Chapter 2- IRS Audits and Underreporter Issues and Solutions

IRS Audits and Underreporter Notices

INTRODUCTION

Key Highlights:

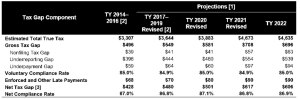

- Inaccurate tax returns are the IRS’s #1 compliance problem: the U.S. Treasury loses $539 billion a year (2022 measurement year) due to inaccurate tax returns. The IRS uses e-file rejections, math errors, matching notices, and audits as their primary efforts to combat inaccurate tax return filings.

- Underreporter Notices are the most common return challenge enforcement program: the IRS automated matching program (CP2000 and CP2501 notice program) issued over 1.15 million notices of return discrepancies in 2024. This underreporter program continues to be the most common method the IRS challenges the accuracy of a tax return.

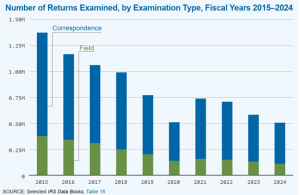

- Audits are rare: since 2010, audits have been steadily on the decline. Only 0.27% of all individual taxpayers were audited in 2024. The extremely low audit rates in 2019-2024 are due largely to limited IRS compliance enforcement personnel. The most commonly audited individual taxpayers are those who claim refundable credits, have small businesses, or are high-income taxpayers.

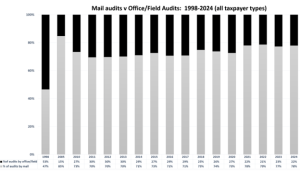

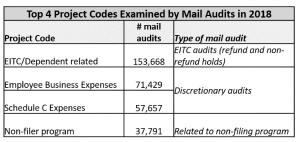

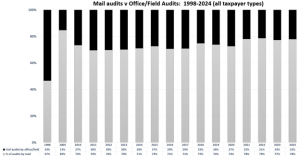

- Most audits are done by mail and are automated: 77% of all audits are mail audits in which the taxpayer needs to provide evidence of 2-4 issues. The most common issue is qualifying for the earned income tax credit. The mail audit process produces automated letters which can cause problems for the taxpayer.

- Office and field audits are the most comprehensive tax return challenges: face-to-face audits (office and field audits) with IRS auditors involve the most complex issues. IRS auditors will also closely examine the taxpayer’s finances for unreported income. Office and field audits have the highest likelihood for large deficiencies and disagreements that require the taxpayer to petition the determination to the IRS Independent Office of Appeals.

- Follow specific procedures that protect taxpayer rights: underreporter notices and audits follow deficiency procedures which allow the taxpayer to appeal unagreed issues to the IRS Independent Office of Appeals and to the U.S. Tax Court before the taxpayer is assessed the tax.

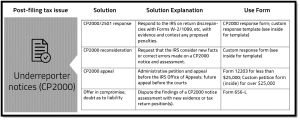

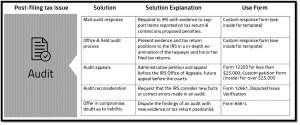

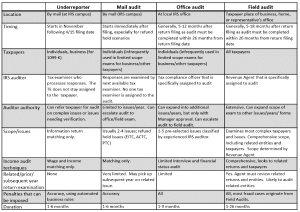

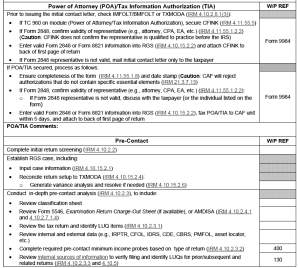

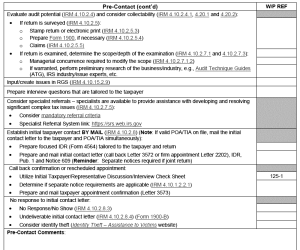

Underreporter Solution Grid

Audit Solution Grid

What’s New for 2025?

- The IRS did increase their auditors by almost 30% in 2024 and 2025. However, audits decreased as many agents were being trained. In 2025, the IRS experienced substantial cutbacks in enforcement resources, resulting in the loss of many of its face-to-face auditors (mostly revenue agents). The impact will be reduced number of complex audits to wealthy individuals and larger businesses. The overall impact has not yet been understood.

- The IRS again suspended the lower-filing threshold for Forms 1099-K until 2026 tax year. For 2025, the IRS announced that third-party payment organizations have a 1099-K filing threshold of $2,500. [IR-2024-299, Nov. 26, 2024] However, the IRS continues to actively match information statements reported under business EIN (Forms 1099-MISC, 1099-K, etc.) to individual Schedule C filed returns as part of the CP2000 notice program.

- The IRS continues to update online response tools for audits and underreporter notices, making it easier to reply and message IRS tax examiners in mail audits and CP2000 notices. Taxpayers can now routinely use the IRS’ Document Upload Tool and Secure Messaging online applications to respond to mail audits and CP2000 notices.

What’s Covered in This Section?

- What to expect in the AUR, audit, and appeals compliance enforcement actions

- The IRS processes for AUR, mail audits, office audits, and field audits, and how-to resolve each of these compliance enforcement actions

- Step-by-step approach to responding to a CP2000 notice and a mail audit, including the format and best practices to use in the response

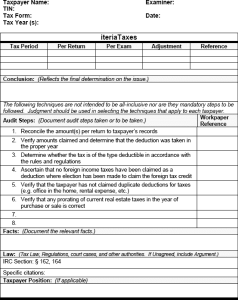

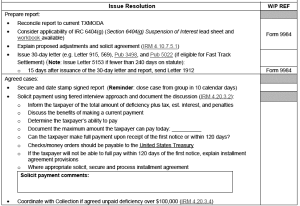

- Specific audit steps taken by the IRS in office and field audits, including how the IRS auditor will examine income

- How to manage and best represent the taxpayer’s position in an office or field audit

- How to appeal unagreed issues in tax return challenges

- Resources to help the taxpayer in understanding the audit process and resolving issues

What’s Not Covered — and Why?

- Tax law arguments for specific tax issues: there are numerous tax issues that arise in an audit and taxpayers should apply a clear understanding of the law when advocating their return position in an audit.

- Alternative dispute resolution: depending on the circumstances, the taxpayer may request mediation or another informal IRS alternative means to resolve audit issues. Few taxpayers utilize these options and they are not covered in-depth in this text.

Most Common Taxpayer and Tax Professional Actions Performed When Addressing Underreporter Notices and Audit

- Responding to an IRS CP2000

- Responding to a mail audit

- Requesting reconsideration of a CP2000 or mail audit determination

- Contesting accuracy penalties

- Managing the office or field audit process

- Appealing disagreed issues with the IRS

When to Get an Expert Involved

- Office and field audits: face-to-face audits involving complex audit procedures by an IRS auditor

- Appealing disputes: filing a protest and negotiating an appeals settlement

- Potential criminal violations: taxpayers who have potential tax fraud claims against them should always consult an attorney

Professional Assistance Fees

- Hourly: Range from $80-$500 an hour for representation by an EA, CPA, or tax attorney. Office audit, field audit, and appeals representations are often charged at the higher rates and can involve extensive work, depending on the size and complexity of the issues involved.

- Flat fee: National firms can charge flat fees from $3,000 – $100,000 depending on the amount owed and complexity of the issues involved. CP2000 and mail audits are less expensive. Field audits and appeals representation can be expensive depending on the amount of work involved.

- No fee: CP2000 and mail audit responses are often services provided for free by the tax preparer of record. Low-income taxpayer clinics can assist taxpayers free of charge.

Closely Related Issues

- Penalties: taxpayers involved in CP2000s and audits can incur accuracy penalties. Taxpayers need to contest the penalty during the CP2000/audit/appeal if they have cause.

- Unfiled returns: IRS auditors in office and field exams will audit the taxpayer’s tax history to ensure that they have filed all required prior/subsequent and related returns.

Time to Complete Estimates for Common Audit Solutions/Actions

| Audit Action | Estimated Hours to Complete | Average Duration Estimate |

| Obtaining tax history and transcripts from IRS | <1 hour (best to call IRS by phone) | 1 day-3 weeks (if transcripts come by mail) |

| Responding to a CP2000 notice | 2-3 hours | 1-6 months (one response closing) |

| Responding to a mail audit | 2-8 hours | 1-8 months (one response closing) (average in 2023 was 192 days, excluding any IRS appeal) |

| Resolving an office audit – from preparation to final closing of the audit | 6-25 hours (self-employed taxpayers require more financial analysis) | 1-10 months (average in 2023 was 291 days, excluding any appeal) |

| Resolving a field audit – from preparation to final closing of the audit | 15+ hours | 1-26 months (average in 2023 was 450 days, excluding any appeal) |

| Appealing unagreed issues to the IRS Independent Office of Appeals (protest through settlement) | 8+ hours, depending on the issues involved and whether issues were addressed throughout the audit | 4-15 months |

| Requesting CP2000 reconsideration (request only) | 2-3 hours | 4-12 months (with one response to resolve the case) |

| Requesting audit reconsideration (mail audit request only) | 5-10 hours | 4-12 months (with one response to resolve the case) |

UPDATES TO THIS CHAPTER

10/6/2025: IRS updated the IRS Appeals Customer Service phone number to 855-865-3401.

