatement for this penalty as most ES penalties are self-assessed or corrected by filing a Form 2210 with a tax return. The IRS may abate the ES penalty if it has made a computational error or the taxpayer provides a corrected Form 2210.

The penalty for underpayment of estimated tax cannot be removed or waived for reasonable cause alone. For the waiver to be available, both of the following conditions must be met: [[IRM 20.1.3.3.2.1.2 at (3) (7-23-2020)]]

- The taxpayer’s failure to comply with the estimated tax requirements was due to casualty, disaster, or other unusual circumstances, and not due to any other reason.

- Given all the facts, it would be against equity and good conscience to apply the penalty.

Practice Tip: In 2024 and earlier years, less than 3% of all ES penalties were abated and taxpayers are rarely successful at requesting ES penalty abatement. Most were abated by the IRS as a result of return changes that impacted the computation of the penalty. Taxpayers wishing to evaluate ES penalty abatement should review IRM 20.1.3.3.2.1 (3-31-2010) for reasons allowed by the IRS for ES penalty abatement.

The penalty for underpayment of estimated tax generally is not waived as a result of disaster. However, in the case of a federally declared disaster area, “the Secretary may specify a period of up to one year that may be disregarded” in determining whether estimated tax payments were paid on time. In these cases, the IRS will issue a memo with specific instructions regarding the payment of estimated tax in the affected area. [[IRM 20.1.3.2.7.1 (12-10-2013)]]

Waivers are sometimes granted by legislation, regulation, or administrative pronouncements to provide relief from ES penalties created by the retroactive application of a change in statute or Service position. [[IRM 20.1.3.2.7 (3-31-2010)]] For example, for 2018 tax returns, Congress provided relief from ES penalties due to the confusion to many taxpayers on how much to properly withhold as a result of tax reform. Taxpayers may apply this relief when filing. However, taxpayers who had already filed for tax year 2018 and did not take the qualifying relief may claim a refund by filing Form 843, Claim for Refund and Request for Abatement, and include the statement “80% Waiver of estimated tax penalty” on Line 7. [IRS News Release IR-2019-55 (March 22, 2019)] On August 14, 2019, the IRS announced that taxpayers would no longer have to request relief and that it would automatically waive ES penalties for eligible 2018 tax filers. [[IRS News Release IR-2019-144 (August 14, 2019)]] However, taxpayers who were not provided the automatic relief should request it using the procedures outlined in the March 22, 2019 news release.

In many cases, approved ES penalty waivers filed on Form 2210 with the return are automatically applied by IRS computers at the time of filing by suppressing the assessment of the penalty when filing a tax return. Taxpayers who are not given the automatic relief should file Form 843 to request the relief.

Failure to Pay Penalty Basics

More than half of all penalties assessed to individuals are for the failure to pay (FTP) penalty. Internal Revenue Code section 6651(a)(2) provides for a penalty if the tax shown on any return is not paid by the due date for payment, unless the failure to pay is due to reasonable cause and not due to willful neglect. In short, the FTP penalty applies whenever a taxpayer does not fully pay his or her taxes by the original due date of the return or the extended due date if an extension is filed and granted. In addition, if the taxpayer files an extension, he must have paid 90% of the final liability reported on the tax return before the due date of the return to avoid the FTP penalty. [[Treasury Regulation §301.6651-1(c)(3)]]

FTP Penalty Rates and Computation

Internal Revenue Code section 6651(a)(2) provides for the computation of the FTP penalty on the tax reported on the return. The normal rate is 0.5%, but the FTP penalty will change based on the taxpayer’s status with the IRS. The FTP rates are:

- 0.5% of the tax not paid by due date.

- 0.25% during an approved installment agreement (if the individual return was filed on time). [[IRM 20.1.2.3.8.1.2 (2-27-2024)]]

- 1% if the tax is not paid within ten days of a notice of intent to levy (ten days after notice of intent to levy — usually given by IRS notice CP504, LT11, Letter 1058). [IRM 20.1.2.3.8.1.1 (4-19-2011)]

The FTP penalty is a recurring charge on the remaining unpaid tax each month or part of a month following the due date, until the tax is paid in full or until the maximum cumulative penalty (25%) is reached. A full monthly charge applies, even if the tax is paid before the month ends.

For each month, the amount subject to this penalty is the portion of the amount shown as tax on the return that is not paid before the beginning of that month, either by payment, or by credit against the tax that may be claimed on the return. Detailed examples and guidance on FTP calculations are found in IRM 20.1.2.3.8 (4-19-2011) and its subsections.

