Chapter 1- IRS Practice: Working with the IRS after Filing

Chapter 1

IRS Practice: Working with the IRS after Filing

INTRODUCTION

Key Highlights:

- Two primary information sources about a taxpayer’s situation after filing: interviewing the IRS and reviewing IRS transcripts. IRS notices can also be an indicator of account changes at the IRS that need further analysis through either an IRS interview or transcript analysis.

- Three important stages to resolving a tax problem: tax problem solving starts with understanding the relevant facts in the due diligence stage. After the facts are known, the taxpayer can evaluate options and execute solutions. Once the issue(s) are resolved, the taxpayer will need to take steps to maintain compliance. Depending on the problem involved and the complexity of the situation, this process can take months to complete.

- Most tax problems for individual taxpayers fall into one of five categories: over 90% of all individual tax post-filing problems are related to audits/underreporter notices (Chapter 2 of this book), collection issues (Chapter 3), penalties (Chapter 4), unfiled returns (Chapter 5), and account issues and discrepancies (covered in all chapters). Most taxpayers are dealing with one or more of these issues when resolving a problem with the IRS.

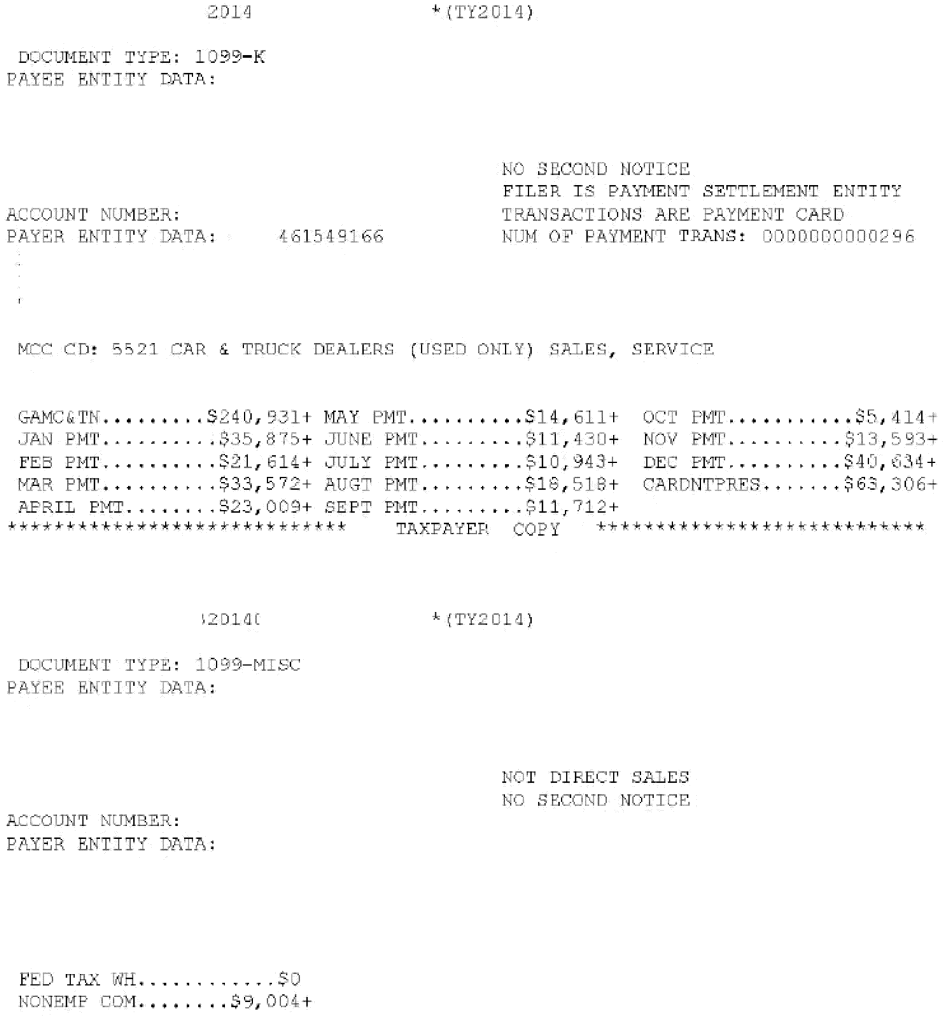

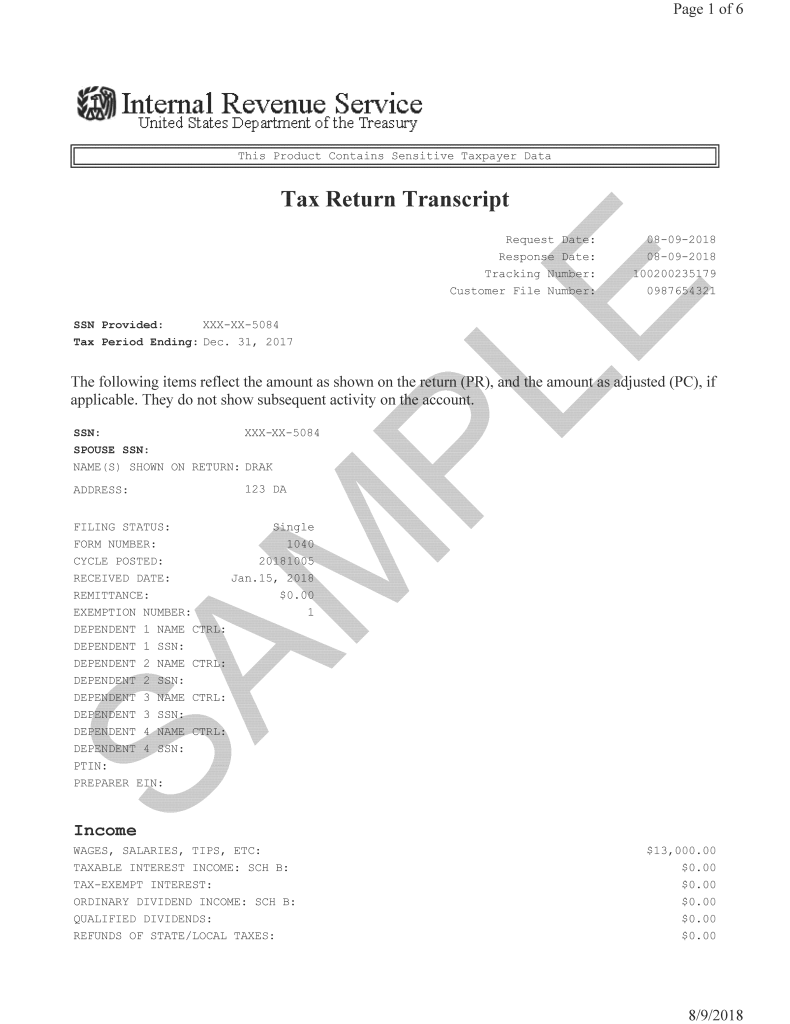

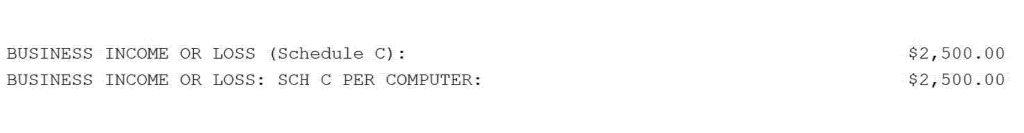

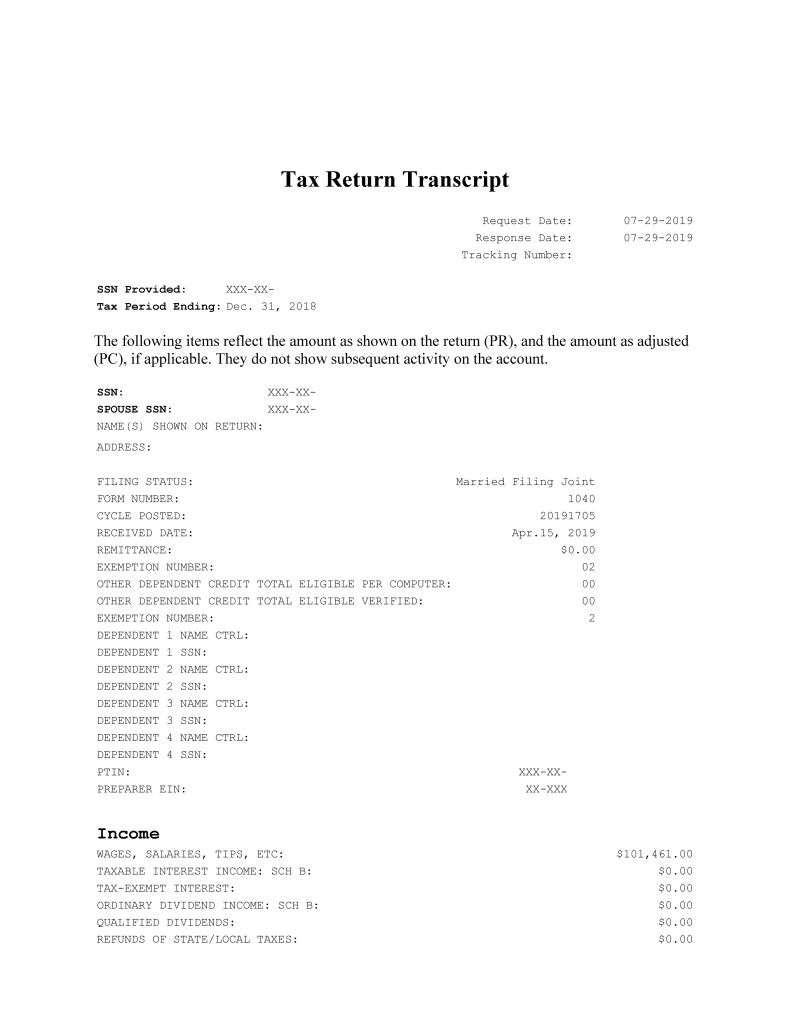

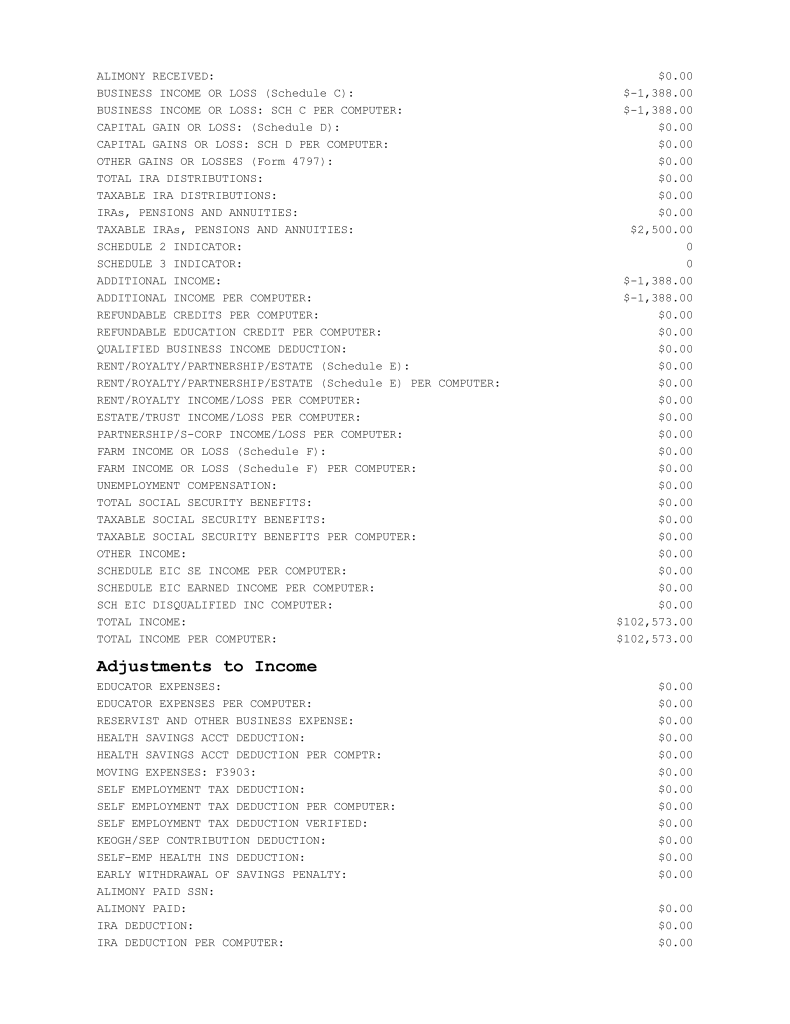

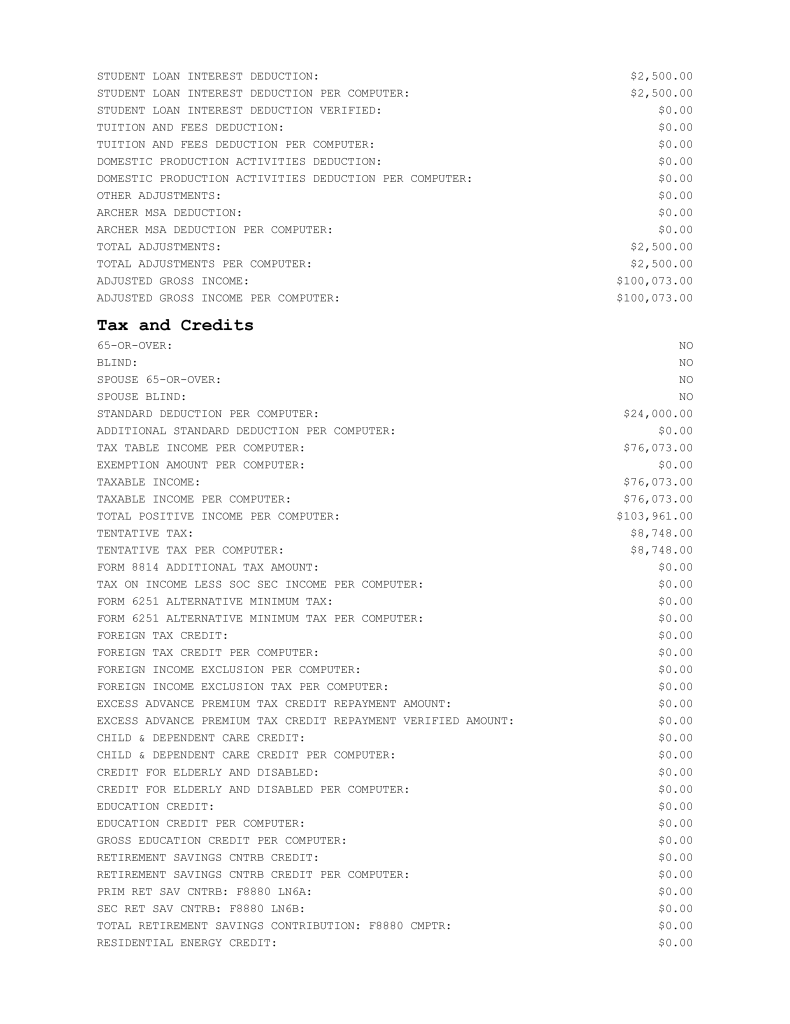

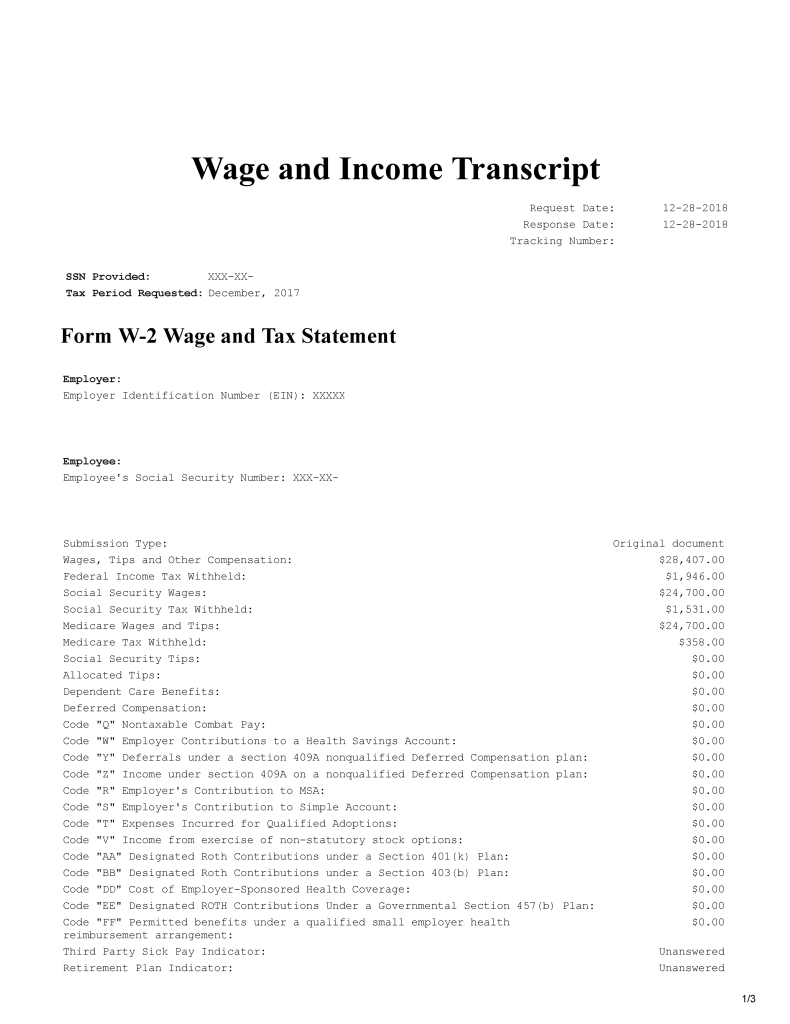

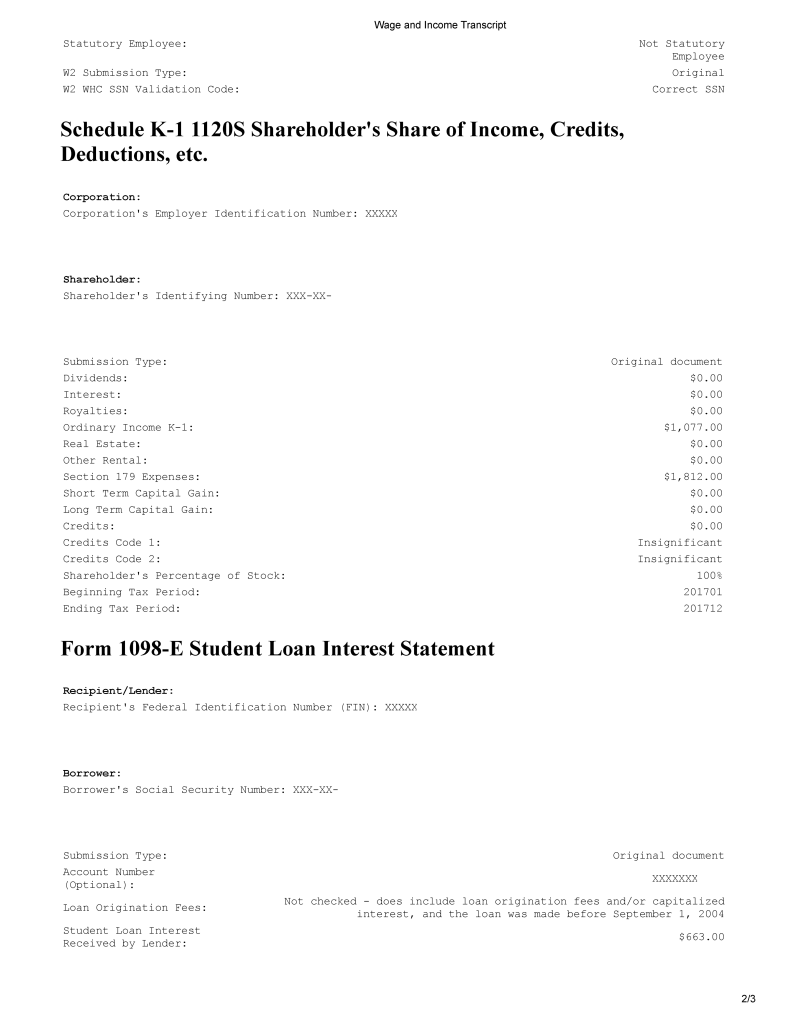

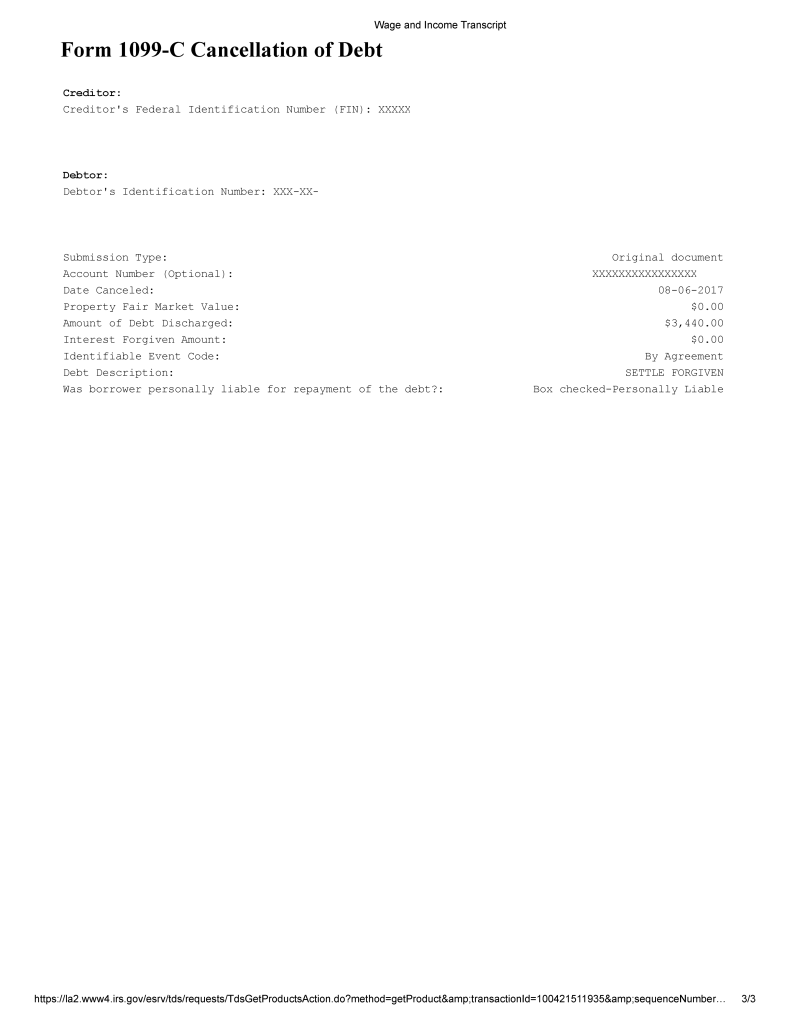

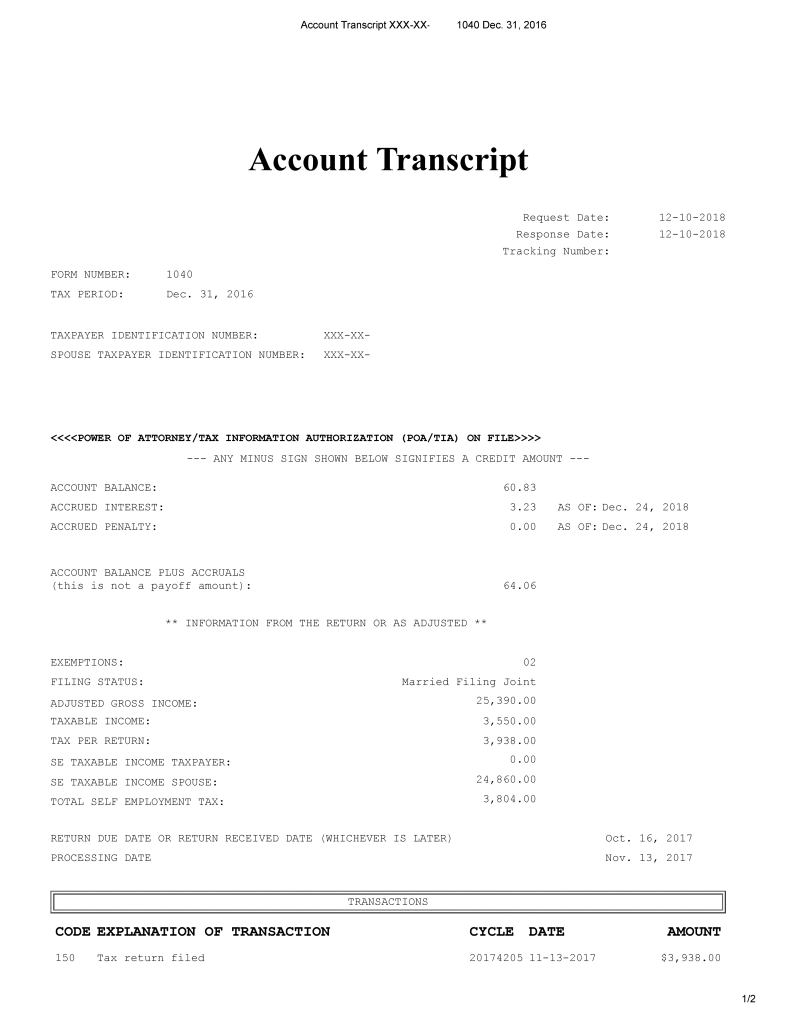

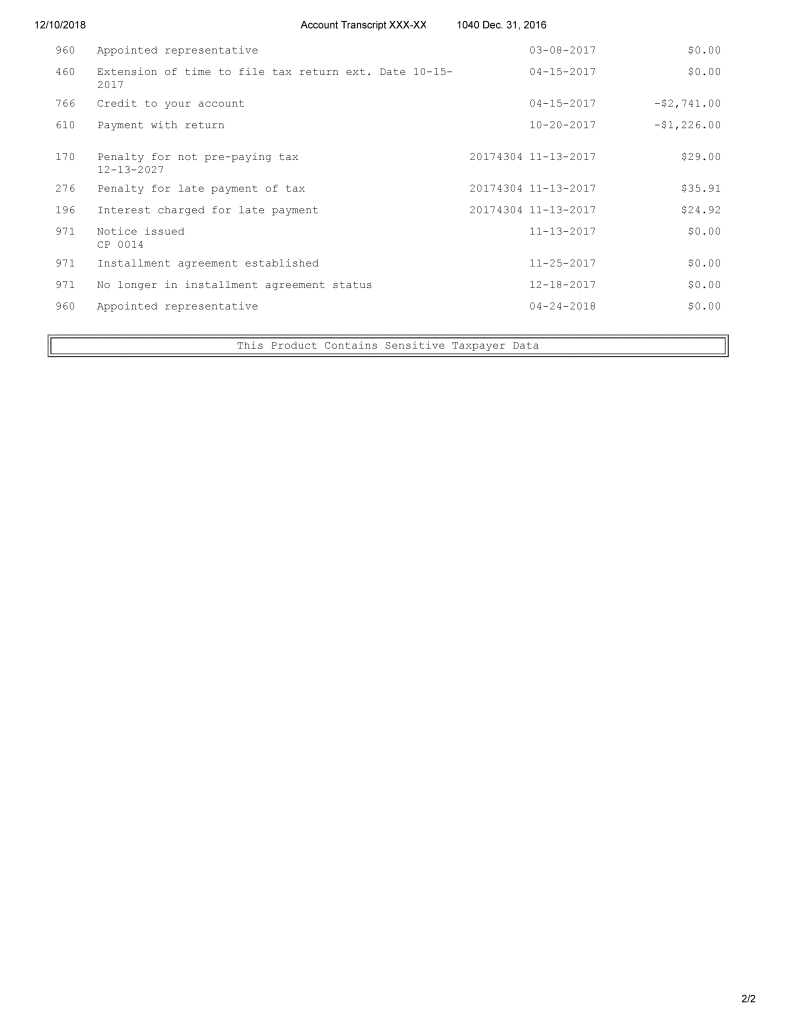

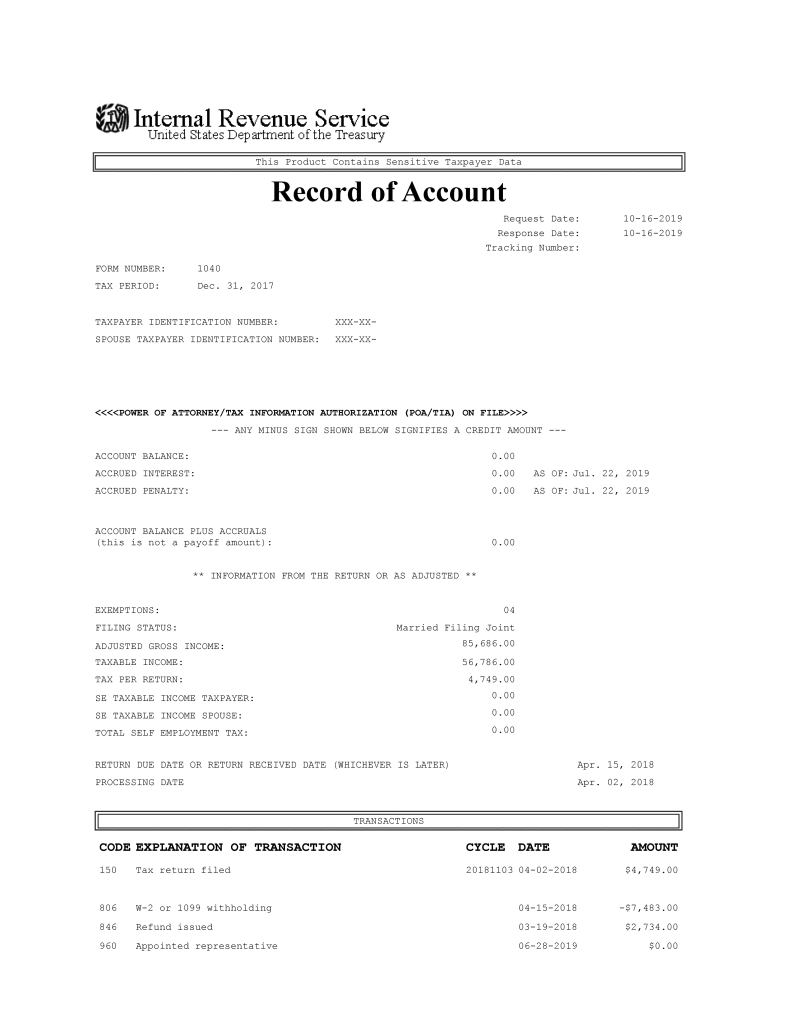

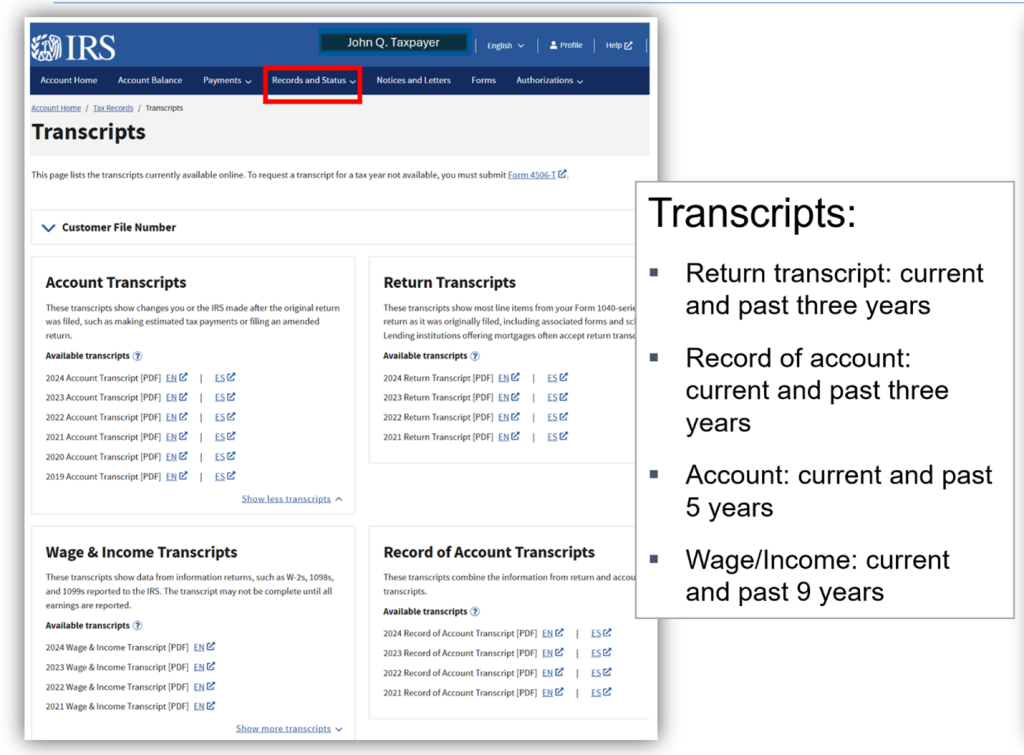

- IRS transcripts are the main tax records available to taxpayers: there are three primary types of transcripts – the tax return transcript, the wage and income transcript, and the account transcript. Each of these transcripts provides information about the taxpayer, their return filings, information returns under their tax identification number, and account activity for each tax year.

