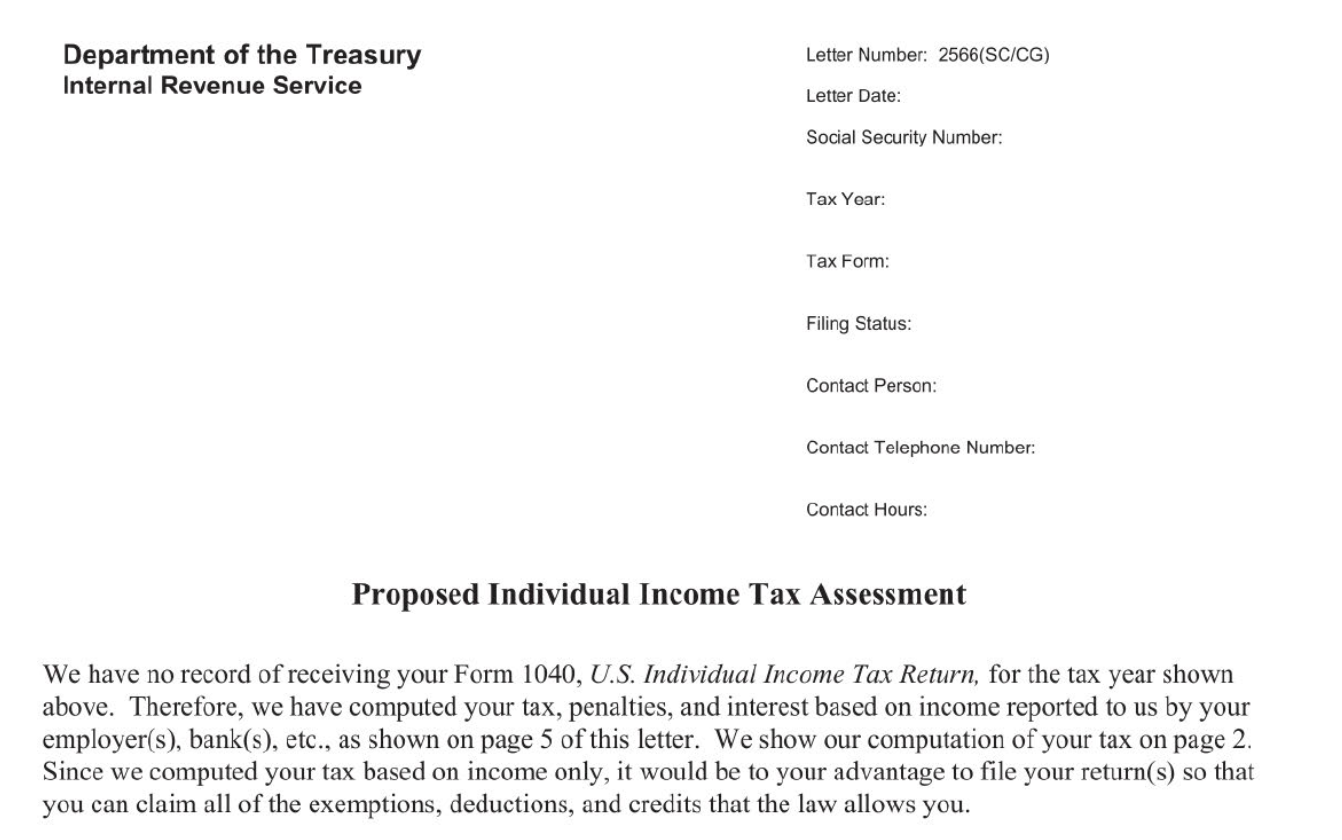

Letter 2566: 30-day letter (no refund hold)

The letter informs the taxpayer that the IRS has not received a tax return for the tax year shown and includes a proposed tax assessment for the taxpayer. The letter advises taxpayers that within 30 days they must do one of the following: send their signed tax return, consent to the proposed tax assessment or explain why they believe they are not required to file.

Updated: June 23, 2025