8/19/2025:

Per IRS FOIA request, these IRS notices are no longer in use or obsolete:

- CP22E: No Longer in Use

- Letter 3219: No Longer in Use

- Letter 3219-C: No Longer in Use

- Letter 3900: Obsolete

- Letter 4314C: No Longer in Use

- Letter 5036: Obsolete

- Letter 5039: Obsolete

- Letter 5043: Obsolete

- Form 866-A: No Longer in Use

- Form 14420: Obsolete

OVERVIEW OF IRS AUDITS AND UNDERREPORTER NOTICES

This section provides a basic overview of the manner in which the IRS challenges tax returns for accuracy and helpful contact information and guidance for resolving audits and CP2000 issues.

| Topic | Covers |

|---|---|

| Overview of IRS Tax Return Challenges | Type of IRS return challenges, including IRS CP2000 inquiries, audit rates, and suspected fraudulent refund holds. |

| Post-Filing Tax Return Challenges: CP2000 Notices and Audits | Includes:

|

| Basic Post-Filing Assessment Principles: Deficiency Procedures | Includes:

|

| Relevant IRS Internal Revenue Manual (IRM) Guidance | IRS internal guidance that contains detailed IRS underreporter, audit, and appeals procedures. |

| IRS Forms and Publications | Common forms and publications that are useful for IRS underreporter notices, audits, and appeals. |

| Frequently Used IRS AUR and Examination Phone Numbers | Phone numbers to directly contact the IRS for underreporter notices, audits, and appeals. |

| Common IRS Notices and Taxpayer Notifications | IRS notices used in underreporter inquiries, all audits, crypto-currency notices, and appeals. |

| Useful Websites and IRS Online Tools | Websites to assist in gathering information and preparing for an audit. |

| Key Terms and Definitions | Terms used in underreporter notices, audits, and appeals. |

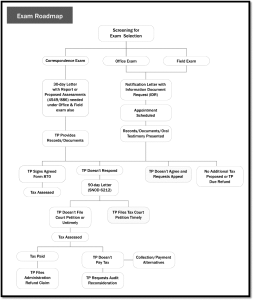

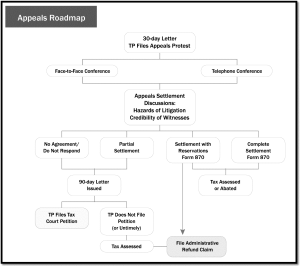

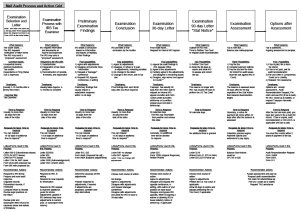

| IRS Audit and Appeal Process: IRS Roadmap Diagram | Process diagram to illustrate the audit and appeals process. |

Other helpful sections:

| Topic | Covers |

|---|---|

| Accuracy-Related Penalties | How to address accuracy penalties in an audit or underreporter notice. |

| IRS Transcripts | How to obtain IRS transcripts needed in preparing for an IRS audit and underreporter response. |

Key Highlights:

- Inaccurate tax returns cost the U.S. Treasury billions a year in lost tax revenue. It is the largest area of taxpayer noncompliance.

- The IRS can challenge the accuracy of tax returns at the time of filing and after filing.

- The IRS has the authority to reject or change a tax return at the time of filing if the tax return has a processing error or other math error.

- The IRS uses matching notices and audits to challenge the accuracy of a tax return after the return is accepted.

- The IRS must follow deficiency procedures before assessing additional tax after filing. These procedures allow taxpayers several opportunities to prove the accuracy of the return and appeal disagreements before the tax is assessed and paid.

Overview of IRS Tax Return Challenges

The United States tax system relies on taxpayers filing correct tax returns. However, recent IRS statistics measuring the 2022 tax year estimates that $539 billion is lost annually due to taxpayers filing an inaccurate tax return—that is, taxpayer errors that understate income, or overstate deductions and credits. [IRS Publication 5869]

To combat underreporting and inaccurate tax return filings, the IRS can challenge the accuracy of returns during the filing process and through post-filing compliance activity. Filing challenges include e-file filters to reject inaccurate returns. For example, if a taxpayer claims a dependent that has already been claimed on another return, the IRS will reject the return when the taxpayer attempts to e-file. The IRS can also challenge a return during filing by correcting filing mistakes to the return through its math error authority. For example, if the taxpayer incorrectly computes tax on the return, the IRS will correct the error and send a notice to the taxpayer about the adjustment.

The IRS can also challenge a return by examining the accuracy of the return through matching programs (Automated Underreporter program or “AUR”) or by auditing the return. AUR and audits require that the IRS follow procedures before assessing additional tax. These procedures, called deficiency procedures, allow the taxpayer to contest the additional tax without payment. [IRC §6213(a)] Deficiency procedures are a core taxpayer right that allows taxpayers the preemptive ability to contest an IRS determination of additional tax owed without having to pay the tax first. E-file rejections and math error adjustments are not subject to deficiency procedures.

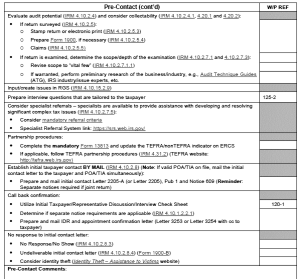

The IRS does not publish e-file rejection volume data. However, based on IRS data for 2020-2024, taxpayers are most likely to encounter a math error notice or an AUR notice when the IRS challenges the accuracy of a return after the return is submitted to the IRS. In 2021 and 2022, the spike in math error notices is largely due to stimulus payment (recovery rebate credit) corrections on a tax return. Post-2022, without additional stimulus or other issues, the math error notice volume returned to pre-2021 levels.

![]()

IRS Challenges to a Return During Filing

The IRS has two primary methods to challenge returns during the filing process:

- E-file rejection: E-file rejection occurs when a taxpayer attempts to e-file a return and the IRS detects an error and rejects the return before it is accepted as a filed return. Common e-file rejections include filing with personal information that does not match information on file with the Social Security Administration (name, SSN, date of birth), a return has already been filed under that SSN (possible stolen identity refund fraud), a dependent was claimed on another person’s tax return (dependent dispute, identity theft, or a dependent filed their own return), or the taxpayer’s electronic signature is not accurate (taxpayer does not know their AGI, identity protection PIN if they had prior reported tax identity theft, etc.). [IRS Publication 1345]

- Math error notices: The IRS has some limited authority to adjust returns and assess additional tax for a math error or a clerical error on a return. In these situations, the IRS accepts the filed return, but changes the return based on math or clerical errors made on the return. [IRM 21.5.4.3 (10-01-2024)] When the IRS adjusts the return, it sends the taxpayer a notice, usually Letter CP10, CP11, CP12, or CP13 Series. [IRM 21.3.1.6.5-9 (10-01-2024)] Taxpayers can request abatement of the adjustment within 60 days of the notice. If the IRS rejects the abatement request, it must audit the taxpayer. [IRC §6213(b)(2)(A) and IRM 21.5.4.4.2 (10-01-2024)] The IRS commonly uses math error authority to resolve paper filing math errors, taxpayer identification number errors and the resultant impact on deductions and credits, and tax computation errors, such as tax rates and the amount of social security income subject to taxation. [ National Taxpayer Advocate, 2023 Purple Book]

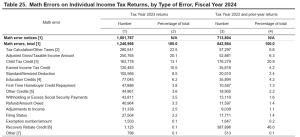

The most common math error issues in 2024 are as follows:

[IRS Data Book, 2024, Table 25, page 67]

IRS math error notices do not include a correction to withholding or estimated tax payments or a tax decrease or increase of credits resulting in a larger refund due to the taxpayer. [IRM 21.5.4.2.1 (4-18-2022)]

Practice Tip: Taxpayers receiving a math error notice can contact the IRS directly by phone to request abatement of the tax change. Taxpayers should be prepared to provide a valid reason for the abatement. When a taxpayer requests an abatement with or without substantiation within 60 days, the IRS must abate the assessment. If the IRS disagrees with the taxpayer’s reason, the IRS may still hold the refund and refer the taxpayer for audit. [IRM 21.5.4.4.5 (10-01-2024)] The taxpayer can also request that the IRS review her case in an audit and if the taxpayer disagrees, the taxpayer will have the opportunity to appeal the determination prior to the issuance of a notice of deficiency. If a notice of deficiency is issued, the taxpayer will have the opportunity to file a petition with the United States Tax Court. [IRM 21.5.4.3.2 (10-01-2024)] Taxpayers who miss the 60-day deadline can file an amended return to provide substantiation to overturn the math error assessment. The IRS may allow or disallow the amended return based on the facts and circumstances. [IRM 21.5.4.4.3 at (4) (10-01-2024)] If the IRS disagrees, the taxpayer can follow the claim for refund procedures to contest the IRS determination.

Suspected Fraudulent Refunds

The IRS can also hold refund returns if they suspect errors or tax identity theft. In the case of suspected errors, the IRS can question the validity of the return and question its accuracy (e.g., Notice CP05). In the case of suspected identity theft, the IRS will ask the taxpayer to verify her identity before releasing the refund (Notice CP05). [IRM 21.3.1.6.1 (10-2-2023); Reference our Tax Identity Theft section for help on tax identity theft issues]

Post-Filing Tax Return Challenges: CP2000 Notices and Audits

After a return is accepted, the IRS can challenge the accuracy of the return. In order to assess additional tax after the return is accepted, the IRS must follow procedures called for in IRC §6213 (deficiency procedures). Deficiency procedures apply to the most common post-filing return challenges: automated underreporter notices (CP2000 notices) and audits.