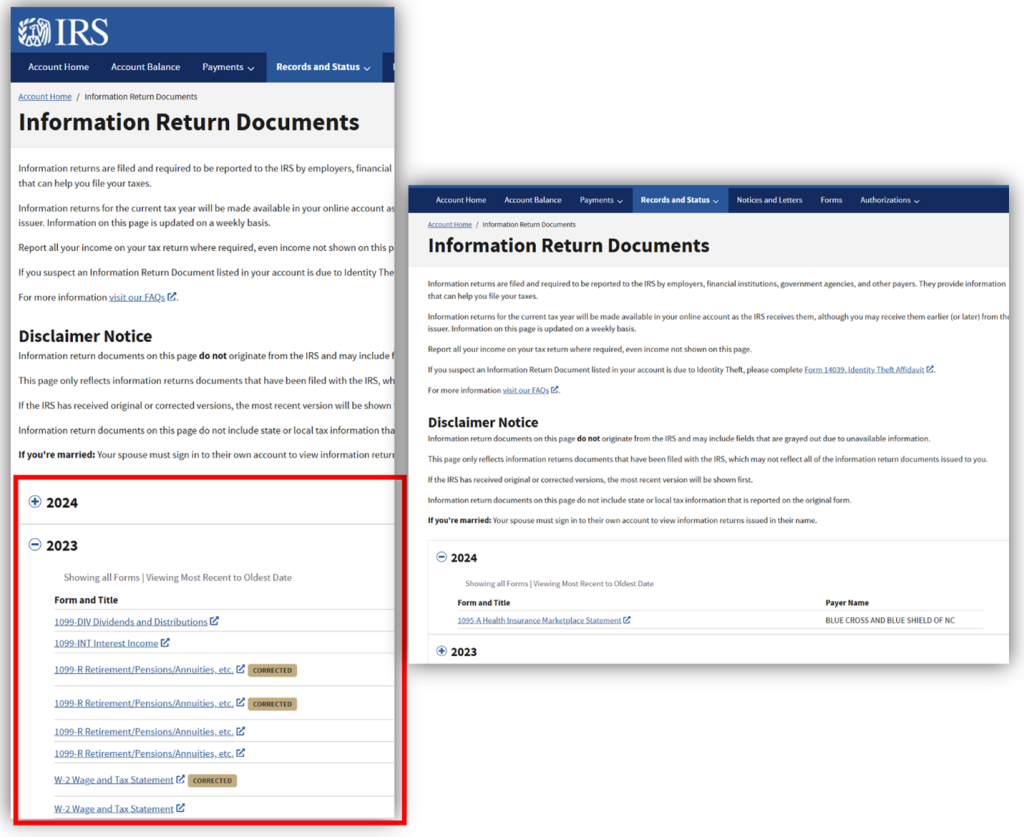

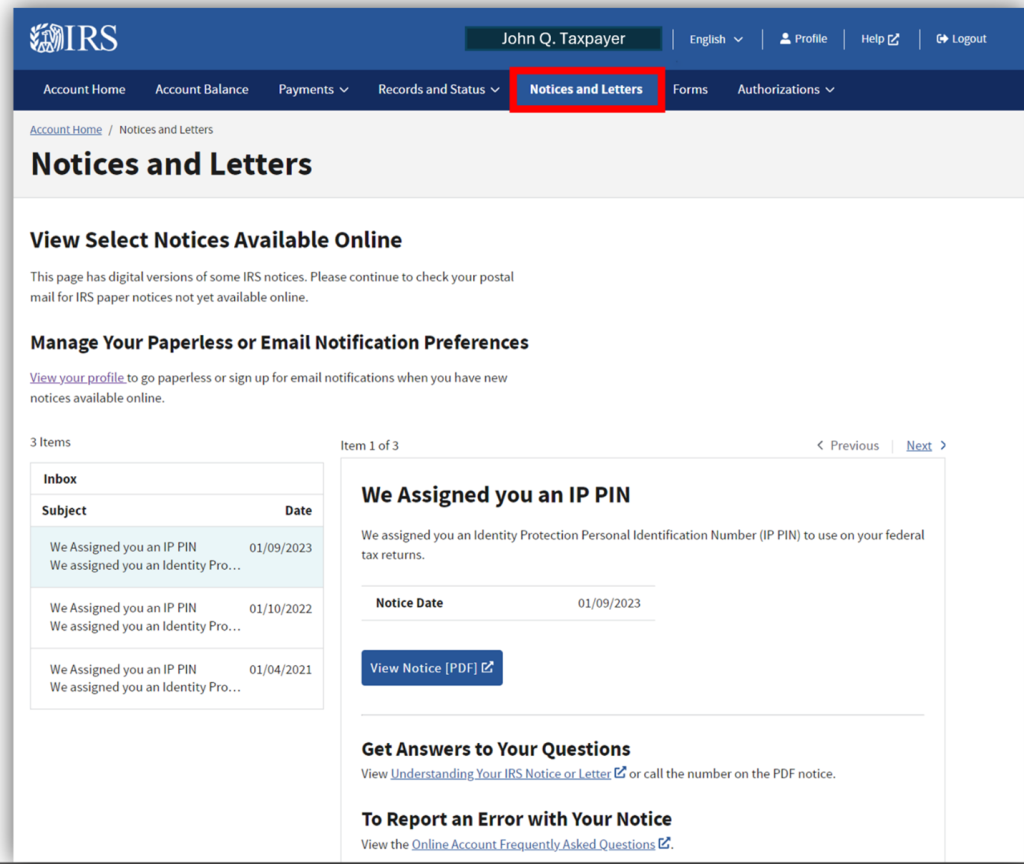

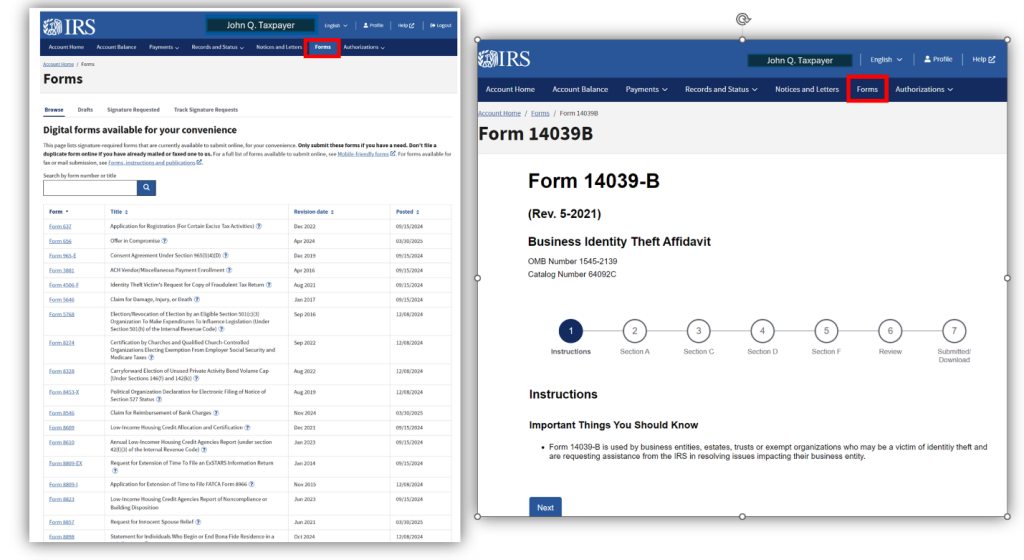

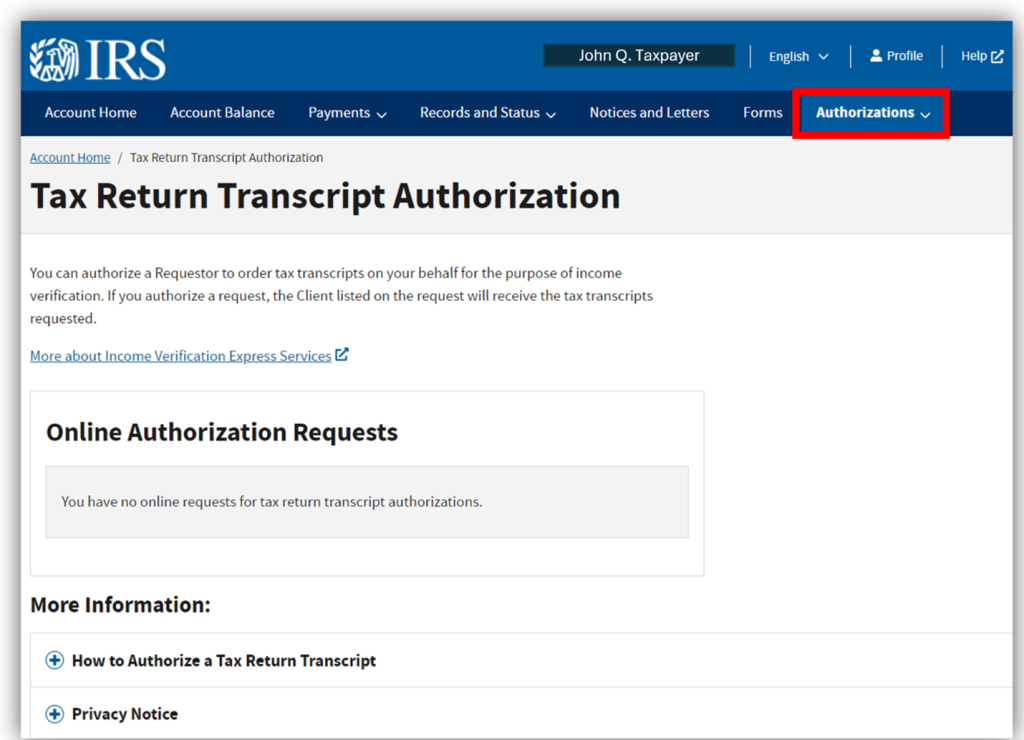

- IRS online digital tools are evolving: the IRS continuously develops new accounts and features for taxpayers and tax professionals to obtain account information and resolve issues directly with the IRS. Online accounts have additional features that can be used to more effectively and efficiently interact with the IRS.

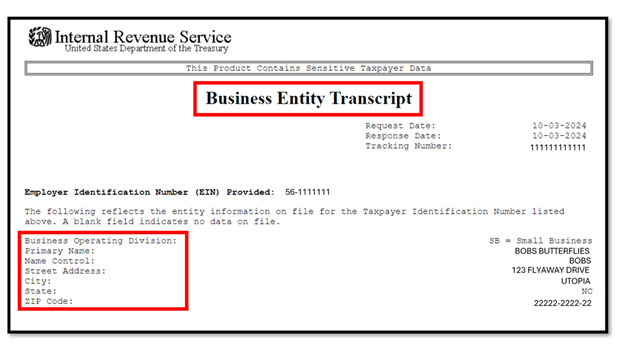

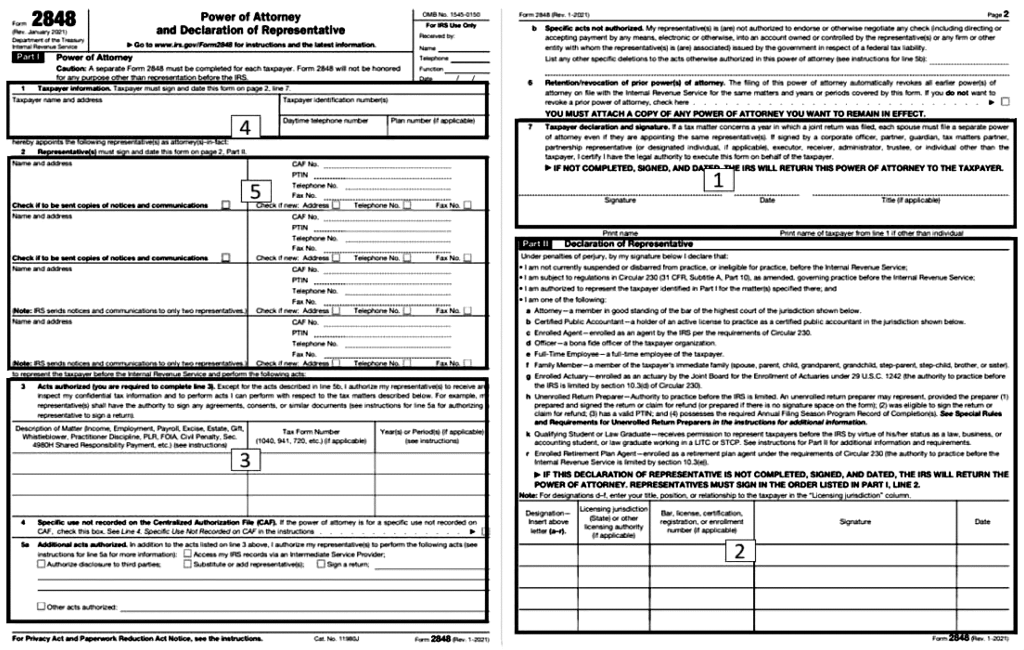

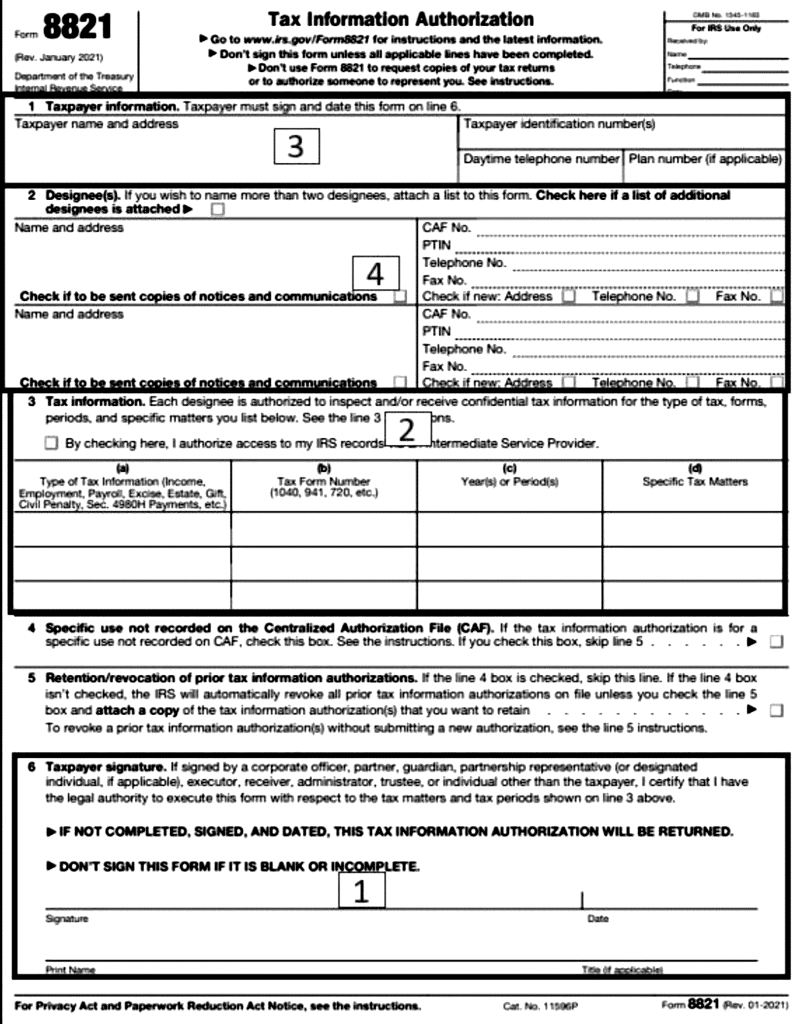

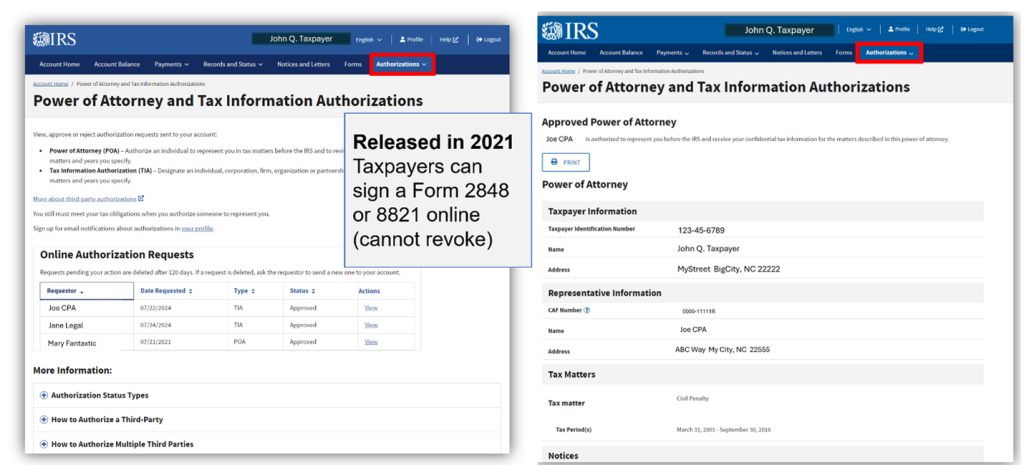

- When it comes to tax problems, taxpayers can use a representative to help: third parties can be authorized to help a taxpayer in two ways—to receive/inspect information and/or represent the taxpayer before the IRS. Any third party can be authorized to receive/inspect information via IRS Form 8821, Tax Information Authorization. Only individuals eligible to practice before the IRS (usually attorneys, CPAs, and enrolled agents) can represent a taxpayer. Representatives must be authorized in writing via IRS Form 2848, Power of Attorney and Declaration of Representative.

- Representatives of taxpayers (power-of-attorneys) must abide by the rules of practice: taxpayer representatives must abide by the rules of practice before the IRS as outlined in IRS Circular 230.

- Taxpayers facing hardship or the inability to resolve their tax problem can ask the Taxpayer Advocate for help: the Taxpayer Advocate can intervene on behalf of a taxpayer when the taxpayer is experiencing financial difficulty, or the IRS is not responding timely to a tax matter. The Taxpayer Advocate Service (TAS) will not intervene in compliance issues.

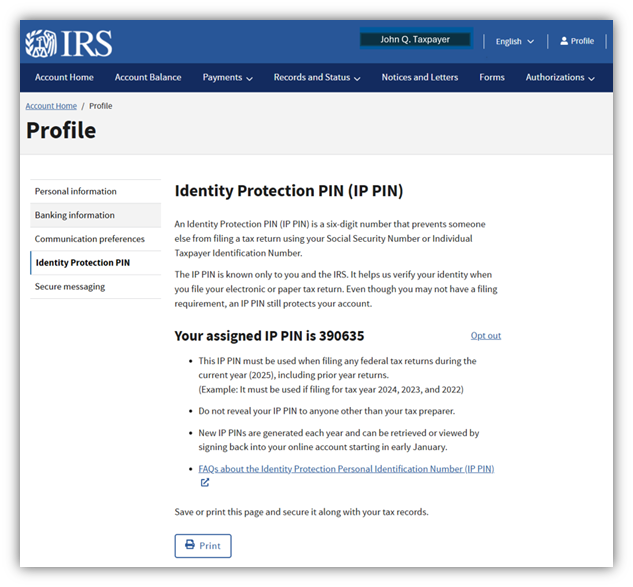

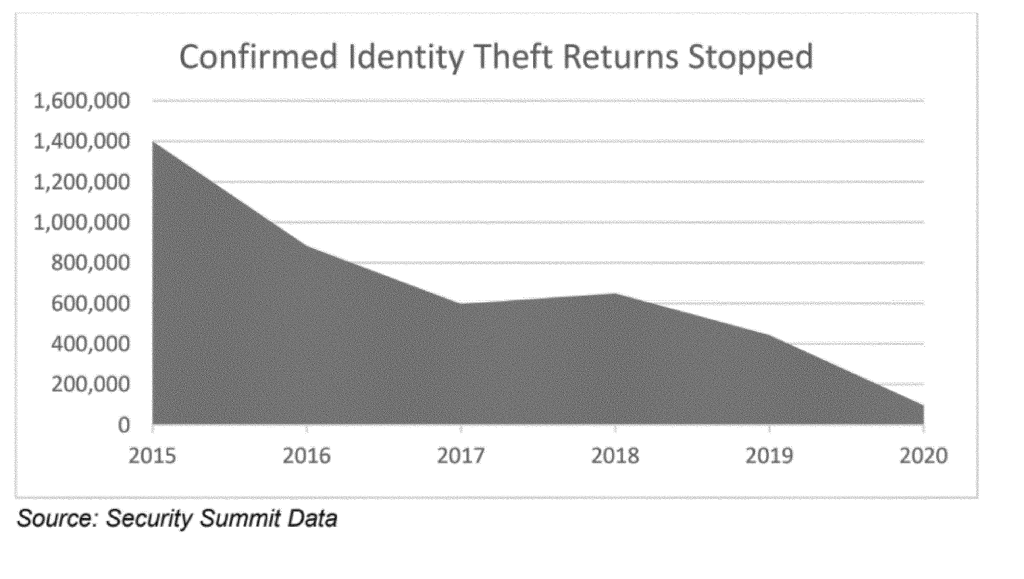

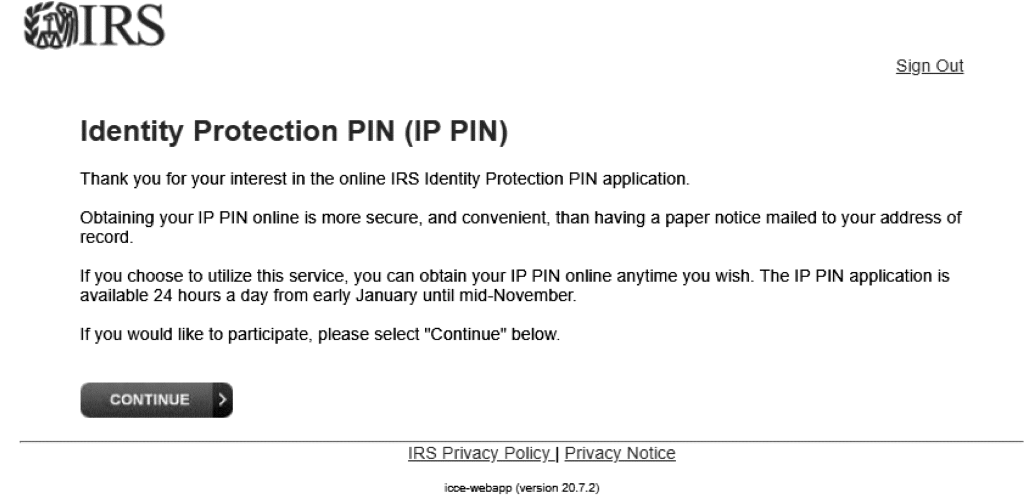

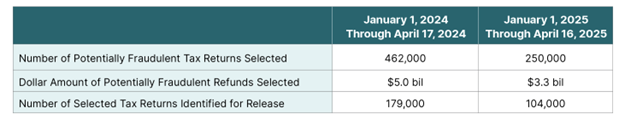

- Taxpayers need to follow special procedures to resolve tax identity theft: taxpayers facing stolen identity refund fraud or employment-related tax identity theft need to resolve their current problem and protect their identity from future identity theft.

Common IRS Phone Hotlines

| Hotline | Phone number | Hours/availability (note: times subject to change) |

| Individual accounts | (800) 829-1040 | For taxpayers (tax pros use Practitioner Priority Service (PPS))

M-F, 7AM-7PM, local time |

| Business and Specialty accounts | (800) 829-4933 | For taxpayers (tax pros use PPS)

M-F, 7AM-7PM, local time |

| Taxpayer Assistance Center appointments | (844) 545-5640 | Call for appt: 7AM-7PM, local time

Local offices (appt only, some centers allow walk-ins), days and times vary – most M-F, 8:30AM-4:30PM |

| e-Services Help Desk | (866) 255-0654 | For tax professionals

M-F, 6:30AM-6PM, CST (can open longer during filing season) |

| Taxpayer Advocate National Hotline (central intake) | (877) 777-4778 | M-F, 7AM-7PM, local time

Local offices: 8AM-4:30PM |

| Automated Underreporter Unit (includes Automated Underreporter (AUR) reconsiderations) | (800) 829-3009 (Wage & Investment (W&I))

(800) 829-8310 (Small Business/Self-Employed (SB/SE)) |

M-F, 7AM-8PM, local time |

| Correspondence Exam Unit (includes audit reconsideration) [IRM 4.19.19.16 (1-3-2023)] | (866) 897-0177 (W&I)

(866) 897-0161 (SB/SE) |

W&I: M-F, 8AM-8PM, local time

SB/SE: M-F, 6AM-9PM, CST |

| Payment plans: taxpayer not in IRS Collection | (800) 829-0922 | M-F, 7AM-7PM, local time

(Set up extensions to pay and simple installment agreements) |

| Automated Collection: Individuals | (800) 829-7650 (W&I) | M-F, 8AM-8PM, local time |

| Automated Collection: Self-employed and businesses | (800) 829-3903 (SB/SE) | M-F, 8AM-8PM, local time |

| Centralized Offer in Compromise Unit (on Form 656-PPV) | (844) 398-5025 (Memphis)

(844) 805-4980 (Holtsville) |

M-F, 8AM-5PM, CST M-F, 8AM-11PM, EST |

| Centralized Lien Unit | (800) 913-6050 | M-F, 8AM-5PM, local time |

| Penalty Hotline | (855) 223-4017 x225 | M-F, 7AM-7PM, local time |

| Identity Protection Specialized Unit | (800) 908-4490 | M-F, 7AM-7PM, local time |

| Treasury (Tax) Offset Program (not an IRS number) | (800) 304-3107 | M-F, 7:30AM-5:30PM, CST, plus automated lookup options |

| Innocent Spouse | (855) 851-2009 | M-F, 6:30AM-2:30PM, CST |

| Automated Substitute for Return Unit | (866) 681-4271 | M-F, 10AM-5PM, local time |

| IRS Appeals appointment hotline | 855-865-3401 | Leave message and will get a response back in 24-48 hours with appeals assignment and contact info |

Practitioner Priority Service Hotline Information (Tax Pros Only)

| Who can call? | Any tax pro with a taxpayer authorization can get information on up to five clients in one call. |

| PPS Phone number | (866) 860-4259 |

| Hours of operation | 7AM-7PM, local time |

| Authorization forms accepted |

|

| Phone options | PPS options:

|

| Information provided | Includes:

|

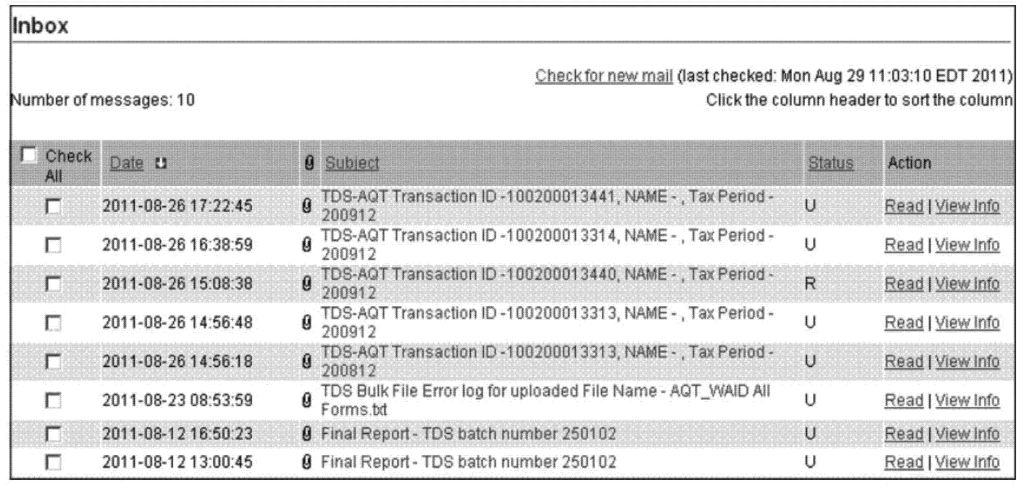

| Transcript access | As of 6/28/2019, PPS will no longer send transcripts via fax to the tax practitioner or the taxpayer.

