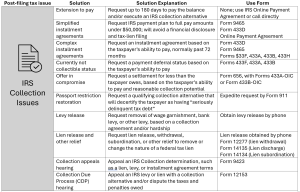

Chapter 3- IRS Collection: Process, Enforcement, and Solutions

Chapter 3

IRS Collection

INTRODUCTION

Key Highlights:

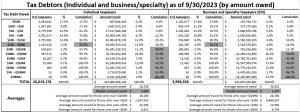

- Many owe and cannot pay: over 20 million individuals owe the IRS at the end of 2023 – and more are added to this status annually as more taxpayers file or have additional adjustments (i.e., from IRS compliance activity such as audits) and cannot pay. Each year, millions file and cannot pay. Over 4 million businesses in 2023 owe the IRS back taxes. It is estimated that, as of 2025, approximately 26 million individuals and business owe the IRS. Of these 26 million individuals and businesses who owe the IRS, only 20% are in an agreement to pay. The other 80% are subject to IRS collection enforcement actions.

- Cannot pay — get a collection alternative: taxpayers who owe and cannot pay need a collection alternative or they will face IRS collection enforcement.

- Collection statute: the IRS has ten years from the date of assessment to collect back taxes.

- The power to collect: IRS enforcement tools are liens, levies, and passport restrictions. In egregious situations, the IRS may seize assets, but it rarely does so.

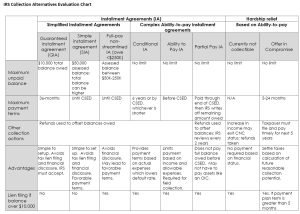

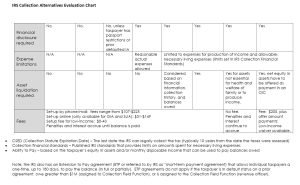

- The alternatives to full payment: the IRS has four categories of collection alternatives to full payment: extensions to pay, installment agreements, currently not collectible hardship status, and the tax settlement called an Offer in Compromise.

- Most common solutions: extensions to pay and installment agreements are most of the collection agreements executed with the IRS.

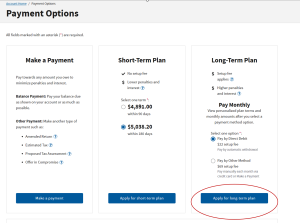

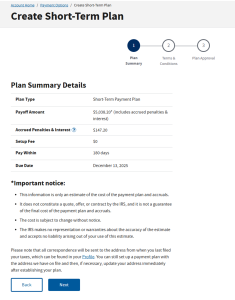

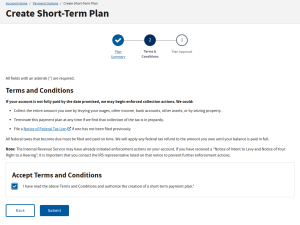

- Most deal with IRS by phone or online: most IRS collection activity is completed through automated collection notices, enforcement actions, and refund offsets. Most IRS interactions regarding complex collection solutions are done by phone. Business taxpayers and taxpayers with large balances owed are often sent to local IRS collection offices for collection. However, over 2/3rds of all payment plans are now completed online using the IRS’s Online Payment Agreement (OPA) application.

What’s New for 2025?

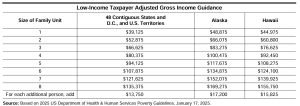

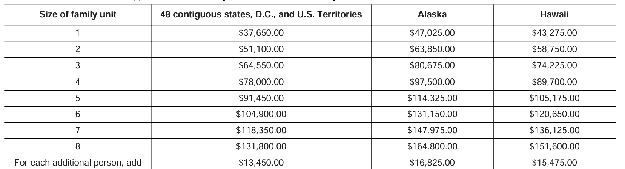

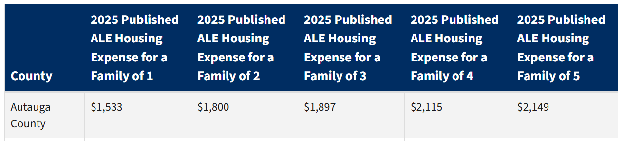

- Updated collection financial standards and exemption amounts to determine ability to pay.

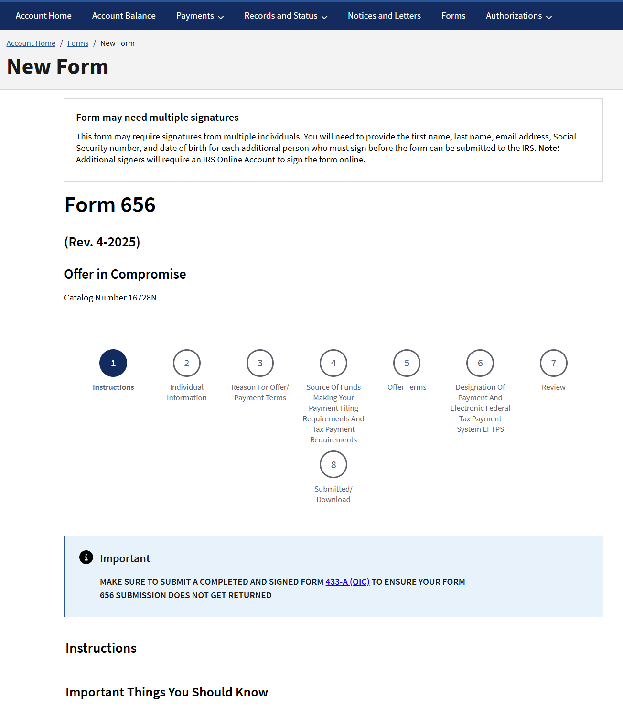

- Updated collection forms: including Form 656-B, Offer in Compromise Booklet.

- IRS restarts campus collection notices and enforcement through levies.

- IRS retires the Streamlined Installment Agreement and replaces it with the more favorable Simple Installment Agreement.

- Expansion of the Tax Pro Account to allow for viewing of balances owed and Online Payment Agreements.

What’s Covered in This Section?

- Step-by-step approach to resolving a collection issue.

- How to determine which collection alternative is best.

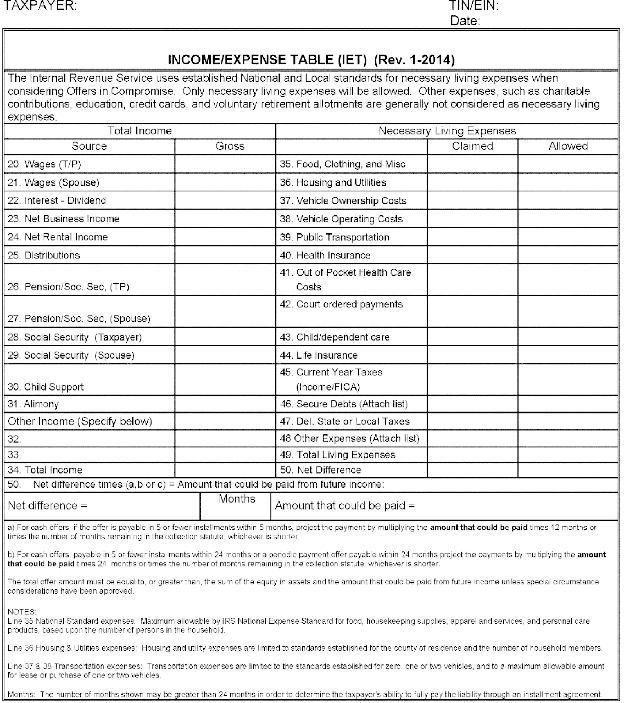

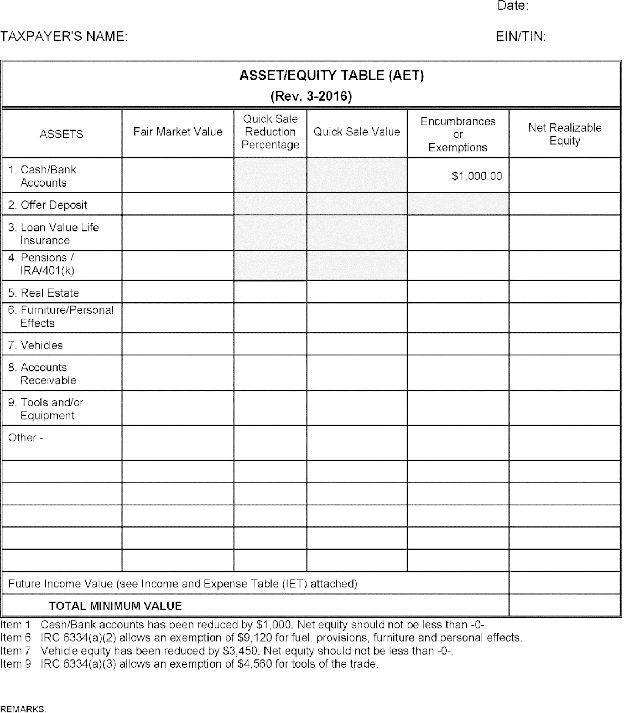

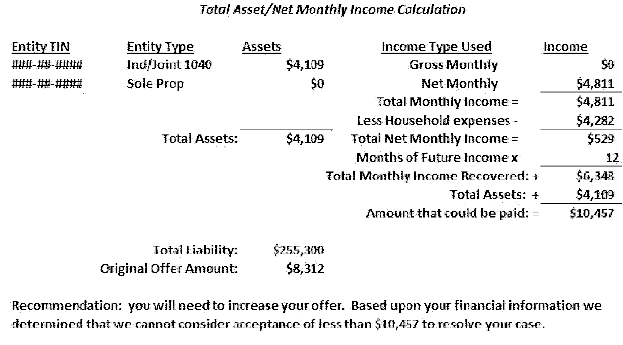

- How to compute a taxpayer’s ability to pay through an installment agreement, currently not collectible, or an Offer in Compromise.

- How to obtain an IRS collection alternative for extensions to pay, installment agreements, currently not collectible, and Offer in Compromise.

- How to resolve collection enforcement actions.

- How to appeal an adverse collection determination.

What’s Not Covered — and Why?

- Bankruptcy options: these options are legal remedies that require the expertise of a bankruptcy attorney. Few taxpayers utilize this option solely for tax debt resolution.

- Evasion of payment situations: taxpayers who have evaded payment by transferring assets or other means should consult an attorney for assistance and legal advice.

Most Common Actions Performed by Taxpayers and Tax Professionals When Addressing Collection Issues

- Evaluating which collection alternative is best.

- Contacting the IRS for tax history and to execute agreements.

- Streamlined installment agreements.

- Extensions to pay.

- Avoiding IRS collection enforcement (lien, levy, passport restrictions).

- Making payments.

When to Get an Expert Involved

- Field collection: collection enforcement by the Collection Field function (revenue officer).

- Complicated solutions: complex ability to pay collection alternatives (Ability to pay installment agreements, Offer in Compromise), especially for small business taxpayers.

- Notice of Federal Tax Lien complications: evaluating and executing lien relief options.