Assessment Statutes and the IRS Exam Cycle

Generally, return challenges and additional assessments must be completed within three years from the date the return was filed. [IRC §6501(a)] There are several conditions that extend the assessment statute expiration date (ASED). [IRM 25.6.1.5 at (4) (10-2-2023)] However, most IRS assessments occur well before the three-year ASED.

IRM 4.10.2.2.2 (9-9-2019) provides that the examination and disposition of income tax returns is to be completed within 26 months after the due date of the return or the date filed, whichever is later, for individual returns (27 months for business returns). The 26-month period (27 months for businesses) is referred to as the “IRS Exam Cycle.” [IRM 4.10.2.2.2 (9-9-2019)] To comply with this requirement, IRS auditors cannot initiate an examination on any return with less than 12 months remaining on the ASED without prior managerial approval. [IRM 4.10.2.2.1 (9-9-2019)] In practice, it is rare to encounter IRS auditors starting examinations on tax years with less than one year left on the ASED. Most deviations from this IRS policy are in field examinations. In these cases, the IRS auditor may ask the taxpayer to voluntarily extend the statute of limitations to assess additional tax (i.e., IRS Form 872).

Practice Tip: The IRS generally likes to select taxpayers for audit within several months after the taxpayer files a return. IRS auditors are instructed to close their examinations at least ten months before the ASED to allow the taxpayer the opportunity to appeal any determination and for the IRS to have time to properly close any examination before the ASED. It is not uncommon for the IRS to take a long time to examine more complex taxpayers and small businesses. If the IRS approaches the end of the exam cycle, the auditor will likely request the taxpayer to extend the ASED using Form 872. If the audit has unagreed issues about which the taxpayer wishes to appeal to the IRS Independent Office of Appeals, the IRS auditor will solicit a statute extension if there is less than 365 days remaining until the ASED. Taxpayers should consider all factors before agreeing to extend the ASED, including receiving an understanding from the IRS as to what specific steps and timeframes are needed to complete the audit.

Automated Underreporter Notices

Most IRS post-filing return challenges are received by correspondence (i.e., mail). The most common return challenge is the Automated Underreporter (AUR) matching notice – the CP2000 notice.

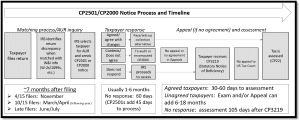

The AUR program matches the billions of information returns filed with the IRS (i.e., Forms 1099, W-2, 1098, etc.) to filed tax returns and looks for discrepancies. If IRS computers detect a discrepancy, the return is flagged and sent to a tax examiner for review. A tax examiner manually reviews the return and can generate a notice to the taxpayer (Notice CP2000) that shows the discrepancy and proposes additional tax owed. In practice, the IRS AUR issues three cycles of matching notices: [TIGTA Report 2021-30-002, December 30, 2020, , Billions in Potential Taxes Went Unaddressed from Unfiled Returns and Underreported Income by Taxpayers That Received Form 1099-K Income ]

- November/December: for returns filed on or before 4/15

- March/April: for returns filed before 10/15

- June/July (following year): for any miscellaneous issues and late filed returns

Note: In 2020-2023, the COVID-19 pandemic did not stop the IRS AUR CP2000 program. However, since the pandemic, the timing of the three cycles have been erratic due to ongoing IRS operations issues.

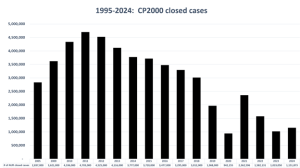

The annual number of CP2000 notices fluctuates based on IRS resources. However, over the past 20+ years, the IRS AUR has sent out millions of notices per year. [IRS Data Books, 1995-2024, Table 24]

CP2000s are not technically an IRS examination or audit. Why? Because CP2000 inquiries are narrow, limited contacts with the IRS, and CP2000s do not involve an IRS inspection of the taxpayer’s books of account. IRS matching information on a return with other records of information items that are already in the IRS’s possession does not constitute an audit. [Revenue Procedure 2005-32, §4.03(1)(b)] As such, the IRS does not require taxpayers to provide books and records to substantiate items on a tax return in a CP2000 notice. The CP2000 inquiry does not turn into an audit if the taxpayer voluntarily provides records. [Revenue Procedure 2005-32, §4.03(1)(c)]

Although CP2000s are not audits, the average CP2000 does lead to a significant tax bill for the taxpayer. [IRS Data Books, 1995-2024, Table 24]

According to the IRS, 94% of all CP2000s and related program underreporter notices resulted in a change to the amount of tax reported on the original return. [IRS FOIA Response 2025-000175, February 2025)] In 2024, the average amount owed increased to $7,074 on 1,126,664 CP2000s issued and 62,655 CP2501s issued.. [IRS FOIA Response 2025-000175, February 2025)]

The IRS can also assess an accuracy penalty (negligence or substantial understatement) in addition to the tax proposed. The IRS uses its business rules to determine whether to “automatically” assess an accuracy penalty. Taxpayers with prior CP2000s with the same type of unreported income will incur an automatic negligence penalty [IRM 4.19.3.18.6 (5-19-2017)] and taxpayers who meet the computational requirements will generally be assessed the substantial understatement penalty. [IRM 4.19.3.18.5 (9-21-2020)] Unlike in an audit, IRS managers do not have to approve the imposition of an accuracy penalty on a CP2000 notice. [IRM 20.1.5.3.2 at (3) (4-22-2019)] In 2024, the IRS assessed an accuracy penalty on 5.2% of all underreporter inquiries. [IRS FOIA Response 2025-000175, February 2025)]

Practice Tip: Accuracy penalties can be contested in a CP2000 notice by responding timely to the notice or requesting reconsideration if the tax and penalty have already been assessed. The IRS is required to review the facts and circumstances in the taxpayer’s protest and make a determination, subject to manager approval, to sustain the penalty. In practice, many taxpayers do not contest the accuracy penalty and allow the IRS to automatically assess it. In these cases, the taxpayer must request CP2000 reconsideration and provide the basis for relief from the penalty in the request for reconsideration. In practice, it is best to respond during the CP2000 process as reconsiderations can take 6-12 months, or more, to complete.

IRS Examinations or “Audits”

The IRS can examine the accuracy of a tax return by auditing the taxpayer. [IRC §7602(a)] IRS auditors are assigned to examine selected returns to determine if the taxpayer reported the correct tax liability.

There are three types of IRS audits:

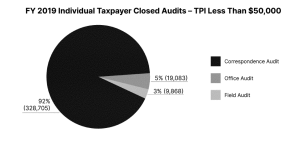

- Correspondence (mail) audits: mail audits done by tax examiners at central IRS campuses usually on individual taxpayers and most times related to refundable credit issues (i.e., earned income tax credit, etc.).

- Office audits: also referred to as a “desk audit.” These audits are conducted at local IRS offices staffed by tax compliance officers.

- Field audits: these are the most comprehensive IRS audits that are done by IRS revenue agents. Field audits take place at the taxpayer’s place of business or at his home. Field audits are rare and are used for the most complex individual, business, employer, and specialty taxpayers.

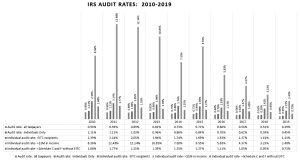

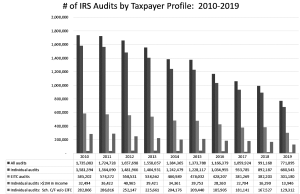

Most IRS audits are done by mail. In fact, in 2024, 77% of all audits were done by mail. IRS data shows the traditional predominance of mail audits over face-to-face examinations (office and field audits). [IRS Data Books, 2011-2018, Table 17b; 2019-2022, Table 18]

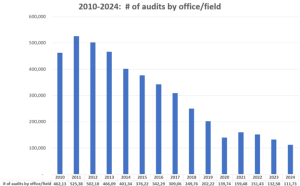

For the past several years, the total number of audits have diminished, largely due to reduced IRS personnel. For 2014-2022, the number of IRS income tax auditors has dropped significantly. However, new hiring in 2023-2024 increased the number of IRS auditors.[IRS Data Books, 2014-2024, Table 34] Despite these gains, the IRS again experienced a significant loss to its audit staff in 2025 due to IRS cutbacks [TIGTA Report 2025-IE-R017, May 2, 2025, Snapshot Report: IRS Workforce Reductions as of March 2025]

![]()

The number of total audits (all taxpayers) measured has steadily dropped since its height in 2010. [IRS Data Books, 2005-2024, Tables 17 and 18]

Individual taxpayers traditionally make up almost nine out of ten audits. [IRS Data Books, 2005-2024, Tables 17 and 18]

IRS audit rates have been declining since 2011. IRS resources currently limit the audit rate to 0.27% for all taxpayers and 0.28% for individual taxpayers. (Note: These are estimates of IRS audit rates. The IRS no longer publishes its audit rates as part of its annual “Data Book.”) In 2020-2024, IRS audit rates were down significantly due to IRS operational issues.

Scope of IRS Return Challenges

For the four major types of IRS post-filing return challenges, the field audit is the most comprehensive of all IRS examinations. IRS field auditors, called revenue agents, have the most authority in IRS audits. Generally, IRS underreporter inquiries and mail audits are issue-specific and warrant only a complete response from the taxpayer. Face-to-face audits – IRS office and field exams – are broader in scope and can include substantial reviews of the taxpayer’s finances to determine the accuracy of the return.

The following chart illustrates, in practice, what taxpayers can expect in the four types of return challenges.

