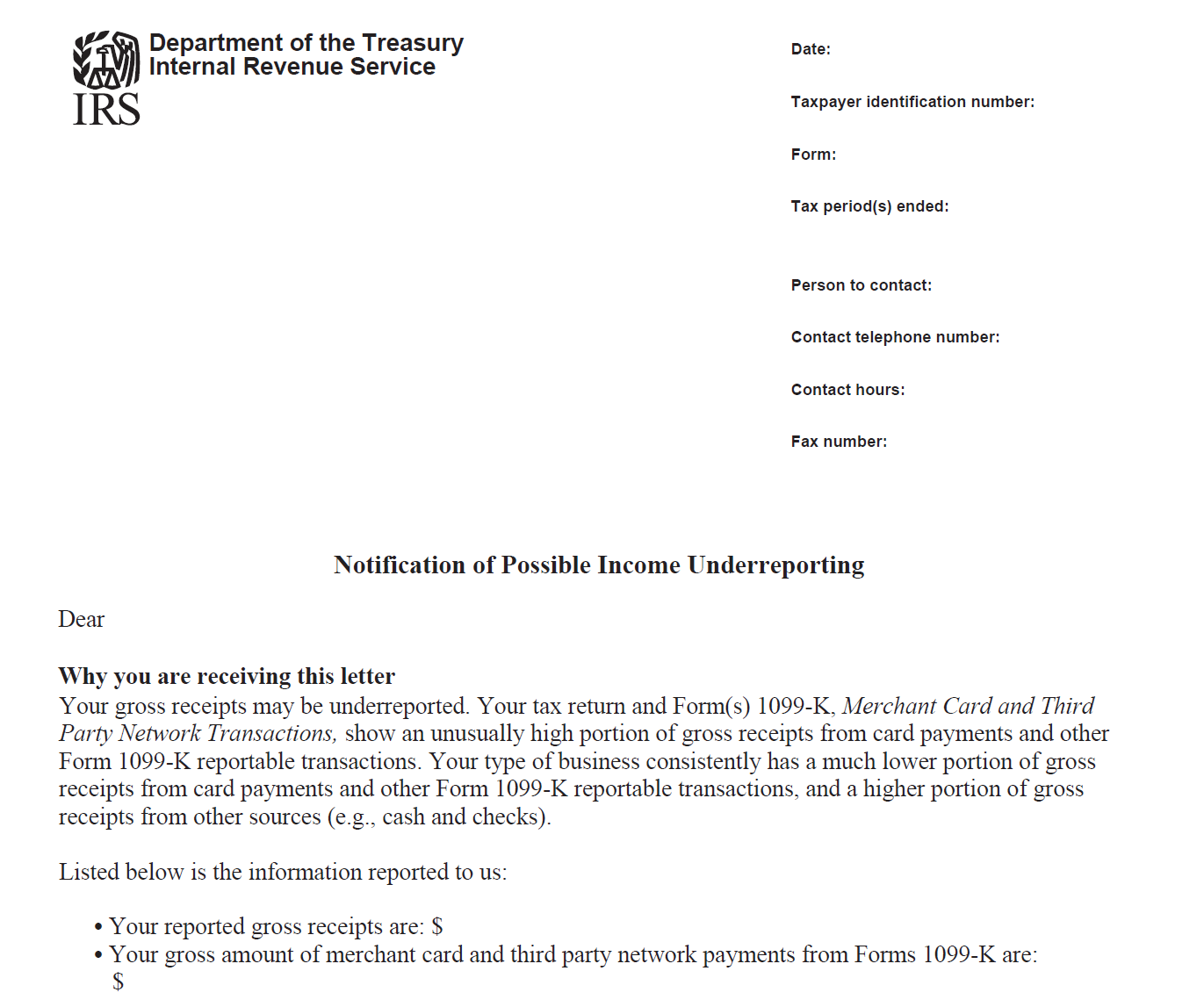

Letter 5039: Notice of Possible Income Underreporting: 1099-K Discrepancy

IRS is questioning underreporting of business income due to 1099-K reporting inconsistencies or discrepancies. Requires a response in 30 days and for the taxpayer to complete Form 14420, Verification of Reported Income. IRS reserves the right to take further action, such as an audit or underreporter notice.

Updated: June 23, 2025