- Bankruptcy: contemplating bankruptcy to resolve back tax debt issues.

- Potential criminal violations: taxpayers who have willfully evaded payment should always consult an attorney.

Professional Assistance Fees

- Hourly: range from $80-$500 an hour for an EA, CPA, or tax attorney representation.

- Flat fee: national firms can charge flat fees from $3,000-$25,000 depending on the amount owed and complexity of the issues involved.

- No fee: low-income taxpayer clinics can assist taxpayers free of charge.

Closely Related Issues

- Unfiled returns: taxpayers must have filed all returns to qualify for most IRS collection alternatives.

- Penalties: taxpayers who cannot pay incur penalties. Taxpayers should request penalty abatement if they qualify.

- Trust Fund Recovery Penalty investigations: IRS Collection has the authority investigate, assess, and collect the Trust Fund Recovery Penalty on unpaid employment taxes from any and responsible persons.

Time Frame Estimates for Common Collection Solutions/Actions

| Collection Action | Estimated Hours to Complete | Average Duration Estimate |

| Obtaining tax history and transcripts from IRS | <1 hour (best to call IRS by phone) | 1 day-3 weeks (if transcripts come by mail) |

| Extension to pay (non-hardship) | <1 hour (by phone or online) | 1 day |

| Simple installment agreements | 1-2 hours (by phone or online) | 1 day (up to 6 weeks to finalize if paying by direct debit) |

| Complex ability to pay installment agreements involving production of Collection Information Statements | 6-25 hours (self-employed taxpayers require more financial analysis) | 1 day-3 months (quickest by contacting IRS by phone/fax) |

| Preparing and negotiating an OIC | 15-40 hours | 6-12 months |

| Post-agreement levy release | 1 hour | 1 day |

| Lien relief options | 6-20 hours | 1-3 months |

| Expedited passport restriction relief (post-agreement) | 5-10 hours | 14-30 days |

| Follow-up status check with IRS | <1 hour (by phone) | <1 day |

UPDATES TO THIS CHAPTER

10/6/2025: IRS updated the IRS Appeals Customer Service phone number to 855-865-3401.

7/20/2025: updated with latest IRM citations

Updated with new Simple installment agreement effective March 5, 2025, and new IRS Collection Standards effective April 22, 2025

UNDERSTANDING THE IRS COLLECTION PROCESS

This section provides a basic overview of the IRS collection process and conveys important information when working with the IRS on a collection issue.

| Topic | Covers |

|---|---|

| Introduction to IRS Collection and U.S. Tax Debtors | How the IRS collects tax and the most likely situations taxpayers face when they have a balance with the IRS. |

| Basic IRS Collection Principles | Ten fundamental principles of IRS collection and how to attain a collection agreement. |

| Relevant IRS Internal Revenue Manual Sections | Highlights of the IRS collection manual that contains the procedures used in IRS collection alternatives, agreements, and enforcement. |

| IRS Collection Publications and Forms | IRS publications and forms used in IRS collection proceedings. |

| Frequently Used IRS Collection Phone Numbers | IRS contact numbers used for IRS collection issues. |

| Common IRS Notices and Taxpayer Notifications | List of common IRS collection notices. |

| Useful IRS Website Resources and Online Tools | IRS resources to obtain tax account information and enter into collection agreements. |

| Key Terms and Definitions | IRS terms used in resolving a collection issue with the IRS. |

| Overview of IRS Collection Alternatives | Quick summary of IRS collection alternatives to full pay. |

| Overview of IRS Collection Enforcement | Quick summary of IRS Automated Collection System and Collection Field function. |

| IRS Collection Process: The Collection Notice Stream and the IRS Collection Roadmap | The IRS notice process used to collect back taxes owed and the process of collection. |

| IRS Collection Enforcement: Levies and Liens | Quick overview of IRS collection enforcement through levies and liens. |

| IRS Collection Enforcement: Passport Restrictions | Quick overview of IRS collection enforcement using passport restrictions. |

| Collection Statute of Limitations | Explanation of how long the IRS can collect on back balances owed. |

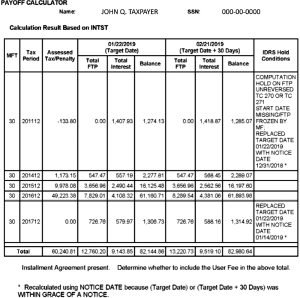

| Additions to Unpaid Taxes: Failure to Pay Penalty and Accrued Interest | Failure to pay penalty rates and interest rates on back balances. |

| Payments Methods | Various ways to pay the IRS. How and why to designate payments on specific balances owed. |

| Private Debt Collection | How the IRS’s private debt collection process works. |

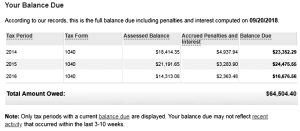

| Tax Debtors: Annual Notices of Balances Owed and Activity | Notices that taxpayers will receive each year when they have a balance with the IRS. |

Other helpful sections:

| Topic | Covers |

|---|---|

| IRS Collection Alternatives | The options available to taxpayers who owe the IRS. |

| IRS Forms Used for Collection Agreements and Issues | Common IRS forms used for collection agreements with the IRS. |

| Common IRS Collection Notices | Examples of IRS collection notices and what they mean. |

| IRS Collection Publications | IRS publications on various IRS collection issues. |

Key Highlights:

- There are approximately 26 million individual and business taxpayers in 2025 who have a balance with the IRS and need a collection alternative to be in good standing with the IRS.

- Taxpayers who are not in an agreement on their unpaid balances face IRS collection enforcement, including levies, liens, and passport restrictions.

- The IRS has a system of collecting through automated notices and systems as well as local collection officers. The rules for working with IRS collection are contained in the IRS’s Internal Revenue Manual.

- The IRS has ten years from the date of assessment to collect on taxes owed. After the collection statute expires, the IRS writes off the remaining balances owed.

Introduction to IRS Collection and U.S. Tax Debtors

Taxpayers who owe and cannot pay the IRS can enter into an agreement with the IRS to pay their taxes. This agreement allows them to get into good standing with the IRS; otherwise, they face possible enforced collection of their balances owed. These agreements can come in the form of:

- an extension to pay,

- one of the many types of IRS payment plans (called installment agreements),

- currently not collectible temporary hardship status, or

- an offer in compromise.

Taxpayers who do not achieve good standing with the IRS face potential enforced collection in the form of IRS levies, federal tax liens, and passport restrictions. It is essential for taxpayers who need a collection alternative to understand the options available to them and the required procedures to successfully execute an agreement with the IRS. Once the taxpayer has successfully executed an agreement on the back taxes owed, they will achieve good standing with the IRS and will avoid enforced collection as long as they abide by the terms of that agreement.

U.S. Tax Debtors

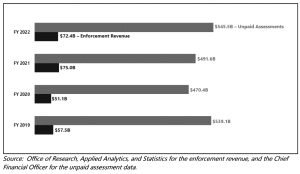

Each year, millions of taxpayers file their tax returns but are unable to pay the balance. Millions more have additional taxes that they cannot pay as a result of assessments from audits, return adjustments, and other additions to tax, such as penalties. As of September 2022, delinquent taxpayers owed the IRS $545 billion. The IRS enforcement resources could only collect approximately $72 billion of the outstanding amount. [TIGTA Report 2024-300-011, Trends in Compliance Activities Through Fiscal Year 2022, December 20, 2023]

In 2023, the IRS reported that there were 24 million individuals and businesses that owed back taxes and could not pay them. Of those individuals, 95% owed less than $50,000 to the IRS. [IRS FOIA Response #2024-05289, February 2024] For businesses, 94.1% owe less than $50,000. The median amount owed is far less than $5,000 for both individual and business taxpayers.

Although data is not yet available for 2024, it is estimated that 26 million taxpayers now the IRS.

The majority of these taxpayers could enter into a simple installment agreement that would satisfy their liability and allow them to achieve good standing with the IRS.

Despite this, many taxpayers fail to seek a collection alternative.

As of September 30, 2024, approximately 20% of taxpayers were not in one of the available IRS collection agreements – and are subject to enforced collection actions.

As of September 2024, the IRS had over 14.9 million delinquent taxpayer accounts in collections with the IRS. [IRS Data Book, 2024, Table 27] Out of the more than 163 million individual filers for the 2023 tax year, 41.6 million filed with a balance due to the IRS. [IRS Filing Season Statistics for 2024 Filing Season, December 27, 2024] Ultimately, several million of these taxpayers will not be able to pay the IRS immediately and will join the population of taxpayers who will require a collection alternative.

Taxpayers who owe back taxes, penalties, and/or interest to the IRS can face IRS collection enforcement if they do not pay the balances owed or come to an agreement with the IRS, called a collection alternative. The IRS can enforce collection of back taxes through levies and federal tax liens that can seize their income and assets to pay the outstanding balances. [IRC sections 6331(a) and 6321] Beginning in 2018, the IRS began to certify seriously delinquent tax debtors, providing their information to the State Department for purposes of restricting their passport use. [IRC §7345]

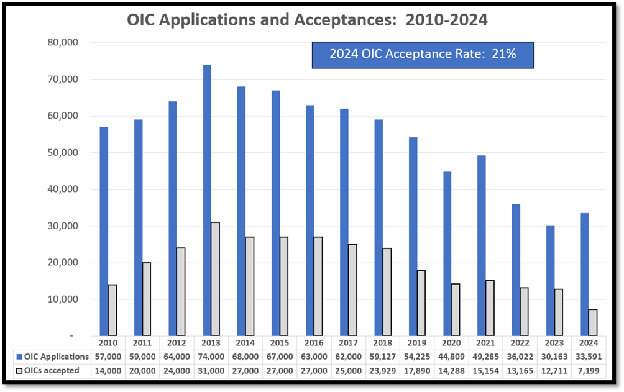

Taxpayers who are unable to pay have alternatives to facing collections by the IRS. The IRS routinely allows taxpayers extensions of time to pay and payment plans that allow the taxpayer to meet the payment obligations. For taxpayers facing financial hardship, the IRS has temporary hardship relief, referred to as “currently not collectible.” The IRS also has a settlement option called an “offer in compromise” that allows for a satisfactory settlement with taxpayers who do not possess the capability to pay in full with their current assets or future income. Each year, millions of taxpayers enter into extensions to pay, installment agreements, and currently not collectible status. 7,199 taxpayers in 2024 successfully secured an offer in compromise to settle their tax bill for less than the amount owed. [IRS FOIA Response #2025-00032, October 2024 and IRS Data Book 2024, Table 27] Taxpayers who require a collection alternative must act timely in order to avoid the adverse consequences of enforced IRS collection activity.

IRS Collection Enforcement Functions

Most IRS collection enforcement originates from IRS computer systems (called the Automated Collection Systems or ACS). More serious IRS collection enforcement is usually assigned to Collection Field function (local IRS collection offices staffed with special collection enforcement personnel called revenue officers). The rules and procedures to obtain each type of collection alternative differ and the rules change frequently. Most of these rules are in the IRS’s operational guidelines that are explained in the Internal Revenue Manual. Part 5 of the IRM contains many of these procedures. Other rules can also be found in other IRS guidance including publications and forms instructions. It is important to accurately follow the most current IRS procedures to successfully secure an IRS collection alternative.