Comparison Chart of Aspects of IRS Return Challenges, by Type

How Returns Are Selected for Audit

The IRS uses many different methods to select a taxpayer for audit. [GAO Study 16-103, IRS Return Selection, December 2015]

The seven most prominent methods are:

- Random selection and computer screening: return audit selection based solely on a statistical formula. The formula compares a filed tax return against norms for similar returns.

- Related examinations: the IRS can select to audit returns when they involve issues or transactions with other taxpayers, such as business partners or investors, whose returns were selected for audit.

- Referrals: IRS employees and units, as well as external sources, such as other agencies and other taxpayers, can refer potentially noncompliant taxpayers to the IRS. The IRS may start an audit if the referral indicates significant potential for noncompliance. Referrals can involve, among others, those promoting shelters created to avoid taxation, whistleblowers, and those not filing required tax returns.

- Data matching: when information on a tax return — such as wages, interest, and dividends — does not match information provided to the IRS by states, employers, or other third parties, these discrepancies may prompt the IRS to review returns for audit potential. An example is the data matching from merchant and payment processors (1099-K), which uses information from credit and debit card transactions to identify income that may be underreported.

- Project cases: the IRS often identifies returns with specific characteristics that generally involve a specific tax issue known or suspected to have high noncompliance in a geographic area, industry, or population.

- Taxpayer-initiated audits: taxpayers can contact the IRS to request an adjustment to their tax returns, tax refunds, or tax credits, or request to have a previous audit reconsidered. The IRS may initiate an audit after reviewing these requests.

- Random identification: the IRS’s National Research Program (NRP) studies tax compliance through audits of a randomly-identified sample of tax returns. The goal of the NRP audits is to identify noncompliance areas and to improve audit selection. NRP audits measure voluntary compliance in reporting income, deductions, and credits, among a variety of categories, and applies those measures to the population being studied to help identify returns with the highest probability of noncompliance.

The IRS is in the early stages of using Artificial Intelligence (AI) for audit selection. The IRS aims to replace the cumbersome NRP studies to update audit selection criteria and replace them with AI selection processes. [TIGTA Report 2025-308-022, May 19, 2025, The IRS Could Leverage Examination Results in Artificial Intelligence Examination Case Selection Models and Improve Processes to Evaluate Performance]

Mail audits are generally used by the IRS to combat questionable refunds and specific issues. IRS tax examiners are not involved in the ultimate selection of the return for audit. Most returns selected for audit are computer generated by Correspondence Exam units at IRS campuses.

However, with regard to office and field audits, the IRS auditor (tax compliance officer or revenue agent) has some discretion on return selection. IRS exam group managers ultimately have the discretion to assign the case for actual examination by the IRS auditor.

Historically, individual taxpayer audit selection provides much higher than normal audit rates for taxpayers who have the earned income tax credit, a small business, or earn more than $1 million in income (high income taxpayers). [IRS Data Books, 2010-2019, Table 17] Note: Starting in 2020, the IRS no longer publishes specific audit rates by taxpayer type. However, in 2020-2024, IRS audit rates were very low due to IRS operational issues.

The number of IRS audits of individual taxpayers has dropped considerably over the past nine years. Earned Income Tax credit audits have historically made up one of the largest audit areas. In 2024, EITC audits make up 38% of all individual audits [IRS Data Book 2024, Table 18].

Small business audits historically have been high. In 2019, small business audits were 19% of all IRS individual audits. Note: Starting in 2020, the IRS no longer publishes specific audit rates by taxpayer type. However, in 2020-2022, IRS audit rates were very low due to pandemic-related operational issues.

IRS Soft Notice Programs

IRS resources limit the number of return challenges it can make on questionable returns or returns with matching discrepancies. The IRS has several “soft-notice” programs that communicate potential non-compliance. Most of these notices are not from IRS compliance enforcement units (i.e., audit, AUR), but rather they originate from IRS accounts management (i.e., the function that processes and accepts a filed tax return). The notice only requests that the taxpayer review their returns for accuracy and voluntarily file an amended return if there is an error.

Notice CP2057, You may need to file an Amended Return, is a common example of an IRS soft notice. This notice informs the taxpayer that there may be a discrepancy between the information returns filed by employers and payers (banks, etc.) with the filed return. The notice asks the taxpayer to consider filing an amended return. The IRS does not follow up with the taxpayer and initiate an AUR inquiry (CP2000 or 2501 notice) if the taxpayer does not respond. [IRM 21.3.1.6.41 (5-14-2024)]

Letters CP85 and CP87 are also examples of IRS soft notices that request the taxpayer to correct a potential earned income tax credit error by filing an amended return. [IRM 21.3.1.6.37 (10-3-2022)]

In 2019, the IRS started a notice program aimed at underreporting and non-filing of crypto-currency transactions. [IRS News Release IR-2019-132, July 26, 2019] Over 10,000 taxpayers received one of three letters requesting the taxpayer to review their 2013-2017 tax returns for proper reporting and filing of virtual currency transactions. The IRS has previously acquired virtual currency transaction data from a summons of Coinbase — a virtual currency exchange. [U.S. v. Coinbase, Inc., 2017-2 USTC ¶50,423 (U.S. DC Ca., Nov. 28, 2017)] It is believed that the letters were aimed at taxpayers who were identified in the summonsed information.

Two of the three letters (Letters 6174 and 6174-A) were soft notice programs asking the taxpayer to consider filing an amended return. [IRM 21.3.1.8.5.1 (7-19-2023)] No response was required for these letters. Taxpayers receiving Letter 6174-A were warned that the IRS may follow-up on their case, at the IRS’s discretion, at a later date.

However, the third letter, Letter 6173, was not a soft notice. Taxpayers who received Letter 6173 were required to provide a response to the IRS. [IRM 21.3.1.8.5 (7-19-2023)] Taxpayers were instructed to take one or more of the following actions by the response date, depending on their circumstances:

- File a delinquent return(s) reporting their virtual currency transactions

- Amend a prior return to correct reporting and underreporting of virtual currency transactions

- If the reporting was correct, provide a statement, under penalties of perjury, that their returns were complete and correct as filed. The statement would need to explain the taxpayer’s position, including a complete history of previously reported virtual currency transactions and provide copies of previously filed documents that confirm the taxpayer’s compliance.

These initial letters are believed to be the first wave of IRS compliance activity directed at the misreporting of virtual currency transactions. The IRS has plans to use many soft notices to close the tax gap. [IRS Inflation Reduction Act Strategic Operating Plan]

Basic IRS Post-Filing Assessment Principles: Deficiency Procedures

When a taxpayer and the IRS disagree on the findings of an audit, the taxpayer has right to appeal the IRS determination before the deficiency is assessed and paid. These pre-payment rights are provided to the taxpayer in IRC §6213 and are known as “deficiency procedures.”

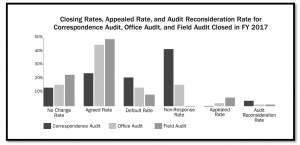

A CP2000 AUR inquiry or an audit can be concluded in one of four ways:

- No-change: an audit in which the taxpayer has substantiated all the items being reviewed and results in no changes to the filed return.

- No-change, with adjustments: adjustments were made to the return, but no additional tax is due.

- Agreed: an audit where the IRS proposed changes and the taxpayer agrees with the changes and additional tax due.

- Unagreed: an audit where the IRS has proposed changes and the taxpayer does not agree with the changes.

Taxpayers who disagree with their CP2000 or audit determination will follow deficiency procedures to contest the determination. Deficiency procedures require the IRS to propose additional tax and penalties and allow the taxpayer to contest the determination prior to the tax being assessed and paid.

For AUR program and audits, the normal IRS deficiency procedures produce at least four taxpayer notifications:

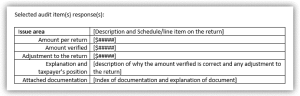

- Notice of AUR inquiry or audit: a notification to the taxpayer that the IRS is challenging the accuracy of a tax return. The year and form will be noted on the letter. The IRS may outline the issues in question in the letter.

- Notice of Proposed Adjustment: a proposal of the changes made to a return and the tax and penalties as a result of the change. The taxpayer is given details on the IRS adjustments to the return and given an opportunity to contest the changes during the time period noted on the letter.

- 30-day letter: a letter that identifies the proposed adjustments and gives the taxpayer the right to request an independent hearing in the IRS Independent Office of Appeals.

- 90-day letter (“Statutory Notice of Deficiency”): before assessing the additional tax, penalties, and interest, the taxpayer is given a final opportunity to contest the IRS’s determination in the U.S. Tax Court.

The 30-day letter begins the timeframe for the taxpayer to contest her CP2000 or audit determination with the IRS Independent Office of Appeals (30 days from the date of the letter).

The Letter CP 3219, Statutory Notice of Deficiency (SNOD, or 90-day letter), provides the last day (90 days from the date of the letter) for the taxpayer to petition her case to the U.S. Tax Court. The SNOD is a legal determination that is presumptively correct and consists of a letter explaining the purpose of the notice, the amount of the deficiency, and the taxpayer’s options. The 90-day letter includes:

- A waiver to allow the taxpayer to agree to the additional tax liability (usually Form 870 (audit) or 5564 (AUR))

- A statement showing how the deficiency was computed (Forms 4549 and 886-A (audit) or partial reprint of the CP2000 notice (AUR))

- An explanation of the adjustments (Form 886-A (audit) or partial reprint of the CP2000 notice (AUR))

- Information on taxpayer’s rights to appeal (Publication 5)

[IRM 4.8.9.2 (8-11-2016) and IRM 4.19.3.22.11 (10-02-2024)]

At the end of the 90-day letter, if the taxpayer does not contest the determination or waives her rights to contest, the IRS can assess the additional tax, penalties, and interest.