When the taxpayer owes an additional amount as a result of a deficiency (i.e., an audit, CP2000 assessment, amended return, math error adjustment), the taxpayer will be assessed the FTP penalty if they do not pay the deficiency in full within 21 days of the date of notice and demand. [[IRM 20.1.2.3.8.5 (4-19-2011)]] The time to pay is reduced to ten business days if the amount in the notice and demand equals or exceeds $100,000. [Internal Revenue Code Section 6651(a)(3)] An example of how to compute the FTP penalty in the case of a notice and demand related to a deficiency is found at IRM 20.1.2.3.8.7.3 (2-27-2024).

The FTP penalty is coordinated with the FTF penalty. When both penalties are charged for the same month, the penalty for filing late is reduced by the penalty for paying late for that month. An example of how the two penalties are computed is found in IRM 20.1.2.3.8.7.1 (2-27-2024).

FTP Penalty Relief: Undue Hardship When Filing or When Assessed Additional Tax

Taxpayers can request abatement of the FTP penalty using first-time abatement (FTA). However, if the FTA does not apply, taxpayers can still request both non-assertion of the FTP penalty as well as abatement. Non-assertion should be requested for undue hardship or for reasonable cause. Abatement is requested for reasonable cause after the penalty is assessed.

Taxpayers who are unable to pay with their tax return, or upon receipt of a tax bill from an audit or CP2000, can request an extension of time to pay and relief from the FTP penalty. The extension to pay and penalty non-assertion may be proactively requested only if the taxpayer has an undue hardship. Taxpayers use Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship, to request the extension of time to pay and the suppression of the FTP penalty. For filed tax returns, the penalty can be suppressed for six months. If the amount owed is due to a deficiency (audit, CP2000), then the taxpayer should qualify for 18 months of FTP relief. [[IRM 20.1.1.3.3.3 (08-05-2014)]]

The IRS defines an “undue hardship” as a substantial financial loss if you pay your tax on the date it is due. An undue hardship means more than a mere inconvenience to the taxpayer.

Taxpayers need to request relief in a timely manner using Form 1127. If a taxpayer is requesting an extension of time to pay the tax due on a current year return, Form 1127 must be received on or before the due date of that return, not including extensions. For taxpayers requesting an extension of time to pay an amount determined as a deficiency, Form 1127 must be received on or before the due date for payment indicated in the tax bill.

FTP Penalty Relief: Statutory Exceptions

Taxpayer may also qualify for abatement (i.e., relief after the penalty is assessed) if they meet one of the statutory exceptions to the penalty.

There are two statutory exceptions to a penalty for individual taxpayers and these can provide the basis for a request for abatement:

- Internal Revenue Code section 6404(f) allowing abatement due to an IRS error: abatement of a penalty or addition to tax attributable to erroneous written advice by the Internal Revenue Service. [[IRM 20.1.1.3.3.4.1 (11-25-2011)]]

- Internal Revenue Code sections 7508 and 7508A: for disaster area and combat relief.

Most disaster relief is provided automatically by the IRS. However, taxpayers who qualify for statutory relief and are not automatically granted the relief should request it on Form 843.

FTP Penalty Relief: Reasonable Cause

Taxpayers may also get abatement for the FTP penalty due to reasonable cause. Reasonable cause is generally established when the taxpayer exercises ordinary business care and prudence, but, due to circumstances beyond the taxpayer’s control, the taxpayer was unable to pay the tax or would suffer an undue hardship if the tax was paid before the due date.

For the failure to pay penalty, reasonable cause is defined in Treasury Regulation §301.6651-1(c)(1):

In determining whether the taxpayer was unable to pay the tax in spite of the exercise of ordinary business care and prudence in providing for payment of his tax liability, consideration will be given to all the facts and circumstances of the taxpayer‘s financial situation, including the amount and nature of the taxpayer‘s expenditures in light of the income (or other amounts) he could, at the time of such expenditures, reasonably expect to receive prior to the date prescribed for the payment of the tax. Thus, for example, a taxpayer who incurs lavish or extravagant living expenses in an amount such that the remainder of his assets and anticipated income will be insufficient to pay his tax, has not exercised ordinary business care and prudence in providing for the payment of his tax liability. Further, a taxpayer who invests funds in speculative or illiquid assets has not exercised ordinary business care and prudence in providing for the payment of his tax liability unless, at the time of the investment, the remainder of the taxpayer‘s assets and estimated income will be sufficient to pay his tax or it can be reasonably foreseen that the speculative or illiquid investment made by the taxpayer can be utilized (by sale or as security for a loan) to realize sufficient funds to satisfy the tax liability. A taxpayer will be considered to have exercised ordinary business care and prudence if he made reasonable efforts to conserve sufficient assets in marketable form to satisfy his tax liability and nevertheless was unable to pay all or a portion of the tax when it became due.