Chapter 3 provides the options and step-by-step guidance and practice tips to obtain the most appropriate collection alternative with the IRS.

Basic IRS Collection Principles

Taxpayers who cannot pay the amounts owed need to be aware of the ten basic principles of IRS collection:

- The four IRS alternatives to full payment of taxes: if a taxpayer cannot pay, the IRS has four collection alternatives to full payment: extension to pay, installment agreement, currently not collectible temporary status, and an offer in compromise. There are different rules for each alternative. Bankruptcy can also be a collection option, but this program operates within the guidelines of the U.S. Bankruptcy Code.

- The IRS can enforce payment: taxpayers who do not pay their balances owed to the IRS or make other collection arrangements can face IRS collection enforcement in the forms of levies, federal tax liens, and possible passport restrictions. [IRC sections 6331, 6321, and 7345]

- Agreements require filing and payment compliance: in order to enter into a collection alternative, taxpayers must file all required returns and have sufficient withholding and/or estimated tax payments in order to avoid owing additional taxes on future return filings. [IRM 5.14.1.4.2 (12-23-2022)]

- Only one agreement allowed: for taxpayers who owe for multiple years, the IRS requires that the taxpayer enter into only one agreement to pay. Additional balance-owed years will cause a default on existing agreements with the IRS. [IRM 5.14.1.4.2 (12-23-2022)]

- Penalties and interest continue to accrue: balances owed to the IRS will continue to accrue a failure to pay penalty (up to 25%) and interest (the rate determined by quarter) on the outstanding balances owed. [IRC sections 6651 and 6601]

- Refunds are taken to offset balance owed: when a taxpayer owes back balances, the IRS will take the taxpayer’s refunds and overpayments to offset against the balanced owed until the balance is paid in full. [IRC §6402(c)]

- IRS has ten years to collect: the collection statute of limitations is ten years from the date of assessment. The IRS can collect all balances until the collection statute expiration date. [IRC §6502]

- Certain taxes and taxpayers get more serious enforcement: taxpayers who owe payroll and other trust fund taxes, who owe higher balances and/or for repeated years, or have unfiled tax returns, in addition to balances owed, face more scrutiny from the IRS.

- Most IRS collection enforcement is automated: collection of back taxes can be enforced by IRS automated systems or by local IRS field personnel. Most collection activity is pursued by the automated systems. Most interactions to resolve collection issues can be done by phone to the IRS campuses or “service centers” that send these automated notices and collection enforcement activity.

- Importance of agreement to avoid enforcement: taxpayers who do not make an agreement with the IRS can be subject to enforcement by levy, federal tax lien, and, possibly, passport restrictions. Taxpayers need to execute a collection agreement and complete the terms of their agreement to stay in good standing with the IRS to avoid enforced collection.

Relevant Internal Revenue Manual Sections

The IRS’s Internal Revenue Manual (IRM) contains most of the rules related to IRS collection procedures and collection alternatives. Part 5 of the IRM contains most of the IRS collection procedures. The following sections are most often used in assisting taxpayers with IRS collection issues:

| IRM Section | Topic |

| Part 5 | IRS collection process |

| 5.19 | IRS automated collection procedures |

| 5.15 | Financial analysis rules for installment agreements and CNC |

| 5.16 | Currently not collectible status and rules |

| 5.14 | Installment agreement rules and options |

| 5.1.19 | Collection statute of limitation rules |

| 5.12 | Federal tax lien rules and options |

| 5.11 | Levy rules |

| 5.9 | Bankruptcy rules for tax debtors |

| 5.8 | Offer in compromise rules |

IRS Collection Publications and Forms

The IRS website (IRS.gov) contains useful publications such as those listed below.

| Publication | Title |

| Pub. 594 | The IRS Collection Process |

| Notice 746 | Information about Your Notice, Penalty and Interest |

| Pub. 783 | How to Apply for Certificate of Discharge from Federal Tax Lien |

| Pub. 784 | How to Apply for a Certificate of Subordination of Federal Tax Lien |

| Pub. 1024 | How to Apply for a Certificate of Non-Attachment of Federal Tax Lien |

| Pub. 1450 | Instructions for Requesting a Certificate of Release of Federal Tax Lien |

| Pub. 1468 | Guidelines for Processing Notice of Federal Tax Lien Documents |

| Pub. 1660 | Collection Appeal Rights |

| Pub. 1854 | How to Prepare a Collection Information Statement (Form 433-A) |

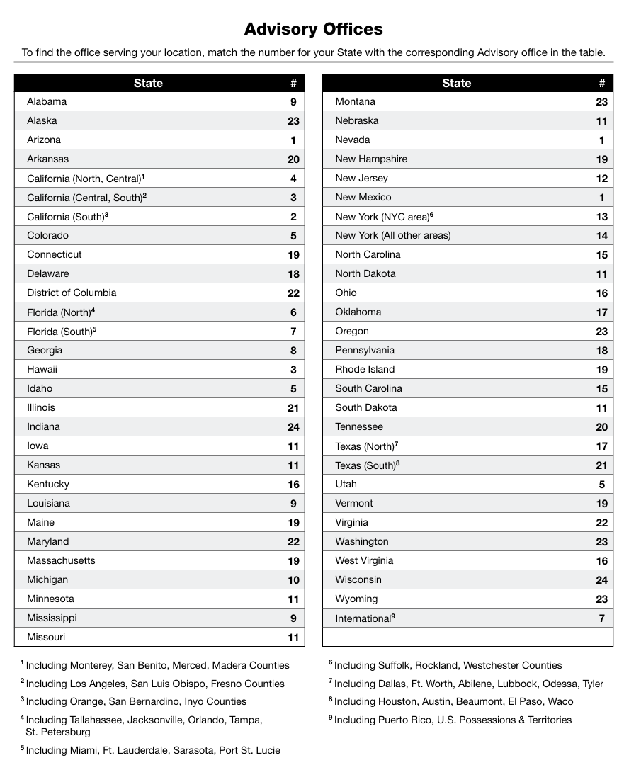

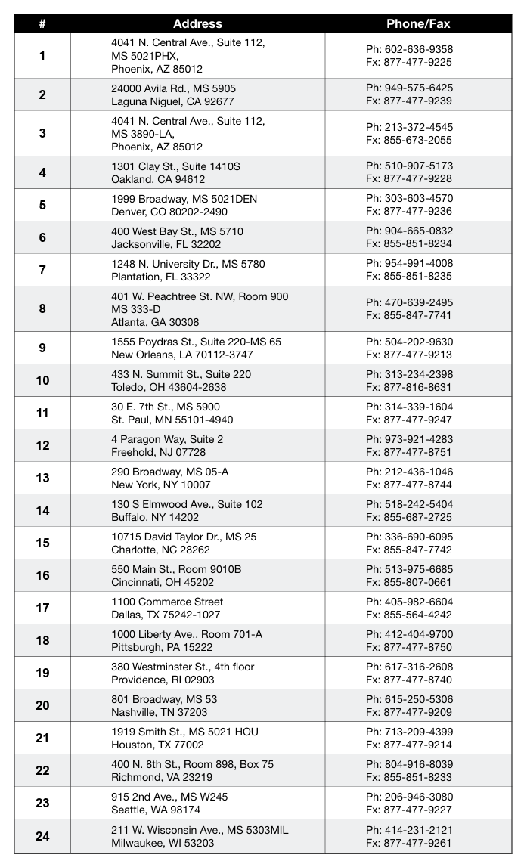

| Pub. 4235 | Collection Advisory Offices Contact Information |

| Pub. 4518 | What You Can Expect When the IRS Assigns Your Account to a Private Collection Agency |

| Pub. 5059 | How to Prepare a Collection Information Statement (Form 433-B) |

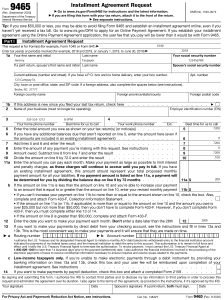

| Form 9465 Instructions | Instructions for Form 9465 |

| Form | Title |

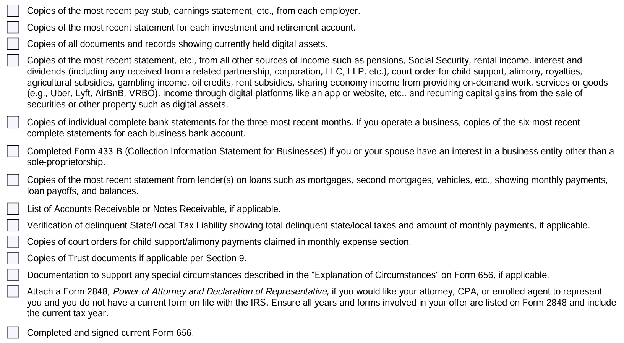

| Form 433-A | Collection Information Statement for Wage Earners and Self-Employed Individuals |

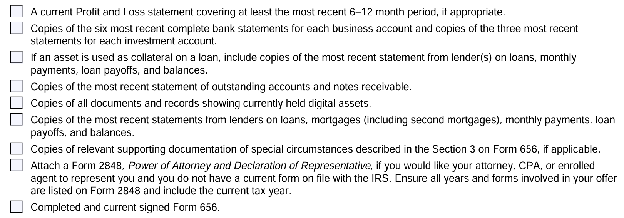

| Form 433-B | Collection Information Statement for Businesses |

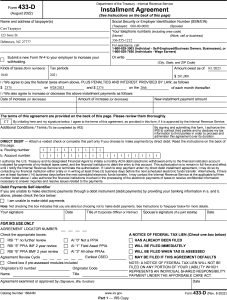

| Form 433-D | Installment Agreement |

| Form 433-F | Collection Information Statement |

| Form 433-H | Installment Agreement Request and Collection Information Statement |

| Form 656-B | Offer in Compromise Booklet |

| Form 1127 | Application for Extension of Time for Payment of Tax Due to Undue Hardship |

| Form 2159 | Payroll Deduction Agreement |

| Form 9465 | Installment Agreement Request |

| Form 9423 | Collection Appeal Request |

| Form 12153 | Request for a Collection Due Process or Equivalent Hearing |

| Form 12277 | Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien |

| Form 13711 | Request for Appeal of Offer in Compromise |

| Form 13844 | Application for Reduced User Fee for Installment Agreements |

| Form 14134 | Application for Certificate of Subordination of Federal Tax Lien |

| Form 14135 | Application for Certificate of Discharge of Property from Federal Tax Lien |

Frequently Used IRS Collection Phone Numbers

| IRS Hotline | Phone Number | Hours/Availability (times subject to change) |

| Individual Accounts | (800) 829-1040 | For taxpayers, tax pros use PPS

M-F, 7AM-7PM, local time |

| Business and Specialty Accounts | (800) 829-4933 | For taxpayers, tax pros use PPS