After the expiration of the 90-day period, the taxpayer can contest the assessment by either requesting reconsideration (if she did not participate or was not given the opportunity to present her facts or appeal in the CP2000 or audit) or following the claim for refund procedures. The claim for refund procedures requires the taxpayer to pay the balance and file a claim for refund. [IRC §7422(a)] If the IRS denies the claim or the IRS does not act within six months from the date of filing of the claim, the taxpayer can file suit to recover the balance paid. [IRC §6532(a)(1)]

Practice Tip: The claim for refund procedures is usually not a practical remedy for most taxpayers to contest an IRS determination. Most taxpayers will want to go to the IRS Independent Office of Appeals to contest the IRS determination. If the tax and penalties have already been assessed to the taxpayer, the taxpayer can request informal reconsideration from the IRS if the taxpayer has new information not reviewed by the IRS. Reconsideration is commonly allowed in CP2000 and mail audit assessments. It is common for these taxpayers to have premature IRS assessments that do not consider their response. The IRS often cannot review the response before the 90-day letter is issued or the taxpayer did not respond in time before the 90-day letter was automatically issued.

Streamlined Deficiency Procedures for CP2000 Notices and Mail Audits

Deficiency procedures can be confusing in CP2000 and mail audit notices. In the AUR and correspondence audit programs, the CP2000 notice and the initial mail audit notice can serve multiple purposes. The initial notices in these programs can serve as a “combination” notice for taxpayers who do not timely respond to the initial notice. For example, the CP2000 serves as a “combination” notice of the start of a deficiency proceeding, a notice of proposed tax, and a 30-day letter. [IRM 4.19.2.2 (03-13-2024) at (7)] Taxpayers who do not respond to the original CP2000 are generally not given a separate 30-day letter that affords them the right to go to IRS Appeals. Unresponsive CP2000 taxpayers are automatically issued the 90-day Statutory Notice of Deficiency letter. In these cases, the IRS directs taxpayers to petition U.S. Tax Court to contest the liability. Taxpayers in these situations are confused on their options. Do they petition the Tax Court or try to have the IRS consider their response? A more practical alternative may be to request CP2000 reconsideration. In practice, the IRS frequently allows for CP2000 reconsideration for non or late responders which alleviates the taxpayer from having to petition the Tax Court on a defaulted CP2000 assessment.

Practice Tip: It is not uncommon for the IRS to prematurely assess deficiencies on AUR and mail audit cases. This routinely allows AUR and mail audit reconsiderations (i.e., reopening of the CP2000 and mail audit) to allow the taxpayer to respond and correct the tax determination. Most taxpayers follow the reconsideration process rather than petition the Tax Court on a premature assessment. However, if the IRS has reviewed the taxpayer’s responses and has made an adverse determination, taxpayers should consider timely petitioning the Tax Court to contest the determination.

Deficiency Procedures and IRS Office and Field Audits

IRS deficiency procedures are more transparent in IRS face-to-face examinations (office and field audits).

Unlike AUR inquiries and mail audits, face-to-face examinations usually are conducted by one IRS auditor throughout the process. The taxpayer is provided a formal notice of examination by the IRS auditor assigned and given the opportunity to provide the auditor information to prove the accuracy of the return.

In these examinations, the auditor (likely a revenue agent or tax compliance officer) will discuss the proposed return adjustments with the taxpayer prior to issuing a report. The taxpayer is given an opportunity to respond with additional evidence or argument. The taxpayer also can easily access the auditor’s Group Manager if there are any disputes in the audit. This back-and-forth communication and information exchange can resolve most issues in the examination. If the taxpayer and the IRS cannot agree, the auditor will provide a formal 30-day letter that allows the taxpayer to have his dispute heard by the IRS Independent Office of Appeals. If the taxpayer does not request an appeal or cannot reach agreement in IRS Appeals, the taxpayer is provided a Statutory Notice of Deficiency which provides him 90 days to petition the determination to the US Tax Court.

Practice Tip: It is a best practice in face-to-face audits to obtain the IRS auditor’s Group Manager’s name and contact information should any disputes arise in the examination that warrant manager involvement. [IRM 1.4.40.3.7.1 (5-19-2010)] Examination group managers are required to intervene on all unagreed face-to-face examination cases to resolve the issues, obtain agreement, and limit taxpayer burden. [IRM 4.10.7.5.5 (9-12-2022)]

Relief from Repetitive IRS Examinations

Taxpayers may be selected for IRS examination for multiple years in a row. The IRS has an administrative policy to provide relief from repetitive IRS audits to compliant taxpayers who have demonstrated compliance in past examinations. [IRM 4.10.2.13 (2-11-2016)]

A repetitive audit is an audit that occurred in one or both of the preceding two years, does not contain a Schedule C (business income) or Schedule F (farming income), and resulted in a no change or small tax change on the same issues selected for the current year under examination. The taxpayer will be provided relief if the issues examined in either of the two preceding tax years are the same as the issues selected for examination in the current year. [IRM 4.10.2.13 at (1b) (2-11-2016)]

Taxpayers who obtain repetitive audit relief before the examination starts receive a Letter 2685, Repetitive Exam Letter, closing their audit. [IRM 4.10.2.13.2 at (2b) (2-11-2016)]

Practice Tip: The IRS uses a “facts and circumstances” test in applying repetitive audit relief. Taxpayers who believe they qualify for repetitive audit relief should quickly request this relief after audit notification. If the IRS starts the examination and has begun to review the taxpayer’s books and records, the IRS auditor must issue a “no-change” examination letter if they determine repetitive audit relief applies. In practice, IRS auditors are resistant to allowing repetitive audit relief after they have started to review the taxpayer’s records.

Relevant IRS Internal Revenue Manual (IRM) Guidance

Part 4 of the IRM contains most of the IRS examination and underreporter procedures. These sections are most often used to understand IRS examination and underreporter processes.

| IRM Section | Topic |

| Part 4 | IRS Examination Process |

| Part 8 | The Appeals Process |

| 4.19.2 and 4.19.3 | Individual (IMF) Automated Underreporter Program |

| 4.19.3.8 | CP2000 Analysis by each type of omitted income |

| 4.10 | Examination of Returns |

| 4.13 | Audit Reconsiderations |

| 4.19.15 | Liability Determination – discretionary programs (Includes acceptable documentation for audit areas) |

| 20.1.5 | Return related penalties |

IRS Forms and Publications

The following table lists frequent publications used in IRS underreporter notices and audits.

| Publication | Title |

| 1 | Your Rights as a Taxpayer |

| 5 | Your Appeal Rights and How to Prepare a Protest If you Don’t Agree |

| 556 | Examination of Returns, Appeal Rights, and Claims for Refund |

| 1035 | Extending the Tax Assessment Period |

| 3498 | The Examination Process |

| 3498-A | The Examination Process (Audits by Mail) |

| 3524 | EITC Eligibility Checklist |

| 3598 | Audit Reconsideration |

| 4167 | Appeals: Introduction to Alternative Dispute Resolution |

| 4227 | Appeals Welcome Brochure |

| 5022 | Fast Track Settlement |

| 5146 | Employment Tax Returns: Examinations and Appeal Rights |

| 5181 | Tax Return Reviews by Mail |

The following table lists frequent forms used in IRS underreporter notices and audits.

| Form | Title |

| 656-L | Offer in Compromise (Doubt as to Liability) |

| 866 | Agreement as to Final Determination of Tax Liability |

| 870 | Waiver of Restrictions on Assessment and Collection of Deficiency in Tax and Acceptance of Overassessment |

| 870-AD | Offer to Waive Restrictions on Assessment and Collection of Tax Deficiency and to Accept Overassessment |

| 872 | Consent to Extend the Time to Assess Tax |

| 886-A | Explanations of Items (accompanies a Form 4549, Income Tax Examination Changes) |

| 4549 | Income Tax Examination Changes |

| 4549-A | Unagreed Report – Income Tax Examination Changes |

| 4549-E | Income Tax Discrepancy Adjustments |

| 886-H-AOC | Supporting Documents to Prove American Opportunity Credit |

| 886-H-AOTC-MAX | American Opportunity Tax Credit Available for a Maximum of 4 Years |

| 886-H-DEP | Supporting Documents for Dependency Exemptions |

| 886-H-EIC | Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children for Tax Year 2019 |

| 886-H-HOH | Supporting Documents To Prove Head of Household Filing Status |

| 886-H-ITIN | Dependent – Related Tax Benefits and Credits – Explanation of Items |

| 906 | Closing Agreement on Final Determination Covering Specific Matters |

| 4564 | Information Document Request (IDR) |

| 4822 | Statement of Annual Estimated Personal and Family Expenses |

| 5564 | Notice of Deficiency – Waiver (AUR program) |

| 5701 | Notice of Proposed Adjustments (used in more complex Field Audits) |

| 11652 | Questionnaires – Form 1040 Schedule C |

| 12203 | Request for Appeals Review (Small Case Request – entire amount of additional tax and penalty proposed for each tax period is $25,000 or less) |

| 12661 | Disputed Issue Verification |

| 14086 | Qualifying Children Residency Statement Third Party Affidavit |

| 14420 | Verification of Reported Income |

| 14800 | Child Tax Credit and Additional Child Tax Credit |

| 14801 | Child and Dependent Care Credit – Explanation of Items |

| 14803 | Duplicate Education Credit & Tuition Deduction |

| 14804 | Schedule A – Gifts to Charity |

| 14805 | Casualty and Theft Loss |

| 14806 | Adoption Credit Documentation Requirements |

| 14808 | Schedule A – Medical and Dental Expenses |

| 14809 | Interest you Paid |

| 14810 | Schedule A – Taxes You Paid |

| 14815 | Supporting Documents to Prove the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) for 2018-2025 |

| 14817 | Reply Cover Sheet (for correspondence exam, used for online response submission) |

| 14824 | Supporting Documents to Prove Filing Status |

| 14950 | Premium Tax Credit Verification |

| 14978 | Moving Expenses Deduction Supporting Documents |

Frequently Used IRS AUR and Examination Phone Numbers

The following table contains the IRS phone contact information frequently used for CP2000 notices and audits.