All transcript requests will be mailed to the taxpayer or put into the tax pro’s e-Services mailbox (the “Secure Object Repository” or “SOR”). |

IRS Transcripts Snapshot

| Transcript Information | Tax Return Transcript | Wage and Income Transcript | Tax Account Transcript |

| Information provided | Shows information on most line items of a tax return filed with the IRS. | Information returns, such as Forms W-2, 1099, 1098, 5498, Sch. K-1, etc. | Four primary sections:

|

| Years available | Current year and returns processed in the prior three tax years. | Current and past nine years. | As far back as 1990. |

| Access online? | Yes | Yes | Yes |

Common IRS Online Tools for Taxpayers

| IRS online service | IRS.gov search term | Capabilities |

| Get your tax record/Get Transcript | “Get your tax record” or “Get Transcript” | Use online ordering tool to order recent account and return transcripts by mail without setting up an IRS account. |

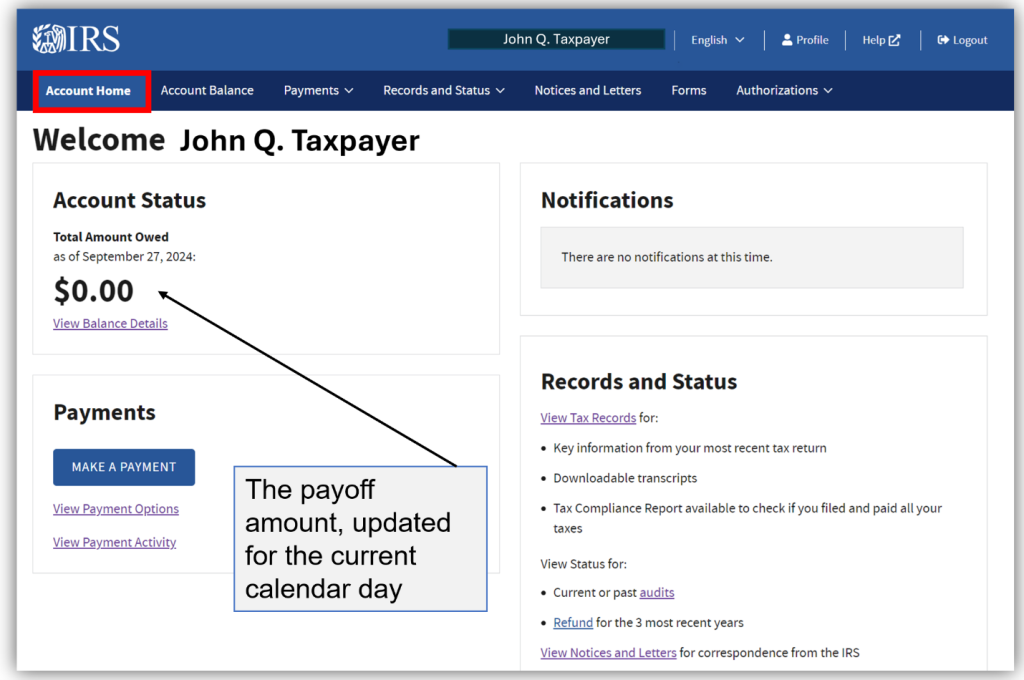

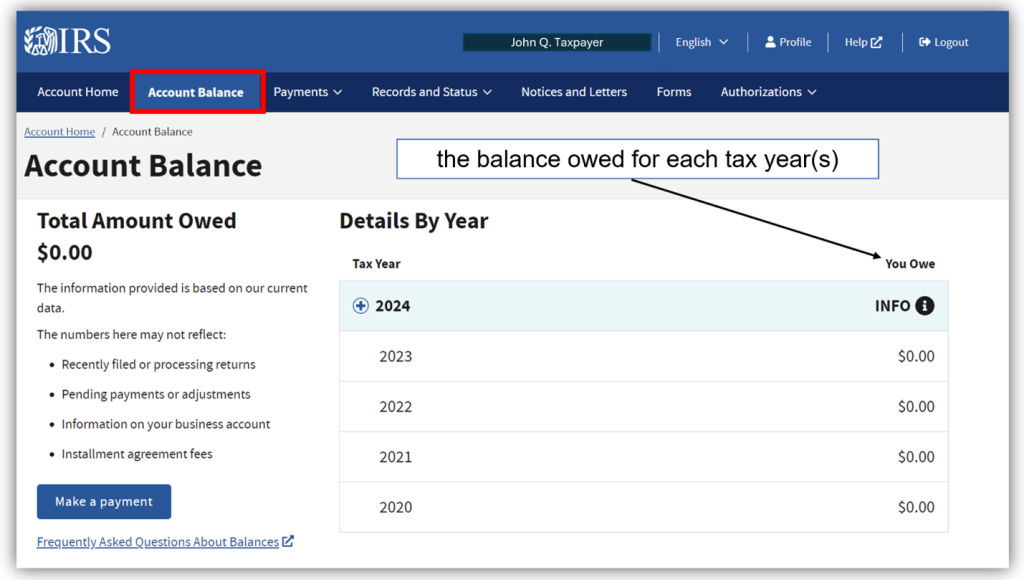

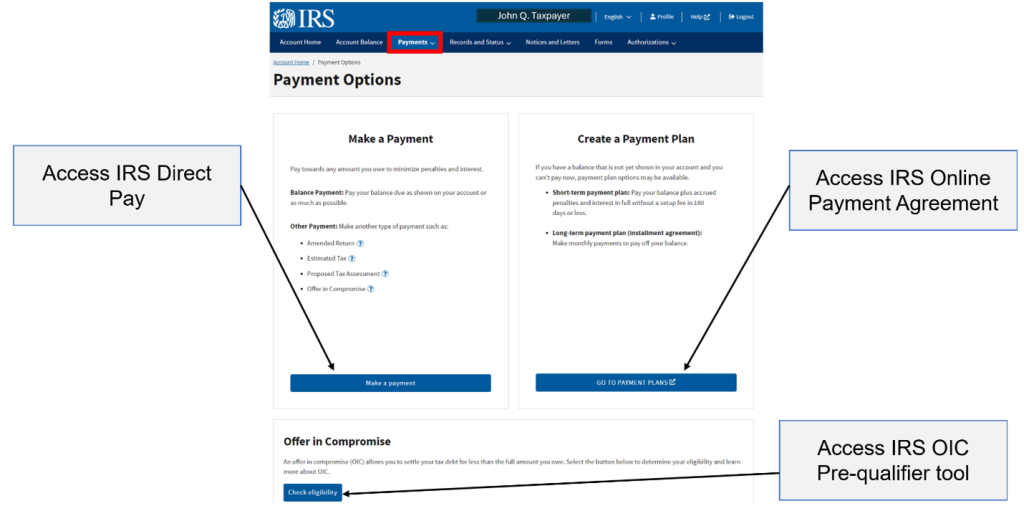

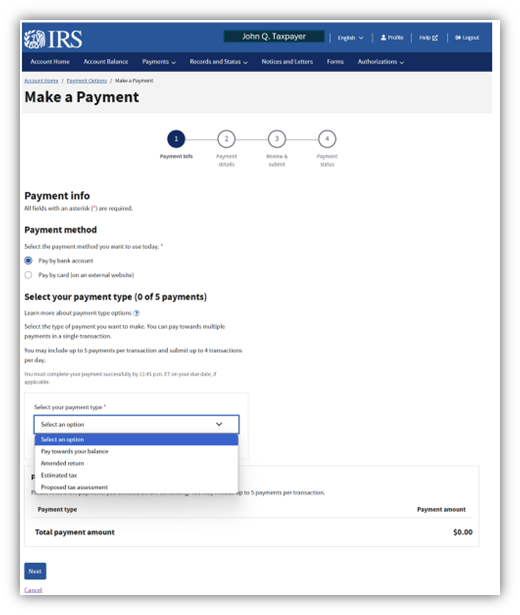

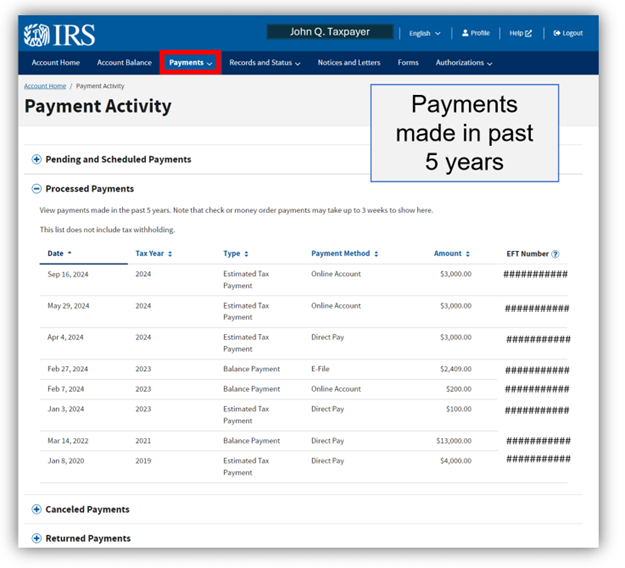

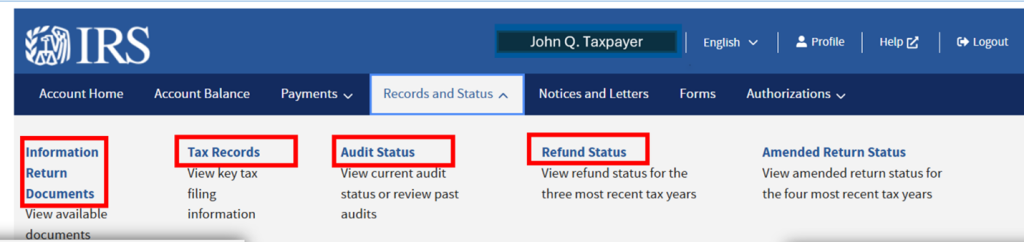

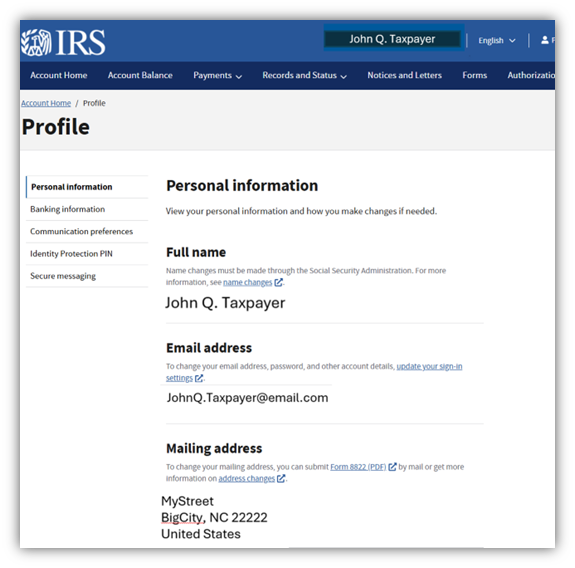

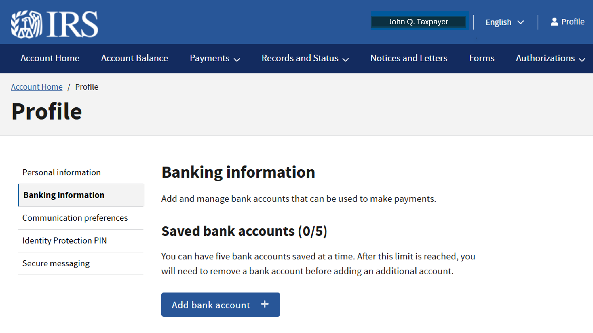

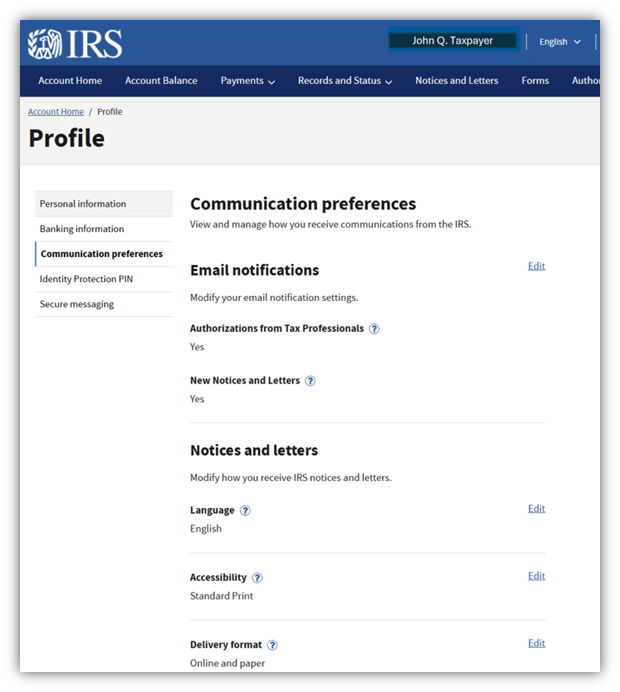

| View Tax Account* | “View your tax account” | Create an IRS account (individuals only); view payoff amounts, balances for each year owed, five years of payment history & key info on the current year’s filed return. Also access payment options, transcripts, select IRS notices, and authorize a representative or third party to obtain your information and/or represent you before the IRS. |

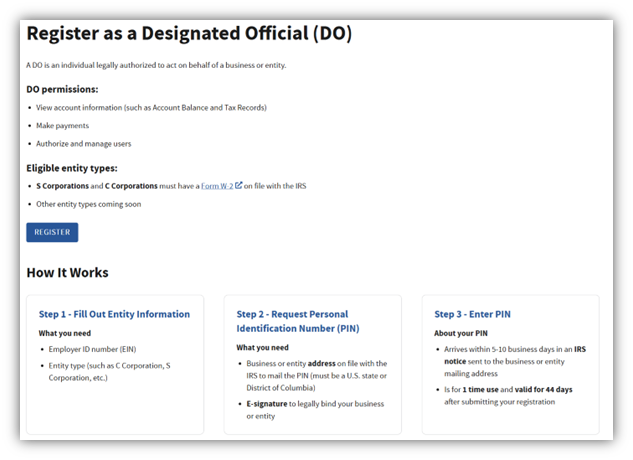

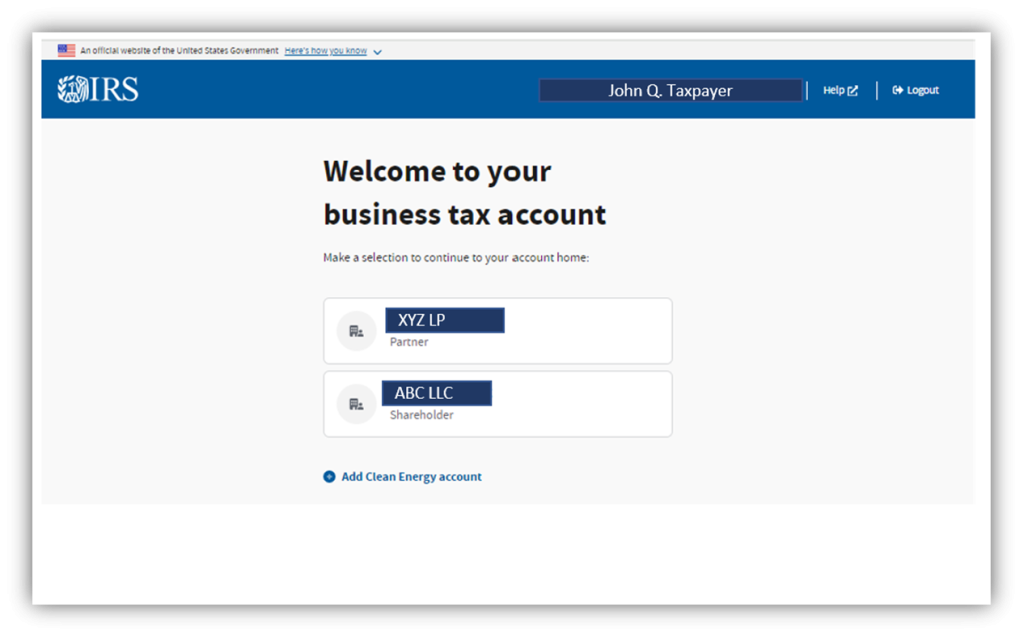

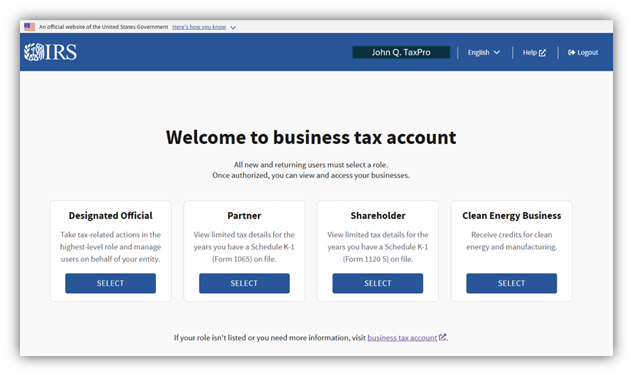

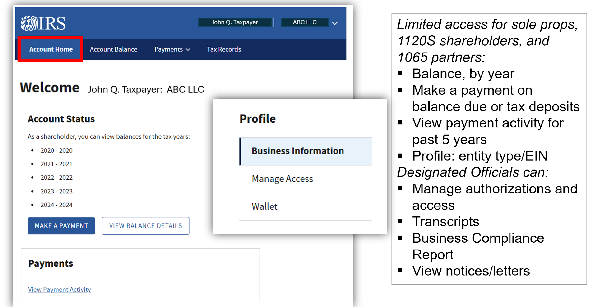

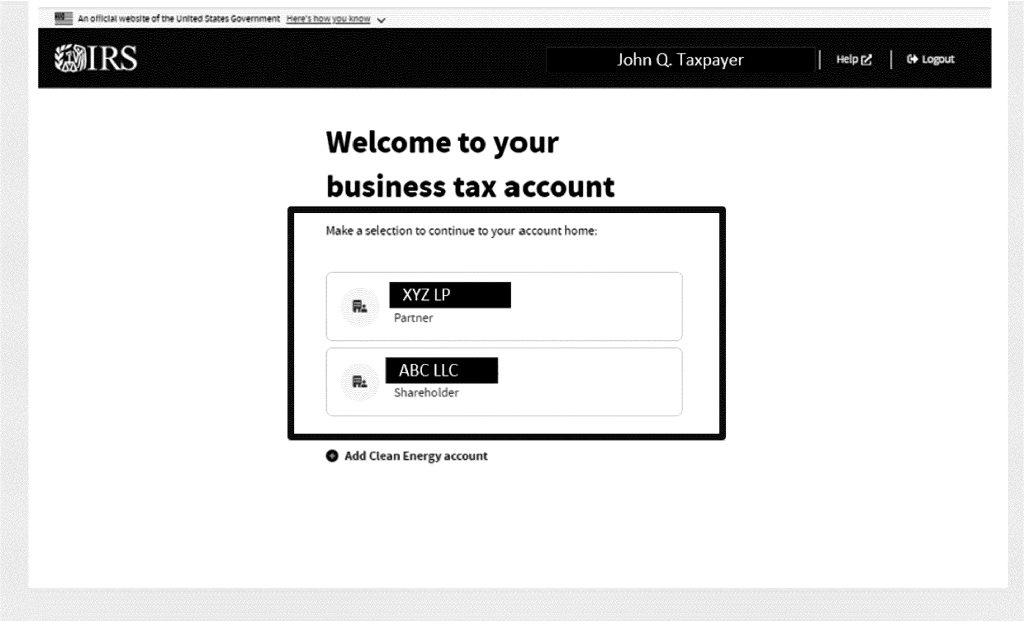

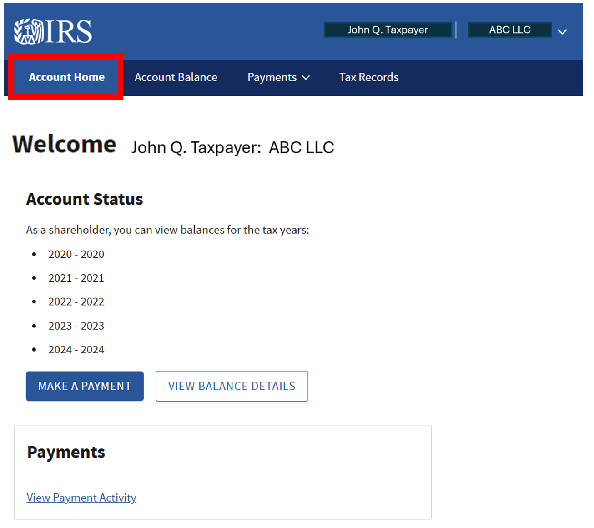

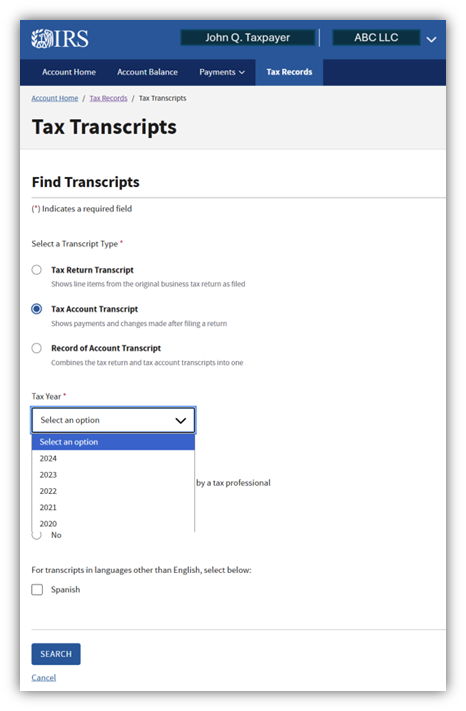

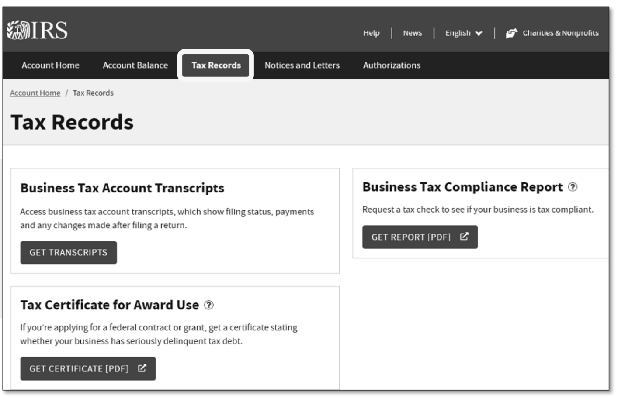

| Business Tax Account* | “Business tax account” | For sole proprietors with an EIN (and filings under EIN). Sole proprietors can view filings, amounts owed, and tax records, and request a tax compliance check.

Limited access is available to individual partners in partnership and individual shareholders in S corporation who have a Schedule K-1 reported by the entity. Partners and shareholders can see entity tax records and amounts owed. S corporations and C corporations can designate officials online. Designated officials have full access additional items such as tax records, notices, and authorizations. They can also view a tax compliance report. Partnerships do not have the ability, as of 7/4/2025, to designate an official. Note: The IRS is continuously updating business tax account with new entity types and capabilities. |

| Direct Pay | “Direct Pay” | For individuals and businesses, make a tax payment via a checking or savings account. |

| Online Payment Agreement* | “OPA” | Individuals: Payment plans for balances under $50,000, or extension to pay for balances under $100,000.

Businesses: Payment plans for balances under $25,000. Note: Special rules apply. Can be used for installment agreements for businesses with employment tax liabilities of $25,000 or less (paid within 24 months). Amounts owed between $10,000-25,000 must be paid by direct debit. |

| Amended return status | “Where’s my amended return?” | Check status of amended return for the current and three prior years on individual accounts. |

| Refund status | “Where’s my refund?” | Check status of refund on individual accounts. |

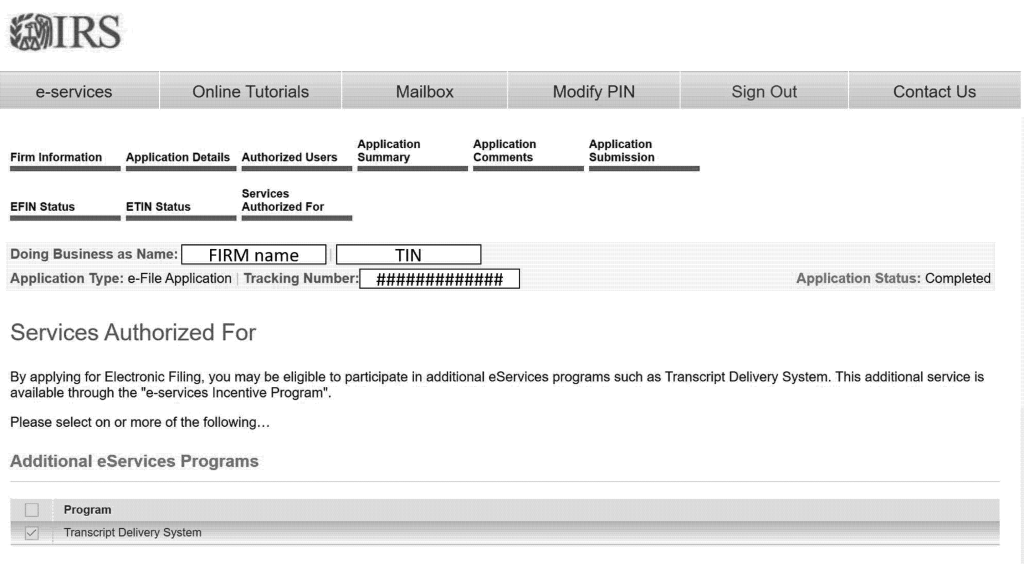

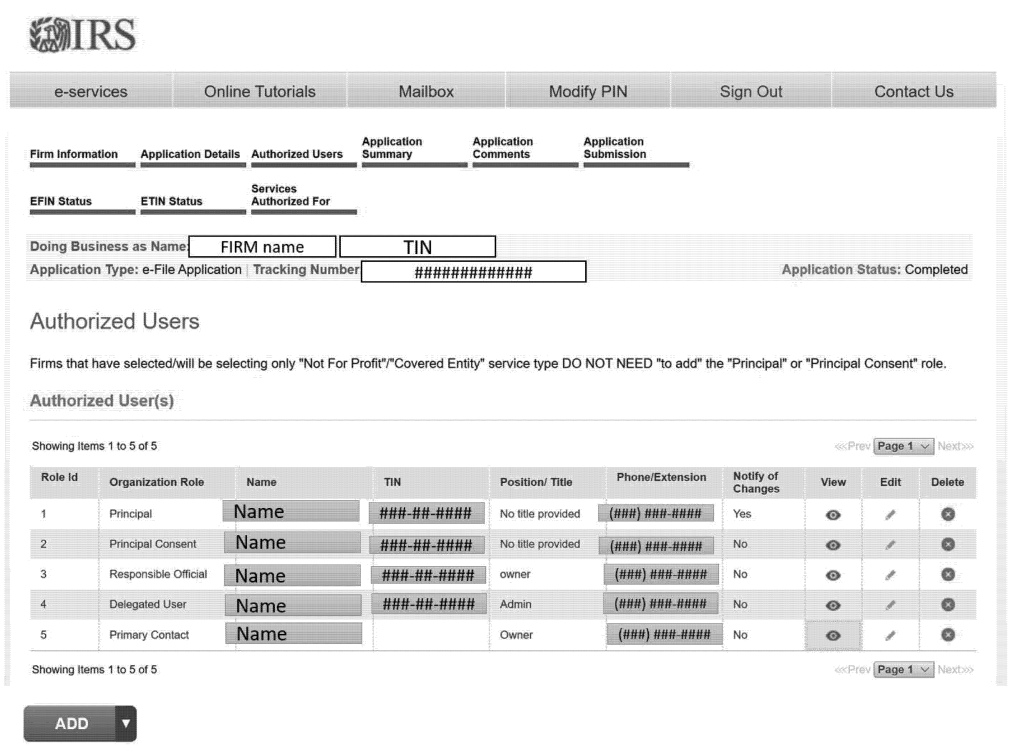

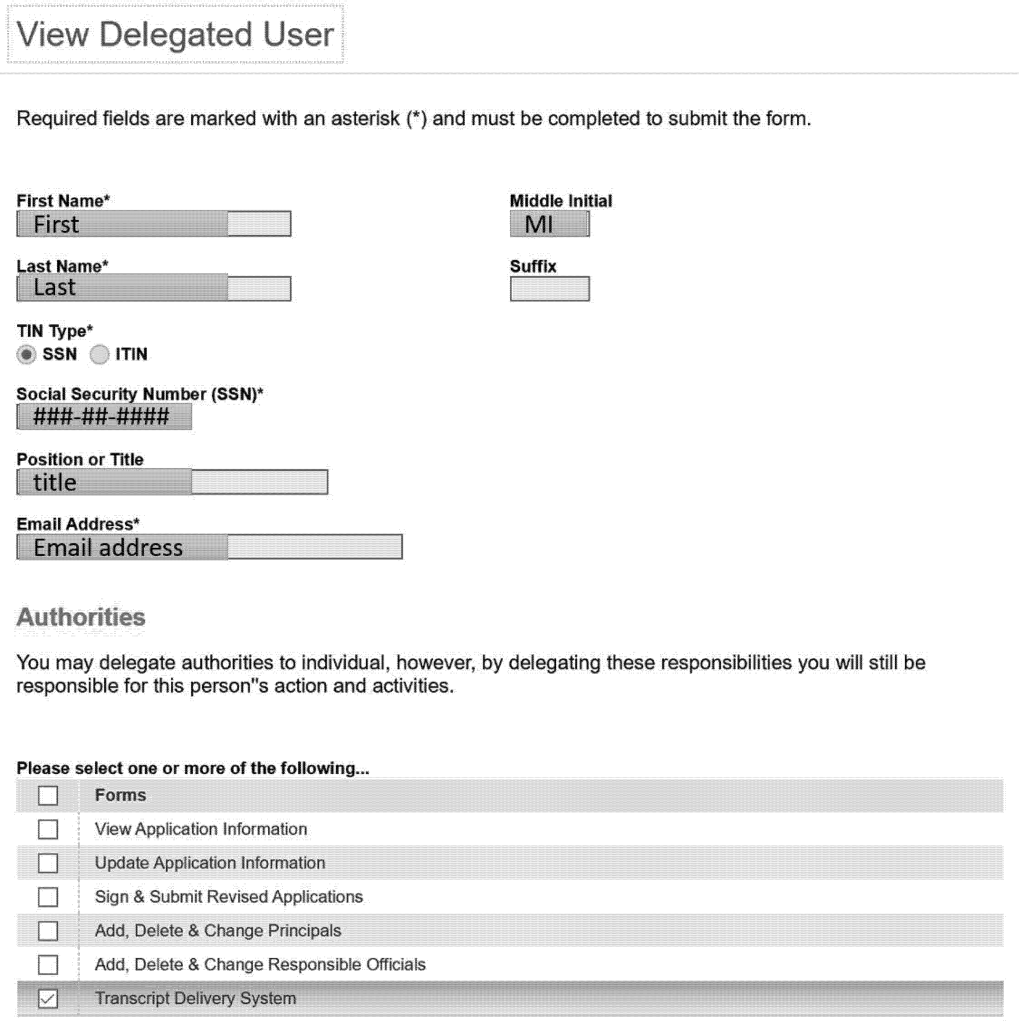

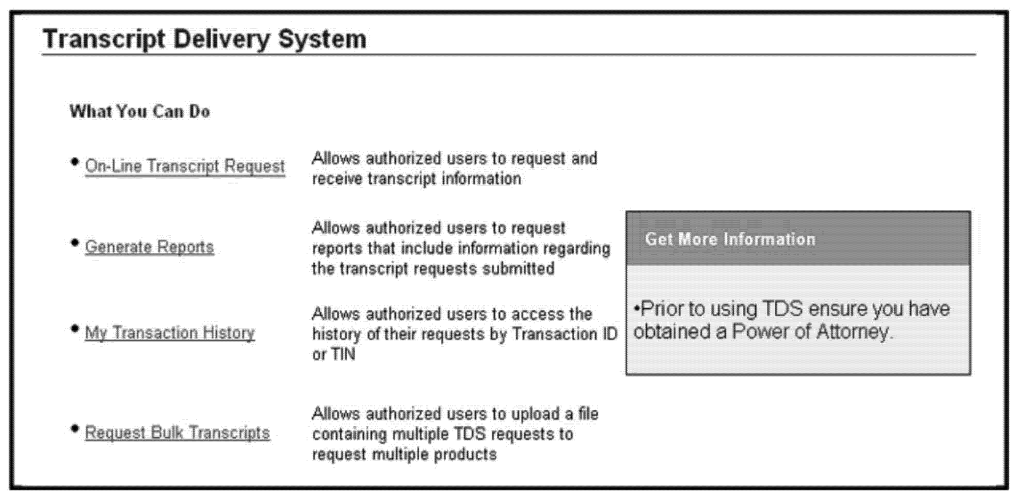

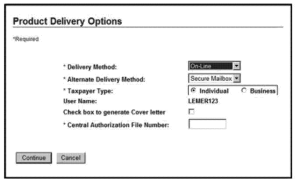

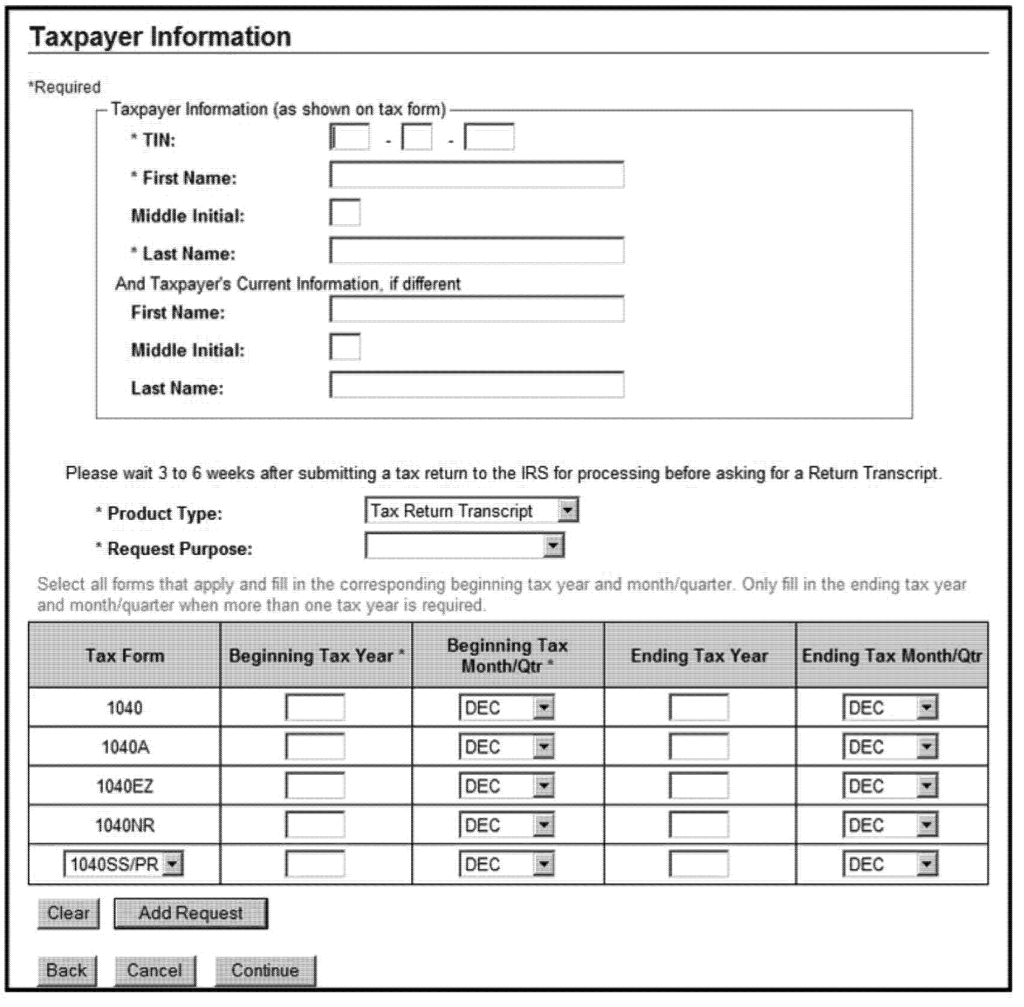

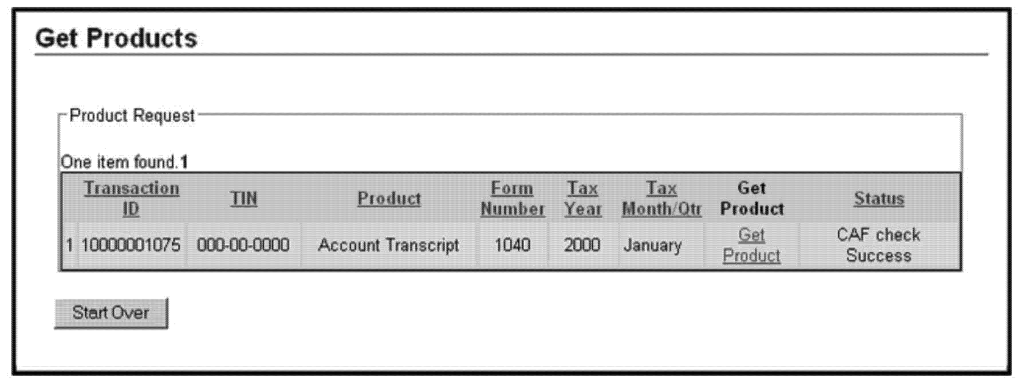

| IRS e-Services for Tax Professionals* | e-Services | Several applications, including e-file application management, Information Return Intake System (file 1099s), TIN Matching, and the Transcript Delivery System (TDS). TDS allows tax pro access to client transcripts for authorizations (Forms 2848 and 8821) on file with IRS Centralized Authorization File (CAF) unit.