In short, successful FTP reasonable cause arguments demonstrate the taxpayer’s significant financial hardship if the tax is paid. [[IRM 20.1.2.2.4.1 at (2e) (7-18-2016)]] “Insufficient funds” generally is not reasonable cause for failure to pay, unless the funds were depleted due to unusual or unforeseen circumstances. The manner in which the taxpayer handled his or her finances and unforeseen circumstances outside the taxpayer’s control are critical factors in determining reasonable cause.

The IRM provides some context of how the IRS determines significant hardship:[[IRM 20.1.2.2.4.1 at (2e) (7-18-2016)]]

Example 4-1 A taxpayer who was able to pay, but who needed the money to pay for necessary medical expenses, may be able to demonstrate that payment of the tax (in lieu of paying for the medical expense) would have resulted in a significant hardship. Similarly, significant hardship also exists if the taxpayer would only have been able to pay the tax by liquidating assets well below fair market value.

Practice Tip: IRS personnel, including appeals officers, often ask the following six questions to determine if the taxpayer qualifies for FTP penalty relief due to reasonable cause:

- What evidence does the taxpayer have to show lack of funds to pay the tax?

- What efforts were made to access equity in assets to pay?

- What measures did the taxpayer take to get funds by 4/15?

- Was the taxpayer only able to pay essential living expenses?

- Was the taxpayer living beyond his or her means?

- Were other creditors in arrears in addition to the IRS?

These questions provide the IRS insight as to how the taxpayer handled his or her finances and whether the situation was a significant hardship that was unforeseen and outside of his or her control. Taxpayers requesting FTP penalty abatement should be prepared to address and provide documentation to each question.

When taxpayers have multiple years and/or assessments, FTP reasonable cause is determined separately for each year and assessment. Taxpayers must provide their reasonable cause argument for each year and assessment when requesting FTP penalty abatement.

Practice Tip: Taxpayers should file separate penalty abatement requests for each year/assessment when they are requesting abatement for multiple years. Each request should provide the reasonable cause argument for each year/assessment.

IRS Notice 2024-7: Systemic Failure to Pay Penalty Relief

On December 19, 2023, the IRS announced broad-based FTP penalty relief for certain 2020 and 2021 returns due notice delay occurring during IRS operation interruptions due to the COVID-19 pandemic. The IRS provided FTP penalty relief to over 4.7 million taxpayers who were assessed an FTP penalty for 2020 and 2021. [IR-2023-244, Dec. 19, 2023] The relief applied ONLY to the FTP penalty.

Applicable returns include: [IRS Notice 2024-07, Dec. 19, 2023)

- Form 1040 series

- Form 1041

- Form 1120 series

- Form 990-T

To qualify, the taxpayer must owe less than $100,000 in assessed income tax. The $100,000 limit applies separately to each year. Taxpayers do not qualify for the relief in any year that has an assessed tax balance greater than $100,000. The assessed balance limit does not include applicable penalties and interest added to the balance after the initial assessment. Also, the taxpayer must have had the assessed tax bill before December 7, 2023, via IRS Notice CP14 (individual), CP161 (business) or its equivalent notice. This provision presumably removes many taxpayers who would have filed in the latter part of October 2023 or after.

The FTP penalty relief period begins on the date the IRS issued an initial balance due notice to the eligible taxpayer, or February 5, 2022, whichever is later. The penalty relief would only be provided through March 31, 2024. After that date, the IRS will continue to charge the FTP penalty on any outstanding balance owed.

Practice Tip: Taxpayers who qualify for relief should check their IRS account transcripts to confirm relief has been granted. FTP penalties show in the transaction section of an account transcript (transaction code 270/276). Abatements show up as a reversal of the penalty (transaction code 271/277). If the taxpayer qualifies for relief but it was not granted, they should contact the IRS Penalty Hotline immediately to request relief.