| IRS Hotline | Phone Number | Hours/Availability (note: times subject to change) |

| Automated Underreporter Unit (AUR) | (800) 829-8310 (SB/SE)(800) 829-3009 (W&I) | M-F, 7AM-8PM, local time

[IRM 4.19.19.5.2 (3-18-2020)] |

| Business Underreporter Unit | (877) 571-4712 | M-F, 10AM-4PM, central time

[IRM 21.3.1.7.47 (10-3-2022)] |

| Correspondence Examination (SB/SE: Schedule C, E, F, or Form 2106) | 866-897-0161 | M-F, 7AM-7PM, local time

[IRM 4.19.19.5.2 (3-18-2020)] |

| Correspondence Examination (W&I) | 866-897-0177 | M-F, 8AM-8PM, local time

[IRM 4.19.19.5.2 (3-18-2020)] |

| Individual accounts | (800) 829-1040 | For taxpayers, tax pros use PPS

M-F, 7AM-7PM, local time |

| Business and Specialty accounts | (800) 829-4933 | For taxpayers, tax pros use PPS

M-F, 7AM-7PM, local time |

| International Account Inquiries | (267) 466-4777 | M-F, 6AM-11PM, ET

[IRM 21.3.8.1 at (1) (10-01-2021)] |

| Taxpayer Advocate National Hotline (central intake) | (877) 777-4778 | M-F, 7AM-7PM, local time

Local offices: 8AM-4:30PM |

| Practitioner Priority Service(tax professionals only) | (866) 860-4259

Option #2: Individual accounts Option #3: Business accounts Option #5: Automated Underreporter Unit Option #6: Correspondence Exam Unit |

M-F, 7AM-7PM, local time |

| IRS Appeals Account Resolution | 855-865-3401 | Leave message, IRS responds in 24-48 hours

[IRM 8.1.9.3 at (1a) (02-26-2025)] |

Common IRS Notices and Taxpayer Notifications

Common Notices for Underreporter Inquiries

| Notice # | Title | Used for: |

| CP2000 | Request for Verification of Unreported Income, Payments, or Credits | Notifies taxpayer of a proposed change to tax liability because of income that is not identifiable or apparently not fully reported on the return and/or credits and deductions that appear overstated. |

| CP2501 | Initial Contact to Resolve Discrepancy Between Income, Credits, and/or Deductions Claimed on Return and Those Reported by Payer | Pre-CP 2000 Contact Letter. In certain situations, an initial notice sent to the taxpayer requesting an explanation to resolve a discrepancy between items reported by the taxpayer on the tax return and the information provided by third parties regarding those items. If the taxpayer fails to respond or if the response is insufficient, the Service sends a CP 2000 notice proposing an adjustment. [IRM Exhibit 1.4.19-1] |

| 4314C | Interim Response | When a quality response cannot be issued timely, an automatic, interim response is sent on the 30th calendar day from the IRS received date. [IRM 4.19.2.3.1 at (1b) (09-12-2024)] |

| CP2005 | AUR No-change letter | AUR Inquiry is closed with no change to the tax liability and/or refundable credits. |

| CP2006 | We received your response | The IRS needs additional time to resolve the CP2000 or the case has been transferred to another IRS office (IRS Examination) and should receive a response from that office within 60 days. [IRM Exhibit 1.4.19-3] |

| CP3219A | Statutory Notice of Deficiency | Statutory Notice of Deficiency, required by law, informs the taxpayer of the tax assessed, plus penalties and interest, that he or she owes. This letter also advises the taxpayer of appeal rights to the U.S. Tax Court. |

| CP21E | Assessment from a CP2000 | Balance due from the AUR adjustment. [IRM 3.14.1.6.18.1.1 (1-1-2015)] |

| CP2057 | Soft Notices Income Discrepancy | Informs the taxpayer there appears to be a discrepancy with income reported by a third party to the IRS. The notice provides information, such as the name of the third party and the address. Requests that the taxpayer review their records and if the income reported on their return is correct or not. The taxpayer is instructed to file an amended return if the original return was not correct. [IRM 21.3.1.6.41 (6-14-2024)] |

| 2030 | Business Underreporter Notice | Business underreporter matching notice showing underreported income information and proposing additional tax and penalties. (Similar to the individual letter CP2000) |

| 2531 | Business Underreporter Notice, initial notice to explain discrepancies | Pre-Letter 2030 business underreporter matching letter. Requests taxpayer to resolve discrepancies related to business (EIN) underreporting. (Similar to individual letter CP2501) |

| 5035 | Notice of Possible Income Underreporting: 1099-K Discrepancy | IRS soft notice questioning underreporting of business income due to 1099-K reporting inconsistencies or discrepancies. This notice does not require a response to the IRS. The taxpayer may need to voluntarily file an amended return based on its own investigation of income. |

| 5036 | Notice of Possible Income Underreporting: 1099-K Discrepancy | IRS notice questioning underreporting of business income due to 1099-K reporting inconsistencies or discrepancies. Requires a response in 30 days that provides information that shows that the 1099-K is not accurate, an amended return to report the income, and/or an explanation that the return and 1099-K are correct with an explanation as to why the business gross receipts from card payments are higher than expected (card payments as compared to cash payments received). |

| 5039 | Notice of Possible Income Underreporting: 1099-K Discrepancy | IRS notice questioning underreporting of business income due to 1099-K reporting inconsistencies or discrepancies. Requires a response in 30 days and for the taxpayer to complete Form 14420, Verification of Reported Income. The IRS reserves the right to take further action, such as an audit or issuing an underreporter notice. |

| 5043 | Notice of Possible Income Underreporting: 1099-K Discrepancy | IRS notice questioning underreporting of business income due to 1099-K reporting inconsistencies or discrepancies. Requires a response in 30 days that provides: information that shows that the 1099-K is not accurate or an amended return to report the income. The IRS may contact the taxpayer for further enforcement (underreporter notice or audit). |

Common Notices for Mail Audits

| Notice # | Title | Used for: |

| CP75 | Exam Initial Contact Letter – EITC – Refund Frozen | EITC audits in which the IRS has frozen the taxpayer’s refund until the taxpayer can prove he/she is entitled to the EITC. [IRM 4.19.14.4 (1-01-2025)] |

| CP75A | Exam Initial Contact Letter – EITC – No Refund Frozen | EITC audits in which the IRS has not frozen the taxpayer’s refund. [IRM 4.19.14.4 (1-01-2025)] |

| CP06 | Exam Initial Contact Letter – PTC – Refund Frozen | Premium tax credit discrepancy audits in which the IRS has frozen the taxpayer’s refund until the taxpayer can prove the correctness of the PTC. [IRM 21.3.1.6.2 (10-01-2024)] |

| CP06A | Exam Initial Contact Letter – PTC – No Refund Frozen | Premium tax credit discrepancy audits where the IRS has not frozen the refund. [IRM 21.3.1.6.2 (10-01-2024)] |

| 566-B | Service Center Initial Contact Letter/30 Day Combo Letter (Examination by mail) | IRS audit notification letter with identified issues under audit, not including EITC. The letter also has proposed changes to the return shown on Forms 4549 and 886-A. Also serves as a 30-day letter if taxpayer does not respond. [IRM 4.19.15.25.4 (2-1-2022)] |

| 566-S | Initial Contact Letter (Examination by mail) | IRS audit notification letter with identified issues under audit and request for information, including EITC. The letter can also propose changes to the return shown on Forms 4549 and 886-A. [IRM 4.19.15.25.4 (2-1-2022)] |

| 2194 | Alternative Minimum Tax Proposal Letter | Processed tax returns identified as taxpayers who are liable for the AMT but have not completed or attached Form 6251, Alternative Minimum Tax – Individuals. Taxpayers will initially receive Letter 12C and Letter 2194 will be issued if the taxpayer does not respond in order to assess the AMT. Form 4549 is included; this Form proposes the AMT. [IRM 4.19.15.8.1 (2-1-2022)] |

| 915 | Letter to Transmit Examination Report | Report transmittal letter for both agreed and unagreed issues if there are 240 or more days remaining on the statute of limitations.[IRM 4.10.8.4.1.1 (3-25-2021)] |

| 525 | General 30-day Letter | Includes Examination Report (Form 4549 with Form 886-A) and provides right to appeal within 30 days to IRS Independent Office of Appeals. [IRM 4.19.13.13 (09-16-2024)] |

| 692 | Request for Consideration of Additional Findings | Taxpayer replies to a 30-day letter where an audit report was issued, and additional information is needed. [IRM 4.19.13.11 at (4) (09-16-2024)] |

| 3219 | Statutory Notice of Deficiency | Statutory Notice of Deficiency, required by law, informs the taxpayer of the tax assessed, plus penalties and interest, that he or she owes. This letter also advises the taxpayer of appeal rights to the U.S. Tax Court.[IRM 4.19.13.13 (9-16-2024)] |