e-Servcies also contains the tax pros “Secure Object Repository” or “SOR” (e-Services mailbox) which allows IRS representatives to send transcripts electronically to the tax pro. |

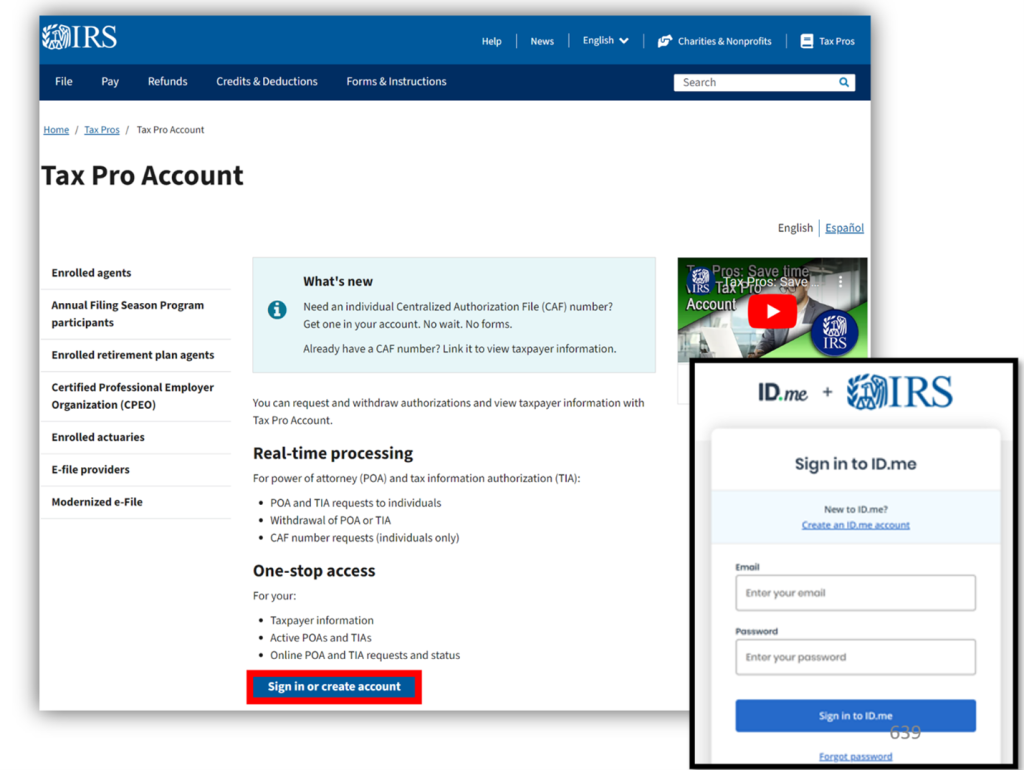

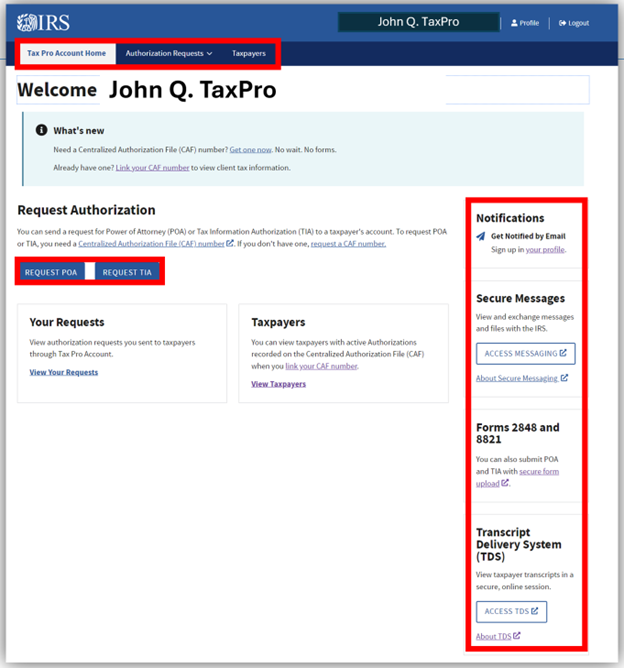

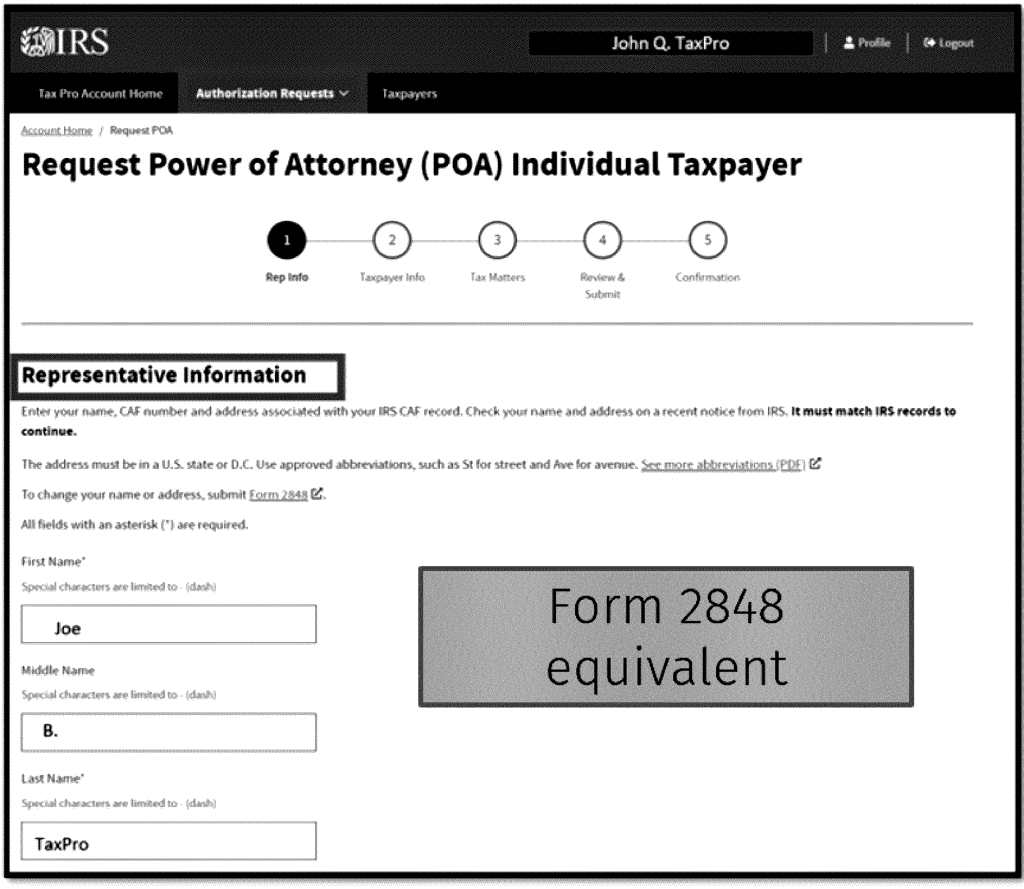

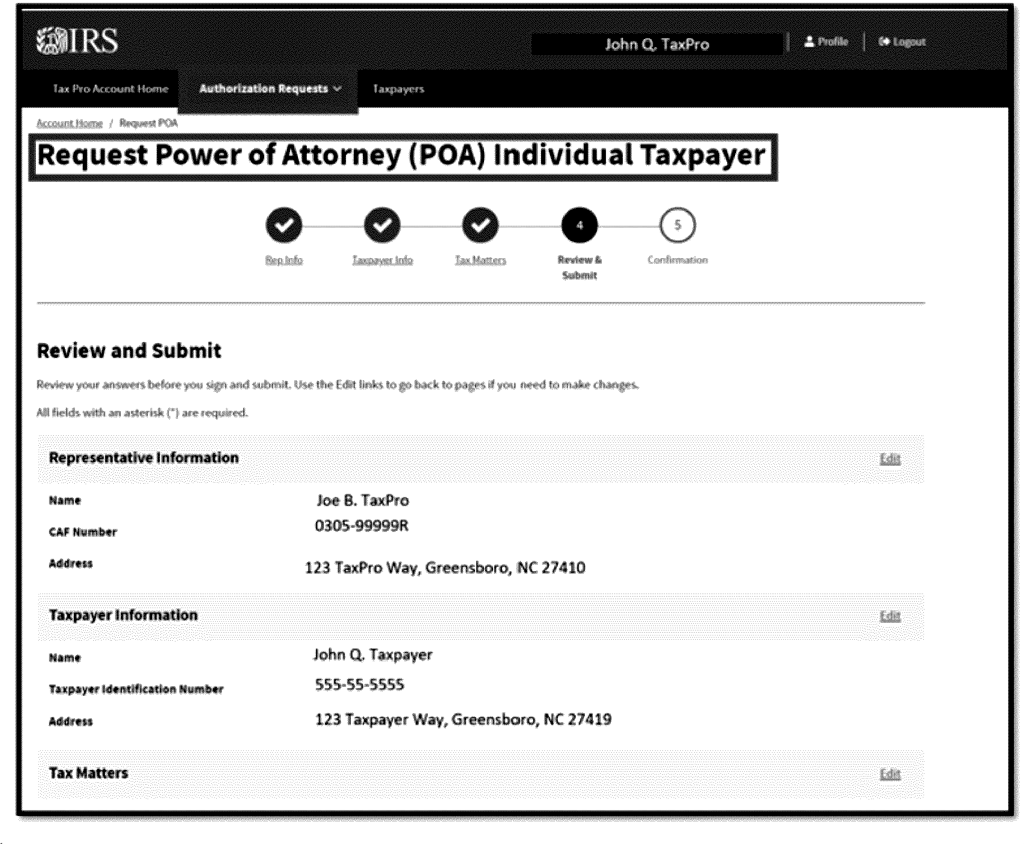

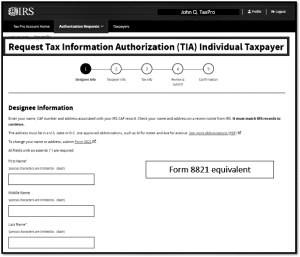

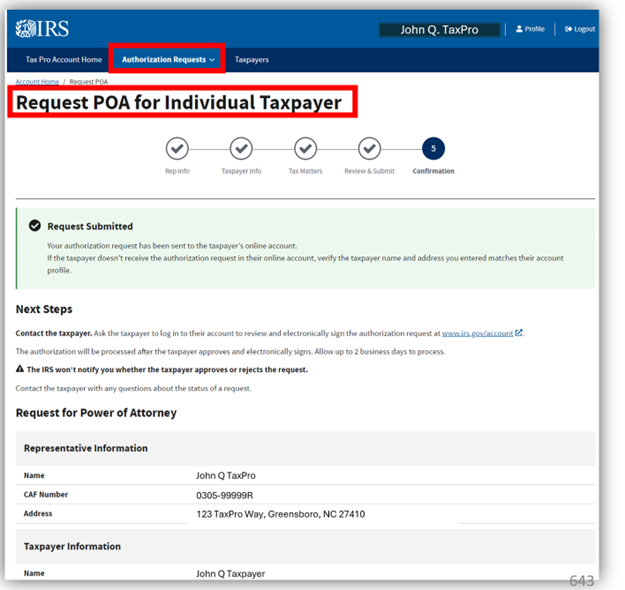

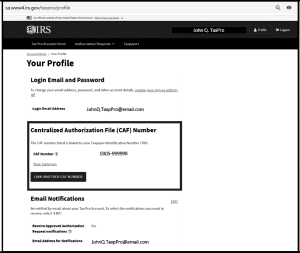

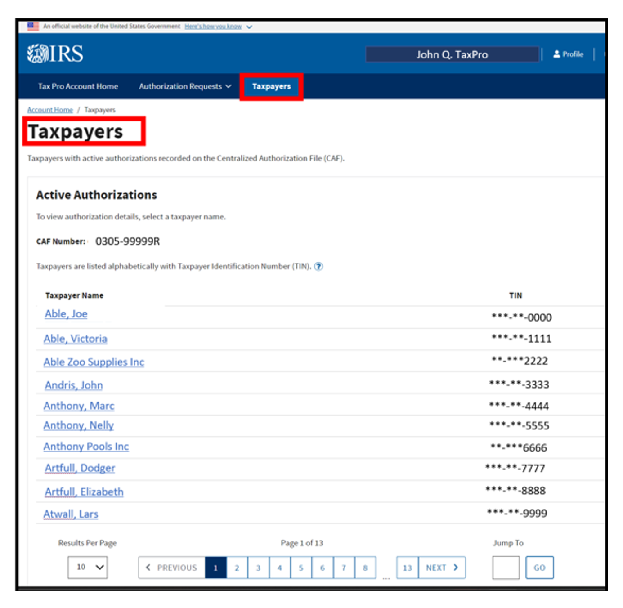

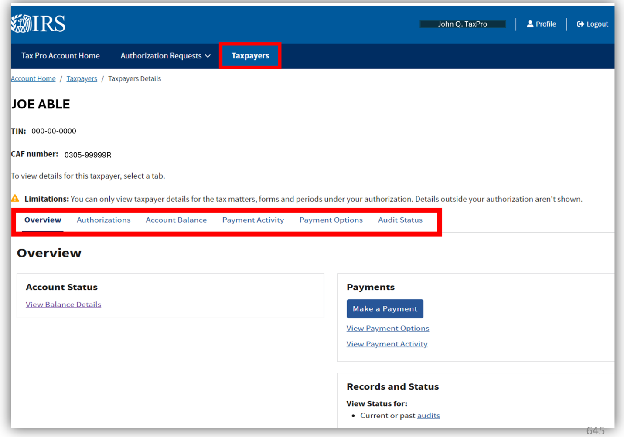

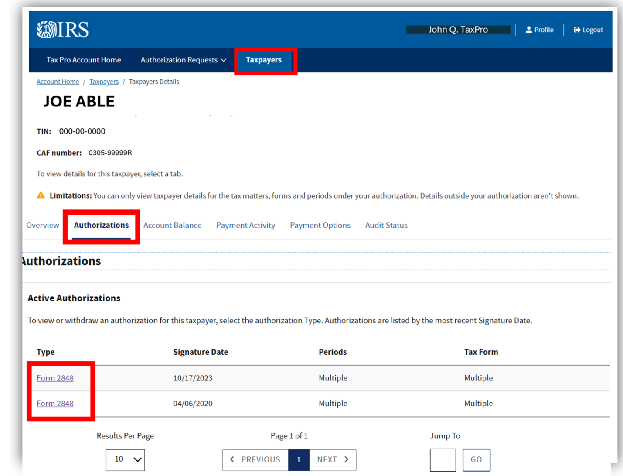

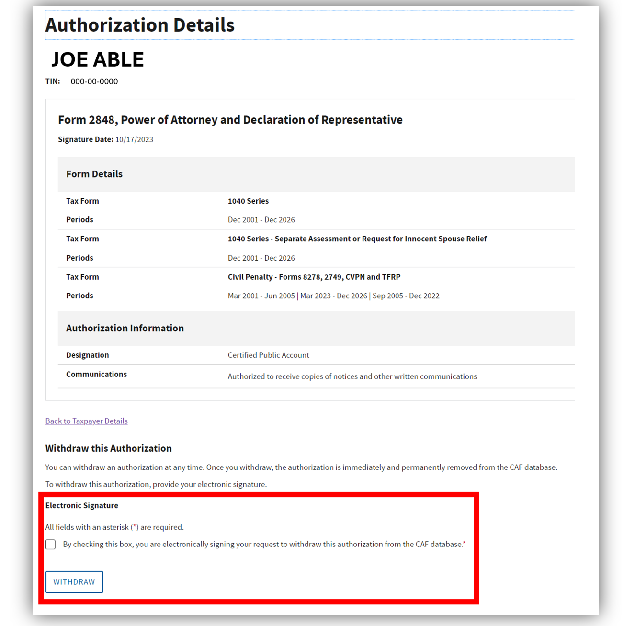

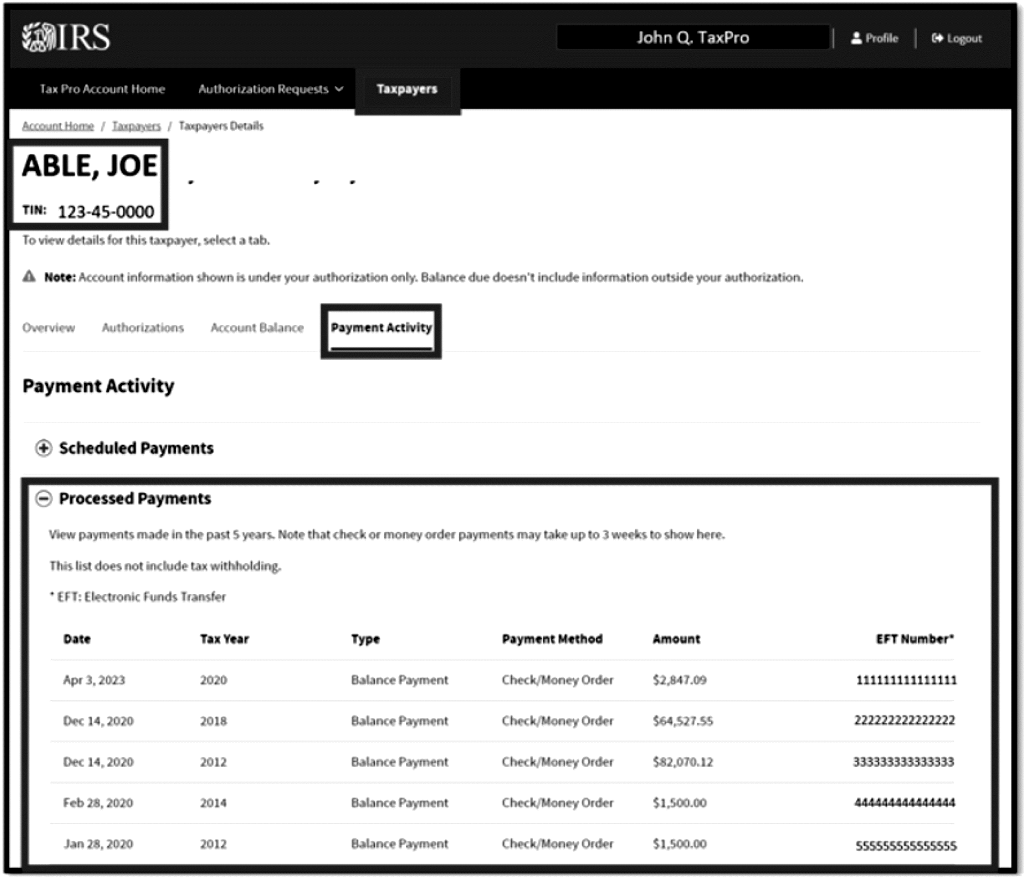

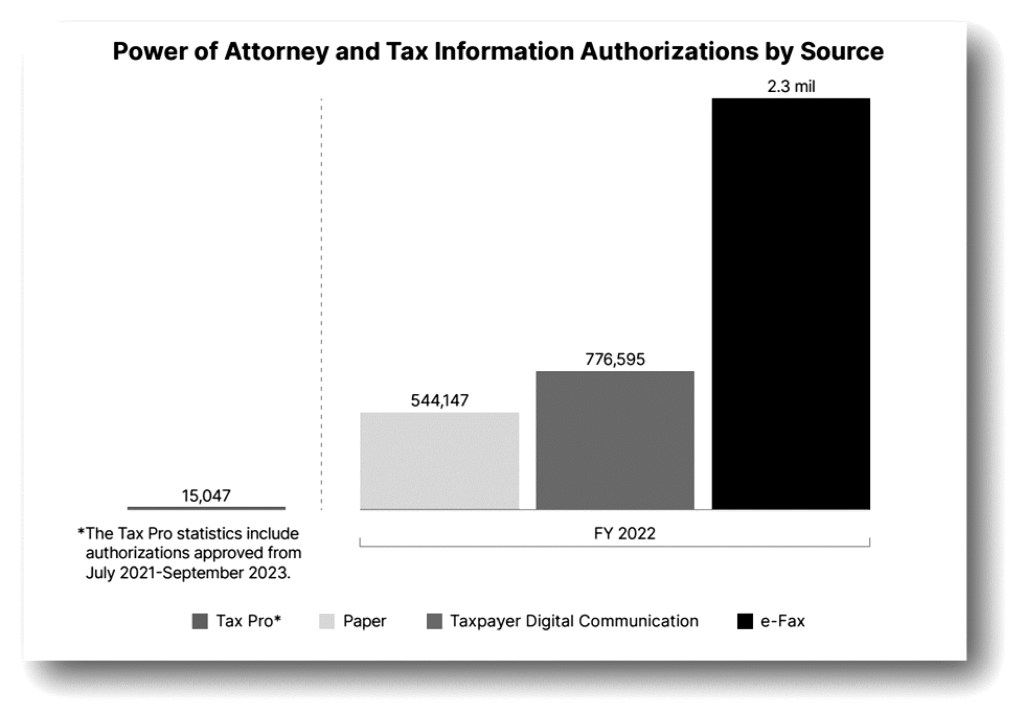

| IRS Tax Pro Account* | “Use Tax Pro Account” | Allows a tax pro to submit an authorization request to an individual’s IRS online account (i.e., electronically enabled power-of-attorney or tax information authorization). Tax pros can manage their authorizations (Forms 2848 and 8821) online through Tax Pro Account.

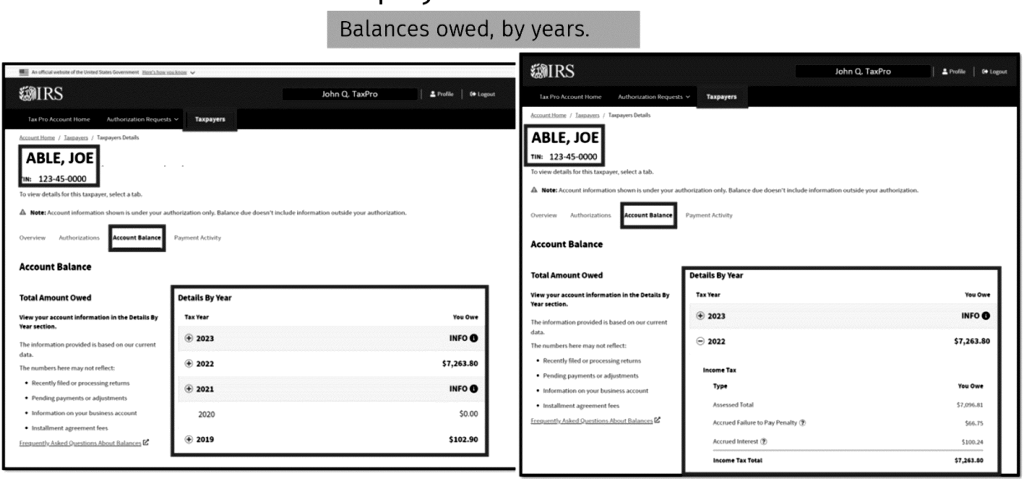

For taxpayers with a recorded Form 2848 or 8821, the tax pro can view the taxpayer’s tax balance, view/make payments, set up a payment plan, and view the status of a mail audit. |

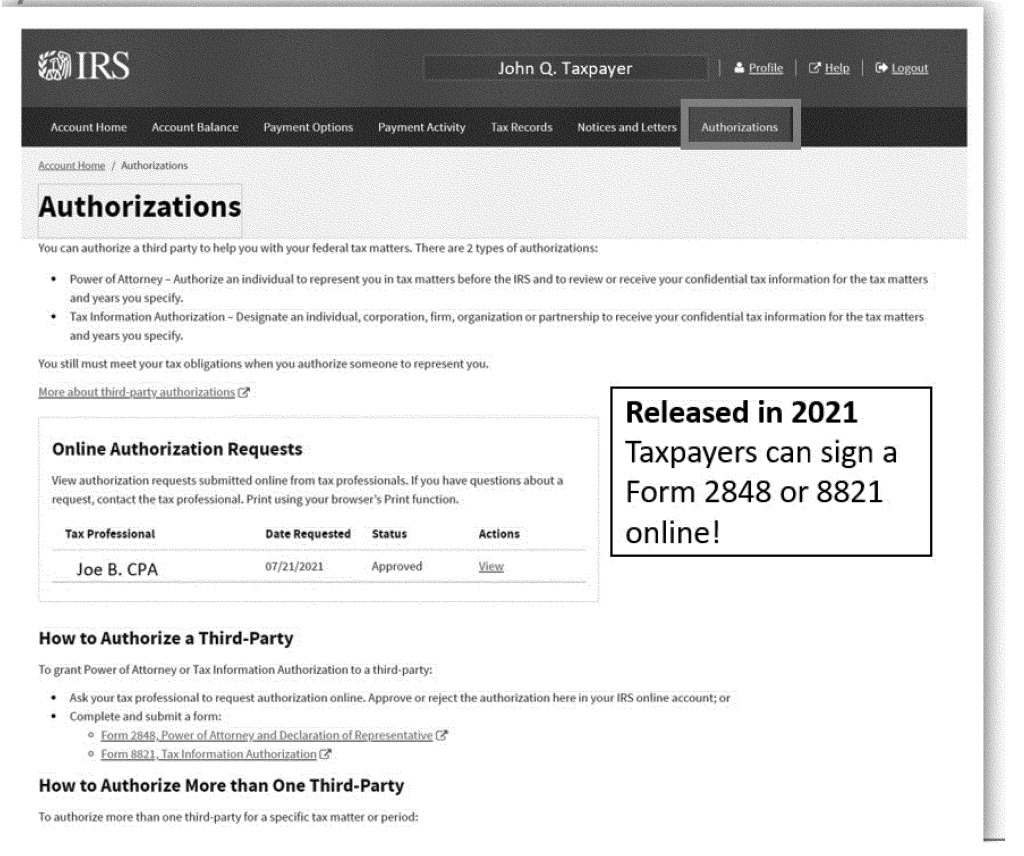

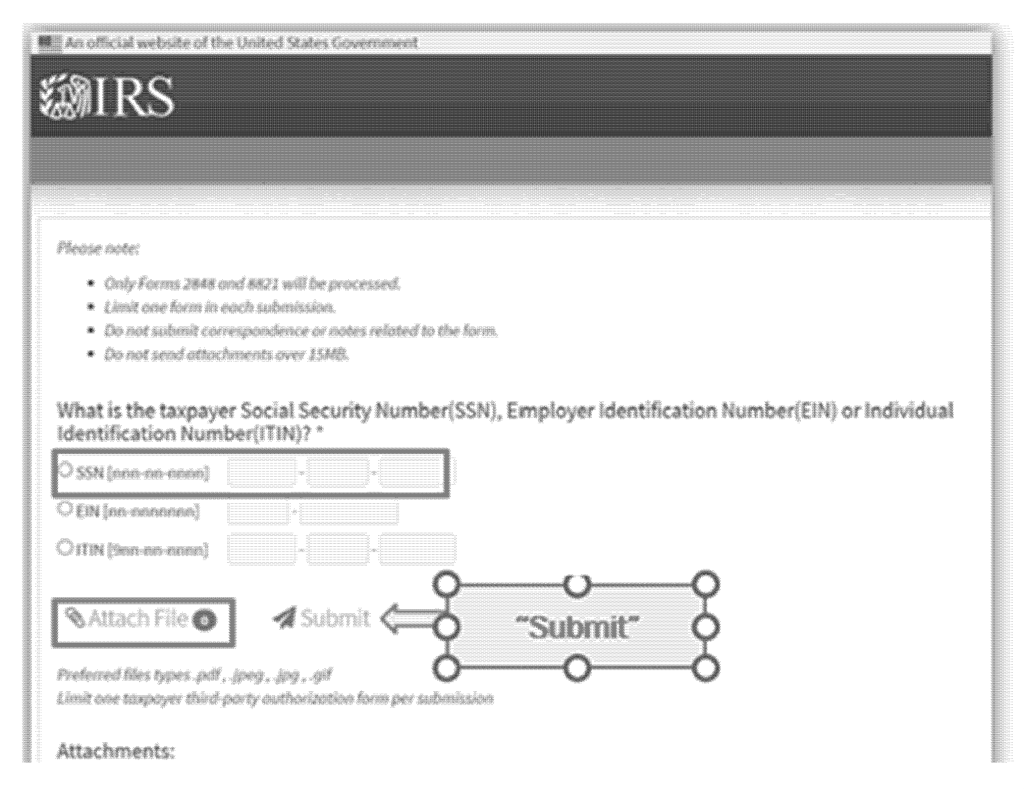

| Form 2848 and 8821 online* | “Submit Forms 2848 and 8821 Online” | Allows a tax pro to submit a Form 2848 or 8821 online. Also, enables the taxpayer, under certain conditions, to e-sign the authorization form. (This tool is the only IRS system that allows an e-signature other than the IRS Tax Pro Account, which enables authorization through the tax pro/taxpayer online accounts.) |

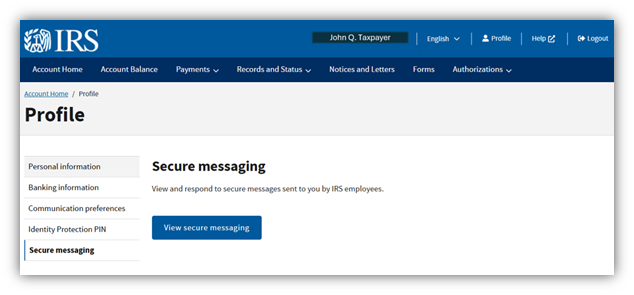

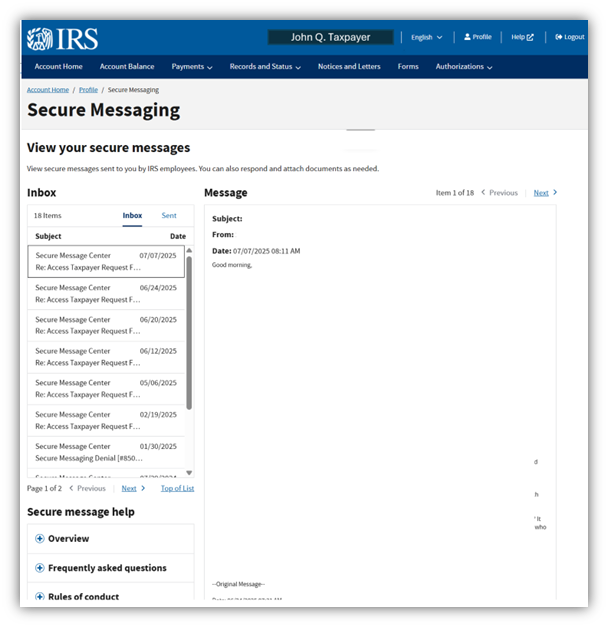

| IRS Secure Messaging* | None | Allows taxpayers to respond and communicate with IRS appeals, underreporter, and certain audit cases using IRS secure messaging application (ID.me account required). Also allows, through several methods, for taxpayers and tax pros to interact if they are invited via an access code. |

| IRS Correspondence Exam reply* | None | Allows taxpayers to submit responses to mail audits online. Note: the IRS also released an online correspondence response tool on February 16, 2023, for IRS notices CP04, CP05A, CP06, CP08, CP09, CP75, CP75A, and CP75D. |

| IRS Document Upload Tool | IRS Document Upload Tool | Allows taxpayers and tax pros to submit responses to IRS notices online. |

| “*” denotes an IRS application that requires ID.me authentication | ||

What’s New for 2025?