M-F, 7AM-7PM, local time |

| Taxpayer Advocate National Hotline (central intake) | (877) 777-4778 | M-F, 7AM-7PM, local time

Local offices: 8AM-4:30PM |

| Balance Due Questions: Taxpayer Not in IRS Collection | (800) 829-0922 | M-F, 7AM-7PM, local time |

| Automated Collection: Individuals | (800) 829-7650 (W&I) | M-F, 8AM-8PM, local time |

| Automated Collection: Self-Employed and Businesses | (800) 829-3903 (SB/SE) | M-F, 8AM-8PM, local time |

| Centralized Offer in Compromise Unit (on Form 656-PPV) | (844) 398-5025 (Memphis)

(844) 805-4980 (Holtsville) |

M-F, 8AM-5PM (CST)

M-F, 8AM-11PM (EST) |

| Centralized Lien Unit | (800) 913-6050 | M-F, 8AM-5PM, local time |

| Treasury (Tax) Offset Program (not an IRS number) | (800) 304-3107 | M-F, 7:30AM-5:30PM (CST), plus automated options |

| Practitioner Priority Service | (866) 860-4259

Option #2: Individual accounts Option #3: Business accounts Option #4: Automated Collection System |

M-F, 7AM-7PM, local time |

| Automated Substitute for Return Unit | (866) 681-4271 | M-F, 10AM-5PM, local time |

| IRS Special Compliance Program | (833) 282-7220 | M-F, 8AM-8PM, ET |

Common IRS Notices and Taxpayer Notifications

| Notice # | Title | Used for: |

| CP14 | Balance Due for Year | First balance due notice. |

| CP14i | Balance Due: Installment Agreement Set-up | Taxpayer with a balance due owed on a filed return in which a payment plan was requested and granted. |

| CP90 | Intent to Levy and Notice of Right to Hearing | Notice of Intent to levy on a federal payment. |

| CP91 | Final Notice Before Levy on Social Security Benefits | Notice of intent to seize 15% of social security benefits. |

| CP92 | Notice of Levy on Your State Tax Refund — Notice of Your Right to a Hearing | Notification of state income tax levy. |

| CP501 | Balance Due Notice | Second balance due notice (first notice was CP14). |

| CP503 | Second Reminder: Balance Due Notice | Third balance due notice (prior notice was CP501). |

| CP504 | Notice of Intent to Levy | Fourth balance due notice; notice of intent to levy state income tax refund. |

| CP508C | Notice of Certification of Your Seriously Delinquent Federal Tax Debt to the State Department | Notify taxpayer that they are subject to passport restrictions on past-due tax debt owed. |

| CP508R | Reversal of Notice of Certification of Your Seriously Delinquent Federal Tax Debt to the State Department | Notify taxpayer that he or she is in good standing and not subject to passport restrictions. |

| CP521 | Monthly Installment Agreement Reminder | Notify taxpayer of monthly installment agreement payment due (with payment voucher). |

| CP522 | IRS Partial Pay Installment Agreement—Two-year review | Notice requiring taxpayer to provide new financial information related to a partial pay installment agreement (as required by law). Taxpayer directed to call IRS at 800-831-0273 (taxpayer will be given an extension number on the CP522). |

| CP523 | Notice of Intent to Levy and Intent to Terminate Your Installment Agreement | Notify taxpayer that he/she is in default of the installment agreement. |

| Form 8519 | Taxpayer Copy of Notice of Levy | Notify taxpayer that a bank/financial institution levy was issued for collection of back balances owed. |

| Letter LT11/L1058 | Final Notice of Intent to Levy (LT11: Automated Collection System; L1058: Collection Field Function) | Notify taxpayer that he or she is subject to levy in 30 days and he/she has a right to request a Collection Due Process Hearing within 30 days. |

| Letter LT16 | Account Has Been Assigned for Collection Enforcement | Notifies taxpayer that he/she is assigned to IRS collection for enforcement (lien and levy). |

| Letter LT38 | Reminder: You Have a Balance Due; IRS Has Ways to Help You | IRS reminder notice sent in 2024 to taxpayers who owe in years prior to 2022. The notice provides years and amounts owed, with information and links to collection alternatives. |

| Letter 3172 | Notice of Federal Tax Lien and Right to a Hearing under IRC §6320 | Notifies taxpayer that a Notice of Federal Tax Lien has been filed and he/she has a right to request a Collection Due Process hearing within 30 days. |

| CP89 | Annual Installment Agreement Notice | Annual notice for those in an installment agreement that shows amounts paid and balances owed. |

| CP71 Series | Annual Notice | Annual installment agreement reminder for taxpayers in CNC or assigned to collection. |

| CP40 | Taxpayer Account Assigned to a Private Debt Collection Agency | Taxpayer’s account has been assigned to PDC. Further notices and contacts for collection will be made by one of the PDCs. |

| Letter 725 | Meeting Scheduled with Taxpayer | Revenue officer meeting request/confirmation. |

| Form 9297 | Summary of Taxpayer Contact | Revenue officer request and deadline for information. |

| PDC Letter | Private Debt Collection Letter | Letter from the PDC that notifies taxpayer that he/she is assigned to a Private Debt Collection agency. |

Useful IRS Website Resources and Online Tools

| Website | URL | Description |

| IRS Collection Financial Standards | https://www.irs.gov/businesses/small-businesses-self-employed/collection-financial-standards | Updated IRS collection standards for expenses allowed in ability to pay agreements. |

| IRS Online Payment Agreement | https://www.irs.gov/payments/online-payment-agreement-application | Request simple payment agreement or extension to pay online. |

| IRS “View your tax account” online tool | https://www.irs.gov/payments/your-online-account | Taxpayer IRS online account that provides transcripts and account information, including balances owed. |

| IRS Get Transcript service | https://www.irs.gov/individuals/get-transcript | Obtain IRS transcripts for each tax year/form. |

| IRS e-Services Transcript Delivery System (tax pros only) | https://www.irs.gov/tax-professionals/transcript-delivery-system-tds | Tax pro electronic account with features to access authorized taxpayer transcripts. |

| IRS OIC Pre-qualifier tool | https://irs.treasury.gov/oic_pre_qualifier/ | Tool to use to see if a taxpayer qualifies for an OIC. |

| IRS Collection Process | https://www.irs.gov/businesses/small-businesses-self-employed/collection-process-for-taxpayers-filing-and-or-paying-late | IRS resources and forms for resolving back taxes. |

Key Terms and Definitions

| Term | Definition |

| Ability to Pay (ATP) | The amount a taxpayer can afford to pay based on equity in assets and income and allowable expenses. |

| Automated Collection System (ACS) | Refers to the IRS automated function of issuing past-due notices and triggering enforced collection actions, including levies and liens. |

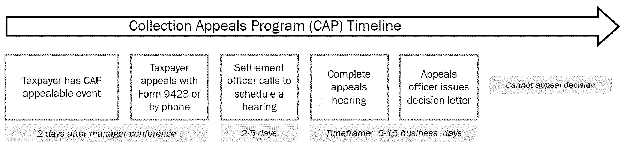

| Collection Appeals Program (CAP) | An informal IRS appeals function generally used to dispute the terms of an installment agreement. A taxpayer uses Form 9423 to request a CAP hearing. |

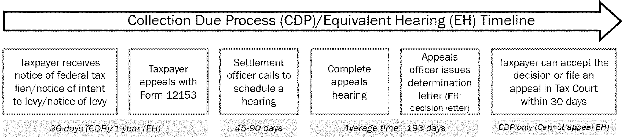

| Collection Due Process Hearing (CDP) | A formal IRS appeals hearing that is triggered by a Notice of Federal Tax Lien filing or a Final Notice of Intent to Levy. Taxpayers are given an opportunity to contest the liability, including penalties, or offer a collection alternative. The taxpayer requests this hearing 30 days after the lien filing or intent to levy notice using IRS Form 12153. |

| Collection Field Function (CFf) | The CFf is a local IRS collection office staffed with revenue officers who collect on the more complicated taxpayers (high wealth, employers, business entities), and more serious delinquent tax obligations (high amount owed, payroll trust fund taxes, corporate taxes, and abusive transactions). |

| Collection Information Statement (CIS) | Financial disclosure by a taxpayer to the IRS. This includes personal information, assets, liabilities, income, and expenses. The purpose of this statement is for the IRS to determine collectability and collection options for the taxpayer.

Individuals: File Form 433-A, 433-F, or 433-H. Businesses: File Form 433-B. |

| Collection Notice Stream | Series of IRS notices sent by the IRS to collect on back taxes owed. |

| Collection Statute of Limitations (CSED) | Refers to the amount of time the IRS has to collect on a balance owed. The collection statute expiration date (CSED) is ten years from the date the tax was assessed. It can be extended by several taxpayer or IRS actions. |

| Conditional Expenses | Actual household expenses that may be allowed as a necessary expense or as another expense in determining monthly disposable income for installment agreements when the taxpayer can pay within six years, or the CSED, whichever is shorter. |

| Currently Not Collectible (CNC) | A status granted by the IRS to a taxpayer who has no ability to pay the tax owed (based on the ATP calculation). |

| Equity in Assets and Net Realizable Equity in Assets (NRE) | The calculation of the amount of equity available to pay toward outstanding liabilities. |

| Extension to Pay Agreement (ETP) | IRS one-time extension to pay for each tax year in which the taxpayer is given 180 days to pay. Only available from the IRS ACS. There can be other ETP that the IRS provides if it is in the best interest of the government and the taxpayer to provide a short-term extension. |

| Federal Tax Lien | There are two types of liens: a “silent lien” and a public “Notice of Federal Tax Lien” (NFTL). Once a taxpayer owes the IRS, the government has a claim on the taxpayer’s assets – called a “silent lien.” A filed NFTL is the government’s legal claim that alerts creditors of the government’s legal right to property and rights to property for an amount of unpaid tax liability. An NFTL is an enforcement action taken by the IRS on a taxpayer who is in the IRS Collection compliance unit. |

| Financial Disclosure | The process of disclosing financial information to the IRS for the purposes of collection. |

| Full-pay non-streamlined installment agreement (NSIA) | A payment plan that allows a taxpayer who owe between $50,000 and less than $250,000 to make monthly payments before the collection statute expiration date. This agreement is new for 2020 and beyond. This agreement usually requires the IRS to file a Notice of Federal Tax Lien as part of the terms. |

| Installment Agreement (IA) | An agreement between a taxpayer and the IRS to make payments in monthly installments to pay the balance owed. There are several different types of IAs that have varying payment terms. |

| IRS Fresh Start Initiative | The 2012-2013 IRS collection program initiatives that eased IRS collection rules on installment agreements, lien filings, and OIC offer amounts. Most of these initiatives have been permanently implemented into IRS collection policy and procedures. |

| Levy | An enforcement action taken by the IRS on a taxpayer who is in the IRS Collection compliance unit. A levy is a seizure of taxpayer income and assets in order to pay an outstanding tax liability. |

| Monthly Disposable Income (MDI) | Used to calculate your client’s ATP. MDI is the amount of income remaining after necessary expenses have been paid. |

| Necessary Living Expenses | Household expenses that are allowed in determining monthly disposable income of a taxpayer in an ability to pay analysis. Some expenses are limited by IRS Collection Financial Standards (food/clothing, housing/utilities, transportation). |

| Not Allowable Expenses | Discretionary expenses that the IRS does not allow in determining the taxpayer’s ability to pay on an installment agreement. |

| Offer in Compromise (OIC) | A settlement of a balance owed for less than the amount owed. There are three types of OICs: Doubt as to Collectability (owe but cannot afford to pay – the most common type of OIC), Doubt as to Liability (do not owe the amount), and Effective Tax Administration (owe and can pay but special circumstances exist requiring the government to accept less than the amount owed). |

| Passport Restrictions | IRS enforcement provision that allows the IRS to “certify” that a taxpayer has seriously delinquent tax debt to the U.S. State Department for purposes of restricting use or renewal of his/her passport. Taxpayers can decertify by getting into good standing with the IRS. |

| Private Debt Collection (PDC) | IRS outsource of old tax debt accounts to one of the four private debt collectors. The PDCs can contact taxpayers directly to solicit payment or enter into an installment agreement to pay. PDCs cannot enter into complex collection alternatives such as currently not collectible or an OIC. |