| 555 | Notification of Findings Based on Taxpayer’s Recent Data Re: Tax Liability | Taxpayer replies after the 90-day letter is issued. [IRM 4.19.13.11.2 (09-16-2024)] |

| 2685/1024 | Repetitive Audit Letter | Audit stopped due to repetitive audit. [IRM 4.10.2.13.2 at (2) (2-11-2016) and IRM 4.10.2.13.2 at (3a) (2-11-2016)] |

| 1024 | Return Accepted as Filed | IRS closed audit (surveyed) after contacting the taxpayer but before the records were reviewed (i.e., audit did not take place). [IRM 4.10.2.5.1 (9-9-2019)] |

| 590 | No Change Final Letter | Final closing letter for no change cases with no adjustments. [IRM 4.10.8.3.1 at (4) (4-10-2023)] |

| 987 | Agreed Income Tax Change | Letter that Informs taxpayer that the IRS has accepted, after review, his/her agreed changes to the return(s). [IRM 4.10.8.2.3.1 at (4) (4-10-2023)] |

| 1156 | Change/No Change Final Letter | Final closing letter for no change with adjustment cases. [IRM 4.10.8.3.2 (4-10-2023)] |

| 5153 Series | Examination Report Transmittal – Statute < 240 Days | Letter used to transmit a proposed agreed report and notify the taxpayer that additional time is needed on the statute for Appeals to consider the case if it is unagreed.[IRM 4.10.8.12.1 at (4) (4-10-2023)] |

| 3500/3501 | Interim Letter to Correspondence from Taxpayer/Second Interim Letter | Issued by IRS when additional time is needed (usually 30-45 days) to review a taxpayer’s response. [IRM 4.19.13.12.1 (4-6-2022)] |

| 21E | Changes to Your Return from an Audit | Balance due from the audit adjustment. [IRM 3.14.1.6.18.1.1 (1-1-2015)] |

Common Notices for Office/Field Audits

| Notice # | Title | Used for: |

| 2202 | Initial Contact Letter – Firm Set Appointment Letter | Office Exams: Initial contact letter used to schedule a firm initial appointment date and time for individual taxpayers. [IRM 4.10.2.8.1.1 (11-4-2016)] |

| 2205 | Initial Contact Letter | Field Exams: Initial contact letter, does not list the issues being examined. Allows the taxpayer 14 calendar days to respond. [IRM 4.10.2.8.1.2 (9-9-2019)] |

| 2205-A | Initial Contact Letter | Field Exams: Initial contact letter, lists the issues being examined. Allows the taxpayer 14 calendar days to respond. [IRM 4.10.2.8.1.2 (9-9-2019)] |

| 3572 | SB/SE Office Exam Call-Back Appointment Letter | Office Exam: sent to request individual taxpayers call to schedule an initial appointment. Allows the taxpayer 14 calendar days to respond. [IRM 4.10.2.8.1.1 (11-4-2016)] |

| 3253 | Taxpayer Appointment Confirmation Letter (Letter 3254 is used to send to taxpayer’s representative) | After the initial telephone conversation, revenue agents must issue one of the following letters to confirm the initial appointment. [IRM 4.10.2.8.1.2 (9-9-2019)] |

| 1912 | Follow-Up Letter Transmitting Examination Reports | Office Exams: taxpayer does not respond within 15 days of Letter 915. [IRM 4.10.8.2.3.1 (4-10-2023)] |

| 525 | General 30-Day Letter | Letter from IRS auditor proposing adjustments to the return. Includes the audit report (Form 4549), explanation of adjustments, and tax computation. The taxpayer must request an appeal within 30 days if the taxpayer disagrees and wants to appeal within the IRS. |

| 915 | Examination Report Transmittal | Office Exams: used to issue both agreed and unagreed reports. [IRM 4.10.8.4.1.1 (3-25-2021)] |

| 950 | 30-Day Letter | Field Exam: 30-day letter transmitting audit results where there was a change to the return. This notice allows the taxpayer the right to appeal. [IRM 4.10.8.12.1 (4-10-2023)] |

| 531 | Statutory Notice of Deficiency (90-day letter) | Statutory Notice of Deficiency, required by law, informs the taxpayer of the tax assessed, plus penalties and interest, that he or she owes. This letter also advises the taxpayer of appeal rights to the U.S. Tax Court. [IRM 4.8.9.9.3 (7-9-2013)] |

| 4121 | Agreed Examination Report Transmittal | Letter to a taxpayer with audit report when they have indicated agreement to all adjustments. [IRM 4.10.8.4.1.1 at (1) (3-25-2021)] |

| 590 | No Change Final Letter | Final closing letter for no change cases with no adjustments. [IRM 4.10.8.3.5 (4-10-2023)] |

| 987 | Agreed Income Tax Change | Final closing letter on an audit with an agreed tax change. [IRM 4.10.8.2.3.1 (4-10-2023)] |

| 1156 | Change/No Change Final Letter | Final closing letter for no change with adjustment cases. [IRM 4.10.8.3.2 (4-10-2023)] |

| 21E | Adjustment Made to Account | Balance due from audit adjustment. [IRM 3.14.1.6.18.1.2 (1-1-2015)] |

| 3900 | Closing Agreement Cover Letter | Appeals: Letter that accompanies a Closing Agreement settlement between the taxpayer and the IRS (Form 906). [IRM 8.20.7.13.2 (9-28-2018)] |

| 5968 | Prior or Subsequent Year Pickup | Letter to notify the taxpayer that the scope of the examination is expanded to include another tax period(s). [IRM 4.10.2.7.1.2 at (4) (09-29-2022)] |

Crypto-Currency Notices

| Notice # | Title | Used for: |

| 6173 | Initial Contact Letter: Reporting Virtual Currency Transactions (response required) | Targeted soft notice to crypto-currency holder requesting the taxpayer to file, review, and/or amend the return. A response is required from the taxpayer before the response date on the letter. [IRM 21.3.1.8.5 (7-19-2023)] |

| 6174 | Initial Contact Letter: Reporting Virtual Currency (no response required) | Targeted soft notice to crypto-currency holder requesting the taxpayer to review and/or amend the return. No response is required and the IRS does not plan to follow up on the notice and/or response. [IRM 21.3.1.8.5.1 (7-19-2023)] |

| 6174-A | Initial Contact Letter: Reporting Virtual Currency Transactions (no response required but IRS may follow up) | Targeted soft notice to crypto-currency holder requesting the taxpayer to review and/or amend the return. No response is required, but the IRS may contact the taxpayer in the future about compliance. [IRM 21.3.1.8.5.1 (7-19-2023)] |

Useful Websites and IRS Online Tools

The following table lists websites that help with underreporter notices and audits.

| Website | URL | Description |

| IRS Audit Technique Guides (ATGs) | https://www.irs.gov/businesses/small-businesses-self-employed/audit-techniques-guides-atgs | ATGs help IRS examiners during audits by providing insight into issues and accounting methods unique to specific industries. ATGs explain industry-specific examination techniques and include common, as well as, unique industry issues, business practices and terminology. Guidance is also provided on the examination of income, interview techniques and evaluation of evidence. |

| Bizstats business statistics and financial ratios (IRS auditors use this site for financial ratios) | Bizstats.com | Used to identify normal business profit and expense ratios in preparing for an audit. Offers free business statistics and financial ratios, by type of entity (sole proprietor, corporation, partnership), by industry (retail, beverage store, construction, etc.) and by amount of gross receipts. |

| Prior website pages | Archive.org | Using the “Wayback Machine,” the IRS auditor can review the taxpayer’s historical website pages for the years under audit for any potential issues. |

| Bureau of Labor Statistics Data | http://www.bls.gov | Used to estimate household expenses when determining if the taxpayer has enough income in the year. |

| IRS Get Transcript service (Get your tax record) | https://www.irs.gov/individuals/get-transcript | Obtain IRS transcripts for each tax year/form. |

| IRS e-Services Transcript Delivery System (tax pros) | https://www.irs.gov/tax-professionals/transcript-delivery-system-tds | Tax pro electronic account with features to access authorized taxpayer transcripts. |

| Mail audit issue templates | https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/letter-or-audit-for-eitc | Templates used for common mail audit issues such as the earned income tax credit, dependents, premium tax credit, and others. |

| IRS Correspondence Examination response site | Document Upload Tool | Internal Revenue Service | Authorized Use Warning | IRS site to upload mail audit response. Include Form 14817, Reply Cover Sheet, as the first page of the submission when sent by IRS. |

| IRS Secure Messaging | https://www.irs.gov/help/welcome-to-secure-messaging | IRS portal that allows responses to CP2000/CP2501. Letter 566/525 or 3540/3542, or Letter 12C. |

Key Terms and Definitions

The following are common terms and their definitions for audits and underreporter notices, including appeals.