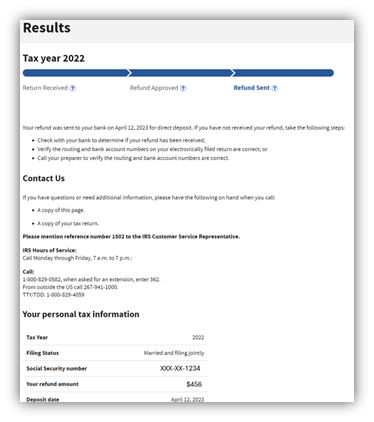

- New online account features: the IRS continues to make improvements to taxpayer online services, including by adding several new features, additional notices, form submission, and status updates to taxpayers’ online accounts and enabling taxpayers and their professionals to submit responses and message to the IRS directly online. The IRS continues to add taxpayer online account improvements and features including more capabilities in the taxpayer and tax pro accounts.

- Enahancements for access and features to business online account: the IRS released the ability for S corporations and C corporations to designate an official for the entity. The designated official can view and conduct additional features online, including viewing a tax compliance report, managing authorizations for third parties (i.e., Forms 2848 and 8821), viewing notices and letters, and managing access to the business entity online account.

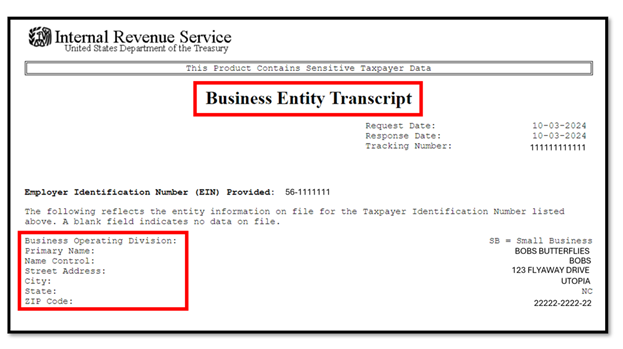

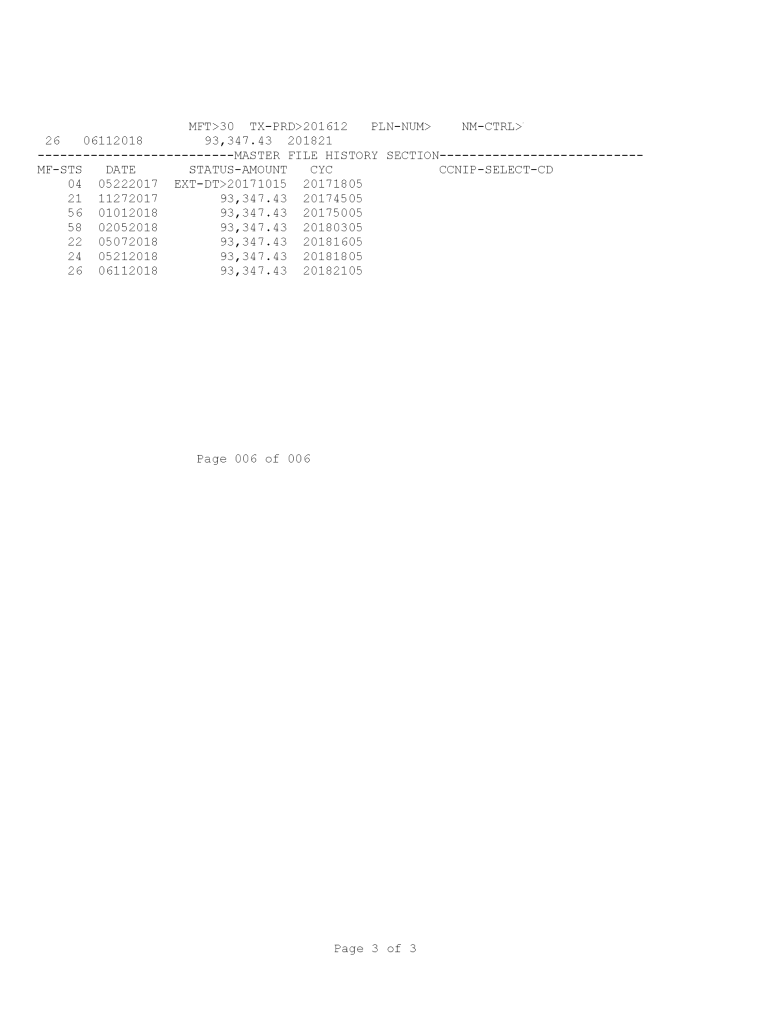

- New IRS transcripts and enhancements: additional business transcrips were including the business entity transcript. The IRS added Form 94X and other return transcripts available for the tax periods beginning in 2023 and beyond.

- Earlier release of wage and income transcripts: in 2025, the IRS released the initial version of the wage and income transcripts on March 31, 2025, for the 2024 tax year. This early release may not contain all of the information returns that are filed for the taxpayer, but allows a tax pro/taxpayer to see some of their reported information statements much earlier- and during the tax season.

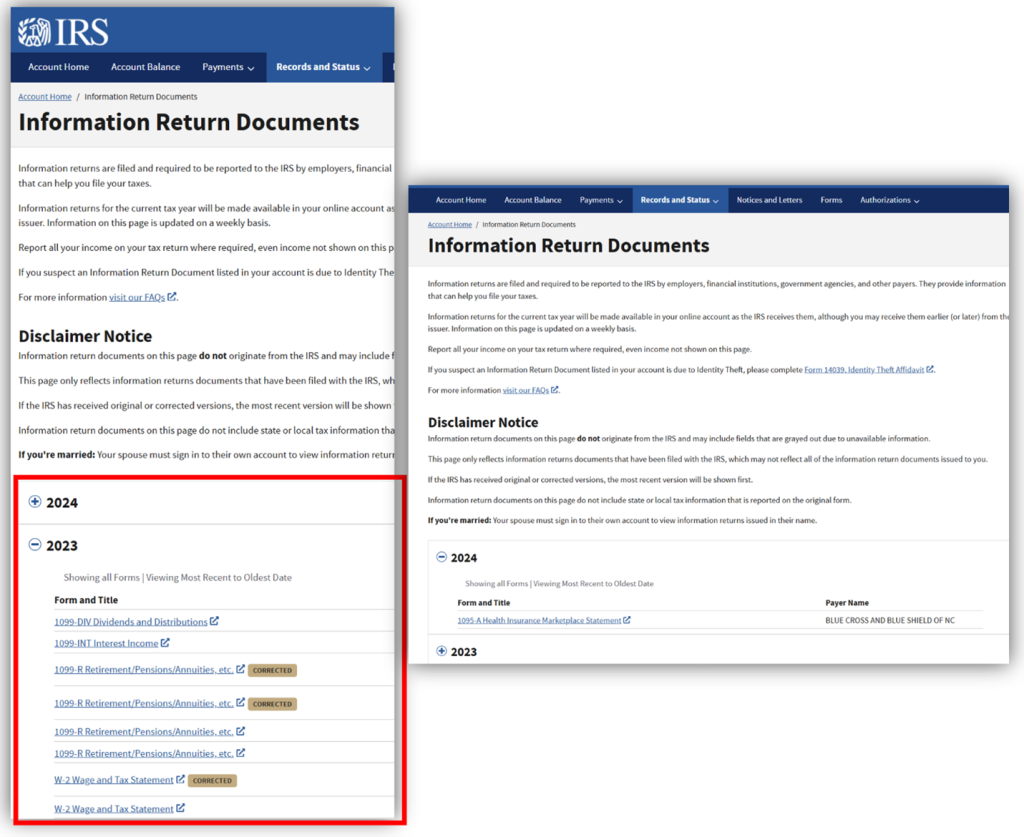

- Release of certain information returns to taxpayer online account: taxpayers can view certain information returns in their taxpayer online account during tax season as the information return (W-2, 1099) is released. Taxpayers can also view their Forms 1095-A for healthcare premium tax credit information in their online account.

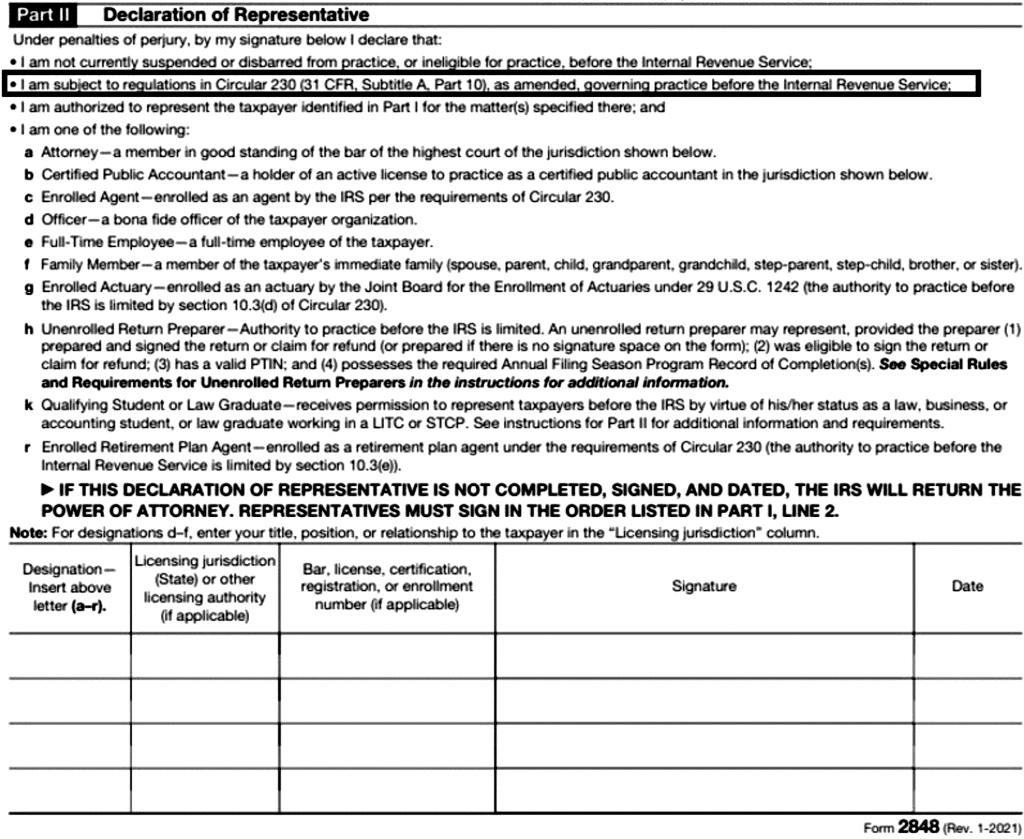

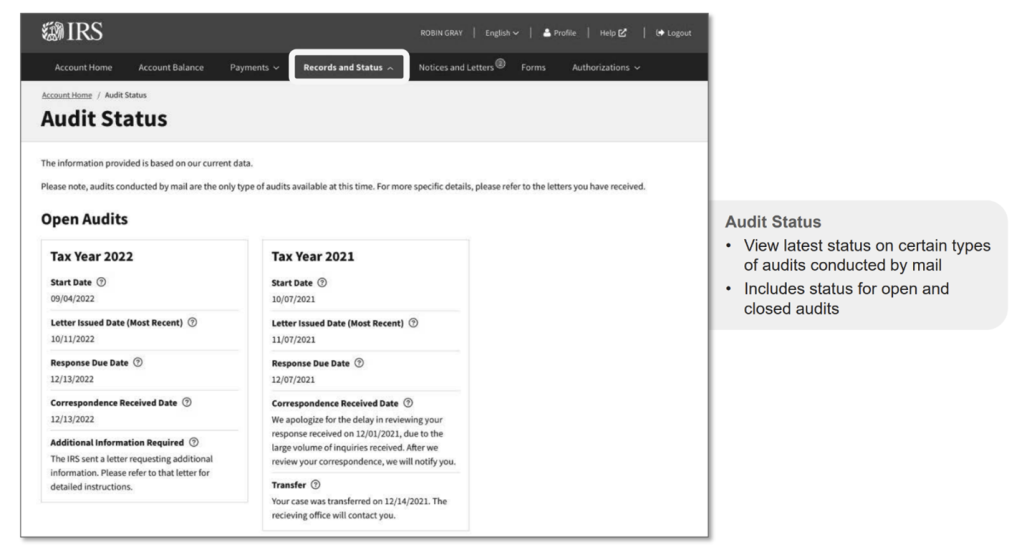

- Enhancements and features to Tax Pro Account: the IRS continues to provide additional features to its tax pro account, including the ability to request a CAF number directly online to use on IRS authoriztions for individual representatives or designees. IRS has enables view of several taxpayer account features to be viewed in the tax pro account, including audit status for the taxpayer and status of payment plans. The IRS plans more features in 2025 and 2026 in an effort to get more tax pros to interact with the IRS online.

What’s Covered in This Section?

- Taxpayers and tax pros’ most common post-filing actions and tax problems encountered.

- Step-by-step approach to resolving a tax problem – from initial due diligence and information gathering, to solving the problem, and follow-up to maintain future compliance.

- How to request taxpayer information from the IRS, including requesting information directly from IRS representatives as well as from IRS transcripts.

