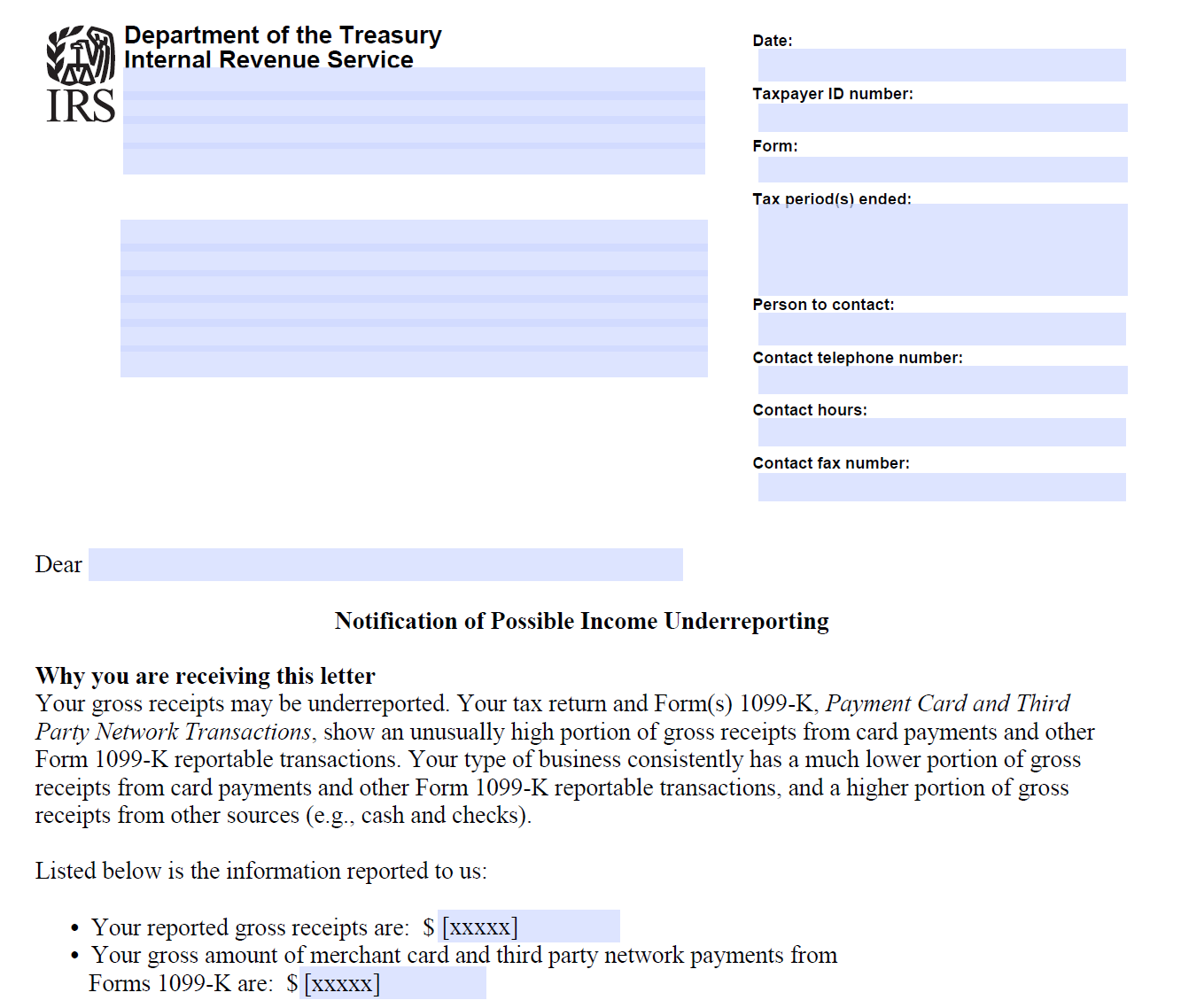

Letter 5043: Notice of Possible Income Underreporting: 1099-K Discrepancy

IRS is questioning underreporting of business income due to 1099-K reporting inconsistencies or discrepancies. Requires a response in 30 days that provides information that shows that the 1099-K is not accurate or an amended return to report the income. The IRS may contact the taxpayer for further enforcement (underreporter notice or audit).

Updated: June 23, 2025