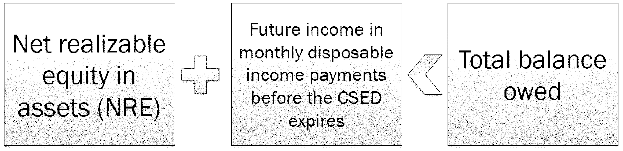

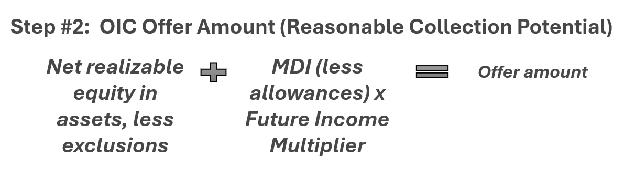

| Reasonable Collection Potential (RCP) | In an IRS OIC, this is the calculated amount of future income and equity in assets that the IRS can reasonably expect to receive if the taxes are settled. This is also referred to as the “offer amount” for an OIC. |

| Repeater | A taxpayer who has multiple tax years with a balance owed. These taxpayers are likely to see quicker IRS collection enforcement because of the continuous balances owed, which default IRS installment agreements and add to the balances owed. |

| Revenue Officer (RO) | A local IRS person responsible for securing collection of an unpaid balance and/or delinquent tax returns. Also referred to as the Collection Field function (CFf). |

| Seriously Delinquent Tax Debt (SDTD) | Taxpayers with tax debt over $64,000 (adjusted annually) and not in good standing with the IRS are certified as having “seriously delinquent tax debt” for purposes of notifying the State Department for passport restrictions. |

| Simple Installment Agreement (SIA) | The most common IRS collection alternative that taxpayers execute. In 2025, this agreement and its terms replaced the streamlined installment agreement (SLIA). The SIA allows taxpayers who owe less than $50,000 and can pay within the collection statute expiration date. Commonly used to avoid an NFTL. |

| Taxpayer Delinquent Account (TDA) | IRS term for a taxpayer who owes and is in IRS collection enforcement. |

| Taxpayer Delinquent Investigation (TDI) | IRS term for a taxpayer who has an unfiled tax return and is in IRS collection enforcement. |

| Taxpayer Relief Initiative (TRI) | IRS COVID-19 collection relief provisions, which provided taxpayers easier terms for extensions to pay, installment agreements, and accepted offer in compromises. |

Overview of IRS Collection Alternatives

The IRS has four basic categories of collection alternatives:

- Extension to pay: these alternatives allow taxpayers to receive an extension to pay an outstanding balance owed. These extensions can be up to 180 days. [IRM 5.14.1.6 (12-23-2022)]

- Practice Tip: In response to the COVID-19 pandemic, the IRS announced in its Taxpayer Relief Initiative (TRI) that the IRS will expand extension to pay agreements from 120 days to 180 days. This provision was made permanent in 2022. Taxpayers should stay up to date as the IRS may change these relief provisions in the future. [IRS News Release IR-2020-248, November 2, 2020]

- Installment agreement: these agreements create a monthly payment plan for the taxpayer with the IRS. There are two types of installment agreements:

- Simple installment agreements: these are the most widely used payment plans as they are easy to obtain and avoid the filing of a Notice of Federal Tax Lien. These plans allow qualifying taxpayers to pay the amount owed over a specific period without the need to provide detailed financial information to the IRS. One simple payment plan, the full-pay non-streamlined installment agreement, does require the IRS to file a Notice of Federal Tax Lien. Practice Tip: From 2012-2024, most IRS installment agreements were the Simple installment agreements, including the replaced Streamlined Installment Agreements (SLIA) and the new Simple Installment Agreement (SIA).

- Ability to pay installment agreements: in these payment plans, the taxpayer cannot qualify and/or afford the terms for the simple installment agreements. These agreements require the taxpayer to provide financial information (called collection information statements) and documentation to prove their ability to pay.[IRM 5.19.1.6.4 (1-26-2023)]

- Currently not collectible status: when taxpayers experience a financial hardship and only have enough income to pay for their necessary living expenses they can qualify and receive a temporary payment deferral from the IRS. Like proving the inability to pay installment agreements, the taxpayer must provide financial information and documentation to prove they cannot pay. [IRM 5.16.1.2 (3-3-2025)]

- Offer in compromise: taxpayers who are unable to pay the IRS in full with their assets or future installment agreement payments can settle their taxes for less than the amount owed. Taxpayers who qualify can offer their reasonable collection potential (a calculation) to settle their tax bill. [IRM 5.8.1.2.1 (9-23-2008)]

Bankruptcy can also be a legal alternative to address serious back tax issues and financial hardship. Under certain conditions, bankruptcy can eliminate taxes, penalties, and interest and/or provide more favorable payment terms. Because bankruptcy is a legal alternative, taxpayers should consult legal counsel to determine how bankruptcy can be applied as a collection alternative. [IRM 5.9.1 (2-3-2025)]

Overview of IRS Collection Enforcement

The IRS has two primary compliance units that enforce the payment of back taxes:

- Automated Collection System (ACS): the ACS is staffed with IRS collection personnel who interact with delinquent taxpayers by phone and correspondence. They can set up extensions to pay, installment agreements, and currently not collectible status. They can also issue liens and levies.

- Collection Field function (CFf): the CFf are local area IRS collection offices staffed with revenue officers (RO). A RO investigates the most egregious tax debtors including those taxpayers subject to employment tax delinquencies, high tax debt owed, with multiple years owed, non-filers with potential high balances owed, and business tax liabilities. ROs have broad authority and can swiftly file a tax lien and issue a levy to collect on balances owed.

Offer in compromise applications can be investigated locally or through the IRS Centralized Offer in Compromise Units that are in the Holtsville, NY or Memphis, TN IRS Service Centers. Both ACS and the CFf are also responsible for enforcing filing of back tax returns — called taxpayer delinquency investigations (TDI). TDI enforcement is a critical component to overall IRS collection enforcement because taxpayers must file all unfiled past-due tax returns in order to secure an IRS collection alternative.

Practice Tip: Most OIC applications are worked by COIC OIC examiners. Field Revenue officers generally can provide input and opinion as to whether they approve on the OIC via Form 657.

IRS Collection Personnel

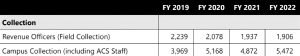

The IRS has two main personnel who collect taxes: field collection personnel, called Revenue Officers, and IRS Campus collection representatives in the Automated Collection System (ACS) function. IRS collection enforcement staffing has been up and down in the past several years. Through 2022, field collection (revenue officers) has declined. [TIGTA Report 2024-300-011, Trends in Compliance Activities Through Fiscal Year 2022, December 20, 2023]

In 2023 and 2024, IRS revenue officers increased to 4,309 as of 9/30/2024. [IRS Data Book 2024, Table 34] However, 2025 cutbacks saw a initial layoff of 611 revenue officers (18%) inb February 2025. [TIGTA Report 2025-IE-R017, Snapshot Report: IRS Workforce Reductions as of March 2025, May 2, 20205]

These personnel collect on the millions of IRS delinquent accounts. In 2023 and 2024, the IRS had millions of taxpayers in IRS collection [IRS Data Book, 2024, Table 27]:

IRS Collection Process: The Collection Notice Stream and the IRS Collection Roadmap

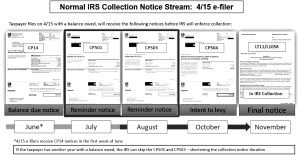

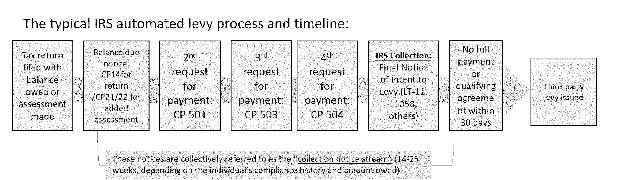

IRS collection enforcement generally follows a coordinated series of notices requesting payment of the balances owed. This process is called the IRS Collection Notice Stream. The normal Collection Notice Stream provides the taxpayer a series of five notices prior to IRS enforced collection actions can begin. This process can take 3-8 months, depending on the amount of debt and the taxpayer’s compliance history. In 2024, the IRS announced that it would increase the time gap between notices from 5 weeks to 8 weeks to allow taxpayers more time to make arrangements with the IRS on back balances owed.

Practice Tip: For an April 15 filer with no other balance due years, the collection notice stream will end late in the calendar year. The taxpayer can receive notices during that time but is likely to be subject to levies and lien filing after the deadline is past on the final notice in the notice stream.

The following is the normal IRS notice stream for an April 15 filer with a balance due that goes directly to IRS collection enforcement:

The entire collection process can be complicated. The Taxpayer Advocate detailed the “Collection Roadmap” in the 2018 Annual Report to Congress. This chart accurately illustrates the detailed collection process. It is important to understand where the taxpayer is in the process to determine the available alternatives, options, and appeal rights.

[Collection Roadmap: Taxpayer Advocate Service]

IRS Collection Enforcement: Levies and Liens

The IRS has two primary collection enforcement tools: a levy and the Notice of Federal Tax Lien. A levy is a seizure of the taxpayer’s income or assets held by a third party. The most common IRS levies are wage garnishments, financial account (bank) levies, accounts receivable levies, and levies on social security.