Failure to File Penalty Basics

When a taxpayer files a return late and has a balance owed, she will incur a failure to file (FTF) penalty. Internal Revenue Code section 6651(a)(1) imposes a penalty for failure to file a tax return by the date prescribed for filing (including extensions), unless it is shown that the failure is due to reasonable cause and not due to willful neglect.

FTF Penalty Rate

For each month or part of a month that the return is late, the penalty is 5% of the amount subject to the penalty. The maximum penalty is 25% of the unpaid tax on the payment due date, unless the minimum penalty applies. Because the penalty cannot exceed 25%, it is not charged for more than five months. [[IRM 20.1.2.3.7.1 (04-19-2011)]]

The penalty for filing late is reduced by the amount of any penalty for paying late for any month during which both penalties apply.

The amount subject to the penalty is the tax required to be shown on the return, reduced by the following: [[IRM 20.1.2.3.7.2 (04-19-2011)]]

- The amount paid on or before the date prescribed for payment of the tax without regard to any extensions of time to file or pay.

- The amount of any credit against the tax that may be claimed on the return (i.e., credits, estimated taxes, and withholding)

Minimum Penalty for FTF

The FTF penalty has a minimum penalty amount. If the return is more than 60 days late, and the normal computed penalty is less than the amount listed in the table below, then a minimum penalty applies. The minimum penalty is the lesser of two amounts — 100% of the tax required to be shown on the return that was not paid on time, or a minimum dollar amount (adjusted annually for inflation): [[IRM 20.1.2.3.7.4 (2-27-2024) and https://www.irs.gov/payments/failure-to-file-penalty]

| Return Due Date (w/o extension) | Minimum Amount |

| On or before 12/31/2008 | $100.00 |

| Between 01/01/2009 and 12/31/2015 | $135.00 |

| Between 01/01/2016 and 12/31/2017 | $205.00 |

| Between 01/01/2018 and 12/31/2019 | $210.00 |

| Between 01/01/2020 and 12/31/2022 | $435.00 |

| Between 12/31/2022 and 12/31/2023 | $450.00 |

| Between 12/31/2023 and 12/31/2024 | $485.00 |

| After 12/31/2024 | $510.00 |

Fraudulent Failure to File

Internal Revenue Code section 6651(f) provides for an increase in the penalty rate for failure to file if the failure to file is fraudulent. The penalty rate is increased from 5% per month to 15% for each month or part of a month the return is late, and the maximum penalty is increased from 25% of the amount subject to IRC §6651(a)(1) to 75% of that amount. [IRM 20.1.2.3.7.5 (07-02-2013)]

The burden of proof is on the IRS to establish the fraudulent FTF penalty. There must be clear and convincing evidence that the FTF was done with the intent to evade taxes. The IRS considers these factors when applying the fraudulent FTF penalty: [[IRM 20.1.2.3.7.5 (07-02-2013)]]

- The taxpayer refuses to, or is unable to, explain the failure to file,

- The taxpayer’s statement does not agree with the facts of the case,

- There is a history of failing to file or late filing, but an apparent ability to pay,

- The taxpayer fails to reveal or tries to conceal assets,

- The taxpayer pays personal and business expenses in cash when cash payments are not usual, or cashes rather than deposits checks that are business receipts, and

- The taxpayer is aware of the filing requirement.

Fraudulent FTF cases are usually investigated and developed by IRS auditors (revenue agents and tax examiners). Before the penalty is imposed, IRS auditors must get the approval of an IRS manager and this must be concurred by an IRS Area Counsel attorney. [IRM 20.1.2.3.7.5.1 at (2) (07-02-2013)]

To assess a fraudulent FTF penalty, the IRS issues the taxpayer Letter 2777, Pre-Assessment Appeals Letter for the Fraudulent Failure to File Penalty, and provides the taxpayer the reasons for the penalty on Form 4549, Income Tax Examination Changes, and Form 886-A, Explanation of Items (these are the same forms used in an IRS audit). Consistent with the deficiency procedures in an IRS audit, taxpayers are given the opportunity to dispute the fraudulent FTF penalty before the penalty is assessed. [[IRM 20.1.2.3.7.5.1 (07-02-2013)]]

Practice Tip: Taxpayers should always file their required tax returns as soon as possible. In practice, the IRS rarely pursues the fraudulent FTF penalty on most non-filers – especially if the taxpayer immediately complies with a request to file a late return. High-wealth, higher income, and self-employed taxpayers generally can experience higher incidents of fraudulent FTF enforcement. Usually, most IRS fraudulent FTF cases originate from multiple year taxpayer delinquency investigations conducted by IRS Collection field personnel (revenue officers) or from related audits conducted by IRS auditors (revenue agents, tax compliance officers, or tax examiners).