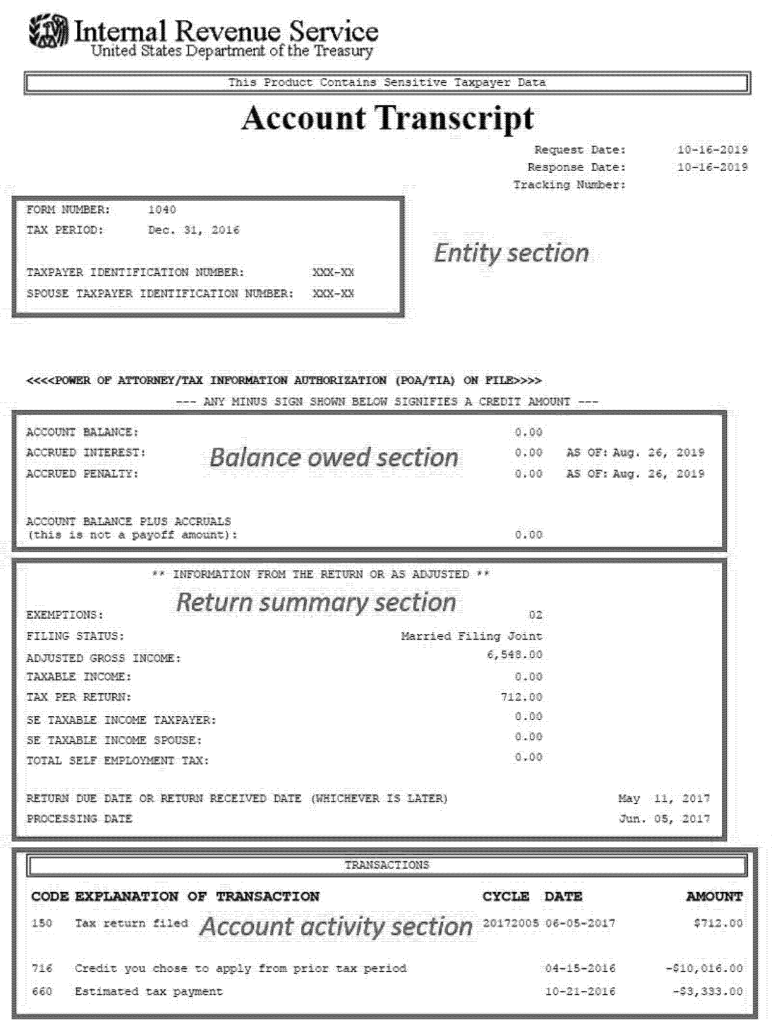

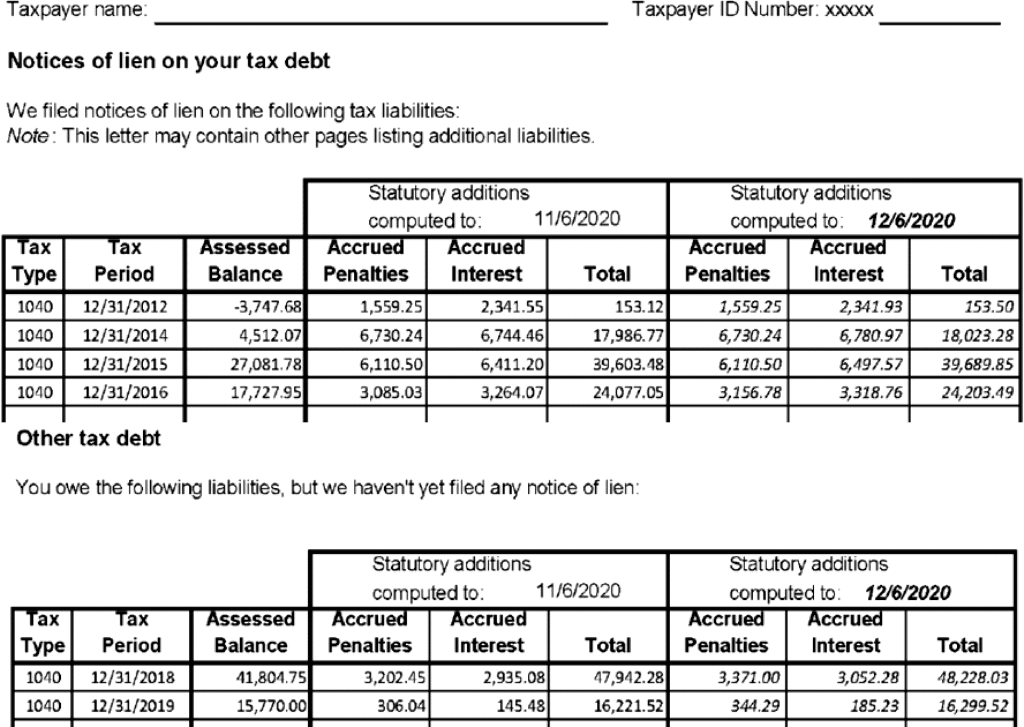

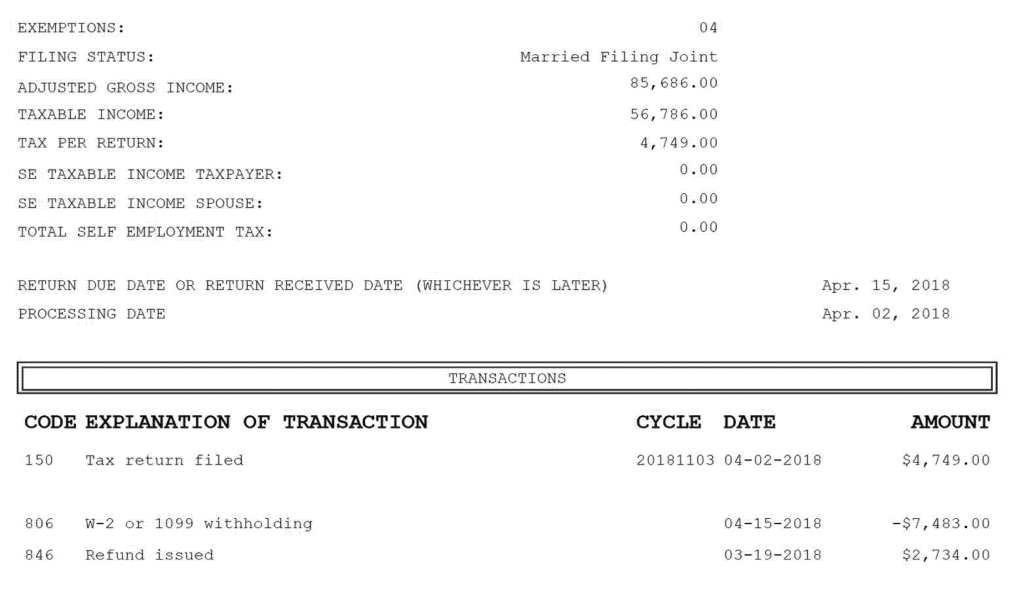

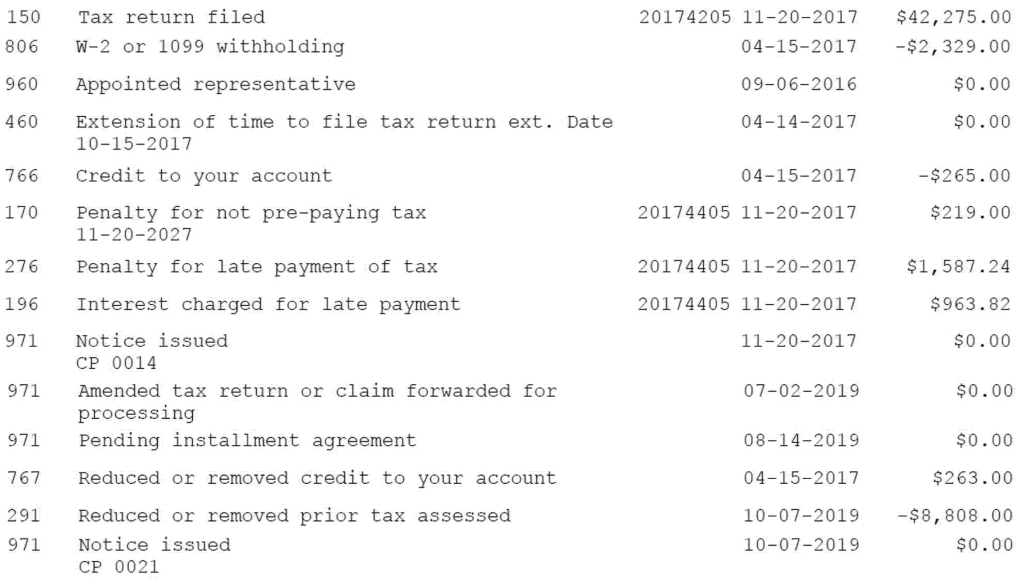

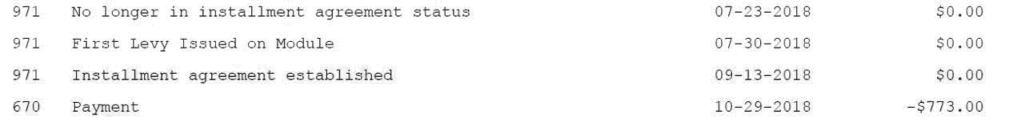

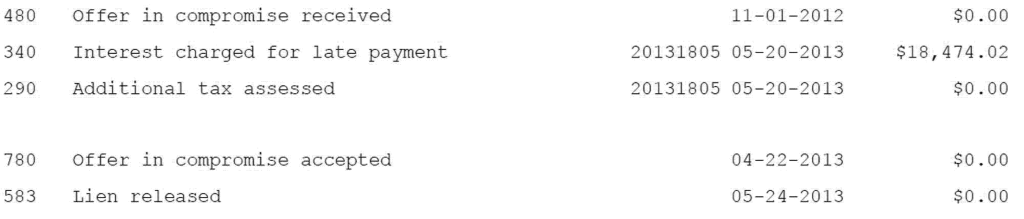

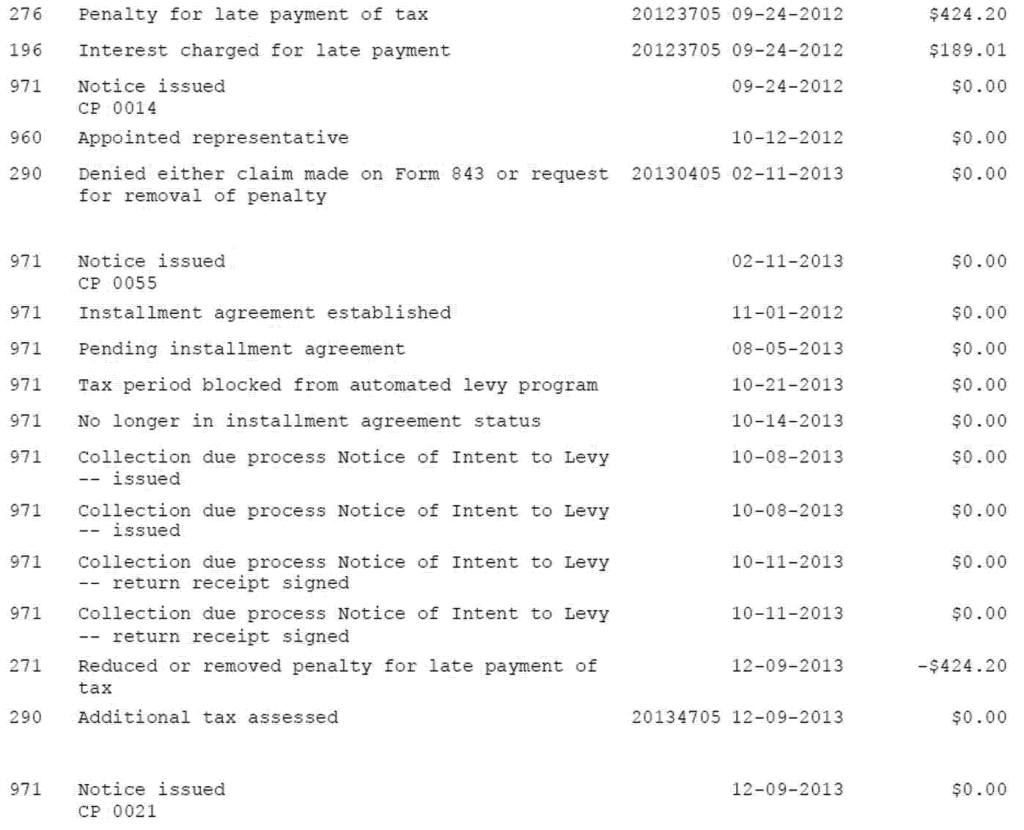

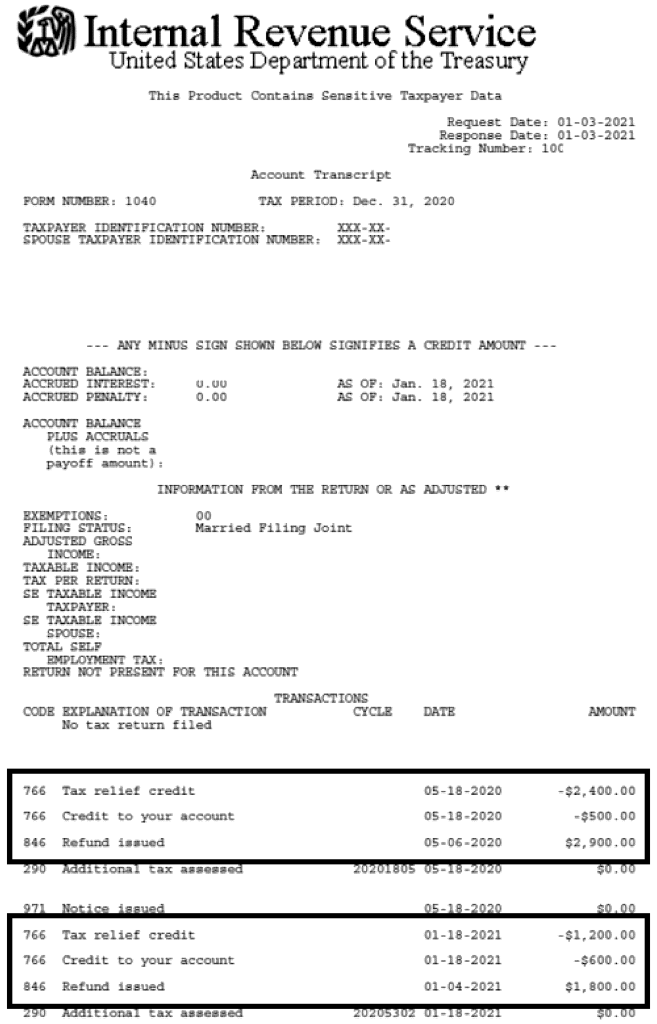

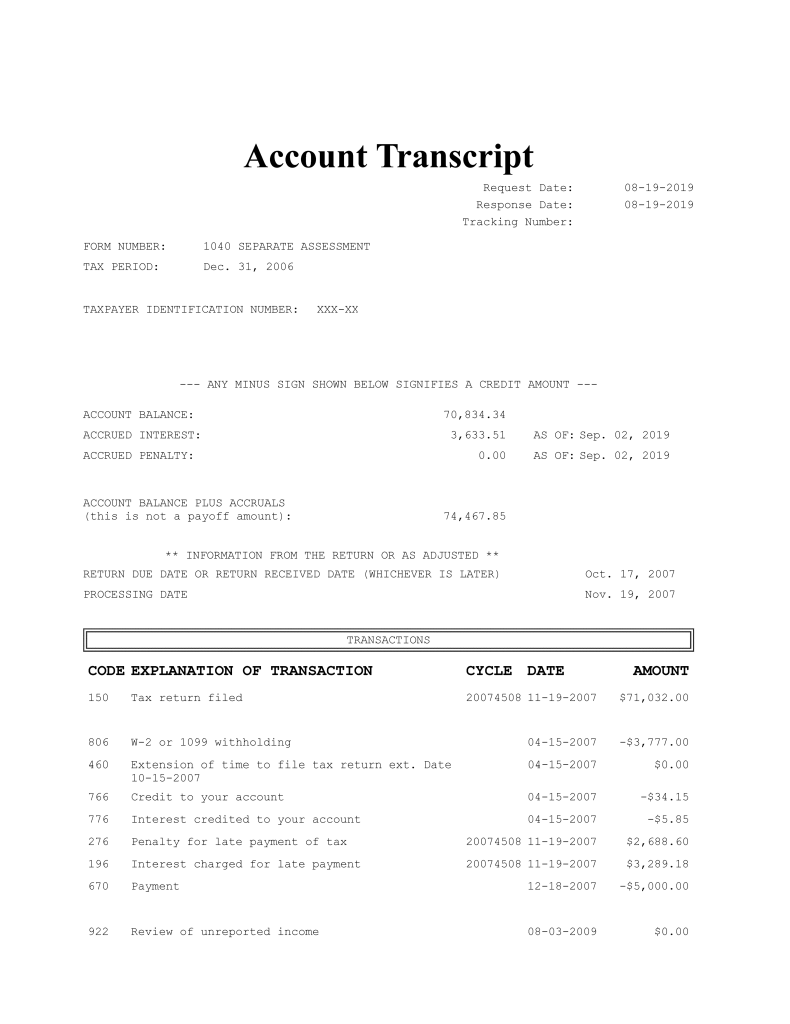

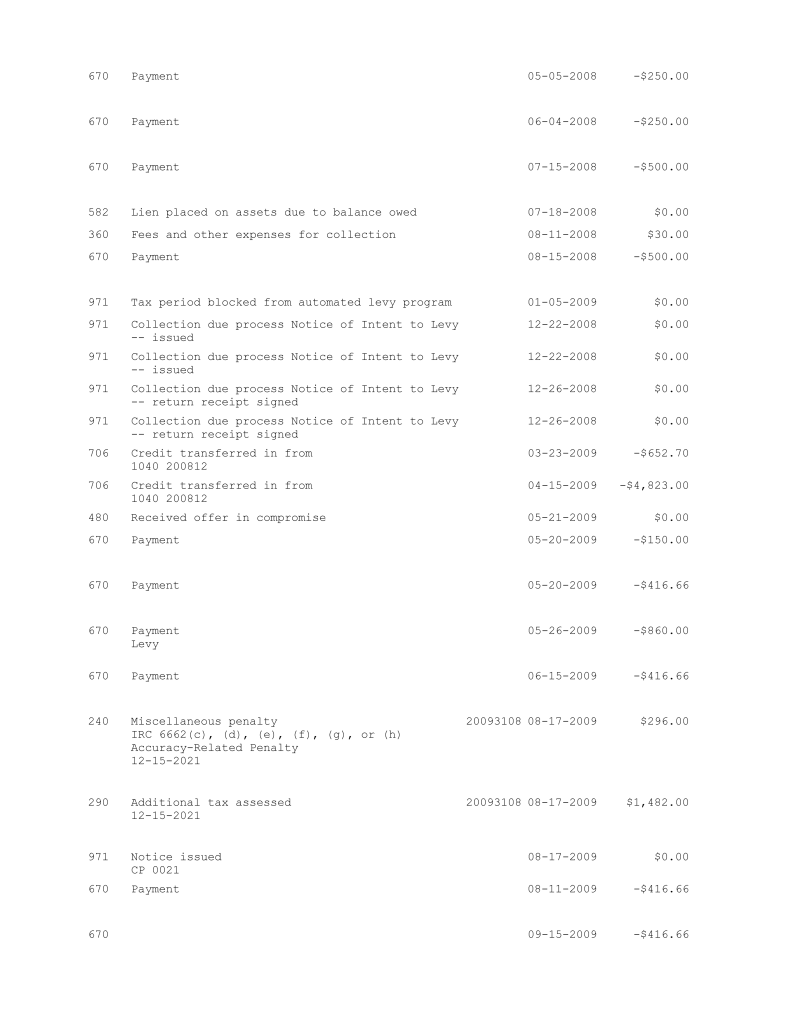

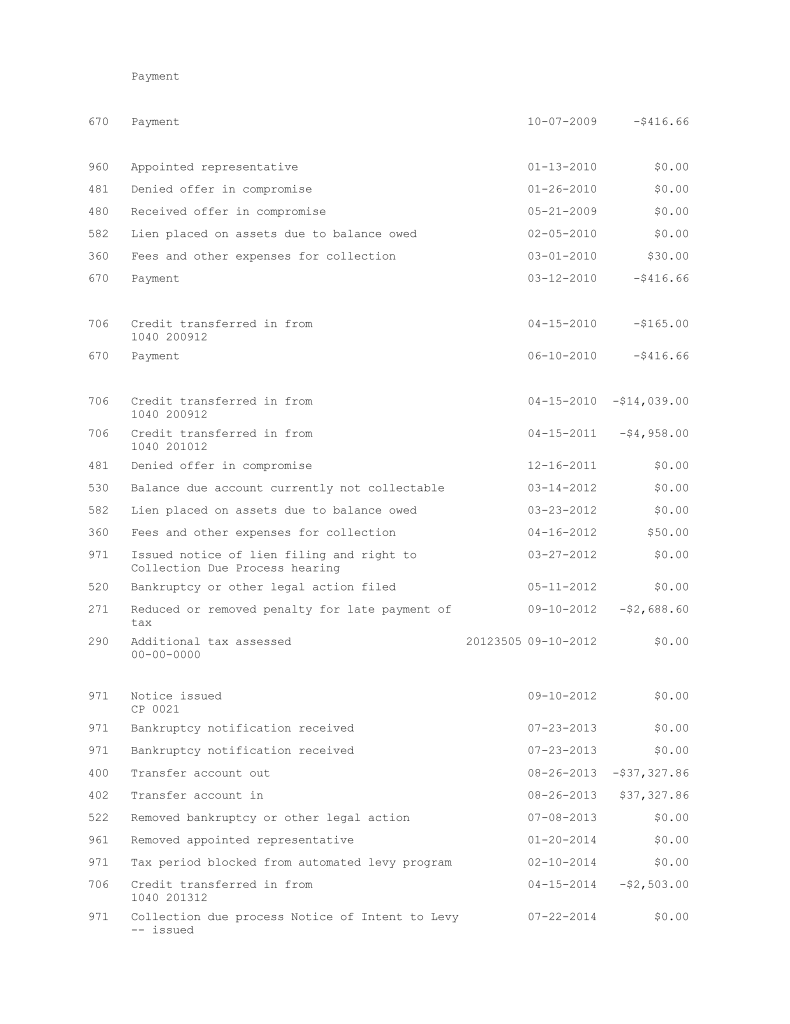

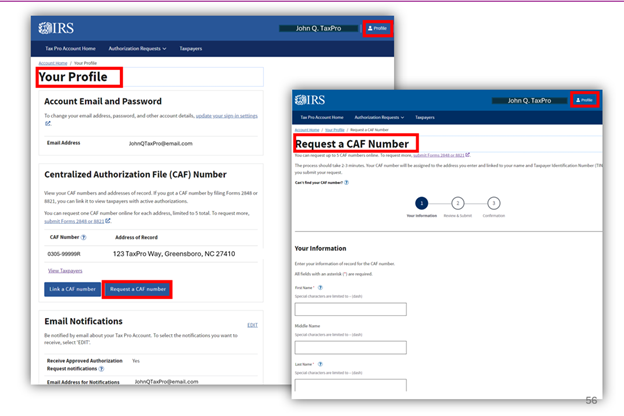

- How to understand all types of IRS transcripts, including deciphering the transactions listed on an IRS account transcript.

- Criteria to request assistance from the Taxpayer Advocate.

- Rights, rules, and logistics in having a third party represent a taxpayer before the IRS as a power-of-attorney or as a designee who receives taxpayer information.

- Tax professional rules in practicing before the IRS.

- Online tools for taxpayers and tax pros to obtain taxpayer information and to interact with the IRS.

- How to resolve tax identity theft — both stolen identity refund fraud and employment-related tax identity theft.

- Resources to help the taxpayer and the tax pro gather information and contact the IRS.

What’s Not Covered — and Why?

- IRS litigation: in rare instances, taxpayers must deal with the IRS in court. In these rare circumstances, it is best for the taxpayer to engage a qualified tax attorney.

- Uncommon tax issues: the five categories of tax problems cover most of the issues facing individual and small business taxpayers. Issues with less frequently occurring tax problems (for example, challenging worker status, etc.) will be addressed in future editions.

Most Common Taxpayer and Tax Professional Actions Performed When Working with the IRS after Filing

- Contacting the IRS and requesting account and status information

- Obtaining and reviewing IRS transcripts

- Resolving identity theft issues (mainly stolen identity refund fraud)

- Resolving one of these issues: requesting penalty abatement, responding to a CP2000 or mail audit, filing a delinquent return, or setting up an IRS payment plan (see Chapters 2-5).

When to Get an Expert Involved

- Multiple year issues: taxpayers with multiple year issues should use a specialist to understand their issues, the sequence of how to resolve them, and how to navigate the IRS to resolution.

- Complex tax problems: few taxpayers have the expertise to resolve complex tax problems and issues. Out of the five problem areas, taxpayers should use a tax pro always when it comes to complex collection alternatives, face-to-face audits involving complex audit procedures by an IRS auditor, and when it is necessary to appeal an adverse determination by the IRS for any issue.

- Potential criminal violations: taxpayers who have potential tax fraud should always consult an attorney.

Professional Assistance Fees

- Hourly: range from $80-$500 an hour for representation by an EA, CPA, or tax attorney. Initial consulting engagements where a tax pro obtains the taxpayer’s information from the IRS and discusses alternatives usually take 2-3 hours.

- Flat fee: national firms can charge flat fees from $3,000 – $10,000 to fully resolve a tax problem depending on the complexity of the issues involved. Some firms will waive the fee for the initial consultation. If the tax firm needs to request the taxpayer’s information from the IRS, the fees usually run from $500-$1000 for this service and consultation on the findings.

- No fee: low-income taxpayers can utilize a low-income taxpayer clinic, free of charge, to help.

Time to Complete Estimates for Common Post-Filing Interactions with the IRS

| Action | Estimated hours to complete | Average duration estimate |

| Obtaining complete tax history and transcripts from IRS | 1-2 hours (contact the IRS by phone and retrieve/review transcripts) Note: more complex issues and multiple years may take longer. | 1 day–3 weeks (if transcripts come by mail) |

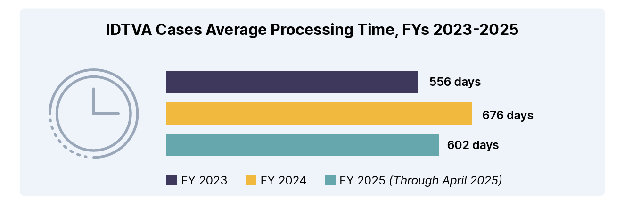

| Resolving stolen identity refund fraud tax identity theft cases | 2-6 hours | 16 weeks–18 months |

| Resolving employment related tax identity theft cases | 3-20 hours, depending on the compliance enforcement resulting from the identity theft (IDT). | 6 months–18 months |

| For other estimates of common interactions related to:

Audits/underreporter notices – see Chapter 2 Collection issues – see Chapter 3 Penalty relief – see Chapter 4 Unfiled returns – see Chapter 5 Spousal issues – see Chapter 6 Trust fund recovery penalty issues – see Chapter 7 |

||

UPDATES TO THIS CHAPTER

10/6/2025: IRS updated the IRS Appeals Customer Service phone number to 855-865-3401.

7/20/2025: updated with latest IRM citations

Updated with new IRS transcripts, release dates, and new IRS online tool features including business tax account features

Updated Notices

| Notice # | Title | Description |

|---|---|---|

| CP310 | Thank you for using Tax Pro Account | A Personal Identification Number (PIN) was assigned to your Centralized Authorization File (CAF) number through your tax pro account |

| CP312 | Disclosure Authorizations | Notifies of authorizations with the IRS to discuss tax matters on behalf of clients/taxpayers |

| CP547 | We Assigned You a Centralized Authorization File (CAF) Number | Letter to tax professional or authorized third-party generated when a new CAF number is issued. |

OVERVIEW OF IRS PRACTICE AND WORKING WITH THE IRS AFTER FILING

This section provides guidance on common tax problems and post-filing actions performed by taxpayers and tax professionals as well as how to approach resolution of a tax problem. Helpful IRS contact information, forms, and references are provided to assist in efficiently and effectively working with the IRS to obtain tax account information and to resolve problems.

| Topic | Covers |

|---|---|

| Post-Filing Taxpayer Needs and Tax Problems | The primary tax problems faced by taxpayers and other common IRS post-filing interactions. |

| IRS Organization | A brief overview of the structure of the IRS and its Operating Divisions. Taxpayers often will interact with two of the operating divisions’ functional areas when resolving a tax issue. |

| Most Common Tax Problem Actions | The most frequent actions taxpayers perform in the tax problem solving process. |

| Frequently Used IRS Sources for Taxpayer Tax Information | Sources for taxpayer information and IRS procedures/solution options. |

| Requesting Assistance from the Taxpayer Advocate Service | TAS assistance qualification criteria and how to request TAS assistance. |

| Using Third Parties and Representatives When Working with the IRS | How-to enable third parties, including eligible representatives, to obtain taxpayer information and resolve IRS issues. |

| Frequently Used Internal Revenue Manual (IRM) Sections in Working with the IRS | IRM parts that provide the most assistance on procedural matters in working with the IRS, including specific IRM sections in obtaining taxpayer information and for authorized third parties. |

| Key Terms and Definitions in IRS Practice and Working with the IRS after Filing | Common terms used in dealing with the IRS after filing. |

| Important IRS Contact Information When Working with the IRS | IRS account information/assistance hotlines and IRS Centralized Authorization File (CAF) Units used to file third-party authorizations (Forms 2848 or 8821). |

| Useful IRS Publications When Working with the IRS | Helpful IRS publications for authorizing a third party, filing a power-of-attorney, requesting assistance from the Taxpayer Advocate, and accessing/using IRS online tools. |

| Common IRS Forms Used in Working with the IRS | Representation forms, transcript and tax return request forms, and the Taxpayer Advocate assistance request form. |

| IRS Notices and Letters Used in Third-Party Authorizations and Identity Theft Issues | Common letters issued by the IRS for third-party representation and tax identity theft issues. |

| Useful IRS Website Resources and Online Tools | Helpful online tools and reference materials for working with the IRS. |

| Tax Problem Solving Process | Three stages of the tax problem solving process Example of the tax problem solving process: penalty abatement. |

| Best Practices in Resolving Tax Problems and Working with the IRS | Important tips to follow when solving any tax issue or problem. |

| Best Practices in Responding to the IRS | Rules to follow and a template for responses to the IRS. |

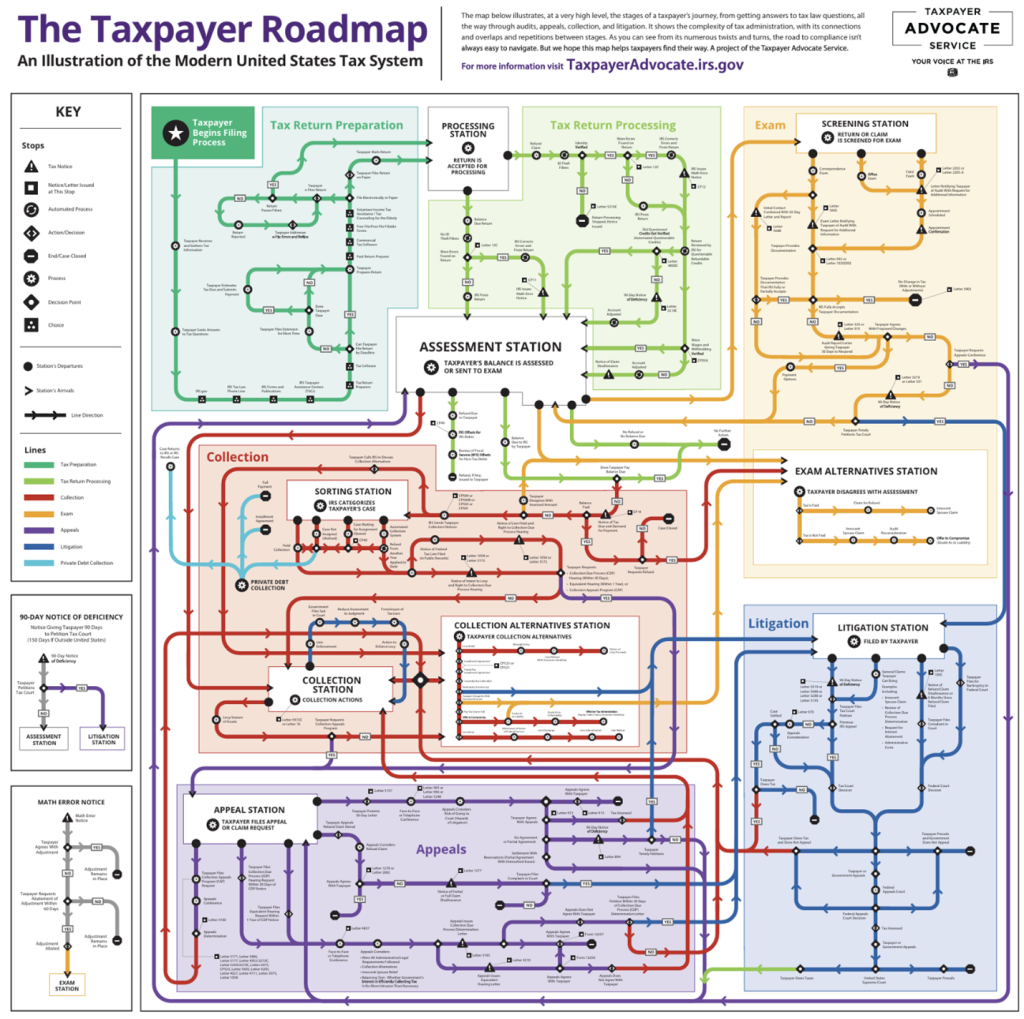

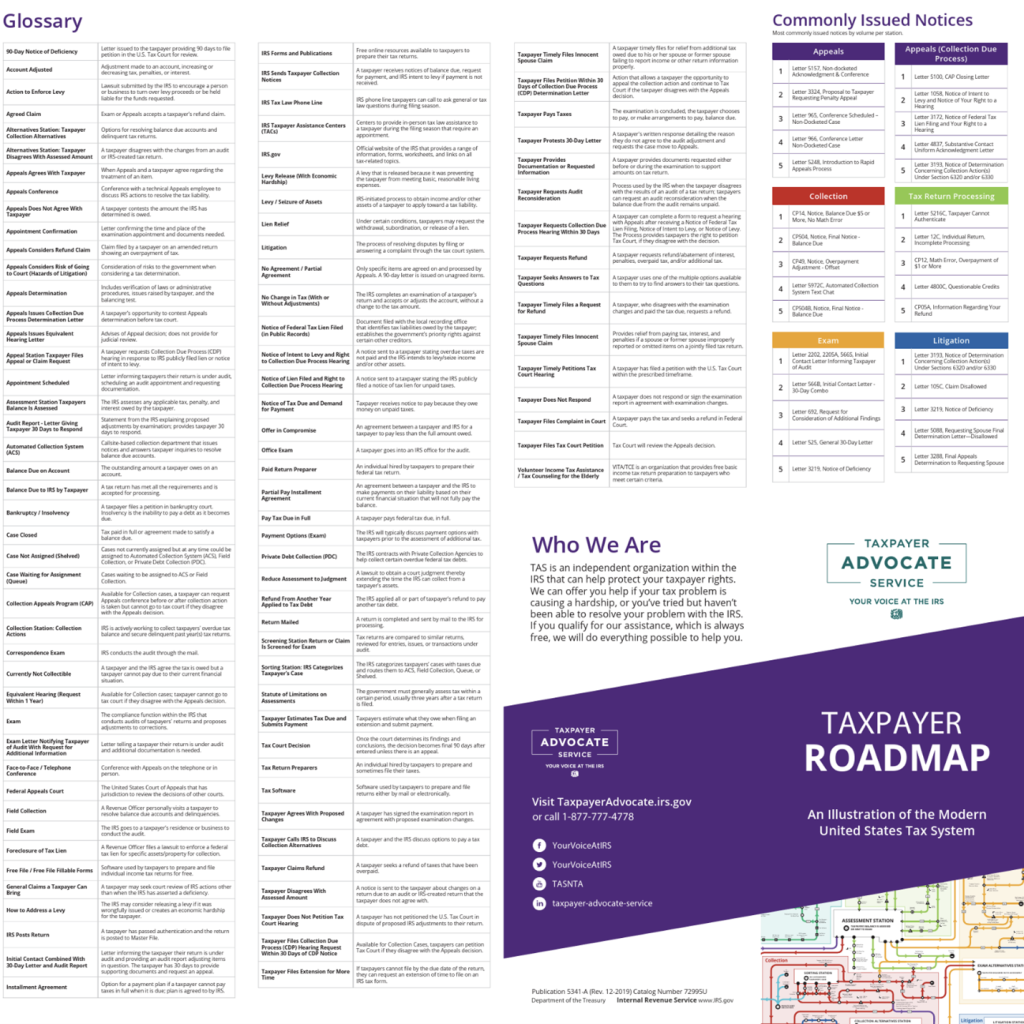

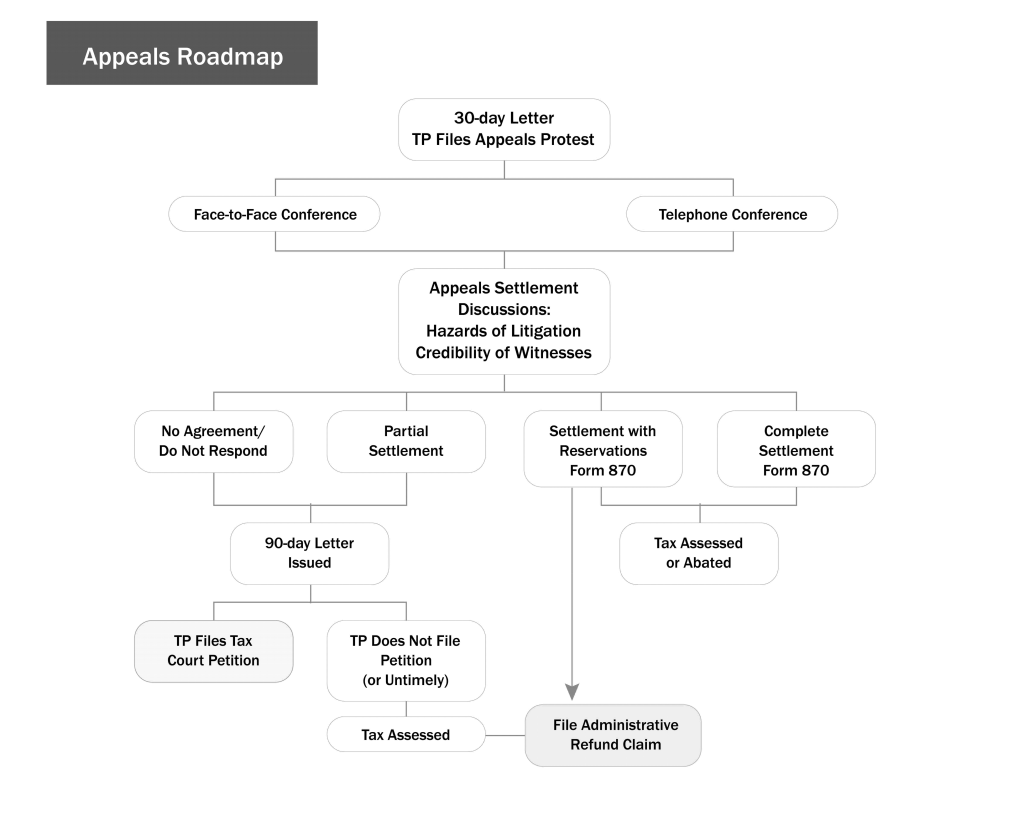

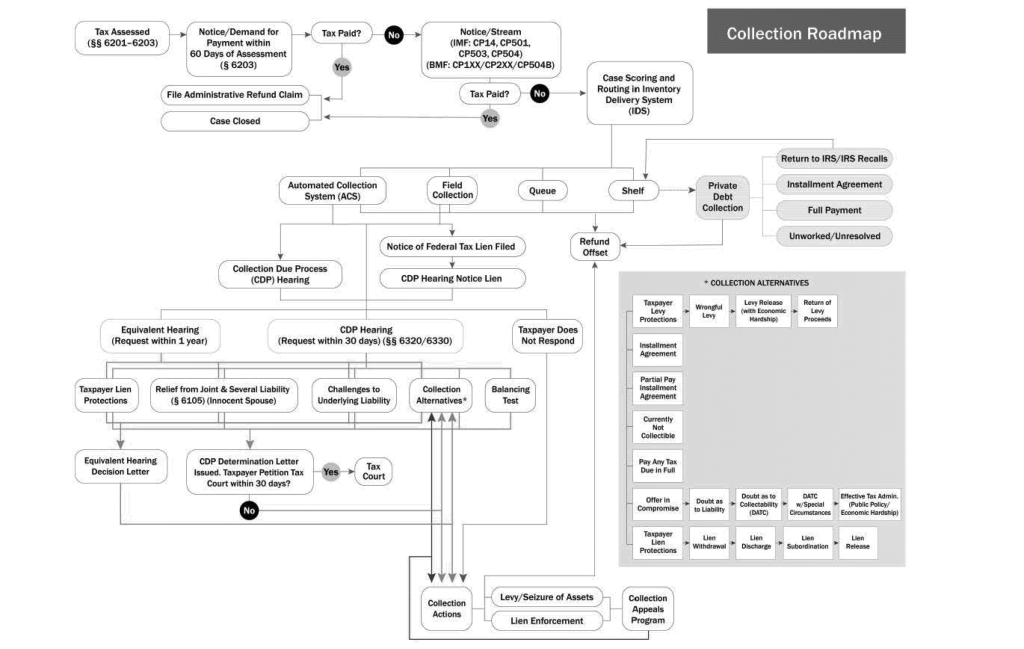

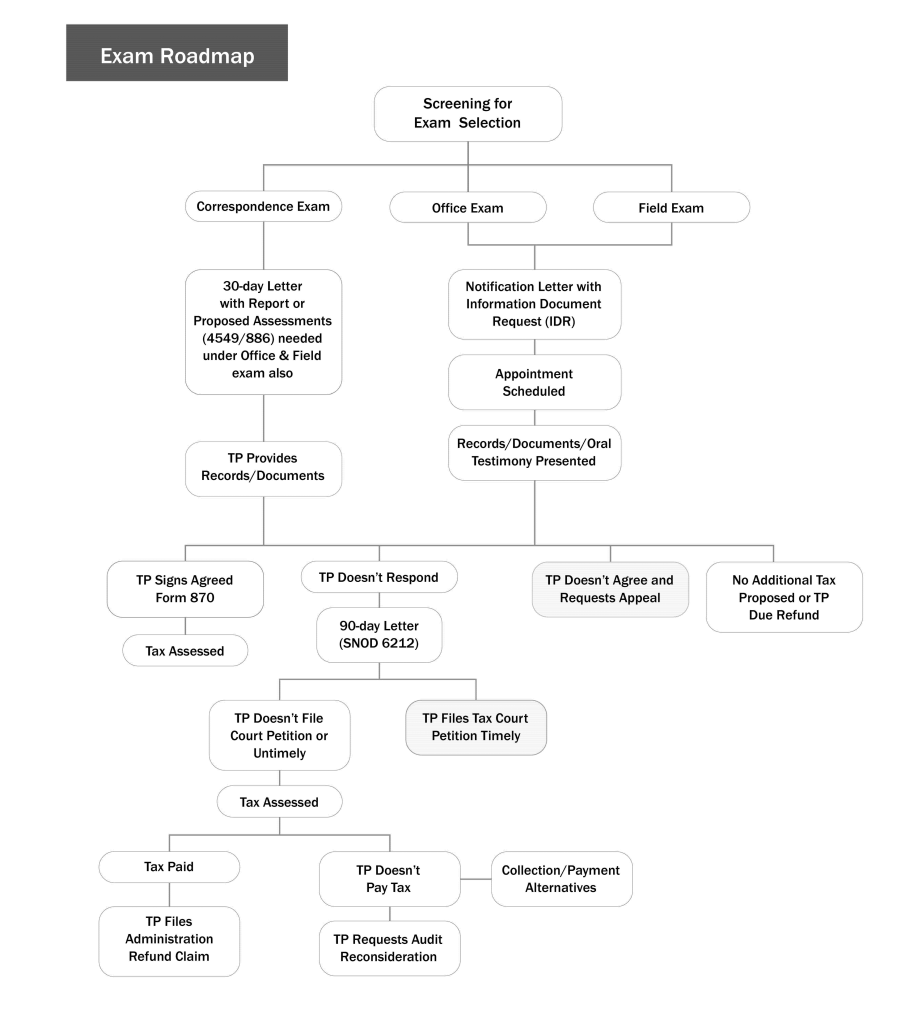

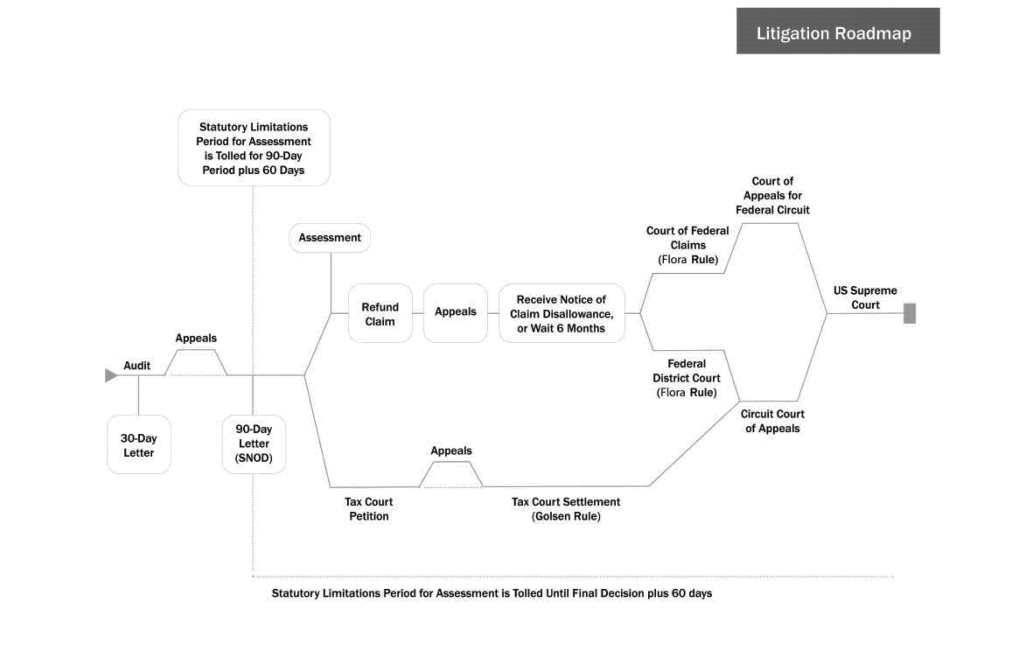

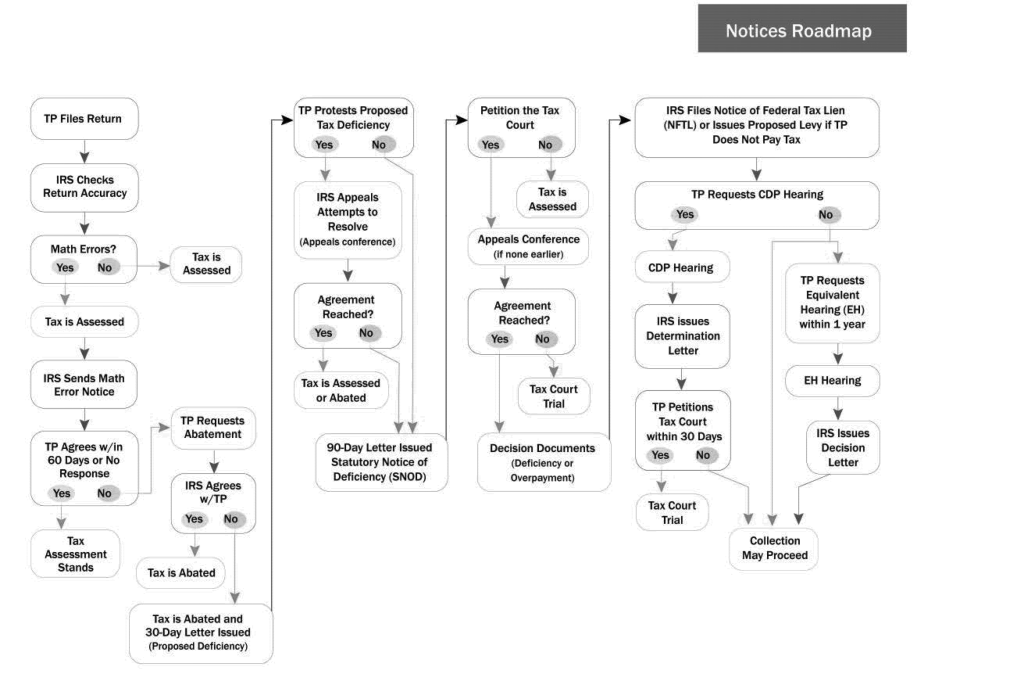

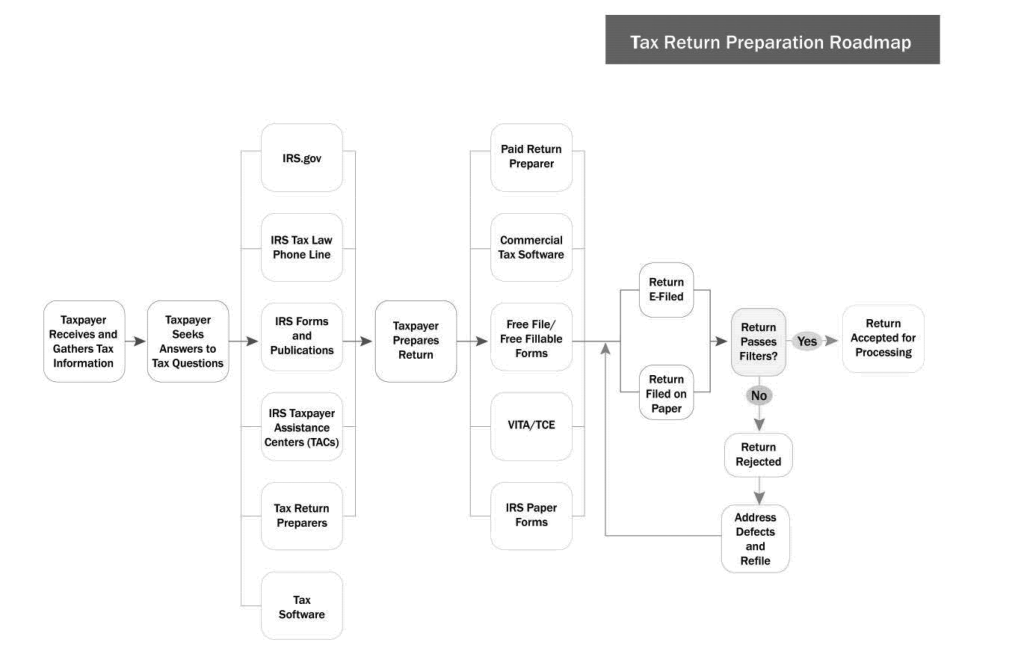

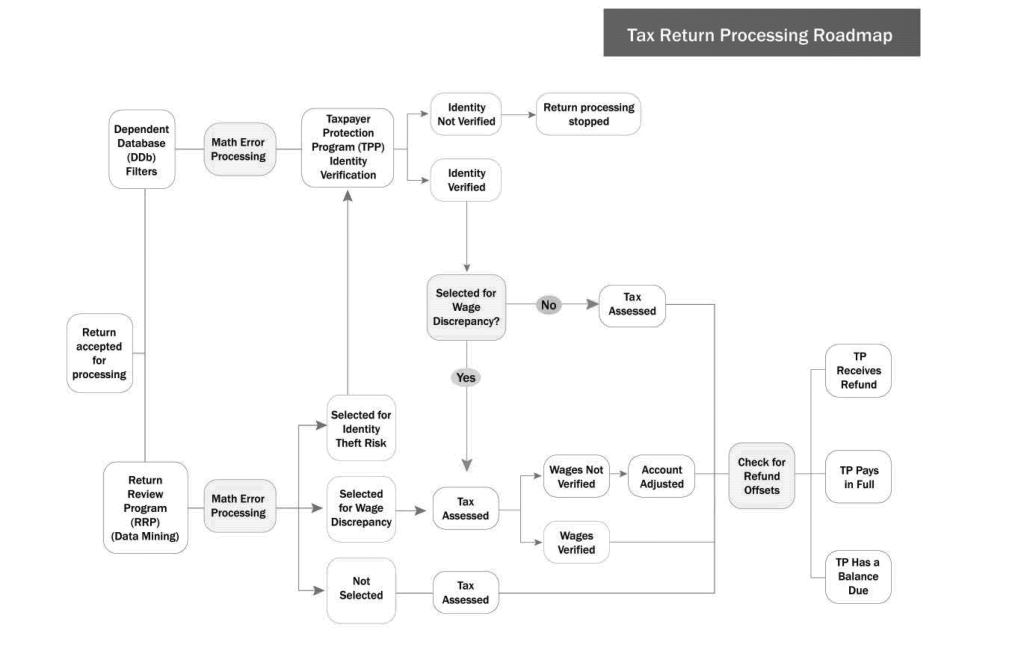

| Navigating the IRS: IRS Process Roadmaps | Navigation roadmaps from the Taxpayer Advocate to illustrate options and steps for most IRS post-filing problem categories. |

Key Highlights:

- Annually, millions of taxpayers and tax professionals interact with the IRS after filing to obtain a tax history/account information and to resolve a tax problem or notice.