IRS Levy Requirements

The requirements for issuance of a levy are:

- Tax due notice: the IRS assessed tax and sent a notice and demand for payment,

- Non-payment: the taxpayer refused or neglected to pay,

- Notice of a right to a Collection Due Process (CDP) hearing: the IRS sent a Final Notice of Intent to Levy (“FNIL”) at least 30 days before the levy is issued,

- No Collection Due Process (CDP) request is filed: the taxpayer does not respond to the Final Notice of Intent to Levy and Notice of Your Right to a Hearing (i.e., request a hearing), or a CDP hearing is conducted sustaining the proposed levy, and

- Notice of third-party contact: when a notice of levy is issued to a third party, it is a third-party contact. IRS letters L1058 and LT11 give proper advance notice of third-party notification. Note: when a Notice of Levy is issued to a third-party, it is a Third-Party Contact (TPC). IRC 7602(c)(1) requires that the IRS provide advance written notification of intent to contact third parties for each module that will be referenced in the TPC. The IRS is required to carefully review each module to determine if the taxpayer received advance TPC notification and that the date of TPC notification is less than one year old. If it has been more than one year since the taxpayer last received advance written notification of TPC, on one or more modules, a new notification is required. The calculates the one-year period from the 46th day after the date of the notice, provided the 46th day is the first day of the contact period specified in the letter. IRS employees may not contact a third-party (levy) until the 46th day following the date of the TPC notice. [IRM 5.11.1.3.2 at (2) (4-3-2025)][IRM 5.11.1.3.2 (4-3-2025)]

Practice Tip: The IRS does not have to issue the FNIL prior to levying a state income tax refund. This notice provides the taxpayer a right to a CDP hearing to provide a collection alternative, contest the tax owed, or provide another remedy.

Practice Tip: IRS procedures used to require the IRS to “renotify” the taxpayer of the intent to levy if no action is on the account for 180 days before a new levy can be issued. However, in 2021, the IRS removed the 180-day requirement for revenue officer “manual levies.” [IPU SB/SE-05-0221-0290 (2-22-2021)] IRS officials have stated that they intend to renotify taxpayers every 180 days despite the removal of the 180-day requirement from its procedures. In 2024, the IRS used Letter LT38 to notify taxpayers that they owe back taxes, meeting the IRS’s renotification procedures. Changes to IRM 5.11.1.3.2 at (2) indicate that the IRS will provide a renotification for ACS notices if the taxpayer has not received a prior notification in 1 year.

IRS Lien Requirements

An IRS Notice of Federal Tax Lien (IRS Form 668(Y)) secures the government’s interest in a taxpayer’s property when he owes and does not pay his taxes. An NFTL should not be confused with an IRS levy. A lien secures the IRS interest in the property, whereas a levy takes the property from a third-party to pay the tax bill. The requirements to file a Notice of Federal Tax Lien are:

- Assessment of a tax liability: records the tax owed from a filed return or from an assessment like an audit, CP2000 assessment, or a trust fund recovery penalty assessment,

- Demand for payment: the IRS sends a bill for payment, and

- Non-payment: taxpayer neglects or refuses to pay.[IRC §6321 and IRM 5.12.1.3 (7-11-2018)]

Collection Notices and Enforcement Due Process

The IRS Collection Notice Stream satisfies the legal requirements to enforce collection through levies and liens. In practice, the IRS rarely issues a levy or files an NFTL prior to the completion of the notice stream.

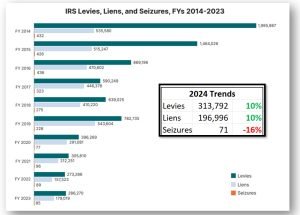

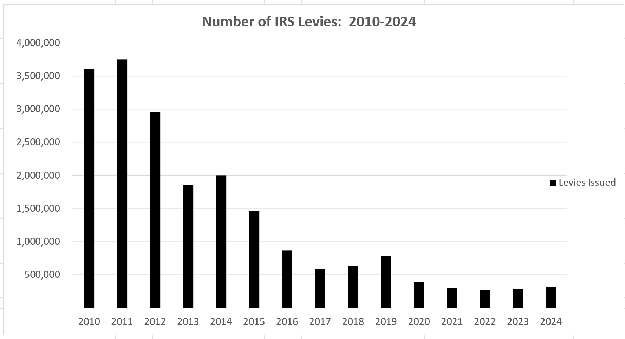

Since 2011, the IRS has reduced the number of levies and liens issued to taxpayers as part of an effort to help struggling taxpayers. In 2019, the IRS started increasing its levy and lien actions to taxpayers. However, during the years 2020-2024, IRS levy and lien enforcement has been at a low volume. IRS campus levy and lien enforcement has been limited, severely lowering the volume of lien and levies issued. [IRS Data Boks 2014-2024, Table 37]

Most of the traditional relaxed collection enforcement activities, relaxed payment terms, and increased access to the Offer in Compromise program are referred to as the IRS’s “Fresh Start Initiative.” [IR-2011-20, February 24, 2011, IRS Announces New Effort to Help Struggling Taxpayers Get a Fresh Start; Major Changes Made to Lien Process]

Most of the IRS Fresh Start changes to IRS collection policy remain in effect. However, the IRS returned to the policy of issuing automated liens and levies again in 2018. [TIGTA Report 2018-30-068, Fiscal Year 2018 Statutory Review of Compliance with Legal Guidelines when Issuing Levies, September 7, 2018.] During the COVID-19 pandemic, the IRS ceased many automated liens (unless the lien was required as a result of the taxpayer’s requested collection agreement) and levies. However, Field Collection (revenue officers) still issued liens and levies during this time. In 2025, liens from the ACS have resumed.

Practice Tip: If the taxpayer is assigned to the Collection Field function, i.e., a revenue officer, the revenue officer is more likely to issue a levy or lien very quickly if all requirements have been met and the taxpayer has not made arrangements to pay.

IRS Collection Enforcement: Passport Restrictions

In early 2018, the IRS began sending notices to taxpayers with seriously delinquent tax debt. [IRS News Release IR-2018-7, January 16, 2018] Such taxpayers received IRS Notice CP508C indicating that they have been certified as having seriously delinquent tax debt. The State Department also receives this certification and can deny the issuance or renewal of a passport, or fully restrict or limit its use. The State Department notifies the taxpayer separately in writing of any restrictions imposed on an existing passport. Before denying a new or renewed passport application, the State Department will hold the passport application for 90 days to allow the taxpayer to get in good standing with the IRS and request decertification. [IRM 5.19.25.9 (1-24-2024)]

Seriously delinquent tax debt is defined as outstanding tax debt (including penalties and interest) over $64,000 (this amount is indexed annually for inflation) in which the taxpayer has not made an agreement (i.e., a collection alternative) with the IRS on the outstanding balance owed. Certification requires that the IRS has tried to enforce collection through a lien or levy issuance. To remove these restrictions, a taxpayer must decertify themselves from having seriously delinquent tax debt by paying the outstanding balance in full or taking other actions to get in good standing with the IRS. These actions include entering into collection alternatives, such as an installment agreement, currently not collectible status, or an offer in compromise. Appealing a levy with a CDP hearing or applying for innocent spouse relief also decertifies the debt. [See our Passport Section for more on passport restrictions]

Collection Statute of Limitations

General Rule

The IRS Collection Statute Expiration Date, or “CSED,” is the last day the IRS can collect on an assessed tax debt (and associated penalties and interest). [IRC §6502(a) and IRM 5.1.19.1.1 (12-18-2023)] CSEDs are an important factor in deciding which collection option is appropriate. For example, the IRS Simple and Full pay Non-Streamlined Installment Agreement Terms call for the outstanding balances to be paid before the CSED. Offer in compromise qualification also considers the CSED in determining if the taxpayer can fully pay the liability before the statute expires. If the taxpayer can pay before the CSED expires, the taxpayer generally will not qualify for an offer in compromise.

Determining the CSED(s)

The CSED begins ten years from the date of assessment. [IRC §6502(a)(1) and IRM 5.19.1.4.4.3 (11-30-2020)] For example, the CSED for a return filed on a 2018 return with a tax assessment date of June 3, 2019, is June 3, 2029. Each tax year has its own CSED because each tax year results in a separate assessment. A taxpayer can have multiple CSEDs during a year if they have multiple assessments. For example, the taxpayer may file and assess tax on June 3, 2019, and then be audited for the same year. The IRS audit adjustment would be assessed after the June 3, 2019 filing assessment date and create a second CSED associated with the amount of the audit assessment. Additional assessments can be found on IRS account transcripts.

Practice Tip: Most timely filed tax returns mailed on or before the deadline (i.e., April 15) with a balance owed will have an assessment date a few weeks after the return is filed (i.e., usually in the last week of May or the first week of June). The assessment date, not the filing date, triggers the ten-year CSED. Taxpayers can find their assessment date as the corresponding date on the IRS Account Transcript transaction code TC 150. In IRS non-filer investigations, the IRS can file a return for the taxpayer which will trigger the tax assessment date. If the IRS files a return for a taxpayer (called a “substitute for return” or SFR), the IRS will establish a TC 150 for the taxpayer with the SFR that will start the CSED.

Common IRS account transcript transaction codes that carry their own CSEDs appear below. [IRM 5.1.19.2.1 (6-4-2009)]

| Transaction Code | Definition |

| TC 150 | Tax Assessed |

| TC 160 | Manually Computed Delinquency Penalty |

| TC 166 | Delinquency Penalty |

| TC 170 | Estimated Tax Penalty |

| TC 176 | Estimated Tax Penalty |

| TC 180 | Deposit Penalty |

| TC 186 | FTD Penalty |

| TC 234 | Daily Delinquency Penalty (if it is the only CSED in the module) |

| TC 238 | Daily Delinquency Penalty |

| TC 240 | Miscellaneous Civil Penalty |

| TC 246 | Form 8752 or Form 1065 Penalty |

| TC 290 | Additional Tax Assessment |

| TC 294 | Tentative Carryback Disallowance with Interest Computation Date |

| TC 298 | Additional Tax Assessment with Interest Computation Date |

| TC 300 | Additional Tax or Deficiency Assessment by Examination or Appeals |

| TC 304 | Tentative Carryback Disallowance by Exam with Interest Computation Date |

| TC 308 | Additional Tax or Deficiency Assessment by Examination or Appeals with Interest Computation Date |

| TC 320 | Fraud Penalty |

| TC 350 | Negligence Penalty |

CSED Extension Actions

The CSED can be extended based on taxpayer actions. These actions extend the CSED because the IRS is precluded from collecting if the taxpayer takes these actions. [IRM 5.1.19.3 (2-7-2020)] Some common ways taxpayers can extend the CSED appear in the table below.

| Action | CSED extended time |

| Bankruptcy

[IRM 5.1.19.3.1 (5-19-2016)] |

Bankruptcy period, plus six months. |

| Collection Due Process Appeal Request

[IRM 5.1.19.3.3 (4-26-2018)] |

Appeals request through decision period (not less than 90 days). |

| Offer in Compromise

[IRM 5.1.19.3.4 (12-18-2023)] |

Offer review/appeal period, plus 30 days (Offers after 3/9/2002). |

| Installment agreements

[IRM 5.1.19.3.5 (12-18-2023)] |

Time for proposed installment agreement is pending. 30 days after rejection of an installment agreement. 30 days after a termination of an installment agreement. Any appeal of the termination or rejection of an installment agreement. |

| Innocent Spouse

[IRM 5.1.19.3.6 (4-26-2018)] |

The collection period is suspended from the filing of the claim until the earlier of the date a waiver is filed, or until the expiration of the 90-day period for petitioning the Tax Court, or if a Tax Court petition is filed, when the Tax Court decision becomes final, plus, in each instance, 60 days. |

| Taxpayer living outside US

[IRM 5.1.19.3.7 (4-26-2018)] |

Period outside of U.S. (if absence > 6 months). (Note: The IRS does not automatically input this CSED extension. It is usually applied when the IRS investigates the taxpayer for collection and discovers the taxpayer was outside the country.) [IRM 5.1.19.3.7 (4-26-2018) and IRM 5.1.19.3.7.1 (5-19-2016)] |

| Combat zone

[IRM 5.1.19.3.8 (4-26-2018)] |

Period while in combat zone plus 180 days. |

| Taxpayer Assistance Order

[IRM 5.1.19.3.13 (12-18-2023)] |

Period receiving assistance from Taxpayer Advocate Service. (Note: The IRS rarely “inputs” this extension.) |

The IRS does not readily provide taxpayers with their CSED. For example, IRS transcripts do not contain the CSED(s) for that year. Taxpayers need to ask the IRS for their CSED by contacting the IRS accounts hotline. Alternatively, a simpler approach may be for a taxpayer to authorize a tax professional to contact the Practitioner Priority Service to obtain the CSED(s). The Practitioner Hotline is accustomed to releasing this information; taxpayer hotlines, on the other hand, rarely get CSED requests.