| Term | Definition |

| Accuracy penalty | A penalty (usually 20% of the additional tax owed) for filing an inaccurate tax return. Negligence and substantial understatement are the two most common accuracy penalties issued. |

| Appeals Officer (AO) | IRS employee in the IRS Independent Office of Appeals that helps the taxpayer resolve a tax dispute through an informal process. Most audited taxpayers access the IRS Independent Office of Appeals by timely requesting an appeal after receipt of a 30-day letter. |

| Assessment statute of limitations | The time period the IRS has to assess additional tax. In most cases, the assessment statute is three years from the due date of the return, or the date filed, whichever is later. [IRC §6501] |

| Assessment Statute Expiration Date (ASED) | The last day the IRS has to assess additional tax for a tax form/period. [IRC §6501] |

| Audit (IRS Examination) | An IRS audit is a review/examination of a taxpayer’s accounts and financial information to ensure information is reported correctly according to the tax laws and to verify that the reported amount of tax is correct. |

| Audit Reconsideration | The process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid, or a tax credit was reversed, in which the taxpayer disagrees with the original determination and has new information for the audited issue(s) that was not previously considered during the original examination. |

| Automated Underreporter (AUR) | The Automated Underreporter Program matches taxpayer income and deductions submitted on information returns by third parties (employers, banks, brokerage firms, etc.) against amounts reported by taxpayers on their individual income tax returns to identify discrepancies. The Automated Underreporter Program routinely identifies individual tax returns with discrepancies each year and, when warranted, assesses additional taxes as well as interest and penalties. |

| Correspondence Exam | An audit by mail. Most mail audits consist of an IRS notice asking for clarification of a tax return item(s) (usually earned income tax credit, additional child tax credit, or a deduction/credit that appears to be incorrect). These audits are conducted at IRS campuses by tax examiners. |

| CP2000 Reconsideration | The process of re-determining the correct tax based on additional information available or not considered in the initial CP2000 deficiency process. |

| Deficiency procedures | The legal process that requires the IRS to notify the taxpayer of the changes made to the return and to provide the taxpayer the opportunity to contest the determination without payment of the deficiency. IRS procedures require the taxpayer to receive a 30-day letter (opportunity to go to IRS Appeals) and a 90-day letter (opportunity to contest in U.S. Tax Court) prior to assessing the deficiency. [IRC §§6212 and 6213] |

| Field Exam | The most comprehensive of all IRS audits of individuals, partnerships, corporations, and specialty taxpayers that occur either at the taxpayer’s place of business or through interviews at an IRS office. These audits are conducted by IRS revenue agents. |

| Group Manager, Examination (GM) | The IRS auditor’s manager whom the taxpayer or his/her representative can contact regarding any disputes in an audit. The GM has specific duties in the examination, including concurring with all penalty determinations and resolving unagreed disputes before the taxpayer requests to go to IRS Appeals. |

| Information Document Request (IDR) | Form 4564, Information Document Request, is issued by an IRS auditor (revenue agent, tax compliance officer, or tax examiner) to request information, substantiation, and/or other documents or interviews in an audit. |

| IRS Independent Office of Appeals | An independent office within the IRS that impartially reviews determinations made by IRS enforcement functions, including unagreed audits and CP2000 determinations. |

| Large Business & International Division (LB&I) | LB&I Division serves and enforces compliance on corporations, subchapter S corporations, and partnerships with assets greater than $10 million as well as on high-wealth individuals. These taxpayers typically employ large numbers of employees, deal with complicated issues involving tax law and accounting principles, and conduct business in an expanding global environment. [IRM 1.4.40.1.7 (5-19-2010)] |

| Matching notice | Generally referring to IRS Notice CP2000, where the IRS AUR program identifies a filed return in which the income or payment information does not match the information reported on the return. This discrepancy notice may propose additional taxes, penalties, and interest to the tax return in which the taxpayer must agree or contest. |

| Office Audit | Also referred as a “desk audit.” A taxpayer audit (usually an individual) conducted at a local IRS office by a tax compliance officer. |

| Repetitive Audit | Taxpayer relief from a current year examination when the taxpayer was examined for one or both of the two preceding tax years and the audit resulted in a no change or a small tax change (deficiency or overassessment). Does not apply to taxpayers with a Schedule C or F. [IRM 4.10.2.13 (2-11-2016)] |

| Revenue Agent (RA) | An employee in the Examination function who conducts face-to-face examinations of more complex tax returns, such as businesses, partnerships, corporations, and specialty taxes, such as excise or employment tax returns. |

| Revenue Agent Report (RAR) | Form 4549, Income Tax Examination Changes, that provides the specific adjustments proposed to a tax return in an IRS audit. |

| Small Business/Self-employed Division (SB/SE) | SB/SE Division serves and enforces compliance on individuals filing Form 1040; Form 2106, Employee Business Expenses; Form 1120; Form 1120-S; or Form 1065, as well as other business returns with assets less than $10 million. SB/SE Division’s examination staff includes revenue agents, tax compliance officers, revenue officer examiners, and tax analysts who perform examinations either in the field or at a campus via a correspondence audit. [IRM 1.4.40.1.7 (5-19-2010)] |

| Statutory Notice of Deficiency (SNOD or 90-day letter) | A “statutory notice of deficiency” or “90-day letter,” is a legal notice in which the IRS determines the taxpayer’s tax deficiency. IRC §§6212 and 6213 require that the Service issue a notice of deficiency before assessing additional income tax, estate tax, gift tax and certain excise taxes unless the taxpayer agrees to the additional assessment. This is the last notice that allows the taxpayer 90 days to appeal without first paying the deficiency. [IRM 4.8.9.2 (8-11-2016)] |

| Tax Compliance Officer (TCO) | An employee in the IRS Examination function who primarily conducts examinations of individual taxpayers through office audits at IRS field offices. |

| Tax Examiner (TE) | An employee located in an IRS office who conducts examinations and reviews CP2000 responses through correspondence. |

| Wage and Investment Division (W&I) | W&I Division serves and enforces compliance on individual taxpayers who pay taxes through withholdings, prepare their own tax returns, receive refunds, and generally interact with the IRS one time per year. The W&I Division also works to provide balance in compliance and outreach activities, such as enhancing delivery of Earned Income Tax Credit Initiatives. Examinations within the W&I Division are mainly conducted at an IRS campus via correspondence. The substantial portion of the W&I Division’s compliance activities now revolve around addressing noncompliance involving refundable credits, including, but not limited to, the Earned Income, Child, Educational, and Premium Tax Credits. [IRM 1.4.40.1.7 (5-19-2010)] |

| 30-Day Letter | This notice is issued in an IRS examination to allow the taxpayer to request an appeal with the IRS Independent Office of Appeals. Once the 30-day period expires, the taxpayer is issued a Statutory Notice of Deficiency (90-day letter) which allows a further appeal to the U.S. Tax Court prior to paying the deficiency. [IRM 4.10.8.12.1 (4-10-2023)] |

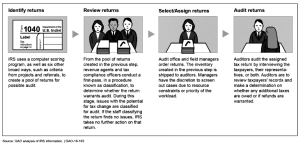

IRS Audit and Appeal Process: IRS Roadmap Diagram

Navigating the IRS audit process can be difficult. In 2019, the Taxpayer Advocate Service provided a roadmap of the IRS audit and appeals process to assist taxpayers in understanding how the audit and appeals process works. [Taxpayer Advocate Service, 2018 Annual Report to Congress]

A broad overview of the mail, office, and field audit process appears below.

In 2024, 23,105 IRS Examination cases were sent to the IRS Independent Office of Appeals. [IRS Data Book, 2024, Table 29] The Appeals Office plays a critical part in resolving disputes in IRS examinations. The Taxpayer Advocate provides a brief overview of the appeals process to help taxpayers understand how IRS appeals works in Examination cases.

AUTOMATED UNDERREPORTER (CP2000) NOTICES

This section explains the IRS Automated Underreporter Program (AUR) and how-to resolve AUR inquires.

| Topic | Covers |

|---|---|

| Automated Underreporter Program Overview | Includes:

|

| AUR Notices | The AUR contact, response, and assessment notices used in Underreporter inquiries. |

| IRS AUR Contact Information | IRS AUR campuses and how to reach them by mail, phone, or fax. |

| Steps to Resolve a CP2000/2501 Underreporter Inquiry | The 11 steps to take to resolve a CP2000/2501 notice. |

| CP2000/2501 Response Format | The nine items to include in a CP2000/2501 response to the IRS. |

| CP2000/2501 Template Response Cover Letter | A template cover letter to use in responding to the IRS on a CP2000/2501 notice. |

| AUR Reconsideration and Appeals | How-to request reconsideration or appeal of a CP2000 determination. |

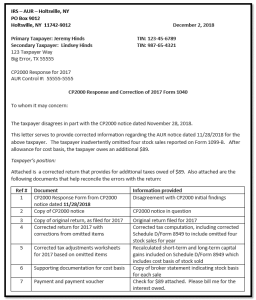

| CP2000 Example | A common CP2000 situation and the 11 steps/cover letter completed by the taxpayer. |

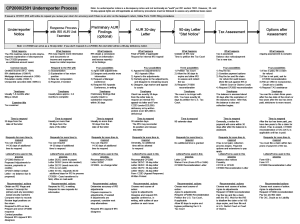

| CP2000/2501 Process and Action Grid | A detailed grid of the CP2000/2501 process. |

Other helpful sections:

| Topic | Covers |

|---|---|

| Accuracy-Related Penalties | How to address accuracy penalties in an underreporter notice. |

| IRS Transcripts | How to obtain IRS transcripts needed in preparing for an underreporter response. |

Key Highlights:

- The most common IRS return challenge compliance enforcement program is the matching notice or CP2000 Automated Underreporter (AUR) program.

- CP2000 notices are not audits, but they do follow deficiency procedures similar to the procedures found in audits.

- CP2000 notices propose additional tax, penalties, and interest. The taxpayer must respond to contest the additional proposed deficiency, or the deficiency will be assessed and collected.

- The IRS commonly grants taxpayers CP2000 reconsideration if the taxpayer does not respond to a CP2000 notice before the IRS proceeds to assess the additional deficiency.