- There are five primary categories of post-filing problems: audits/underreporter notices, IRS collection issues, penalties, unfiled delinquent tax returns, and IRS account discrepancies and issues. There are several other, less common issues that taxpayers can experience that are related to the five primary issues, such as spousal issues (injured and innocent spouse) and the trust fund recovery penalty which are covered in this handbook.

- Taxpayers can obtain their tax information and resolve problems themselves or use a third-party to assist. Taxpayers can authorize any third party to receive tax information. Taxpayers can also authorize an eligible tax professional (usually an attorney, CPA, or enrolled agent) to represent them before the IRS to resolve a tax issue or problem.

- Taxpayers can request assistance from the Taxpayer Advocate if they have financial difficulty or if the IRS has not resolved their tax issues properly and timely through normal IRS processes.

- There are three stages in resolving a tax problem: IRS and Taxpayer Due Diligence to fully understand the relevant facts and issues; Solution Execution to evaluate solution options and complete the solution steps; and Maintain Future Compliance which involves preventing future issues by completing the terms of the agreement and taking future actions to prevent noncompliance.

Post-Filing Taxpayer Needs and Tax Problems

In 2024, over 163 million individual taxpayers filed a tax return. [IRS Filing Season Statistics as of 12-27-2024] However, many of these filers (and those who did not file) also needed to interact with the IRS outside of filing a return. These taxpayers needed to contact the IRS and obtain information from the IRS about their circumstances and/or resolve a tax issue, notice, or problem.

Studies show that the number of people who interact with the IRS after filing is in the millions. A 2018 IRS survey showed that 10% of taxpayers were contacted by the IRS (usually by a notice), and another 31% of taxpayers had to contact the IRS for information within a 12-month period. Furthermore, Treasury Inspector General for Tax Administration (TIGTA) data shows that taxpayers received 219 million notices in 2018. [TIGTA Report 2019-40-074, Additional Actions Are Needed to Further Reduce Undeliverable Mail, September 11, 2019] In 2022, during decreased operations and reduced enforcement by the IRS, taxpayers still received 170 million notices. In short, in normal year, approximately 41% of taxpayers interact with the IRS outside of filing.

The main categories where taxpayers require post-filing assistance are:

- Notice/compliance issues: responding to an IRS notice or dealing with a compliance inquiry

- Tax return errors: assistance with processing their tax return, such as a late refund or amended return

- Status with the IRS: status of their account, such as receipt of filing, penalty relief request, issue/notice closure

- How to apply the tax rules: tax law questions specific to their circumstances

- IRS account issues: tax account issues, such as payments and adjustments and errors to their account

- Obtain records and account information: accessing their tax history, including copies of returns or tax information

Primary Tax Problems Faced by Taxpayers

Taxpayers with tax issues must interact with the IRS to have the issue(s) resolved. Taxpayers most often are dealing with one or more of these five issues:

| Issue | Help with | Estimated number of individual taxpayers annually | Reference (latest data reported) |

| IRS audits, underreporter notices, and mail error adjustments | Mail, office, and field examinations; CP2000 and related notices; and adjustments to tax returns on math error notices. | 1.65 million audits and CP2000s; 1.2 million math error notices | IRS Data Book, 2024, Tables 18, 24, and 25

This book: Chapter 2 |

| IRS Collection | Paying back taxes, setting up collection alternatives, and resolving enforced collection issues. | 14.9 million (tax years in collection, not the number of taxpayers. 20 million individual taxpayers currently owe the IRS back taxes – an additional 4 million business taxpayers owe the IRS) | IRS Data Book, 2024, Table 27 This book: Chapter 3

IRS FOIA Response 2024-05289, Jan. 2024 |

| Penalties | Understanding penalties assessed and requesting relief. | 43.5 million (number of individual penalties, not number of taxpayers); 50.7 million penalties in total to all taxpayers | IRS Data Book, 2024, Table 28

This book: Chapter 4 |

| Unfiled delinquent tax returns | Filing back returns and resolving delinquent return investigations. | 11.3 million TIGTA reports 50.7 million individual known nonfilers from 2015-2019 and business nonfilers inventory at 87.6 million as of 9/30/2022. | Latest data:

IRS FOIA Response 2023-00580, Nov. 2022 TIGTA Report 2024-300-011, Dec 20, 2023, 2022 IRS Compliance Trends Update This book: Chapter 5 |

| IRS account discrepancies and issues | Resolving various issues, such as requests for explanation of account changes, tax identity theft, payment discrepancies, spousal issues, and correcting tax records. | Phone calls and contacts to IRS: 88 million Electronic transactions with IRS: 2.1 billion Taxpayer correspondence to IRS: 8.9 million | IRS Data Book, 2024, Tables 9 and 10

This book: Chapter 1 |

Other Common IRS Post-Filing Interactions

Other common taxpayer post-filing interactions with the IRS include:

- Requesting IRS transcripts: in 2024, there were 81 million requests by taxpayers for transcripts through the IRS website and over 1.47 billion tax professional requests for taxpayer transcripts using IRS e-Services. [IRS Data Book, 2022, Table 10]

- Requesting assistance from the Taxpayer Advocate: in 2024, taxpayers requested the Taxpayer Advocate Service to intervene on 256,737 new taxpayer issues. [IRS Data Book, 2024, Table 11]

- Appealing disputes: the IRS Independent Office of Appeals received 51,990 new cases from taxpayer requests for hearings to dispute IRS collection actions, examination adjustments, and penalty case determinations. [IRS Data Book, 2024, Table 27]

- Tax professionals can be a valuable resource to many taxpayers who face a tax problem. Tax professionals already prepare more than half of all tax returns. [IRS Filing Season Statistics for 2024, 12-27-2024] Tax pros who are also experienced and skilled in IRS procedures and tax problem solving options can help the taxpayer to understand the relevant facts, evaluate options, and obtain the best outcome. Since most taxpayers cannot be expected to navigate the IRS and understand what is involved in resolving a tax issue with the IRS. For these reasons, many taxpayers obtain professional representation to deal with the IRS after filing.

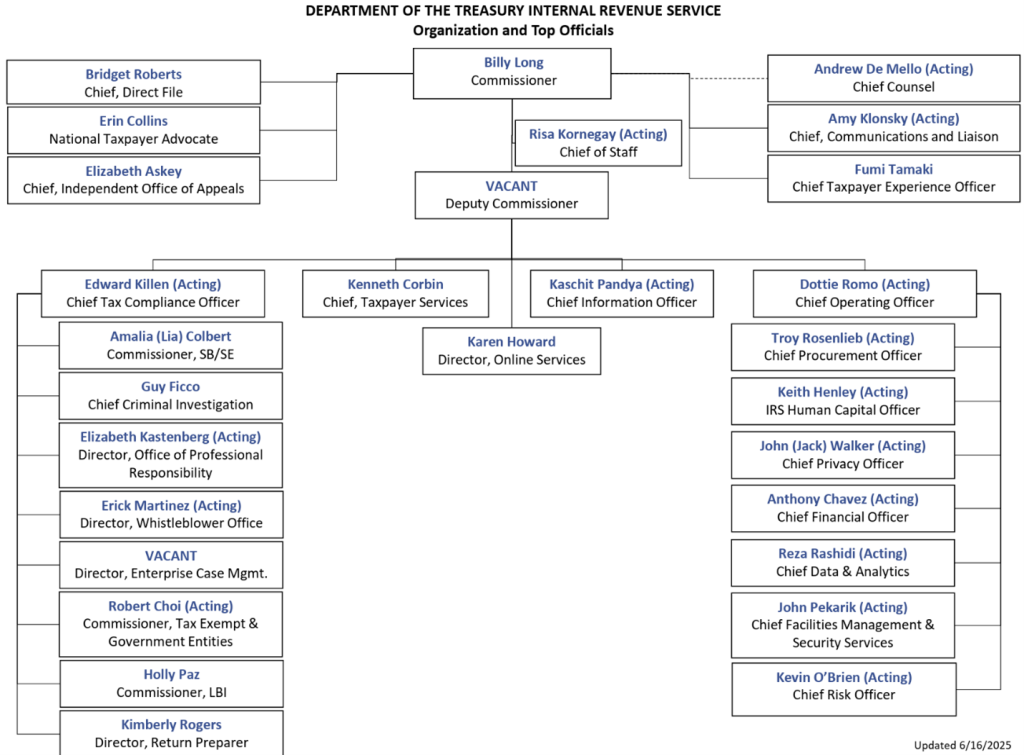

Taxpayers and tax professionals must navigate the IRS organization to effectively obtain their information and resolve tax issues after filing. However, navigating the IRS can be difficult. The current IRS organizational structure is organized around customers with similar needs. The IRS Commissioner (an appointed official) leads the IRS and has specialized IRS units that report directly to the Commissioner’s Office. These units include two important taxpayer safeguards: Appeals and the Taxpayer Advocate Service.

IRS Organization

Taxpayers and tax professionals must navigate the IRS organization to effectively obtain their information and resolve tax issues after filing. However, navigating the IRS can be difficult. The current IRS organizational structure is organized around customers with similar needs. The IRS Commissioner (an appointed official) leads the IRS and has specialized IRS units that report directly to the Commissioner’s Office. These units include two important taxpayer safeguards: Appeals and the Taxpayer Advocate Service.

Most taxpayers and tax professionals spend most of their time working with one of the “operating divisions.” The operating divisions are designed to process tax returns, serve taxpayers and tax professionals, and enforce compliance. The different operating divisions are aligned specifically to different taxpayer segments and profiles.

In 2025, the IRS will realigned to four new IRS chief positions that will oversee taxpayer service, tax compliance, information technology, and operations. The IRS also has a separate director overseeing IRS online services. Updates can be found at: https://www.irs.gov/about-irs/irs-organization,

IRS Operating Divisions

The IRS current operating divisions as of 6/16/2025 are the places where taxpayers interact the most with the IRS. The four operating divisions with their key service and enforcement programs are:

| Operation division | Role | Key service and enforcement programs: |

| Taxpayer Services (formerly Wage and Investment) | Focus on:

Profile includes the following taxpayers:

|

|

| Small Business/Self-Employed (SB/SE) | Focus on:

|

Focused on many compliance enforcement programs including the Collection and Examination (audit) functions |

| Large Business and International (LB&I) | Responsible for tax administration activities for domestic and foreign businesses with a United States tax reporting requirement and assets equal to or exceeding $10 million as well as the Global High Wealth and International Individual Compliance programs.

|

Support and compliance enforcement (Examination) through practice areas:

|

| Tax-Exempt and Governmental Entities (TE/GE) [IRM 1.1.23 (9-30-2021)] | Three segments:

|

Compliance through:

|

Most taxpayers and tax professionals currently interact with Taxpayer Services or SB/SE operating divisions when requesting information or dealing with a compliance function or notice. Many IRS notices will indicate the business operating division or “BOD” in the notice (i.e., Taxpayer Services (still noted by IRS mainly as W&I for the old Wage/Investment operating division that was replaced by Taxpayer Services in 2025 and SB/SE). This is useful information when contacting the IRS and finding which IRS unit is assigned a taxpayer’s issue.

Most Common Tax Problem Actions

When working with the IRS after filing, most taxpayers are either requesting information about their situation or proceeding to resolution with the IRS. The most common post-filing interactions between taxpayers (and their tax professionals) and the IRS involve:

- Obtaining IRS information (Chapter 1 of this book; individual problems covered in Chapters 2-5, based on the type of problem)

- Requesting and reviewing transcripts

- Getting information from IRS representatives

- Requesting penalty relief (Chapter 4 of this book)

- Requesting non-assertion of penalties

- Requesting penalty abatement

- Appealing adverse penalty relief determinations

- Obtaining collection alternatives and enforcement relief (Chapter 3 of this book)

- Requesting extensions to pay and payment plans

- Reinstating terminated/defaulted installment agreements

- Requesting relief from levies and tax liens

- Resolving tax return challenges (Chapter 2 of this book)

- Responding to underreporter and math error notices

- Responding to mail audits

- Requesting CP2000 or mail audit reconsideration

- Contesting penalties in an underreporter notice or audit

- Appealing IRS deficiency determinations

- Filing back tax returns (Chapter 5 of this book)

- Filing back tax returns that meet IRS screening and acceptance procedures

- Resolving delinquent return inquiries

- Filing to replace a Substitute for Return filing (i.e., IRS filed return for a non-filer)

Most tax problem solving interactions involve contacting and working with these IRS functions:

- IRS accounts management: for information and tax account actions, such as to obtain IRS account information and transcripts, request penalty abatement and correction of account discrepancies, or to resolve tax identity theft issues

- IRS Compliance Units: to resolve a tax issue with IRS Collection, Examination, or the Automated Underreporter Program

- IRS Appeals: disputing an adverse IRS determination, such as an enforced collection action, IRS audit determination, penalty abatement denial, or denial of offer in compromise or innocent spouse relief

- Taxpayer Advocate Service (TAS): obtaining assistance from TAS to intervene on a non-compliance related issue in which the taxpayer is suffering from a hardship, a systemic breakdown within the IRS, or non-response from the IRS.

Post-filing notices and tax issues rarely find their way to the Courts. As a practical remedy, most tax problems are resolved by following administrative procedures and processes within the IRS to resolve issues. This book provides guidance on how to obtain taxpayer information and practically resolve tax issues administratively before the IRS. This book does not cover how to resolve matters with the IRS within the judicial system.

Frequently Used IRS Sources for Taxpayer Tax Information

Taxpayers and tax professionals who need to resolve a tax problem or notice will likely need to obtain relevant taxpayer information and work with various IRS functions to resolve the issue(s).

Obtaining Taxpayer Information

Taxpayers and tax professionals primarily obtain information about their tax history and IRS situation from two sources:

- IRS personnel: contacting and interviewing the appropriate IRS personnel, and

- IRS documents: obtaining and reviewing taxpayer IRS transcripts and documents.

IRS notices can also be a good source of information. However, many notices are limited to the one year in question and do not provide additional information or clarity if multiple years or taxpayers are involved.

The primary tax record documents readily available to taxpayers and tax pros are IRS transcripts. However, IRS transcripts alone may not provide the entire picture of the taxpayer’s situation. Often, taxpayers need to contact the IRS to understand important details regarding their situation. IRS transcripts are useful for obtain certain information about the taxpayer (tax return filing information, information returns filed under the taxpayer’s identification number) and certain transactions (penalties, payments, assessments, etc.). Usually, the combination of an IRS interview and the transcripts will provide a complete picture of the taxpayer’s situation.

Taxpayer Information Sources and Information Provided

| Interview IRS personnel | Review of IRS Transcripts | |

| Information to be provided |

|

|

| How to obtain | Taxpayers can:

Authorized tax professionals:

|

Taxpayers can order:

Authorized tax professionals can obtain:

|

In rare cases, the taxpayer may have to file a Freedom of Information Act request to obtain information. Many FOIA requests are made by taxpayers and tax professionals when disputes are escalated, such as appealing an audit determination.

Practice Tip: Effective 7/1/2020, the Taxpayer First Act allows certain taxpayers to request their audit file when protesting their case to the IRS Independent Office of Appeals. In the past, many taxpayers had to submit an FOIA request to obtain this information. See Chapter 2, IRS Audits and Underreporter Notices, for more information.

Understanding IRS Procedures and Solution Options

Most IRS procedures and available options to resolve tax issues are found in the IRS’s Internal Revenue Manual (IRM). Parts of the IRM which address and provide guidance about obtaining information and resolving specific tax issues include the following:

| IRM Section | Useful for |

| Part 21 | Obtaining and understanding taxpayer’s IRS account information (transcripts, etc.) |

| Part 4 | Understanding audit and underreporter inquiry procedures |

| Part 5 | Obtaining collection alternatives and relief from collection enforcement |

| Part 8 | Appealing adverse determinations within the IRS |

| Part 20 | Contesting penalties |

Throughout this book, IRM references are provided for guidance. Taxpayers and tax professionals can act efficiently and effectively by understanding and working within IRS procedures, found in the IRM, to achieve the best outcome for their circumstances.

Practice Tip: The IRM can be an effective tool in understanding procedures to obtain taxpayer information, work with the IRS, and to resolve tax problems. IRS personnel must follow the procedures outlined in the IRM. However, the IRM contains much internal IRS jargon and can be very difficult to understand. Also, IRS procedures can change and the IRM does not follow a routine update schedule. This book contains frequent citations to the latest IRM guidance related to each issue and tax problem. Access this guidance to get more detail on how to resolve a specific tax issue. The IRM is available online at irs.gov at: https://www.irs.gov/irm.

Requesting Assistance from the Taxpayer Advocate Service

One source of assistance to taxpayers and their tax professionals is the Taxpayer Advocate Service (TAS). TAS is an independent organization within the IRS that aids taxpayers if experiencing financial difficulty or in situations where the IRS has not resolved their tax issues properly and timely through normal channels.

TAS caseworkers have the responsibility to help bridge the gap for taxpayers who have unresolved issues or problems by working with the operating and functional divisions within the IRS to resolve the taxpayers’ issue. TAS caseworkers are located at IRS campuses and locally at IRS offices. Taxpayers requesting TAS assistance can be assigned to a caseworker in any location across the U.S.

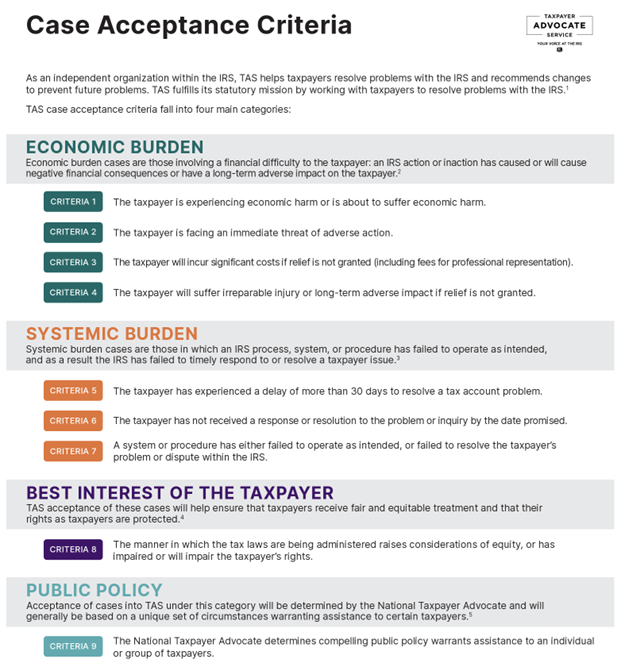

TAS Assistance Qualification Criteria

The criteria for acceptance for TAS assistance is broad. If the taxpayer is suffering or potentially will suffer a financial hardship from an IRS action, or if the IRS delays in resolving issues through normal channels, the taxpayer will qualify for TAS intervention.

TAS assistance acceptance criteria falls into four broad categories, each with specific criteria:

- Economic burden: Economic burden cases are those involving a financial difficulty to the taxpayer from an IRS action or inaction. The financial difficulty can be current negative financial consequences or a long-term adverse impact on the taxpayer. [IRM 13.1.7.3.1 (11-29-2023)]

- Criteria 1: The taxpayer is experiencing economic harm or is about to suffer economic harm.

- Criteria 2: The taxpayer is facing an immediate threat of adverse action.

- Criteria 3: The taxpayer will incur significant costs if relief is not granted (including fees for professional representation).

- Criteria 4: The taxpayer will suffer irreparable injury or long-term adverse impact if relief is not granted.

- Systemic burden: Systemic burden cases are those in which an IRS process, system, or procedure has failed to operate as intended, and as a result the IRS has failed to timely respond to or resolve a taxpayer issue. [IRM 13.1.7.3.2 (11-29-2023)]

- Criteria 5: The taxpayer has experienced a delay of more than 30 days to resolve a tax account problem.

- Criteria 6: The taxpayer has not received a response or resolution to the problem or inquiry by the date promised.

- Criteria 7: A system or procedure has either failed to operate as intended or failed to resolve the taxpayer’s problem or dispute within the IRS.

- Best interest of the taxpayer: TAS acceptance of these cases will help ensure that taxpayers receive fair and equitable treatment and that their rights as taxpayers are protected. [IRM 13.1.7.3.3 (11-29-2023)]

- Criteria 8: The manner in which the tax laws are being administered raises considerations of equity or has impaired or will impair the taxpayer’s rights.

- Public policy: Acceptance of cases into TAS under this category will be determined by the National Taxpayer Advocate and will generally be based on a unique set of circumstances warranting assistance to certain taxpayers [IRM 13.1.7.3.4 (11-29-2023)]

- Criteria 9: The National Taxpayer Advocate determines compelling public policy warrants assistance to an individual or group of taxpayers.Practice Tip: Taxpayers do not have to prove economic hardship when requesting TAS assistance. The TAS will automatically accept the case if the taxpayer claims financial hardship. [IRM 13.1.7.2 at (3) (11-29-2023)]TAS Criteria are summarized on the TAS website and reported in the National Taxpayer Advocate Report periodically.

Traditionally, TAS does not accept processing delays, injured spouse claims, return rejects, and identity theft delays. However, several interim TAS acceptance criteria continuously change TAS acceptance criteria. Taxpayers can refer to IRM 13.1.7.4 for updates and also to the TAS website at: https://www.taxpayeradvocate.irs.gov/can-tas-help-me-with-my-tax-issue/. [IRM 13.1.7.4 (11-29-2023)]

Most TAS assistance is requested under the economic or systemic burden categories. Criteria 1-7 are common reasons taxpayers request assistance.

Practice Tip: The TAS will not intervene on adverse determinations between the taxpayer and a compliance enforcement unit (i.e., Collection, Examination). [IRM 13.1.4.2.3.1 (4-5-2021)] If the taxpayer’s case is open in another IRS function, the TAS does not have the final authority to act. The TAS can work and make recommendations to the IRS function to expedite resolution (i.e., penalty abatement requests, approval of collection alternatives, etc.). TAS caseworkers can ask the Operating Division for approval to make certain adjustments. [IRM 13.1.4.2.3.1.2 (1-3-2024)] However, the TAS does not have the final authority to decide the case.

Specifically, if the taxpayer meets TAS acceptance criteria, TAS employees can help directly with the following common functions:

- Request manual refunds and request offset bypass refund issuance in hardship cases. [IRM 13.1.4.2.3.4 (1-3-2024)]

- Process accounts management adjustments, such as correct erroneous math error adjustments. [IRM 13.1.4.2.3.14 (1-3-2024)]

- Enter into installment agreements in certain situations (not enter into extension to pay agreements). [IRM 13.1.4.2.3.8 (1-3-2024)]

- Release systemic levies (federal payment levies, state income tax levies, and other automated levies) if the account is not in an IRS compliance function. [IRM 13.1.4.2.3.15 (1-3-2024)] The TAS does not have the authority to release non-systemic levies (wage, bank, etc.).

- Release liens when the taxpayer has fully paid their liability. [IRM 13.1.4.2.3.16 (1-3-2024)]

- Input identity theft indicators. [IRM 13.1.4.2.3.20 (1-3-2024)]

Conversely, TAS employees cannot perform the following common functions. They can only make recommendations.

- Overrule a prior determination by another function or operating division (i.e., adverse penalty abatement determination)

- Grant audit reconsideration [IRM 13.1.4.2.3.11 (1-3-2024)]

- Resolve automated underreporter issues (CP2000). [IRM 13.1.4.2.3.10 (1-3-2024)]

- Resolve substitute for return cases [IRM 13.1.4.2.3.9 (1-3-2024)]

- Grant penalty abatement [IRM 13.1.4.2.3.7 (1-3-2024)]

- Process injured spouse allocations [IRM 13.1.4.2.3.5.1 (1-3-2024)]

- Allow and process claims [IRM 13.1.4.2.3.5 (1-3-2024)]

- Grant currently not collectible status on unpaid balance accounts [IRM 13.1.4.2.3.6 (1-3-2024)]

IRM Exhibit 13.1.4-1 has a complete listing of TAS Case Advocate and Intake specialist’s authorities:

| Issue # | Issue | Case Advocate Authorities | Intake Advocate Authority |

|---|---|---|---|

| 1 | Replacement check for a lost or stolen refund without a credit balance on an account where hardship or unreasonable delay exists. | Case Advocates have authority to approve a replacement check when the case involves a request for a replacement check for a lost or stolen refund without a credit balance on an account where hardship or unreasonable delay exists under procedures contained in IRM 3.17.79.3.3 (or successor provision). | Intake Advocates do not have authority to approve a replacement check under these provisions. Create the case and follow procedures for assignment to a Case Advocate. |

| 2 | Refund Trace. | Case Advocates have authority to initiate a refund trace per IRM 21.4.2 (or successor provisions). | Intake Advocates have authority to initiate a refund trace per IRM 21.4.2 (or successor provisions). |

| 3 | Reissuance of a returned refund check. | Case Advocates have authority to reissue a returned refund check posted on IDRS with an S- Freeze per IRM 21.4.3 and IRM 21.5.6.4.38 (or successor provisions). | Intake Advocates have authority to reissue a returned refund check posted on IDRS with an S- Freeze per IRM 21.4.3 and IRM 21.5.6.4.38 (or successor provisions). |

| 4 | Missing or misapplied credits. | Case Advocates have delegated authority to gather documentation to substantiate the credits. Follow the IRM based on delegated authorities to resolve case when the case involves missing or misapplied credits and the taxpayer furnishes proof of payment under procedures contained in IRM 21.5.7.4 (or successor provision). | Intake Advocates have delegated authority to gather documentation to substantiate the credits. Create the case and follow procedures for assignment to a Case Advocate. |

| 5 | Notice of Federal Tax Lien (NFTL) release See IRM 13.1.4.2.3.16, Notice of Federal Tax Lien (NFTL) Release. | Case Advocates have authority to release liens in cases not currently open in another IRS function if the account is full paid and upon substantiation of no other balances under the procedures contained in IRM 5.17.2.8.3 (or successor provisions). Note: Per TAS policy, the authority to sign a NFTL release is granted to LTAs or above, see IRM 13.1.4.2.3.16. | At this time, TAS has made a business decision that Intake Advocates will not exercise authority to release liens in cases not currently open in another IRS function, if the account is full paid and upon substantiation no other balance due exists as described in IRM 5.17.2.8.3 (or successor provisions).