The IRS does not provide a CSED computation document that details how the CSED was computed. Taxpayers can attempt to estimate their CSED date using IRS account transcripts. The transcript will contain these codes that would indicate that the CSED was extended. [IRM 5.1.19.2.2 (5-23-2013)]

| Account Transcript Transaction Code | Description |

| TC 480 | Offer in Compromise Pending |

| TC 488 | Installment and/or Manual Billing |

| TC 500 | Military Deferment |

| TC 520 cc 76-81 | Tax Court or IRS Litigation Instituted |

| TC 520 | Bankruptcy |

| TC 520 | Collection Due Process Hearing |

| TC 550 | Waiver Extension of Date Collection Statute Expires (extends the CSED to date input) |

| TC 550 | Innocent Spouse |

| TC 971 | Pending Installment Agreement |

| TC 971 Action Code 163 | Terminated Installment Agreement |

| TC 971 | Taxpayer Living Outside the U.S. |

Example: Consider the following:

- Taxpayer files her 2007 return on April 15, 2008 and owes $45,000.

- The tax assessment date is June 1, 2008 and establishes the initial CSED as June 1, 2018, ten years from the date of assessment.

- The taxpayer files for an offer in compromise (OIC) on March 1, 2009 (IRS Account Transcript transaction code 480).

- The OIC is rejected by the IRS on October 1, 2009 (IRS Account Transcript transaction code 481).

The OIC extends the CSED by 243 days (213 days during the offer investigation pending period from March 1, 2009 to October 1, 2009 plus 30 days) to January 29, 2019.

CSED Errors

Taxpayers who question their CSED dates have good reason to suspect an error. Several Treasury Inspector General for Tax Administration (“TIGTA”) and National Taxpayer Advocate reports indicate that there are often serious errors in computing the CSED. A 2022 TIGTA study found that 20% of sampled accounts had incorrect CSED calculations. [TIGTA Report 2022-10-043, Review of the Independent Office of Appeals Collection Due Process Program, August 18, 2022]

A transcript review is a good starting point to evaluate whether the IRS has the CSED correct. The IRS has internal transcripts that can provide more specific actions that can show the CSED. This transcript is called a “TXMODA” (named after the IRS internal transcript name). Taxpayers can request this transcript on the account hotline. Tax professionals can contact the IRS Practitioner Priority Service hotline and request the TXMODA. If the IRS denies the taxpayer this information, taxpayers can submit a Freedom of Information Act request for this information. Taxpayers will need to use IRS Document 6209 to help interpret the codes on the TXMODA transcript. [See Chapter 1 for more on IRS transcripts]

One common miscalculation by the IRS that will incorrectly extend the CSED, is the pending installment agreement. In practice, the IRS can put a “Pending Installment Agreement” indicator on a taxpayer account but not later record an accepted agreement after the agreement is completed. These “open-ended” pending installment agreements may serve to incorrectly extend the CSED for long periods. If the taxpayer believes the pending installment agreement is in error and the CSED has expired, the taxpayer should analyze the CSED extending events carefully and determine the correct CSED.

Practice Tip: CSED extensions for pending installment agreements require that the taxpayer has met four requirements:

- Provided sufficient information to identify the taxpayer (name and TIN are sufficient).

- Identified the tax liability to be covered in the agreement.

- Proposed a monthly installment agreement amount.

- Filed all required returns.[IRM 5.14.1.3 at (5) (7-2-2024)]

Once the CSED expires, the IRS writes off the debt. Taxpayers are not given notice by the IRS that the CSED has expired. Account transcripts will show a transaction code 608 with the balance amount that was written off because the collection statute has expired.

![]()

Additions to Unpaid Taxes: Failure to Pay Penalty and Accrued Interest

Taxpayers who cannot pay face both imposition of the failure to pay penalty and accrual of interest on their outstanding balances owed. [IRC §6651]

Failure to Pay Penalty Rates

The failure to pay penalty is 0.5% per month, up to a maximum of 25%. If the IRS is actively collecting on the taxpayer, the rate rises to 1% per month. If a taxpayer obtains an installment agreement to pay on a timely filed return, the rate drops to 0.25% per month.

Interest on Underpayments

The interest rate charged fluctuates by quarter. [IRC §6601]

The table below provides the interest rates on underpayments since 1995.

| History of IRS Interest Rates, by quarter | ||||

|---|---|---|---|---|

| Year | Q1 | Q2 | Q3 | Q4 |

| 2025 | 7% | 7% | 7% | See IRS Notice 746 |

| 2024 | 8% | 8% | 8% | 8% |

| 2023 | 7% | 7% | 7% | 8% |

| 2022 | 3% | 4% | 5% | 6% |

| 2021 | 3% | 3% | 3% | 3% |

| 2020 | 5% | 5% | 3% | 3% |

| 2019 | 6% | 6% | 5% | 5% |

| 2018 | 4% | 5% | 5% | 5% |

| 2017 | 4% | 4% | 4% | 4% |

| 2016 | 3% | 4% | 4% | 4% |

| 2015 | 3% | 3% | 3% | 3% |

| 2014 | 3% | 3% | 3% | 3% |

| 2013 | 3% | 3% | 3% | 3% |

| 2012 | 3% | 3% | 3% | 3% |

| 2011 | 3% | 4% | 4% | 3% |

| 2010 | 4% | 4% | 4% | 4% |

| 2009 | 5% | 4% | 4% | 4% |

| 2008 | 7% | 6% | 5% | 6% |

| 2007 | 8% | 8% | 8% | 8% |

| 2006 | 7% | 7% | 8% | 8% |

| 2005 | 5% | 6% | 6% | 7% |

| 2004 | 4% | 5% | 4% | 5% |

| 2003 | 5% | 5% | 5% | 4% |

| 2002 | 6% | 6% | 6% | 6% |

| 2001 | 9% | 8% | 7% | 7% |

| 2000 | 8% | 9% | 9% | 9% |

| 1999 | 7% | 8% | 8% | 8% |

| 1998 | 8% | 7% | 7% | 7% |

| 1997 | 8% | 8% | 8% | 8% |

| 1996 | 8% | 7% | 8% | 8% |

| 1995 | 8% | 9% | 8% | 8% |

IRS Notice 746 provides the most updated IRS interest rates by quarter.

Payment Methods

The IRS offers several options for taxpayers to pay their balances owed. The IRS regularly updates and modifies payment methods. Taxpayers should visit irs.gov/payments for updated payment information.

| Option | Location | Days for IRS to post to account | Fees |

| Check or money order to “United States Treasury” | Mail Taxpayer Assistance Center | 10-14 days | None |

| Cash

https://www.irs.gov/payments/pay-with-cash-at-a-retail-partner |

Retail partners for up to $500 per payment/no limit on number of payments. https://map.payithere.com/ | 2 business days | $1.50 for ACI Payments and $1.50 for Pay1040.com payments. |

| Electronic funds withdrawal during e-filing

https://www.irs.gov/payments/pay-taxes-by-electronic-funds-withdrawal |

Online, with e-filed return Phone With tax software | 5-14 days | No IRS fee. Software provider may have a fee. |

| Electronic Federal Tax Payment System (EFTPS)

https://www.irs.gov/payments/eftps-the-electronic-federal-tax-payment-system |

Online | 5-7 days | None |

| Debit card through IRS Direct Pay (ACH) | Online | 5-7 days | None |

| Debit/credit card through third-party provider

Note: The IRS is going to offer payment by credit card through the IRS in the future https://www.irs.gov/payments/pay-your-taxes-by-debit-or-credit-card |

Online, through 3 private service providers | 5-7 days | Fees apply based service provider selected |

Designating Payments

Taxpayers can designate voluntary payments in a manner they choose. For example, a taxpayer can designate a voluntary payment to a tax year and tax form or a specific liability. [IRM 5.1.2.9 (6-20-2013)] Taxpayers can also designate a payment within a tax year. For example, in order to qualify for a simple installment agreement, a taxpayer can pay the “assessed” balance for a tax year only to allow the taxpayer to bring the assessed balance under $50,000 to qualify for the SIA.

Example- Consider the following facts:

- John owes $4,000 of mostly remaining interest and penalties for 2016 and $51,000 for 2017 Forms 1040.

- $51,000 of the balance is the original assessed tax, penalties, and interest owed. There is $200 in assessed balance for 2016 ($3,800 in accrued penalties and interest). The assessed balance for 2017 is $50,800 (with $200 in accrued penalties and interest).

- In order to qualify for a simple installment agreement, John only needs to pay the “assessed” amount, reducing it to $50,000.

- John could designate a payment to the IRS for the 2017 Form 1040 to the “assessed balance only” for $1,000 and be able to enter into the SIA.

- If John does not so designate, depending on his circumstances and the priority of payments, John may need to pay the total balance ($5,000) under the $50,000 threshold to qualify.

John sends in his payment for $1,000 with the following request to designate payment:

Another common situation where taxpayers designate payments is for back payroll tax issues. Taxpayers who are responsible for collecting or paying employees’ withheld income and employment taxes and willfully fail to collect or pay them (called a “responsible person”), can be assessed the taxes personally. [IRC §6672] As a result, the responsible person(s) in the business are assessed the trust fund portion (income tax and FICA/Medicare taxes withheld from their employees) to them personally (called the “trust fund recovery penalty”). The business can reduce the exposure of the responsible persons for the trust fund recovery penalty by designating all voluntary payments the “trust fund portion only.” This designation will limit the responsible person(s) liability for the trust fund recovery penalty.