Taxpayers should contest the fraudulent FTF prior to assessment. However, if the fraudulent FTF is already assessed, taxpayers can request abatement. Because most fraudulent FTF penalties are assessed in the audit process, taxpayers usually will be forced to request post-assessment abatement by requesting audit reconsideration or using IRS claim for refund procedures.

FTF Penalty Relief

The FTF penalty can be costly to a taxpayer filing late. For example, a taxpayer who files more than five months late and owes $10,000 will have an additional “delinquency” penalty (delinquency penalty is a common term used by the IRS to describe the combined FTF and FTP penalty for the first five months, which is limited to 25%) of $2,500.

Taxpayers may request penalty relief at the time of filing a late return (non-assertion of the penalty) or after the penalty is assessed (request for abatement). If the taxpayer has disaster relief, the IRS will generally provide an extended deadline to file to avoid the FTF penalty. The penalty is automatically suppressed based on the taxpayer’s location in a disaster zone (the IRS puts a disaster area code on the taxpayer’s account based on their zip code).

FTF Penalty Relief: Reasonable Cause

Taxpayers can request abatement for the FTF penalty due to reasonable cause. Reasonable cause is generally established when the taxpayer exercises ordinary business care and prudence, but, due to circumstances beyond the taxpayer’s control, the taxpayer was unable to file a return within the prescribed period. It is a facts and circumstances test.

There are many circumstances that establish reasonable cause. In practice, taxpayers should be aware of two circumstances that are not considered reasonable cause by the IRS for late filing:

- Undue economic hardship or inability to pay; the inability to pay does not waive the taxpayer’s obligation to file on time.

- Reliance on a tax professional to timely file; the current IRS position is that taxpayers cannot delegate their obligation to file to a third party.

Practice Tip: Taxpayers often rely on their tax preparer or tax software for filing compliance. Often taxpayers claim to the IRS that they hired a tax preparer to file and thought the return was filed. Taxpayers may even show that they signed the e-file authorization that allows the tax preparer to directly e-file the tax return. However, taxpayers who solely rely on reliance on tax preparer or tax software are likely to have their penalty abatement request denied. Taxpayers should not use reliance on a tax pro/software as a primary argument but argue other applicable related reasons such as unable to access records or ignorance of the law. [[IRM 20.1.1.3.2.2.5 at (4) (11-21-2017)]]

First Option for Abatement of FTF/FTP Penalties: First-Time Penalty Abatement

Since 2001, the IRS ordinarily provides penalty relief for taxpayers with a clean compliance history for FTF and FTP penalties that have been assessed. This administrative waiver is called “first-time abatement” (FTA).

Qualifying taxpayers with no penalties in the prior three years and in good standing with the IRS (they have filed all returns and do not have an outstanding balance) may request the first period penalties to be abated without providing reasonable cause.

FTA Qualification

FTA applies to specific taxpayers/returns with the circumstances described in the following table. [[IRM 20.1.1.3.3.2.1 (3-29-2023)]]

| Qualifying taxpayers and returns | Individual: 1040 series

Business: Form 1065 and 1120 Series Payroll: 940/941/944/945 Not applicable: event-based returns (estate, gift) and information returns (W-2s, 1099s, 3520, 5471, etc.). |

| Applicable penalties that can be abated | Failure to file, failure to pay, and failure to deposit (not accuracy or estimated tax penalty). |

| Penalty history | No penalties for the prior three years preceding the penalty year (estimated tax penalty does not disqualify for FTA). If the penalty is on a joint return, neither spouse can have a prior disqualifying penalty. Any penalties abated and coded by the IRS due to “Reasonable cause” in the prior three years should not disallow the taxpayer from FTA. |

| Outstanding balances | If taxpayer owes back taxes, taxpayer is in an agreement to pay and is current on payments. |

| Filing compliance | All required returns have been filed. According to IRM 20.1.1.3.3.2.1 at (5) (3-29-2023), the taxpayer must have filed, if required, the past three years’ returns. In the case of a married filing joint return, both the primary and secondary taxpayers must have filed their prior three years of required returns. |

| Amount that can be abated | There is no dollar limitation on the amount that can be abated. |

| How to request | Any amount can be abated in writing or by phone. |