Note: Per TAS policy, Intake Advocates will not exercise this authority, see IRM 13.1.4.2.3.16. |

| 6 | Release of a systemic levy (FPLP levy). See IRM 13.1.4.2.3.15, Levy Release Authority and Return of Levy Proceeds. | Case Advocates have authority to release the systemic levy. | Intake Advocates do not have authority to release the systemic levy. Create the case and follow procedures for assignment to a Case Advocate. |

| 7 | Streamlined or Guaranteed IA. See IRM 13.1.4.2.3.8, Installment Agreements. | Case Advocates have authority to accept and input Simple or Guaranteed IAs IRM 5.19.1.6.4 (or successor provisions). | Intake Advocates have authority to accept and input Simple or Guaranteed IAs. IRM 5.19.1.6.4 (or successor provisions). |

| 8 | Non-Streamlined or non-Guaranteed Installment Agreement. See IRM 13.1.4.2.3.8, Installment Agreements. | Case Advocates have authority to accept the IA based on delegated authorities to resolve case when the case involves accepting an IA, IRM 5.19.1.6.4. | TAS has made a business decision that Intake Advocates will not accept or input non-Streamlined or non-Guaranteed IAs. Create the case and follow procedures for assignment to a Case Advocate. |

| 9 | Additional skip payment. | Case Advocates have authority to input an additional skip payment on taxpayer’s account, IRM 5.19.1.6.4.18 (or successor provisions). | Intake Advocates have authority to input an additional skip payment on taxpayer’s account, IRM 5.19.1.6.4.18 (or successor provisions). |

| 10 | Collection Hold. | Case Advocates have authority to input collection holds on cases open in TAS, IRM 21.5.2.4.8.2 (or successor provisions). | Intake Advocates have authority to input collection holds on cases open in TAS, IRM 21.5.2.4.8.2 (or successor provisions). |

| 11 | Input an adjustment on an account under control in another Operating Division(OP)/Function. See IRM 13.1.4.2.3.1.2. | Case Advocates have authority to input the adjustment after the OD/Function makes the determination and provides TAS with written specific direction and dollar amounts. | Intake Advocates have authority to input an adjustment after the OD/Function makes a determination and provides TAS with written specific direction and dollar amounts. |

| 12 | Address change. See IRM 13.1.4.2.3.21, Address Change. | Case Advocates have authority to input a change of address on IDRS entity under the procedures contained in IRM 21.2.4.3.5 and IRM 3.13.5.47 (or successor provisions). | Intake Advocates have authority to input a change of address on IDRS entity under the procedures contained in IRM 21.2.4.3.5 and IRM 3.13.5.47 (or successor provisions). |

| 13 | Math error. See IRM 13.1.4.2.3.14, Math Errors. | Case Advocates have authority to correct accounts with substantiated math errors. IRM 21.5.4 (or successor provisions). | Intake Advocates have the authority to correct accounts with substantiated math errors. IRM 21.5.4 (or successor provisions). |

| 14 | Account adjustment meeting tolerance. See IRM 13.1.4.2.3.13, Tolerances. | Case Advocates have the authority to input account adjustments meeting tolerance, IRM 21.5.1.4.12 (or successor provisions). | Intake Advocates have authority to input account adjustments meeting tolerance IRM 21.5.1.4.12 (or successor provisions). |

| 15 | Manual refund. See IRM 13.1.4.2.3.4, Receiving Returns, Manual Refunds and Offset Bypass Refunds. | Case Advocates have authority to issue a manual refund in certain circumstances under provisions in IRM 21.4.4 (or successor provision), Manual Refunds. | Intake Advocates do not have authority to issue a manual refund. Create the case and follow procedures for assignment to a Case Advocate. |

| 16 | Adjustment to a TFRP. See IRM 13.1.4.2.3.7. | Case Advocates have authority to perform certain adjustments to a TFRP. | Intake Advocates do not have the authority to adjust the TFRP. Create the case and follow procedures for assignment to a Case Advocate. |

| 17 | Substantive determination was made by the Operating Division (OD)/Function. See IRM 13.1.4.2.3.2, Prior Determinations. | Case Advocates do not have authority to overturn a determination made by another OD/Function or issue a closing letter with appeal rights process. | Intake Advocates do not have authority to overturn a determination made by another OD/Function or issue a closing letter with appeal rights. Create the case and follow procedures for assignment to a Case Advocate. |

| 18 | Request for penalty abatement. | Case Advocates do not have authority to accept or deny penalty abatement requests (except for TFRP as discussed in issue 16 above). | Intake Advocates do not have authority to accept or deny penalty abatement requests. Create the case and follow procedures for assignment to a Case Advocate. |

| 19 | CNC status. See IRM 13.1.4.2.3.6, Currently Not Collectible. | Case Advocates do not have authority to make a CNC determination. | Intake Advocates do not have authority to make a CNC determination. Create the case and follow procedures for assignment to a Case Advocate. |

| 20 | Determination to allow/disallow a claim (e.g., Form 1040-X, Form 94X, etc.). See IRM 13.1.4.2.3.5, Claims. | Case Advocates do not have authority to allow/disallow claims. | Intake Advocates do not have authority to allow/disallow claims. Create the case and follow procedures for assignment to a Case Advocate. |

| Process a claim for repayment of debt cancellation/claim of right under procedures contained in IRM 21.6.6.4.10, Claim of Right – IRC Section 1341, Repayment of Income Previously Reported (or successor provision). See IRM 13.1.4.2.3.5, Claims. | Case Advocates do not have authority to work such claims. | Intake Advocates do not have authority to work such claims. Create the case and follow procedures for assignment to a Case Advocate. | |

| 22 | Claim for Veteran’s Disability Compensation excluded from gross income under procedures contained in IRM 21.6.6.2.19, Veteran’s Disability Compensation – Public Law 95-479, Section 301 (or successor provision); current provisions found in. See https://www.irs.gov/irm/part13/irm_13-001-004#idm140371124744704IRM 13.1.4.2.3. | Case Advocates do not have authority to work such claims. | Intake Advocates do not have authority to work such claims. Create the case and follow procedures for assignment to a Case Advocate. |

| 23 | Inquiry or adjustment under procedures contained in various sections of IRM 21.5.3.4.16.2, Civil Cases (Department of Justice Cases), through IRM 21.5.3.4.16.12, Late Election by Real Estate Professional – Revenue Procedure 2011–34 (or successor provision). See IRM 13.1.4.2.3. | Case Advocates do not have authority to work such claims. | Intake Advocates do not have authority to work such claims. Create the case and follow procedures for assignment to a Case Advocate. |

| 24 | Change the filing status from Joint to Separate, Single, or Head of Household under procedures contained in IRM 21.6.1.5.5 (or successor provision), Married Filing Joint to Married Filing Separate, Single, or Head of Household Procedures. | Case Advocates do not have authority to change the filing status. | Intake Advocates do not have authority to change the filing status. Create the case and follow procedures for assignment to a Case Advocate. |

| 25 | Change the filing status when only one spouse requests change under procedures contained in IRM 21.6.1.5.6 (or successor provision), Only One Spouse Requesting Filing Status Change. | Case Advocates do not have authority to change the filing status. | Intake Advocates do not have authority to change the filing status. Create the case and follow procedures for assignment to a Case Advocate. |

| 26 | Change the filing status from Joint to Separate, based on unlawful filing procedures under procedures contained in IRM 21.6.1.5.7 (or successor provision), Married Filing Joint or Married Filing Separate is Invalid or Filed with Incorrect Status. | Case Advocates do not have authority to change the filing status. | Intake Advocates do not have authority to change the filing status. Create the case and follow procedures for assignment to a Case Advocate. |

| 27 | Make change in accounting periods or to reprocess returns from an incorrect tax period to the correct tax period under procedures contained in IRM 21.6.7.4.2.5 (or successor provision), Tax Period Changes, and IRM 21.6.4.4.16 (or successor provision), Accounting Period Change. See IRM 13.1.4.2.3.3.1, Issues Worked by Entity. | Case Advocates do not have authority to make an accounting period change or to work mixed period. | Intake Advocates do not have authority to make an accounting period change or to work mixed period cases. Create the case and follow procedures for assignment to a Case Advocate. |

| 28 | Process Form 5329 (specific to IRA issues) under provisions of IRM 21.6.5.4.11.4 (or successor provision), Processing Form 5329 With TC 971 AC 144. See IRM 13.1.4.2.3.17, Exempt Organization/Employee Plan Issues. | Case Advocates do not have authority to process Form 5329. | Intake Advocates do not have authority to process Form 5329. Create the case and follow procedures for assignment to a Case Advocate. |

| 29 | Change an accounting method under procedures contained in IRM 21.6.6.2.4 (or successor provision), Changes in Accounting Methods. | Case Advocates do not have authority to change the accounting method. | Intake Advocates do not have authority to change the accounting method. Create the case and follow procedures for assignment to a Case Advocate. |

| 30 | Process an adjustment involving transportation expense deduction under procedures contained in IRM 21.6.6.2.15, Transportation Expense Deductions or successor provisions. | Case Advocates do not have authority to process adjustments involving transportation expense deductions. | Intake Advocates do not have authority to process adjustments involving transportation expense deductions. Create the case and follow procedures for assignment to a Case Advocate. |

| 31 | Compute interest under Look-Back Method under the procedures contained in IRM 21.6.6.2.27 or successor provision; current provision found in IRM 21.6.6.2.27, Form 8697- Interest Computation Under the Look-Back Method for Completed Long-Term Contracts. | Case Advocates do not have authority to compute interest under the Look-Back Method. | Intake Advocates do not have authority to compute interest under the Look-Back Method. Create the case and follow procedures for assignment to a Case Advocate. |

Requesting TAS Assistance

Taxpayers can request TAS assistance by completing Form 911, Request for Taxpayer Advocate Service Assistance. Taxpayers can contact the central TAS hotline (1-877-777-4778) to request assistance or go directly to their local TAS office. The central TAS hotline will intake the case after screening the facts to determine whether it meets TAS criteria. [IRM 13.3.1.2 (12-10-2020)] Once TAS qualification is determined to be met, the TAS employee at the central TAS hotline intake function will create an electronic Form 911 (e-911) and assign the case to caseworker in a TAS location. The assigned TAS caseworker should contact the taxpayer within one week of the request, but it often takes the IRS 15-30 days to contact the taxpayer. Taxpayers are instructed to contact the TAS hotline if they do not hear from the IRS within 30 days. [See Form 911]

Practice Tip: In practice, taxpayers who contact the central TAS hotline often have their cases assigned randomly to available caseworkers throughout the U.S. Taxpayers who wish to deal with the local TAS (i.e., may have voluminous documents to deliver) will want to mail/fax their Form 911 and supporting documents directly to the local TAS office. (Note: the case may still be routed to another office based on the IRS resources available.) To expedite resolution, taxpayers who contact the central TAS hotline should be prepared to follow up by providing a written Form 911 to their assigned caseworker. Also, in 2025, IRS cutbacks and TAS volume required TAS to reorganize its caseload. Hardship cases are generally routed to the local office where the taxpayer resides. Other cases will be routed to other personnel who “specialize” in the taxpayer’s area of concern/issue.

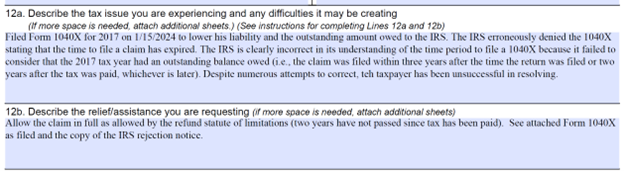

The taxpayer should be specific in his or her problem(s) and request(s) when completing the Form 911. In particular, the taxpayer should clearly describe the tax issue involved (Form 911, line 12a) and the specific relief and assistance requested (Form 911, line 12b). Taxpayers should also attach supporting documents that will assist the caseworker in resolving the issue.

Example- Jeff filed Form 1040X for 2017 on 1/15/2024 to lower his liability and the outstanding amount owed to the IRS. The IRS erroneously denied the 1040X stating that the time to file a claim has expired. The IRS is clearly incorrect in its understanding of the time period to file a 1040X because it failed to consider that the 2017 tax year had an outstanding balance owed (i.e., the claim was filed within three years after the time the return was filed or two years after the tax was paid, whichever is later). Despite numerous attempts to correct, Jeff has been unsuccessful. This qualifies as a systemic burden and Jeff files his Form 911 with lines 12a and 12b clearly stating his issue and the remedy requested. He also attaches the 1040X, supporting notices and requests for correction.

Once the taxpayer is assigned to the caseworker, the caseworker will provide their contact information, their TAS case number, and an estimated completion date of the case. The caseworker will also provide scheduled case updates to keep the taxpayer informed of progress. The TAS caseworker will work with the taxpayer and/or his or her representative until the tax issue is resolved.

A list of local TAS offices and their contact information can be found at https://www.taxpayeradvocate.irs.gov/contact-us/

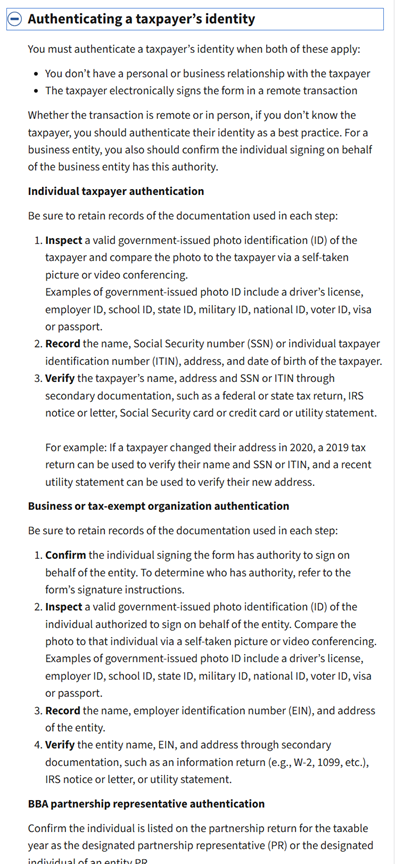

Using Third Parties and Representatives When Working with the IRS

Taxpayers can get help from third parties when working with the IRS. Taxpayers can authorize third parties in the following two areas:

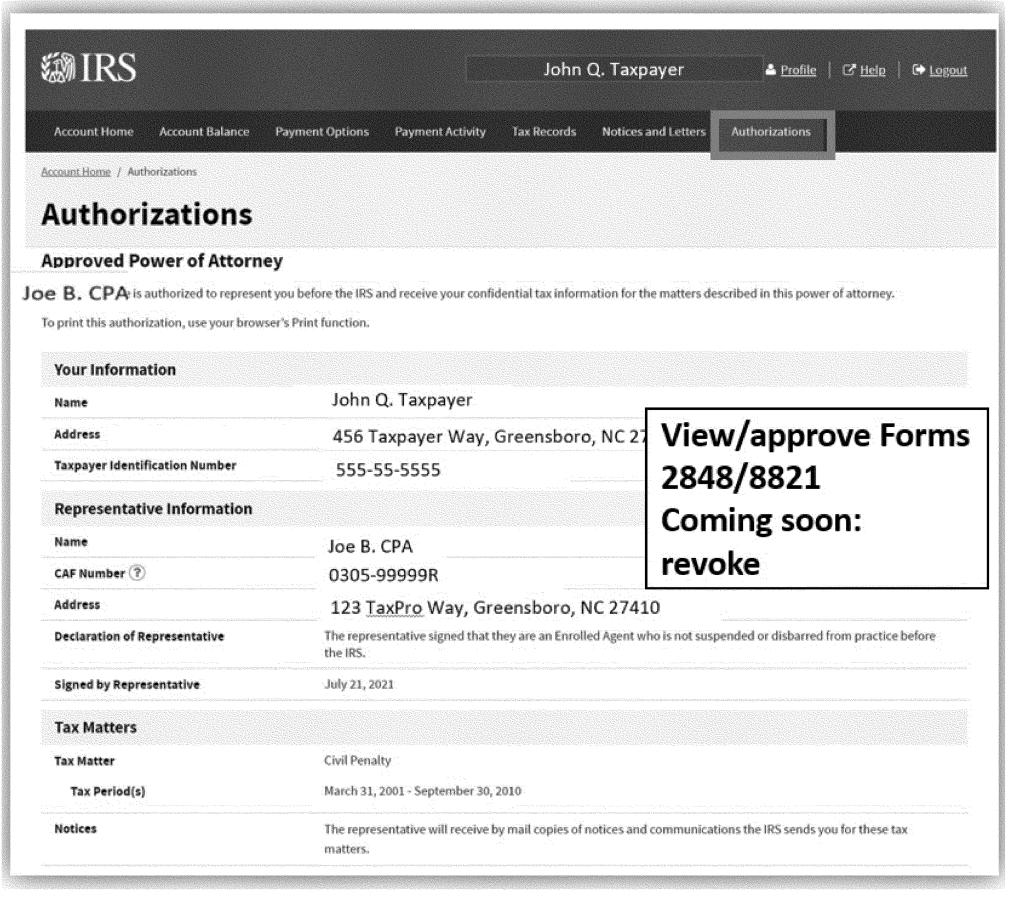

- Receive/inspect confidential IRS tax information: the taxpayer can allow a third party to request, receive, and inspect information on behalf of the taxpayer. This authorization can include requesting information directly from IRS personnel and receiving copies of IRS notices, letters, and transcripts. The IRS form used to authorize a third party to request, receive, and inspect tax information via Form 8821, Tax Information Authorization.

- Represent them before the IRS: a taxpayer can authorize a third-party who is eligible to serve as a power-of-attorney to represent them before the IRS. This designated power-of-attorney can receive information for the taxpayer and advocate for them before the IRS. The IRS form used to authorize an eligible individual to represent a taxpayer before the IRS is Form 2848, Power of Attorney and Declaration of Representative.

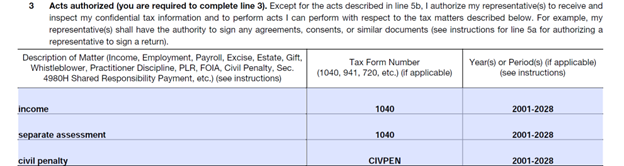

It is common for taxpayers to obtain assistance from third parties, such as their tax preparer, when working with the IRS to obtain and understand their tax account information and review and respond to an IRS notice. When matters are more severe (i.e., when they are subject to IRS compliance activity such as audits, collection matters, penalties, unfiled return investigations, etc.), taxpayers often engage with a qualified tax professional to represent them. The taxpayer will need to provide the IRS written authorization of their representative(s). The written authorization needs to specifically address the tax matters in the representation (usually by indicating the years, tax forms, type of tax involved, and any other specific acts or restrictions in the authorization). Most taxpayers provide written notification of their authorized representative to the IRS by submitting Form 2848, Power of Attorney and Declaration of Representative.

Eligible Representatives and Representation Limitations

Not all tax professionals are eligible to represent taxpayers in IRS compliance matters. Generally, taxpayers will need to engage with one of the following tax professionals to represent them before the IRS: [Circular 230, Section 10.3]

Tax Professionals Eligible to Represent and Their Practice Limitations

| Eligible person | Representation Limitations |

| Attorney | No restrictions |

| Certified Public Accountant (CPA) | IRS: none

IRS appeals: cannot appeal decisions to the Courts (limited to attorneys) |

| Enrolled Agent (EA) | IRS: none

IRS appeals: cannot appeal decisions to the Courts (limited to attorneys) |

| Unenrolled Return Preparer | IRS: very limited representation. Only can represent the year in question if the preparer:

Limitations:

|

| Note: This is not an exhaustive list of who is eligible to represent, but most taxpayers who engage outside professional representation engage one of these designated persons | |

Frequently Used Internal Revenue Manual (IRM) Sections in Working with the IRS

The IRM provides extensive guidance and insight to help taxpayers and tax professionals work with the IRS after filing. The IRM sections that provide the most assistance on procedural matters in working with the IRS are as follows:

| IRM Section | Section | Post-filing help for: |

| Part 3 | Submission Processing | IRS procedures for processing returns, resolving return errors, and issuing notices on return errors |

| Part 4 | Examining Process | IRS procedures for audits and underreporter compliance activity |

| Part 5 | Collecting Process | IRS procedures for collection compliance activity |

| Part 8 | Appeals | IRS procedures for appealing disputes within the IRS |

| Part 13 | Taxpayer Advocate Service | Taxpayer Advocate Service procedures for processing and assisting clients with hardship, systemic, or other issues with the IRS |

| Part 20 | Penalties and Interest | IRS Penalty Handbook that provides IRS procedures for penalty assessment and relief |

| Part 21 | Customer Account Services | IRS internal instructions to resolve taxpayer correspondence, telephone, and in person inquiries. This includes identifying compliance issues and issuing correspondence to adjust tax accounts |

| Part 25 | Special Topics | IRS procedural handbook for several important issues, including:

|

Taxpayers and authorized third parties and representatives can use the following specific IRM sections in practicing before the IRS, including obtaining and understanding taxpayer information from the IRS.

| IRM Section | Title | Useful for: |

| 21.3.7 | Processing Third-Party Authorizations onto the Centralized Authorization File (CAF) | Understanding procedures and requirements for processing of third-party authorizations (mainly Forms 2848 and 8821) |

| 21.1.3 | Customer Account Services Guidelines | Understanding TAS guidelines, FOIA guidelines, and request for information procedures |

| 21.2.3 | IRS Transcripts | Getting detailed information on IRS transcripts and procedures on how-to obtain transcripts |

| 21.3.10 | Practitioner Priority Service (PPS) | Understanding who can contact the IRS and the information available through PPS |

| 21.3.1 | Taxpayers contacts from notice | Notice assistance procedures from IRS phone assistors |

| 21.3.3 | Incoming/outgoing correspondence/letters | Letter assistance procedures from IRS assistors |

| 13.1.1 | TAS Procedures | Taxpayer Advocate procedures to resolve taxpayer assistance requests (Forms 911) |

| 13.1.7 | TAS Case Criteria | Qualification criteria for an issue to be elevated to the Taxpayer Advocate Service |

| 3.42.8 | E-Services procedures | Help with using IRS e-Services |

Key Terms and Definitions in IRS Practice and Working with the IRS after Filing

The terms listed below are often referenced in IRS Practice, when working with the IRS after filing or when using third-party authorizations:

| Term | Definition |

|---|---|

| Audit (IRS Examination) | An IRS audit is a review/examination of a taxpayer’s tax return(s) and financial information to ensure information is reported correctly according to the tax laws and to verify that the reported amount of tax is correct. |

| Automated Underreporter (AUR) | The Automated Underreporter Program matches taxpayer income and deductions submitted on information returns by third parties (employers, banks, brokerage firms) against amounts reported by taxpayers on their individual income tax returns to identify discrepancies. The Automated Underreporter Program routinely identifies individual tax returns with discrepancies each year and, when warranted, sends notices to assess additional taxes as well as interest and penalties. |

| Campus | The IRS centralized operation located in various cities that performs service and compliance functions, usually by mail or phone. May also be referred to as an “IRS Service Center” location. |

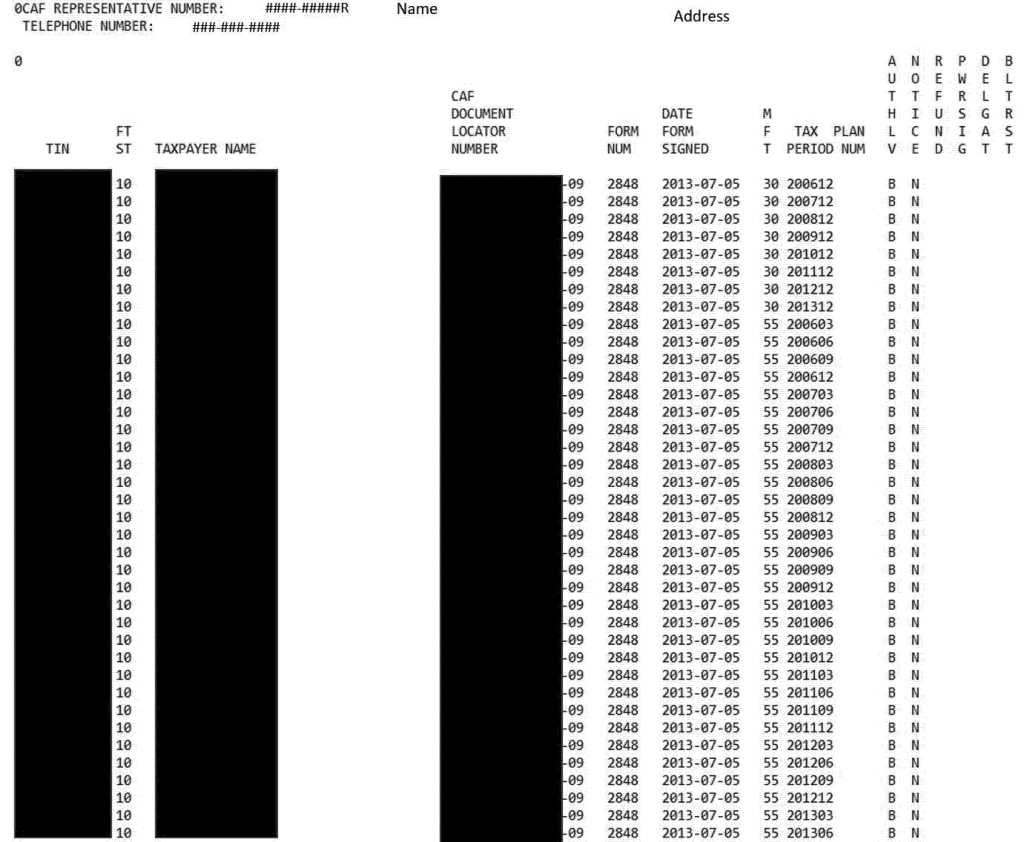

| CAF Number | The Centralized Authorization File number issued by the IRS that is uniquely assigned to each representative (i.e., power of attorney) and each designee (i.e., designee on a tax information authorization). Representative/designees must use this number when filing authorizations with the IRS (Forms 2848 and 8821). |

| Centralized Authorization File (CAF) | The IRS system that records third-party authorizations (Forms 2848 and 8821) on file for taxpayer accounts. This system gives IRS personnel quicker access to authorization information and triggers other actions, such as enabling third parties to be copied on notices if indicated on the Form 2848 or 8821. |

| Circular 230 | Circular 230 is the common name given to the body of regulations under Title 31, United States Code Section 330. These regulations govern practice by representatives (i.e., Power of Attorney) before the IRS. Covers rules governing authority to practice, duties and restrictions in practicing before the IRS, and sanctions/disciplinary hearing procedures for violations of practice rules.

Circular 230 revisions have been proposed in December 2024 and are still under the comment/finalization process. |

| Circular 230 Practitioner | Generally, an attorney, CPA, enrolled agent, enrolled retirement plan agent, Annual Filing Season Program Record of Completion holder, appraiser, or an enrolled actuary eligible to practice before the IRS. These practitioners are eligible to represent taxpayers before the IRS (i.e., via Form 2848). |

| e-Services | Suite of web-based products that provides tax professionals with electronic options for interacting with the IRS. The most widely used e-Service product is the Transcript Delivery System (TDS) which allows authorized tax professionals to obtain taxpayer transcripts online. |

| Fiduciary | Any trustee, executor, administrator, receiver, or guardian that stands in the position of a taxpayer and acts as the taxpayer, not as a representative. |

| IRS Independent Office of Appeals | An independent office within the IRS that impartially reviews determinations made by IRS enforcement functions, including unagreed audits, CP2000 determinations, penalty relief denials, and adverse collection actions. |

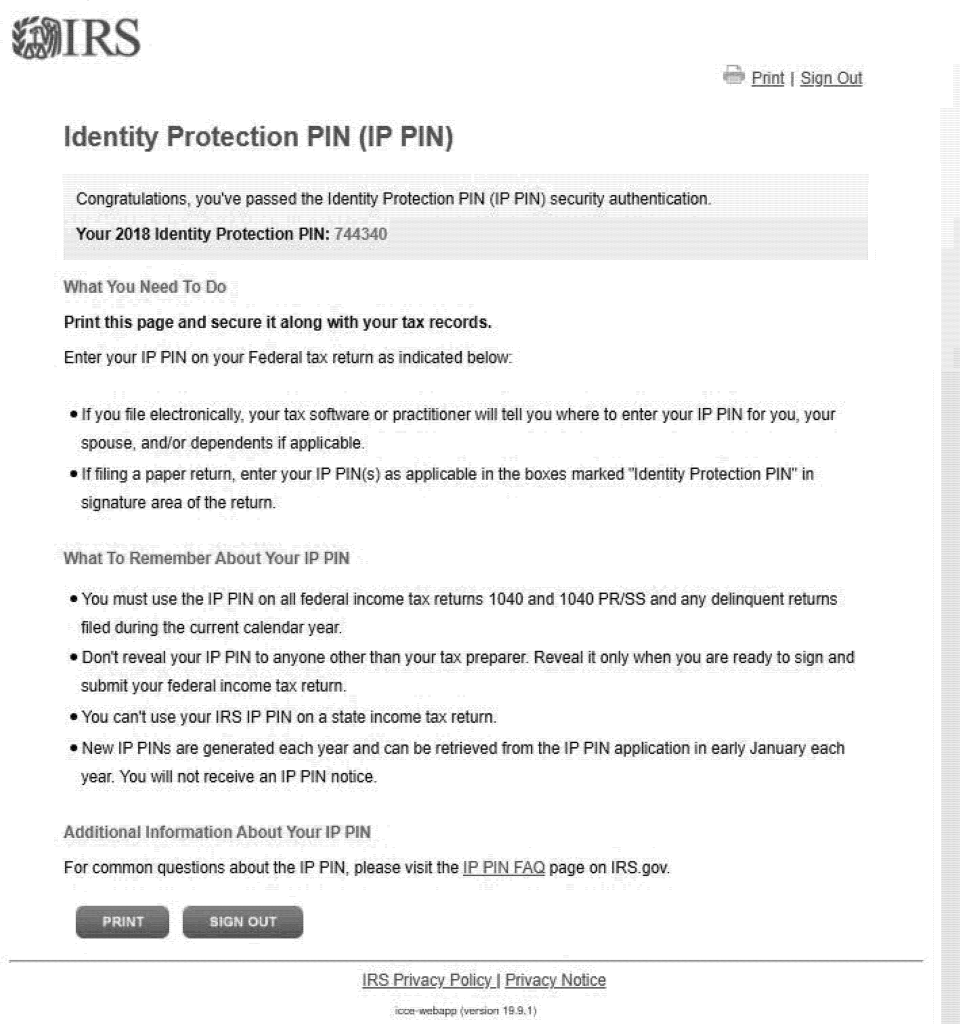

| Identity Theft Victim Assistance (IDTVA) or Identity Protection Specialized Unit (IPSU) | Helps individual taxpayers to directly assist taxpayers who are victims of identity theft (both tax and non-tax reported identity theft). |

| Large Business & International Division (LB&I) | The LB&I Division serves corporations, subchapter S corporations, and partnerships with assets greater than $10 million as well as high-wealth individuals. LB&I taxpayers typically employ large numbers of employees, deal with complicated issues involving tax law and accounting principles, and conduct business in an expanding global environment. |

| Office of Professional Responsibility | Interprets and applies tax professionals’ standards of practice before the IRS. |

| Power of Attorney (POA) | Provides an eligible individual the authority to receive taxpayer information and advocate for a client in all matters before the IRS. A POA is usually executed by using Form 2848, Power of Attorney and Declaration of Representative. |

| Practitioner Priority Service (PPS) | IRS hotline for tax professionals to obtain taxpayer information, resolve account issues, and expedite access to Campus compliance units. |

| Small Business/Self-Employed Division (SB/SE) | SB/SE Division provides assistance and enforces compliance to small business taxpayers (individual taxpayers who file a Schedule C, E, or F, or Form 2106) and other small business entities – all of which have assets under $10 million. Significant SB/SE compliance activity includes AUR, audit (mail and face-to-face audits), and collection. |

| Tax information Authorization (TIA) | An authorization for a third-party (for any person or firm) to receive tax information on behalf of the authorized taxpayer. A TIA is usually executed by using Form 8821, Tax Information Authorization. |

| Taxpayer Protection Program (TPP) | The IRS unit that screens filed returns to proactively identify and prevent the processing of identity theft tax returns and assist taxpayers whose identities are used to file identity theft tax returns. |

| Third-Party Authorization (TPA) | Oral or written authorization for a third-party to receive information and/or advocate on behalf of a taxpayer. Usually, a Form 2848 or 8821. |

| Third-Party Designee (TPD) | Also known as the tax return “checkbox” authorization. Intended to enable the designee to assist the IRS in processing the return should a processing issue arise. |

| Transcript | Taxpayer’s account information at the IRS. There are several forms of transcripts. The three main types of transcripts are the account, tax return, and the wage & income transcript. |

| Transcript Delivery System (TDS) | The IRS automated system which allows taxpayers and tax professionals to request and receive IRS transcripts online or by mail. |

| Taxpayer Services Division (TS) | Formerly known as the Wage and Investment Division (W&I) Division serves individual taxpayers who pay taxes through withholdings, prepare their own tax returns, receive refunds, and generally interact with the IRS one time per year. The TS Division also works to provide balance in compliance and outreach activities, such as enhancing delivery of Earned Income Tax Credit Initiatives. The substantial portion of the TS Division’s compliance activities revolve around addressing noncompliance involving refundable credits, including but not limited to, the Earned Income, Child, Educational, and Premium Tax Credits. |

Important IRS Contact Information When Working with the IRS

IRS phone hotlines are the primary source to obtain information about a taxpayer’s account and compliance activity. Taxpayers and tax professionals should be prepared for long hold times during peak periods (usually later in the day and during tax filing season). To the extent possible, tax professionals should utilize the Practitioner Priority Service (PPS) hotlines to avoid long wait times.

Common IRS Account Information and Assistance Hotlines

| IRS hotline | Phone number | Hours/availability (note: times subject to change) |

| Individual accounts | (800) 829-1040 | For taxpayers, tax pros use PPS

M-F, 7AM-7PM, local time |

| Business and Specialty accounts | (800) 829-4933 | For taxpayers, tax pros use PPS

M-F, 7AM-7PM, local time |

| International Account Inquiries | (267) 941-1000 | M-F, 6AM-11PM (ET)

[IRM at 21.3.10.5 (6-6-2022) at (14)] |

| Taxpayer Assistance Center Appointment | (844) 545-5640 | M-F, 7AM-7PM, local time |

| Taxpayer Advocate National Hotline (central intake) | (877) 777-4778 | M-F, 7AM-7PM, local time

Local offices: 8:30AM-4:30PM |

| Practitioner Priority Service (tax professionals only) | (866) 860-4259 Option #1: Tax law related questions Option #2: Individual accounts Option #3: Business accounts Option #4: Automated Collection System Option #5: Automated Underreporter Unit Option #6: Correspondence Exam Unit | M-F, 7AM-7PM, local time.

[https://www.irs.gov/tax-professionals/practitioner-priority-service-r] |

| e-Help Desk (e-Services) | (866) 255-0654 | M-F, 7:30AM-7:00PM EST |

| Online Services Hotline/Secure Access Registration (help for tax professionals with e-Services registration access) | (888) 841-4648 | M-F, 7:30AM-7:00PM EST |

| Order account or return transcripts by phone to be delivered by mail in 5-10 days (using SSN and last address) | (800) 908-9946 | Automated line |

| Identity Protection Specialized Unit | (800) 908-4490 | M-F, 7AM-7PM, local time |

| Taxpayer Protection Program | (800) 830-5084 | M-F, 7AM-7PM, local time |