[See IRS Collection Templates for a template request to designate payments]

Private Debt Collection

In April 2017, the IRS began using private collection agencies (PCAs) to collect on cases involving inactive tax receivables. In 2024, the IRS had assigned 7.6 million cases to PCAs. [TIGTA Report 2025-300-004, FY2025 Biannual Independent Assessment of the Private Collection Agency Performance, December 20, 2025] An inactive receivable is defined as one which meets any of the following criteria:

- Removed from active inventory for lack of resources or inability to locate the taxpayer,

- More than two years have passed since assessment and such receivable has not been assigned for collection to any employee of the IRS, or

- Assigned for collection, but more than 365 days have passed without interaction with the taxpayer or a third party for purposes of furthering the collection.

[IRC §6306(c)(2)]

Taxpayers who are assigned to a PCA and have new tax years with a balance owed may also have the more current balance due years also assigned to the PCA for collection.

Exclusions from PDC

The 2015 law that enacted PCA collection excluded taxpayers from private debt collection who are:

- Subject to a pending or active offer-in-compromise or installment agreement,

- Classified as an innocent spouse case,

- One of the following: (a) deceased, (b) under the age of 18, (c) in a designated combat zone, or (d) a victim of tax-related identity theft,

- Currently under examination, litigation, criminal investigation, or levy, or

- Currently subject to a proper exercise of a right of appeal.

Taxpayers in presidentially declared disaster areas are also excluded. [IRC §6306(d)] The Taxpayer First Act, signed into law on July 1, 2019, also excluded taxpayers whose income substantially consists of Social Security Disability Insurance benefits as well as those with adjusted gross income that does not exceed 200% of the applicable poverty level. It also defined an “inactive receivable” to be an assessment that is more than two years old.

Taxpayers can identify if they are assigned to a PCA on their IRS account transcript. In the transaction section, a TC 971 with the description “Account assigned to PCA” will appear. [IRM 5.19.1.5.21.2.1 (9-14-2021)]

![]()

PDC Agencies

There are three private collection agencies (PCAs) assigned to collect IRS inactive tax debtor cases. [IR-2021-191, September 22, 2021]

CBE

P.O. Box 2217

Waterloo, IA 50704

1-800-910-5837

ConServe

P.O. Box 307

Fairport, NY 14450-0307

1-844-853-4875

Coast Professional, Inc.

P.O. Box 425

Geneseo, NY 14454

888-928-0510

IRS Notification of Assignment to a PDC

Taxpayers assigned to a PCA will receive a letter from the IRS (IRS Letter CP40). [IRM 5.19.1.5.21.1 (5-1-2023)] The PCA will also send a letter to the taxpayer and then proceed to contact the taxpayer by phone to collect the tax. Taxpayers can request in writing to have their account sent back to the IRS for collection.

Taxpayers working with a PCA have limited payment options available: fully pay or enter into a PDC payment plan (i.e., not an IRS payment plan) lasting up to seven years (or the collection statute of limitations, whichever is less). The PCA can also take partial payments of the tax owed. Any other resolution requested (longer payment terms or hardship status) is referred back to the IRS for approval. PCAs can only ask the taxpayer to pay directly to the IRS through one of the IRS payment methods. PCAs can secure a preauthorized direct debit payment or series of payments from the taxpayer. [IRS News Release IR-2019-165, October 8, 2019]

PCAs cannot enforce collection. That is, they cannot file an NFTL or issue a levy. However, many taxpayer scams have impersonated private debt collectors in order to defraud taxpayers into making payments. As a best practice and to limit confusion, most taxpayers should deal directly with the IRS when making payments or obtaining a collection alternative.

Practice Tip: Taxpayers who are assigned to a PCA and trying to resolve their account with an IRS agreement should request to have their account sent back to IRS collection. IRS personnel have the ability to approve other collection alternatives and to agree to potentially lower amounts owed through penalty abatement or reconsideration of an additional assessment. PCAs do not have access or the ability to lower the amounts owed or provide guidance on reducing the amounts owed. They also do not offer other collection alternatives that the taxpayer may need based on their financial circumstances. Taxpayers can request that the PDC stop contacting them for collection. To do so, taxpayers can send a letter to the PDC with this request. The IRS Taxpayer Advocate has a sample letter to use at: https://www.taxpayeradvocate.irs.gov/wp-content/uploads/2020/10/R3_Do_Not_Contact_Sample_Letter.pdf.

[See IRS Publication 4518, What You Can Expect When the IRS Assigns Your Account to a Private Collection Agency, for more information on the private debt collection process and answers to frequently asked questions]

Tax Debtors: Annual Notices of Balances Owed and Activity

Taxpayers who owe the IRS will receive periodic notices from the IRS outlining the balance owed and any activity on the account. [IRM 21.2.1.6.34 (10-2-2023) and IRM 21.3.1.6.39 (10-3-2022)]

The primary notices issued to taxpayers are listed below.

| Notice | Taxpayer Status | Information Provided |

| IRS CP89, Annual Installment Agreement Statement

[IRM 21.3.1.6.39 (10-3-2022)] |

In an installment agreement with the IRS. | Provides one-year accounting of all payments submitted; shows all years and balances owed. |

| IRS CP71 and 71A, Reminder Notice (annual)

[IRM 21.3.1.6.34 (10-2-2023) and IRM 21.3.1.6.34.1 (10-2-2023)] |

Taxpayer is in currently not collectible (CNC) status. CP71 indicates that the taxpayer is in good standing and has a agreed CNC status with the IRS. CP71A is not an agreed CNC status and the taxpayer is NOT in good standing with the IRS and is subject to IRS collection. | Provides balance owed and accrued penalties and interest. |

| IRS CP71C, 171, Bi-annual Reminder Notices

[IRM 21.3.1.6.34.2 (5-23-2018)] and CP 71D Annual Reminder Notice – Balance Due [IRM 21.3.1.6.34.3 (10-2-2023)], Reminder Notice (annual) |

Taxpayer is in IRS collection and the account is not in good standing (i.e., collection alternative not reached). 71C: in queue to be assigned to CFf

71D: assigned to CFf (revenue officer) |

Separate notice per tax year/form. Provides balance owed with penalties and interest. |

Taxpayers in installment agreements in which the payment is being made monthly by mail will receive IRS Notice CP521, Your Installment Agreement. This notice is a monthly reminder to pay the monthly payment amount and provides the taxpayer a voucher for the payment. This notice can also be viewed in the taxpayer’s online account. Taxpayers may elect to receive the CP521 notifications by email and digitally only; CP521 notices come through the online account (in the “profile” section).

IRS COLLECTION ALTERNATIVES

This section will provide an overview of the IRS collection alternatives.

| Topic | Covers |

|---|---|

| Introduction to IRS Collection Alternatives | The four categories of collection alternatives and the options within each category. |

| Option #1: Extensions to Pay | The 180-day extension to pay and the hardship extension to pay options. |

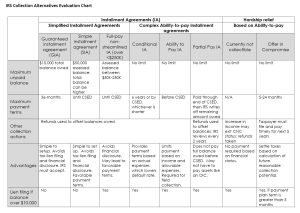

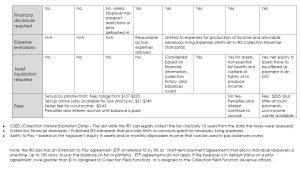

| Option #2A: Installment Agreements That Do Not Require an Ability to Pay Determination | The guaranteed installment agreement, the simple installment agreement, and the non-streamlined payment plan options. |

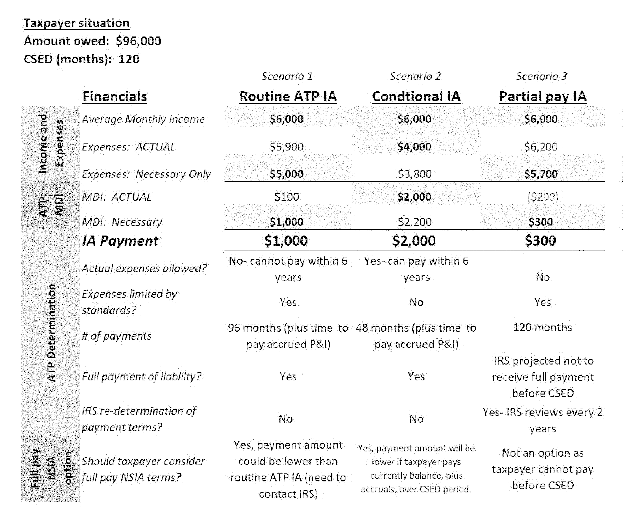

| Option #2B: Installment Agreements That Require an Ability to Pay Determination | The components of determining the ability to pay.

The requirement to use existing assets to pay. The routine ability to pay installment agreement, the conditional installment agreement, and the partial pay installment agreement. |

| Option #3: Not Collectible Status (Currently Not Collectible or “CNC”) | Temporary not collectible status based on the taxpayer’s ability to pay determination. |

| Option #4: Offer in Compromise | The three types of OICs and the rules for the most common OIC: doubt as to collectability. |

| Comparison of IRS Collection Alternatives and Options | A chart that shows the major distinctions between the collection alternative categories and options. |

Other helpful sections:

| Topic | Covers |

|---|---|

| Obtaining IRS and Taxpayer Information for Collection Issues | Information needed to evaluate which alternative is best. |

| Evaluating Collection Alternatives | How to calculate which alternative is best. |

| IRS Collection Alternatives: Extensions to Pay | How to obtain an extension to pay. |

| IRS Collection Alternatives: Simple Installment Agreements | How to obtain a simplified installment agreement. |

| Full-pay Non-Streamlined Installment Agreement Plan (Owe between $50,000 – $250,000) | How to obtain a full-pay non-streamlined installment agreement to pay a balance in full (for amounts owed between $50,000 and $250,000) before the collection statute expires. |

| Determining Ability to Pay for IRS Collection Options | How to determine a taxpayer’s ability to pay for all collection alternatives. |

| Obtain an Installment Agreement Based on Ability to Pay Analysis | How to obtain an installment agreement based on the taxpayer’s ability to pay. |

| Obtain Currently Not Collectible Status (CNC) | How to obtain CNC status. |

| Qualify and Obtain an Offer in Compromise for Doubt as to Collectibility (OIC-DATC) | How to evaluate and apply for an OIC-DATC. |

Key Highlights:

- There are four categories of IRS collection alternatives: extensions to pay, payment plans (installment agreements), not collectible status, and offer in compromise.

- To be able to evaluate which alternative is best, a taxpayer needs a basic understanding about the options and how they work.

- It is important to stay up to date on the latest IRS collection alternatives. The IRS can add/change/remove collection alternatives frequently based on changes in law or administrative enforcement procedures.

Introduction to IRS Collection Alternatives

When a taxpayer cannot immediately pay the IRS in full, they have four categories of collection alternatives. Some categories have more than one alternative:

- An extension to pay (ETP) — a short period to pay the tax bill. There are two types of extensions to pay: [IRM 5.19.1.6.3 (12-20-2022) and IRM 5.1.12.26 (9-20-2012)]

- 180-day extension to full-pay

- Hardship extension to pay