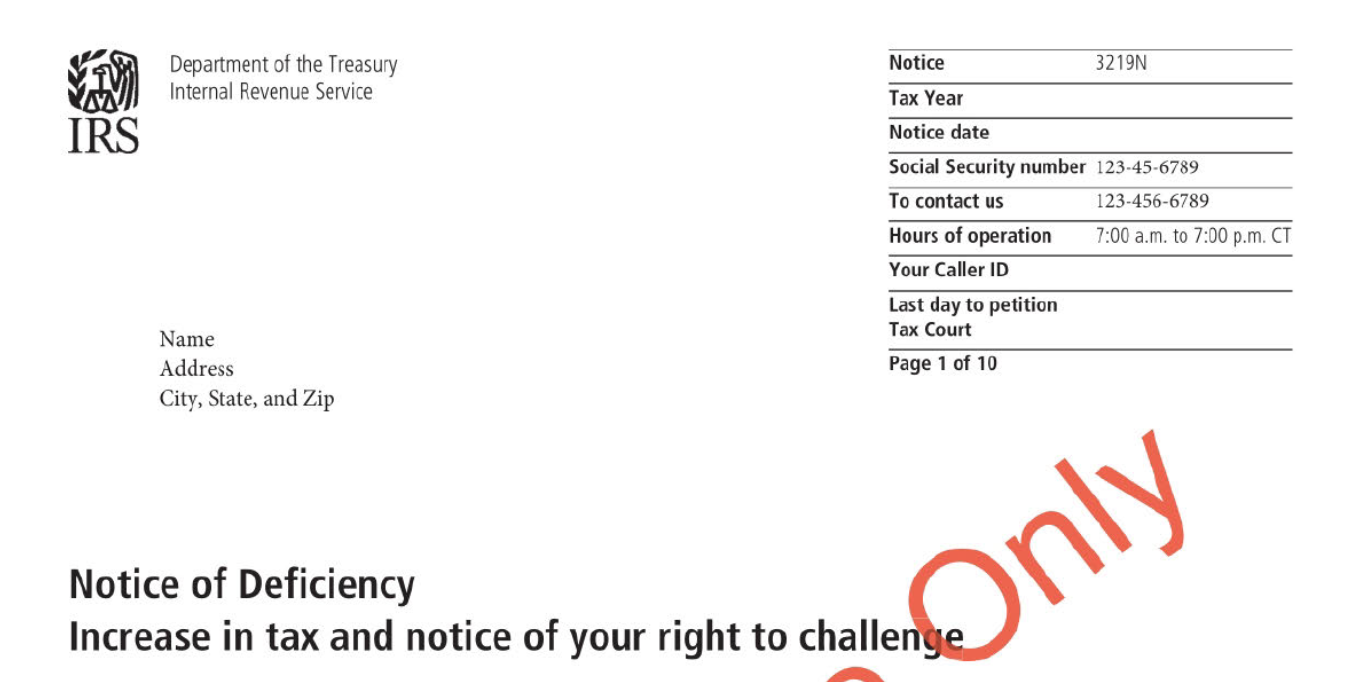

Letter 3219N: Statutory Notice of Deficiency – 90-Day Letter

SFR 90-day letter. The taxpayer is given another 90 days to respond or to seek judicial review before the proposed tax is assessed. The proposed tax computed by the IRS may be higher than what would actually be owed because the IRS cannot make an assessment that includes some exemptions, deductions, or credits the taxpayer must claim on a filed return. At this point, the taxpayer needs to file the return or the SFR proposed amount will be assessed in 90 days.

Updated: June 23, 2025