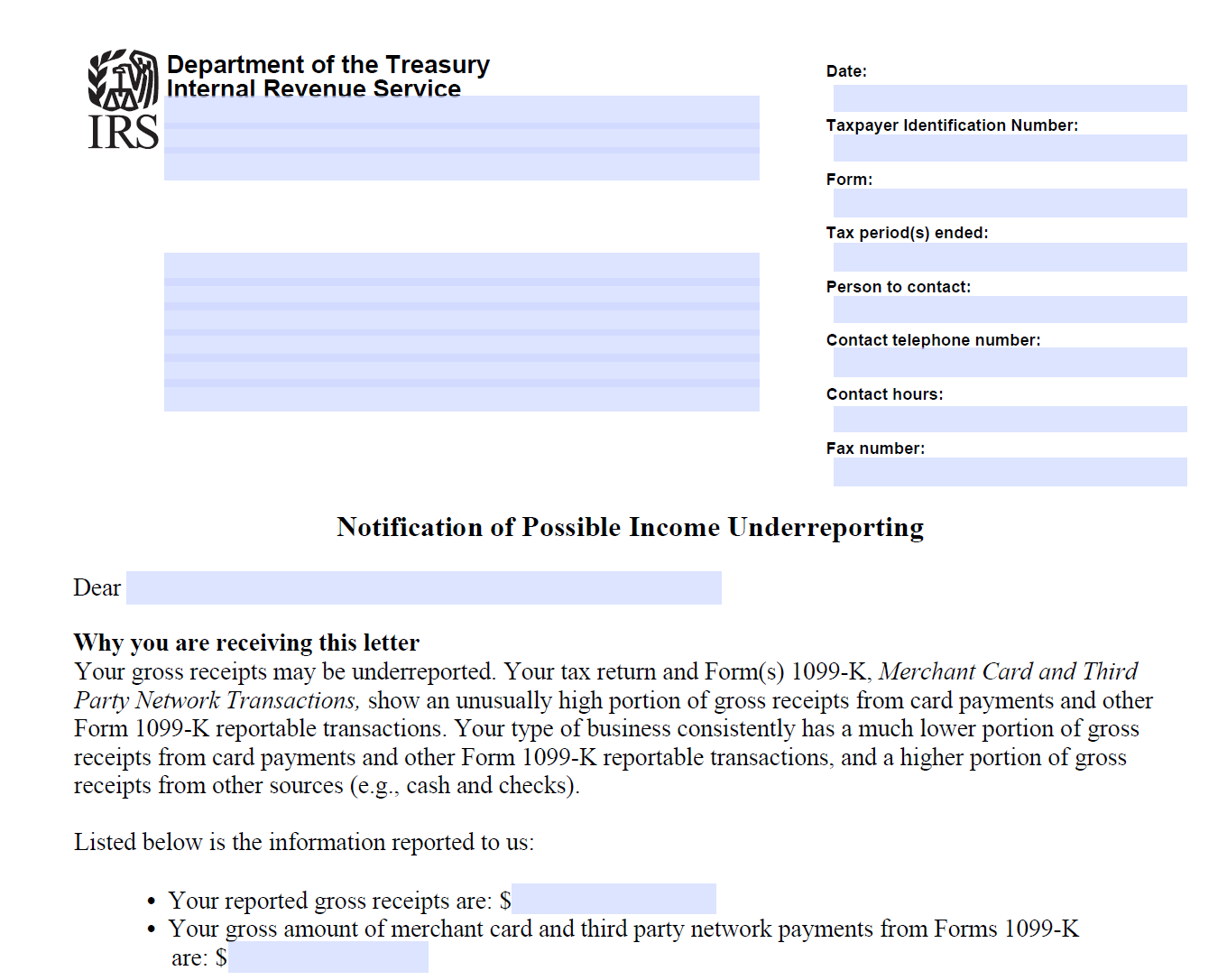

Letter 5036: Notice of Possible Income Underreporting: 1099-K Discrepancy

IRS is questioning underreporting of business income due to 1099-K reporting inconsistencies or discrepancies. Requires a response in 30 days that provides information that shows that the 1099-K is not accurate, an amended return to report the income, and/or an explanation that the return and 1099-K are correct with an explanation for why the business gross receipts from card payments are higher than expected (card payments as compared to cash payments received).

Updated: June 23, 2025